Bitcoin ATMs, QR codes used as weapon by scammers: What to know

Driving back, all Jacquelyn Halushka could think about was how weird it was to be feeding five $100 bills into a bitcoin ATM at a liquor store.

She had never been to the Star Market on a winding, rural part of Joslyn Road in Lake Orion where the Cash2Bitcoin ATM stands by the front window, next to the regular ATM and some Bud Light Seltzer.

“I never bought bitcoin before,” she said.

All Halushka, 27, wanted was a good paying job. And they told her in early August that the bitcoin task was part of the process.

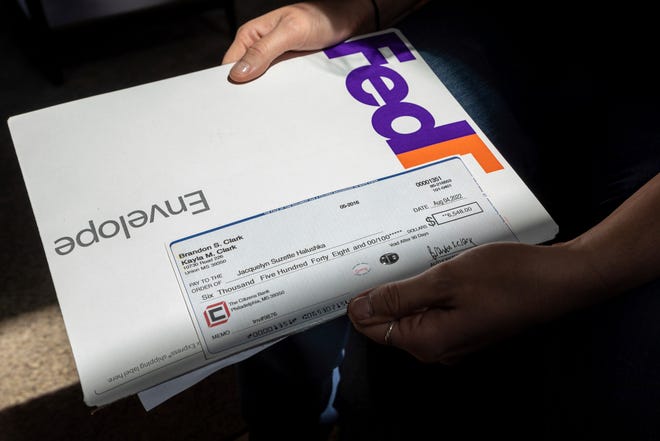

After a long job interview via a messaging app, Halushka was told she was hired. She received a contract and later a $6,548 check was overnighted to her home in Oakland Township by Federal Express for her to buy Apple computer products to work remotely as an administrative assistant for a biopharmaceutical company.

She took a photo of the check to deposit it through her bank’s mobile app. Her bank only made $500 immediately available.

And the scammers convinced her to drive to the bank to get five $100 bills and send that money via a crypto wallet to the equipment vendor. The bitcoin transfer was to prove that she lived in the area before any laptop was sent.

Ultimately, she lost her $500 and realized the job was as phony as can be.

Increasingly, unsuspecting consumers are being directed to a bitcoin ATM somewhere in the city or suburbs and told by convincing con artists how to convert that cash into cryptocurrency. Maybe it starts with a story about needing to pay an overdue utility bill. Maybe it’s someone pretending to be from Apple Support. Maybe it’s a hot prospect you met on an online dating site who turns out to be a crypto cad.

Maybe it’s part of a new attractive — but phony — job offer.

The scammers tell elaborate tales to convince you that grabbing a fistful of cash and walking up to a bitcoin ATM is absolutely the right thing to do.

Just a few years ago, it might have been far tougher to run this sort of a scam when there were far fewer kiosks across the country.

Now, more than 38,500 cryptocurrency kiosks, often known as bitcoin ATMs, are up and running in the U.S., up from roughly 4,000 at the start of 2019, according to data from Coin ATM Radar.

The cryptocurrency ATM could be at a liquor store, a laundromat, a shopping mall, a gas station or grocery. It’s as easy as putting cash on a gift card but many consumers who have heard all the warnings about gift card scams aren’t aware that a bitcoin ATM is just as handy for crooks.

“Crypto transfers can’t be reversed,” the Federal Trade Commission stated in a warning. “Once the money’s gone, there’s no getting it back.”

A $350,000 bitcoin scam

This summer, an elderly couple in northern Michigan lost $350,000 in a shocking bitcoin scam, according to a July report by the Grand Traverse County Sheriff’s Office.

The couple — the man, 76, and the woman, 87 — had received a phone call that allegedly was from “Apple Support” and claimed to be a scam alert.

The scammers who were impersonating Apple convinced the couple that they needed to send money, repeatedly.

The couple reportedly withdrew money from different banks to turn cash into cryptocurrency via a CoinFlip platform. Some money was sent via bitcoin ATMs; the rest was through wire transfers, according to Lt. Brandon Brinks, who worked on the case for the Grand Traverse Sheriff’s Department.

“That money is gone,” Brinks told the Free Press in September, noting that the case has no leads.

CoinFlip operates more than 3,000 bitcoin ATMs in 48 states, including Michigan. The Chicago-based crypto company also offers ways to buy digital currency with bank wire transfers, credit cards and debit cards.

Chris Thatcher, a spokesperson for CoinFlip, said the company “cannot discuss specific customer transactions due to privacy concerns.”

