Is Coinbase Safe? Detailed Review & Data

Over the past decade, Coinbase has reached millions of cryptocurrency traders and expanded to become the largest crypto exchange in the US. Despite its solid reputation, Coinbase did not avert scrutiny and skepticism. It has intensified in the past two years, driven by the sharp upsurge and plunge in crypto prices in a short period. But what has become the hot topic was the sudden collapse of FTX, the former largest crypto exchange worldwide.

Nonetheless, it remains an influential figure in the market. True believers regard cryptocurrencies despite not being a sure inflation hedge. Bitcoin’s inverse correlation with inflation showed how much macroeconomic indicators could affect crypto prices. Traders continue to capitalize on crypto volatility to generate massive gains.

Given this, Coinbase enjoys high crypto balances. This formidable crypto exchange giant leverages the weakness of its smaller peers. Inflows and outflows may sometimes be overwhelming, but its liquidity ensures it can sustain its operations. Hence, this article will explain why Coinbase is a safe cryptocurrency exchange.

What Makes Coinbase a Safe and Liquid Cryptocurrency Exchange

As a crypto trading newbie, one often looks for those exchanges with low transaction fees and secure user anonymity. But a more important consideration is whether it can sustain business operations with massive transactions.

Being in the business for over a decade, we may not have to ask ourselves, “Is Coinbase safe?” It has undergone massive ups and downs, such as the crypto bubble burst in 2017-2018 and the FTX fallout in 2022. Its liquidity and wise token allocation make it one of the most durable crypto exchanges. These are some reasons Coinbase is a safe crypto exchange.

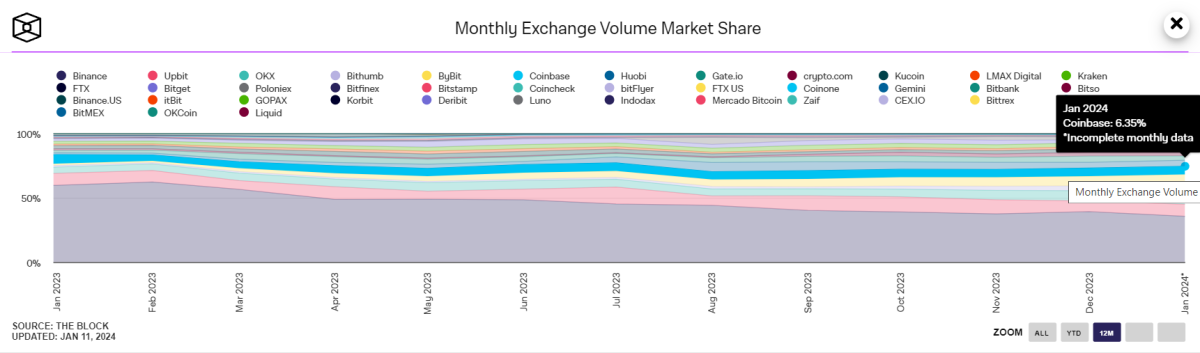

Stable monthly market share

Since the FTX collapse, we have seen how Binance has swiftly taken over the market. It dethroned Coinbase and kept a wide margin from its peers for a long time.

Even so, Coinbase showed it has not yet faltered and would not be another FTX despite the huge drop in traders’ confidence. Binance may be the giant now, but Coinbase is one of the original crypto exchanges. It has stood the test of time, facing massive crypto market shocks in recent years.

But what makes it a memorable crypto exchange contender is its stable market share. In January 2023, its market share was 6.97%. It plunged to 4.58% in only a month, the lowest market share in many years.

It rebounded in the following months but stayed within a 5-6% range. But since the second half of 2023, we can see a sustained increase in its market share before climbing to 6.2%. There have been some ups and downs, but they were much more manageable than in 2022.

At the end of the year, the market share increased again to 6.34%. As of today, it is recorded at 6.35%. It may be lower year-over-year but much better than in the previous months. The sustained rebound shows it can withstand challenges and regain momentum amid tight competition. It is indeed a resilient crypto exchange.

