This Is What to Expect

With the Bitcoin halving on the horizon, cryptocurrency investors eye potential market movements that historically signal the start of a new bull market.

As one stands 60 days before the pivotal moment in April 2024, a glance at Bitcoin’s past reveals a pattern. Pre-halving price corrections have often heralded significant rallies post-halving.

A Bitcoin Price Correction Before the Halving

The trend analysis of Bitcoin since its inception in 2009 underscores a recurring theme. Indeed, a notable price dip precedes each halving, setting the stage for a subsequent market surge.

For instance, in 2012, a dramatic 50.78% drop in Bitcoin’s price was observed just months before the halving. However, Bitcoin climbed to new heights thereafter. Similar patterns were noted in 2016 and 2020, with pre-halving corrections of 40.37% and a stark 63.09% drop, respectively, followed by robust recoveries post-halving.

As of early 2024, Bitcoin experienced a 21.17% growth, igniting speculations of an impending bullish market. However, if historical patterns indicate, the market might brace itself for a correction, potentially dipping below $45,000 before rallying post-halving.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

The Crypto Bull Market Starts Post-Halving

The significance of these halving events cannot be overstated. Following the halvings in 2012, 2016, and 2020, Bitcoin witnessed staggering surges of 11,000%, 3,072%, and 700%, respectively.

These periods of bullish momentum lasted between 365 and 549 days, reflecting the profound impact halvings have on market dynamics.

Should the forthcoming bull market mirror past trajectories, expectations could set the next Bitcoin market peak around April or October 2025.

Why Sell BTC 18 Months After the Halving

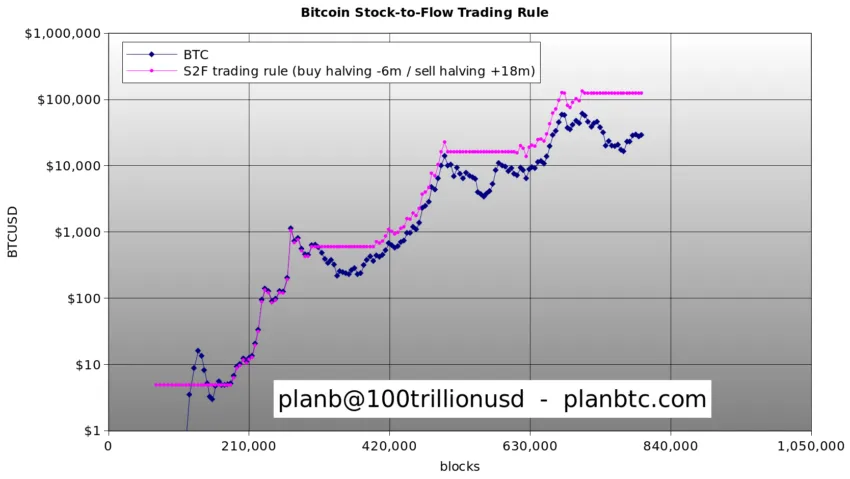

Amidst these cyclical patterns, Plan B’s “Stock-to-Flow Trading Rule” presents a strategic approach to navigating the Bitcoin market. Advocating for purchases six months before the halving and sales 18 months after, this strategy aims to leverage the predictable cyclical behavior of Bitcoin prices.

Plan B emphasized that while this is not a prediction model, it has historically outperformed Bitcoin’s price trends, suggesting a potential 4X increase in Bitcoin price in the current cycle.

“Bitcoin is at $30,000, so the strategy [anticipates a] 4X in the Bitcoin price. We are awaiting the next Buy Signal and we know already that the halving will be around April 2024, so six months before that is around October… Then [Bitcoin will] enter the market and will stay there for two more years until October 2025, 24 months later,” Plan B said.

Read more: Bitcoin Price Prediction 2024/2025/2030

The anticipation of the next bull market is grounded in analyzing Bitcoin’s historical price movements and strategic trading models like Plan B’s. As the early bull market stage is identified, the stage is set for significant price jumps post-April 2024 halving.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.