Bitcoin’s volatility might rise in the days ahead – Why?

- This was the largest spike in the movement of BTC’s dormant supply in more than two years.

- Whales continued to add Bitcoin exposure to their portfolios.

Bitcoin [BTC] consolidated in the $64k — $67k range over the week, facing a stiff resistance at $68k.

At press time, the king coin was exchanging hands at $64.14k, 12% lower than the all-time high (ATH) hit earlier in the month, according to CoinMarketCap.

What to expect next?

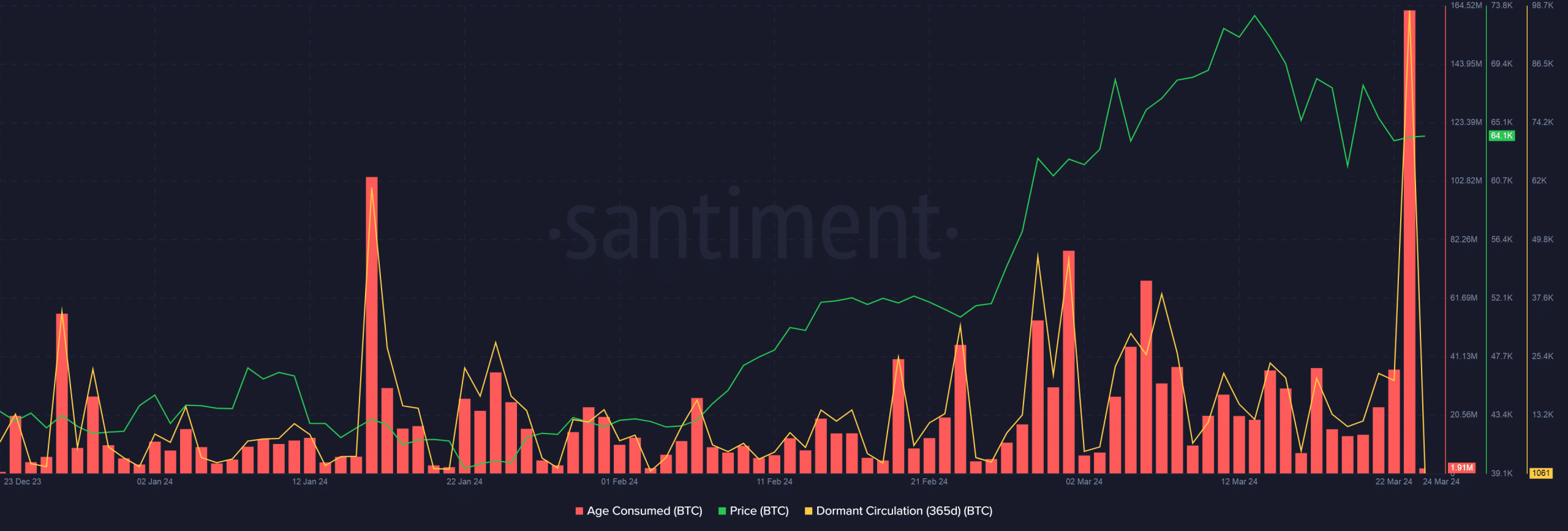

However, days ahead could witness a significant bout of volatility. According to AMBCrypto’s analysis of Santiment’s data, many previously inactive BTCs started moving between addresses on the 23rd of March.

In fact, this was the largest spike in the movement of BTC’s dormant supply in more than two years.

For much of 2023, dormant supply across major age bands hit new highs, signaling a market strategy of caution and HODLing.

But with Bitcoin’s price zooming to new highs in 2024, these long-term holders began chasing profits, freeing up more Bitcoins for active trading. Typically, fall in dormant supply precedes volatility and price surges.