And if we compare it to other exchanges, Coinbase had one of the most stable market share changes in the past year. Take Binance as an example. It remains the largest exchange but has already lost about 25% of its market share after falling from 59% in January 2023 to 35% today.

We can attribute it to the recent controversy where it admitted its fault for violating the US Anti-Money Laundering Act. Hence, its close competitors, such as Coinbase, OKX, and Upbeat, capitalize on it to generate more traders.

High cryptocurrency balance

Another factor to consider is the liquidity and availability of digital assets. Given its adequate balance of primary cryptocurrencies, Coinbase remains a huge cryptocurrency exchange. These include Bitcoin (BTC) and Ethereum (ETH).

Coinbase is the second-largest cryptocurrency exchange in the total Bitcoin balance. As of this writing, it has 411,762.68 Bitcoins or 2.2% of the total circulating supply in the market. It also has a narrow gap with Binance, the top Bitcoin holder, with 554,836.88 or 2.8% of the total market volume.

Bitfinex comes as a close third with 388,742.04 or 2.0% of the total market supply. The top three Bitcoin exchanges have a wide margin from the fourth placer, OKX, with just 132,678.97 or 0.7%.

With regard to Ethereum, the total balance in Coinbase is 2,185,579.12, or 1.8% of the total circulating supply. It ranks third after Binance and Bitfinex with 3,770,920.82 or 3.1% and 2,349,649.56 or 2.0%, respectively. Kraken is in fourth place with 1,691,412.27, or 1.4% of the total circulating coins. These four largest Ethereum holders are far larger than OKX, the fifth placer with 945,955.80 or 0.8%.

Even in other cryptocurrencies, Coinbase also has one of the largest reserves. It ranks second in USDC with 516,852,821.09, although it is far lower than Binance with 1,454,578,122.56. It has a wide difference from OKX, the third placer, with 157,577,919.60. The remaining exchanges with USDC have less than a 100,000,000 balance.

For smaller cryptocurrencies, Coinbase remains popular as it is one of the top ten holders of their reserves. Several examples include DAI (fifth- 2,848,007.58), USDT (ninth- 35,157,653.02), SKL (seventh- 7,393,205.74), and USDP (fourth- 482,327.81).

Given this, Coinbase appears to have adequate liquidity levels, allowing it to sustain high-volume transactions. This is a crucial aspect to consider in a highly volatile market.

Prudent Token Allocation

Traders should also consider the level of reliance on a specific token or coin. The former largest crypto exchange, FTX, may have neglected this crucial aspect. Its reliance on its own tokens led to its unexpected downfall in 2022. This led to capital outflows in many other exchanges, and Coinbase was no exception.

On a lighter note, Coinbase does not appear to be another FTX in the making, given its high balance of various cryptocurrencies. It is not heavily reliant on a single cryptocurrency. It holds various cryptocurrencies and is part of the top ten exchanges in many cryptocurrencies it holds.

Like most crypto exchanges, Bitcoin remains its most abundant reserve. It is a crucial token since many businesses around the world widely accept it. Ethereum comes second, also used for business and government transactions. Many government agencies are taking Ethereum contracts for their services.

These two cryptocurrencies are essential in various states, especially Texas, which has the ninth-largest economy globally. That is why following the requirements and processes of forming an LLC in Texas is easier with crypto payments.

As such, Coinbase can withstand a massive outflow of a single cryptocurrency. Thankfully, its high liquidity will help it cover the foregone capital while refocusing on other reserves.

Key Takeaways

Coinbase has been through crests and troughs since its inception a decade ago. Although it has a long way to go before it goes head-to-head with Binance, it has a huge potential to outperform the third and second placers. Its existence for over ten years says a lot about its resilience and prudence. Hence, this crypto exchange promises safety to cryptocurrency traders.

This is a guest post by Ivan Serrano. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.