The company’s statement noted CoinFlip takes “strict preventative and proactive measures to protect our customers, including clear scam warnings that customers view prior to each transaction. We have 24-hour customer support and customers can call us to ask questions. Our customer support reps are trained to spot potential frauds and actively warn customers.”

I found this CoinFlip warning online as part of its How to use a bitcoin ATM post: “Have you been sent to this ATM to make a payment for ANYTHING, such as SSN fraud, taxes, utility bills, tickets, cars, equipment, money transfers, ransom, bail, eBay, Airbnb, or anything odd? STOP! You are being scammed, hang up and call us at 877-757-2646.”

Many say they didn’t see any warnings on kiosks

Many people who lost money say they never saw any warning when walking up to a bitcoin ATM.

Halushka said she didn’t spot any scam alerts on the bitcoin ATM where she handed over $500. I didn’t see any, either, when I visited the same ATM at the liquor store. I later visited an ATM in the same network at a metro Detroit gas station and did not see a warning sign early in the process, either. The first few slides on the screen ask you how much crypto you want to buy — $1 to $999 or $1,000 to $2,999 or $3,000 to $15,000. Before you can do anything else, you must submit your mobile number. I did not attempt to buy bitcoin.

Some outfits have warnings at kiosks, like: “Do not send bitcoin to anyone you do not know for eBay or to buy a car. It is more than likely a scam.”

Why a QR code is a clue to a scam

The bitcoin ATM scam has a handful of key features: Imposters, a fake reason for why you need to withdraw cash, instructions on where to drive to find that ATM and QR codes. Scammers pretend to be someone reputable and convince you that you need to withdraw money out of your bank or retirement account.

The fraudsters direct you to an ATM in your community where you can put that cash into the kiosk.

The scammers will use your ZIP code to go online to find a cryptocurrency ATM in your area and then suggest that you go there, according to Amy Nofziger, director of victim support for the AARP Fraud Watch Network, said.

Typically, Nofziger said, criminals send a bitcoin QR code to their victims to use at the the crypto machine. When you scan that code, you’re sending that money into digital wallet held by the crooks.

“You’re essentially putting the money you put into your own wallet into their wallet and it’s gone,” Nofziger said.

Another warning: After your money is gone, the AARP warns, some crooks even claim to be able to recover the money you lost in a crypto scam — triggering yet another way to scam people out of more money.

$1B lost to crypto scams

Tens of thousands of consumers nationwide reported losing more than $1.3 billion in cryptocurrency to scams from the start of 2021 through June 2022, according to the Federal Trade Commission.

During the first half of 2022, consumers reported losing $653 million to crypto fraud. By comparison, $680 million was reported lost for all of 2021.

According to FTC data, $785 million was lost from January 2021 through June 22 to investment-related crypto scams. And $220 million was lost in crypto fraud in romance scams, $121 million to fraudsters impersonating a business and $56 million to crooks impersonating a government entity and demanding digital currency. The figures are based on fraud reports to the FTC’s Consumer Sentinel Network indicating that cryptocurrency was used as the payment method.

The number of fraud reports exploded from 1,300 in 2018 to 33,700 last year where crypto was used as payment. In the first six months of 2022, cryptocurrency-related fraud reports already hit 25,000.

Cryptocurrency scams rose to the second riskiest scam type in 2021 — online purchases were No. 1 — based on a reported increase in both exposure and susceptibility to the scam, according to a report by the Better Business Bureau. Crypto scams ranked No. 7 in 2020. More than 66% of people reported losing money when targeted by a crypto-related scam type.

Many times, we’re looking at an investment-related scam where someone says they’ve found a way to double your money and then scams you out of cash. Some romance scams involve a new love who starts out casually offering tips on how to get into crypto. Experts warn: Never mix online dating with investment advice.

More:2 Michigan women tricked by convincing, sophisticated Amazon scam: What to know

More: Zelle scams trick consumersMany lose money when scammers suggest they use the Zelle app

The cash to crypto scams bank on the notion that we’ve heard of bitcoin but what we know about digital currency is extremely limited.

“Bitcoin is used by the fraudsters as many people are still unclear of how it works, so they believe the fraudster,” said Deidre Davis, chief marketing officer for the Michigan State University Federal Credit Union, which has seen some members hit by bitcoin fraud.

Bitcoin ATMS all over the place

The bitcoin machine might look somewhat like an ATM that we’ve used for decades. But only some designated bitcoin ATMs will dispense cash.