Current market structure supports price increase

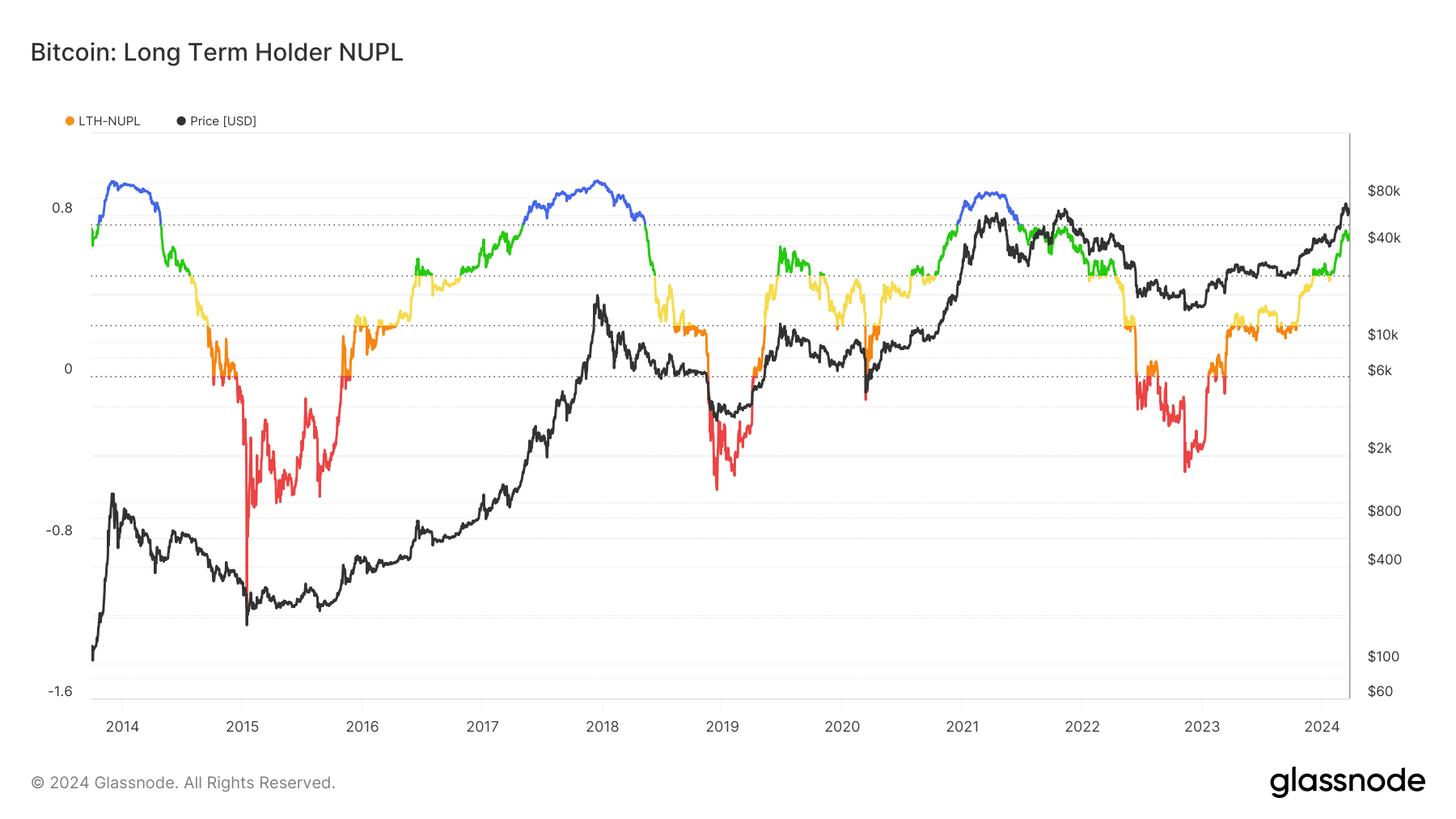

Notably, most of the long-term holders were in a state of profit, AMBCrypto analyzed using Glassnode’s Net Unrealized Profit/Loss metric.

This market phase, dubbed as one of belief, has historically aided further price increases, as shown below. The market top, generally associated with euphoria and greed, was still a long way off.

