Decoding the US Economic Calendar

This week presents a shorter trading period for the United States (US) markets due to Presidents Day, leaving investors with fewer days in the calendar to navigate a packed schedule of economic events. The US Federal Reserve vice chair will also provide insights into the nation’s monetary policy later in the week.

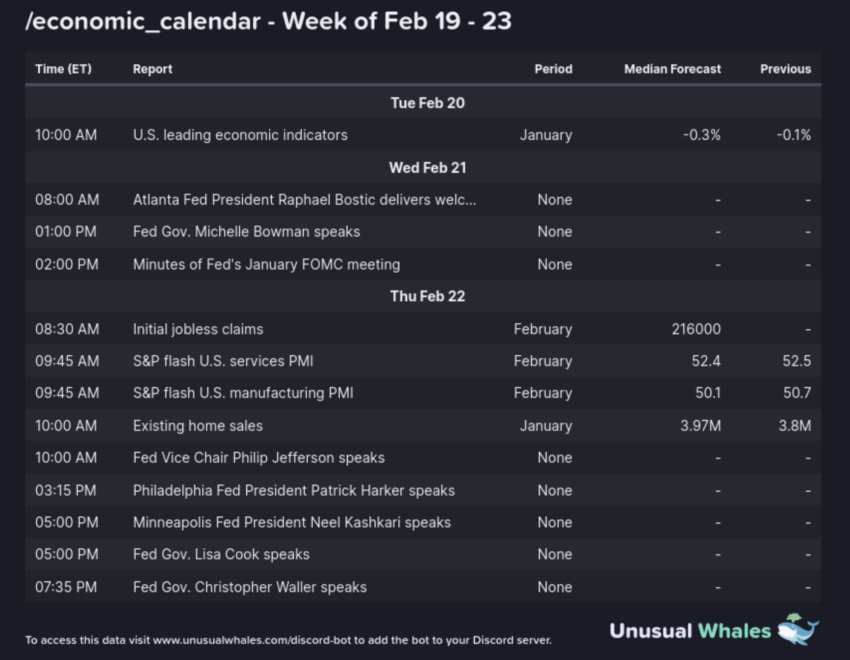

Macroeconomics outlet The Kobeissi Letter shared the key economic events for the United States for the week beginning February 19.

Economic Calendar Events

February 19 is Presidents Day, and the New York Stock Exchange (NYSE), Nasdaq, and bond markets are all closed for the federal holiday.

February 21 will see the release of the latest Federal Reserve FOMC Meeting minutes. There is speculation over how the US Federal Reserve will approach interest rates, with only seven remaining meetings for the year. Currently, the benchmark interest rate is 5.5%.

According to Forbes, this may leave short-term interest rates at approximately 4% by 2024. However, most of the cuts could come in the year’s second half. Lower interest rates normally coincide with boosts in the stock and crypto markets.

Read more: 7 Ways To Handle Retirement With Increasing Inflation

On February 22, the S&P Global Services Purchasing Managers’ Index (PMI) data will be released. The data is based on surveys of over 400 executives in private sector service companies.

Fed Speeches and Earnings Season

Meanwhile, five Federal Reserve officials will speak this week. One speech to note is that of the vice chair of the US Federal Reserve, Philip Jefferson, who will discuss the US economic outlook and monetary policy.

This week, approximately 15% of S&P 500 companies are projected to announce their earnings, drawing the speculative attention of investors.

Read more: What Is Dollar-Cost Averaging (DCA)?

Among these companies, Nvidia, a prominent AI computing company, will release its earnings report on February 21.

In the crypto market, numerous investors closely monitor Bitcoin’s price, which crossed the $50,000 threshold last week. There is also heightened anticipation surrounding the overall crypto market cap, which hit $2 trillion last week.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.