Sam Elyias, owner of the Star Market in Lake Orion, said he has not had complaints about the Cash2Bitcoin ATM at his store, where he leases a spot for it. He does not own the machine. The companies that own the kiosks pitch the space leases as a way for a small business to make passive income, while increasing foot traffic.

Elyias, who stopped to talk while reviewing the well-stocked store’s extensive inventory in late August, said he, too, is frustrated by scam calls, including a recent one that claimed he owed DTE a $500 deposit to change meters. Those scammers, he recalled, wanted money on gift cards, and suggested that he go to a Dollar General to buy them. He didn’t lose any cash because he figured out it was a scam.

Cash2Bitcoin’s website lists 174 locations in Michigan, including liquor stores and gas stations, plus more than 600 locations in other states.

Other names in the bitcoin universe include: Bitcoin of America, which has more than 2,500 BTM kiosks in 31 states, including Michigan.

Bitcoin Depot aims to go public in 2023 and has plans to list on the Nasdaq stock exchange. It has more than 140 kiosks in Michigan, including at liquor stores and small markets in Detroit, Hamtramck, Hazel Park and Warren. There’s even one listed in a Buffalo Wild Wings in Clinton Township. Bitcoin Depot says it has more than 7,000 ATM locations in the U.S. and Canada.

Consumers must understand that they should only send crypto to a wallet that the consumer controls, according to Brandon Mintz, founder, president and CEO of Bitcoin Depot.

Crypto is trustless, he said in an emailed statement, and does not depend on banks to facilitate transactions.

No intermediary will stop or reverse the transaction. “Once it’s in someone else’s wallet, there’s nothing you can do to recover your crypto,” Mintz stated.

Mintz noted that scam warnings are on the company’s Bitcoin ATMs, as well as some competitors.

Scammers sound way too convincing for some

After the fact, the stories that scammers tell admittedly sound convoluted but crooks know how to get you under the ether and suspend critical thinking. Hard-to-trace cryptocurrency only makes it easier for scammers to steal money.

Consumer calls relating to cryptocurrency scams tripled in the past year, according to the AARP Fraud Watch Helpline.

One victim, who lost nearly $15,000 in a bitcoin ATM scam, received an email from a company about a charge he didn’t make, according to a recent complaint to the AARP Fraud Watch Network. He called that number listed in the email and the person on the line had him hand over access to his computer device to supposedly facilitate a refund.

The crooks then gained access to the man’s bank account and falsely claimed that they had “returned” too much money to him as part of that refund on the bad charge. The solution? He was to deposit the extra money into a bitcoin ATM. He made two transactions and ended up losing nearly $15,000.

A woman was told she was owed a refund of $790 after a mistaken charge to her account. But again, the scammers said they deposited too much — $7,900 supposedly in this case — and the woman ended up using a bitcoin machine as instructed by the scammers to send up to $5,200 to fix the phony problem, according to Nofziger. The woman lost her money.

Martha Cheresh, who was born in metro Detroit but now lives in Santa Monica, California, told the Free Press she spent several hours in early August dealing with upsetting conversations after scammers wove one elaborate story after another.

She got a call that claimed to be from Amazon customer service. She answered because she had just bought something at Amazon. But the caller didn’t talk about her purchase but instead informed Cheresh that she bought an iPhone and earbuds costing more than $1,000 that were being sent to Albany, New York.

Something she knew she didn’t do.

The conversation soon turned in another direction as more information was given to her and she was transferred from one authority to the next. She was accused of money laundering involving $100,000. She was told that there were drug trafficking allegations against her. She spoke with a man impersonating the Drug Enforcement Administration and then was transferred to an investigator from the Treasury Department.

“I wasn’t questioning any of this at the time,” she said, pointing out how real it all sounded. “I was just like putty.”

The whole process ran from about that first call at about 11:30 a.m. to roughly 4 p.m. when she was at bitcoin ATM.

In order to fix to the problems, she was told to withdraw cash from the bank and go to a bitcoin ATM in her area, not far from a store where she shops. The idea was to create some kind of government account that would help prove she wasn’t involved in illegal activities.

She doesn’t recall seeing any alerts to consumers about potential scams on that ATM, nothing like you sometimes see now on shelves where retailers sell gift cards.

“I want to go to all the bitcoin machines and put a warning on the side,” said Cheresh, a retired teacher.

Cheresh lost $4,900.

“They get you with fear,” she said. “Fear can make you foggy.”

Flint woman rebuilds her savings after bitcoin ATM scam

A woman in the Flint area lost $4,500 in late April after fraudsters convincd her to withdraw cash from her bank and send money via a bitcoin ATM at a gas station.