Whales continue to stockpile

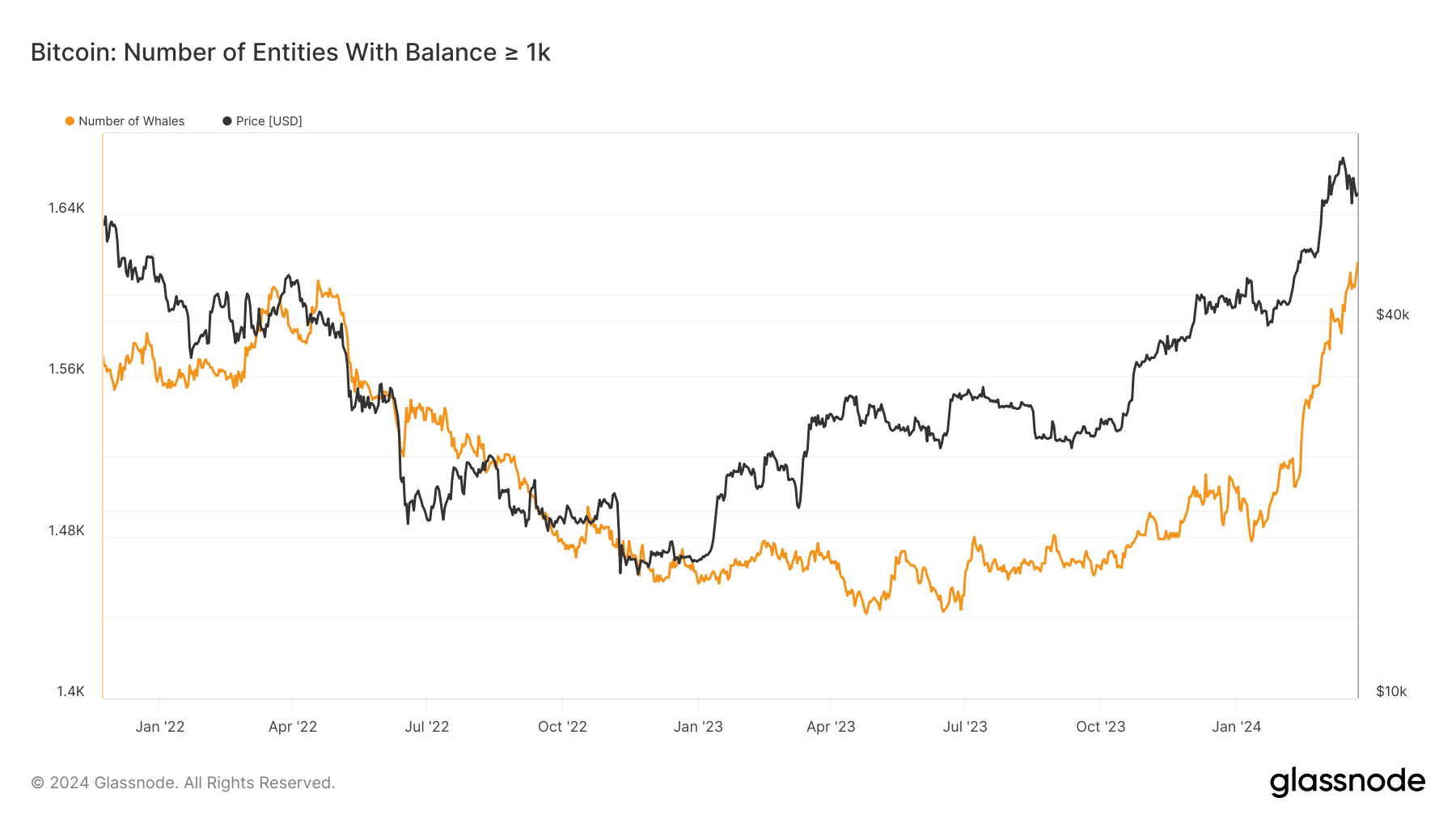

Meanwhile, whales were making full use of the suppressed market to add more Bitcoin exposure to their portfolios.

The number of unique entities holding at least 1k coins jumped to 1,616 on the 23rd of March, the highest since February 2021.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Interestingly, the accumulation didn’t slow down despite Bitcoin’s sharp correction from its peak, suggesting a belief in the crypto’s long-term price appreciation.

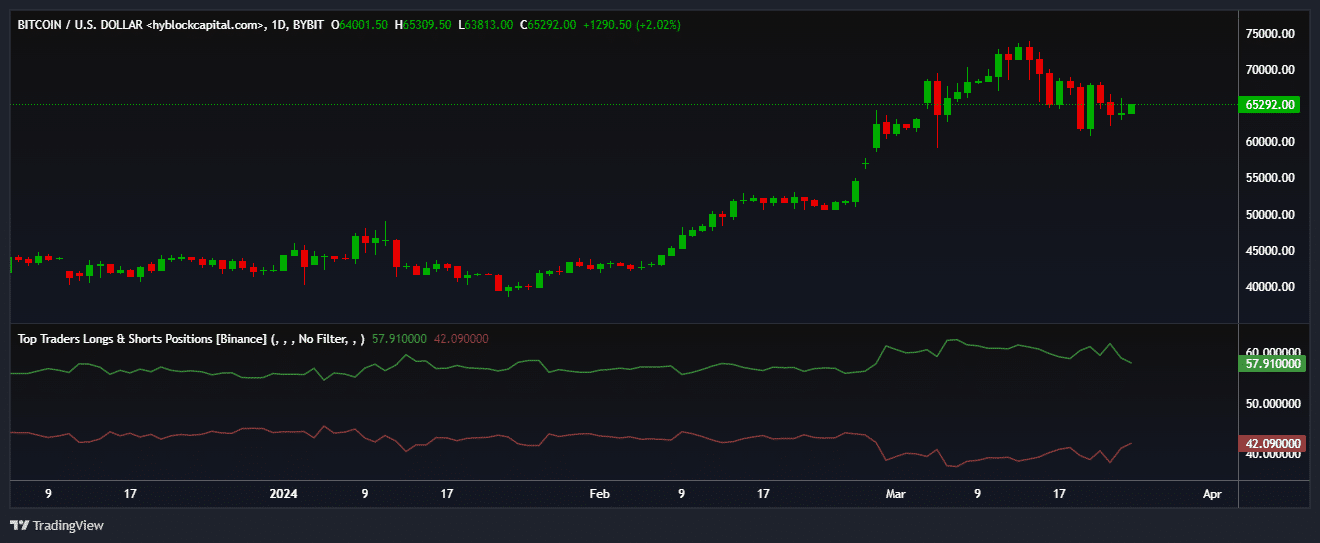

Whales exhibited their optimism in the derivatives markets as well. At press time, nearly 58% of all whale positions on Binance were long on Bitcoin, as per Hyblock Capital.