Taylor Inman, 26, was told initially that an iPhone or a MacBook Pro, she can’t remember which, was bought using her credit for $995 and then was being sent to Brooklyn, New York.

Then somehow the conversation with the caller turned, and she supposedly was transferred to the U.S. Department of Treasury. Somehow her identity and Social Security number, she was told, were used in a money laundering scam.

“They had opened five different bank accounts around the U.S.,” she said.

And the scammers told her that now she needed to send money through a bitcoin ATM as part of a complex process to clear her name. She wasn’t going to lose a dime, supposedly. It was part of a way to freeze her credit and get a new Social Security number. But she was told she could not tell anyone.

The scammers told her where to find the bitcoin ATM at a gas station nearby.

“I was putting the money in the machine thinking and hoping I was going to get it back,” Inman said “I didn’t think it was a scam. They are very convincing people. They already know what to say.”

Inman called her boyfriend to meet her at the ATM gas station to bring her a water. He tried to tell her it was a scam. He called 911 and they told her it was a scam, she said. But it was too late. The money was gone.

“I didn’t know that bitcoin is pretty much untraceable,” she said.

She packages car parts at the NorthGate factory in Flint and has been rebuilding her savings by working as much as possible.

“The thing that people need to know is nobody is ever going to call you asking for money, saying you have to do this and this and this,” Inman said. “It’s just a scam.”

It can sound so official even to a ‘techie’

Halushka’s contact for that so-called job offer knew how to make things sound official and even sent her an employment contract in advance. Family members and friends reviewed it and told her it looked like the real deal.

The idea of sending money via a bitcoin ATM sounded somewhat convincing as a possible way to prove that she lived in the area she said she did. You can’t be sending laptops and other equipment somewhere else, after all.

She drove roughly 15 miles one way to the liquor store to use that bitcoin ATM. She was given a QR code as part of the process. The so-called representative at the company walked her through what seemed to be a fairly complicated process to send cash via bitcoin.

“They gave me step by step instructions,” Halushka said.

She said goodbye to the five $100 bills, got back in her car and thought somehow really, this wasn’t right.

“The whole thing was very weird,” she said.

Sure, she thought she was sending back $500 of their money.

But everything just didn’t add up. The job opening just showed up one day in her email. The main job interview was done via a RingCentral messaging app over roughly three hours. She didn’t talk with anyone until she asked to do so. Even then, the phone conversation was short and the man’s voice was kind of muffled.

“The offer letter was for way more than I was expecting,” she said, noting that it would pay $45 an hour. But then again, she had family members look at the offer and they seemed to think it was OK.

Yet this crypto wallet and bitcoin thing?

“Something was off,” she said.

When Halushka got home to her family’s house in Oakland Township, she decided to call the company, Radius Health — which was listed as Radius Healthcare on that first email that she received out of the blue.

No such job existed, she was told on the phone by someone at the real Radius Health. Halushka recalled the woman saying: “Don’t do anything else. That’s a scam. We’re not offering that position right now.”

By Googling Radius Healthcare after the fact, you’d spot some scam alerts online about this being a fake company.

Halushka could have been out thousands of dollars had the scam been allowed to continue. The scammers wanted her to keep sending more money, given the size of that $6,548 fake check, and turned extremely aggressive when she flat out told them via message that she knew this was a scam.

“You are a theif,” the scammer typed, spelling thief incorrectly. “You want to keep the money. I’ll f— you up big time.”

The bank eventually determined that the check that was sent was fake — and Halushka was out the $500 but that was all. The check itself was supposedly issued by a Brandon Clark of Union, Mississippi. (A name that oddly enough appears online as part of a U.S. Immigration and Customs Enforcement narcotics investigation in Mississippi.)

“I had never heard of any employment scam up until now,” Halushka said.

Halushka, who was targeted by scammers in early August, still cannot believe that she never heard of how crooks track resumes posted on job search sites, target those who need work and then use fake checks that ultimately bounce to trick consumers out of their cash.

She had no idea that a bitcoin ATM could cause trouble; she knows of a relative who lost money buying Target gift cards in one scam.

“I consider myself a techie,” she said. “Every single year, they’re getting more and more crafty.”

She still shakes her head — and hopes that somehow she can get her money back — when she thinks of driving to a store in a neighborhood that she had never been in before.

“Why am I going to this sketchy liquor store?” she asked, long after her money was gone.

ContactSusan Tompor via stompor@freepress.com. Follow her on Twitter@tompor. To subscribe, please go to freep.com/specialoffer. Read more on business and sign up for our business newsletter.