Why did Bitcoin’s market cap surge by over $102 billion while realized cap only grew by $4 billion?

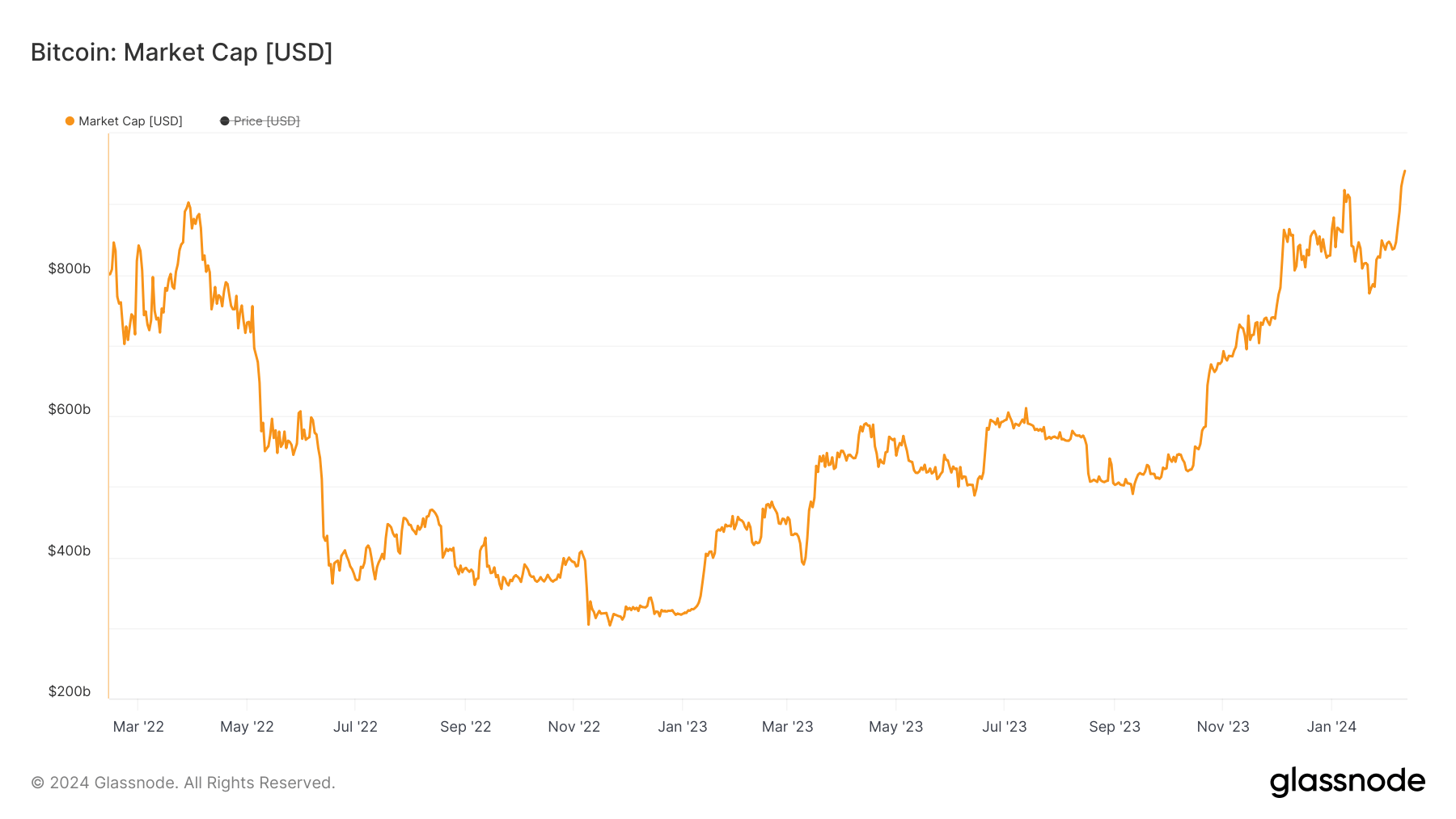

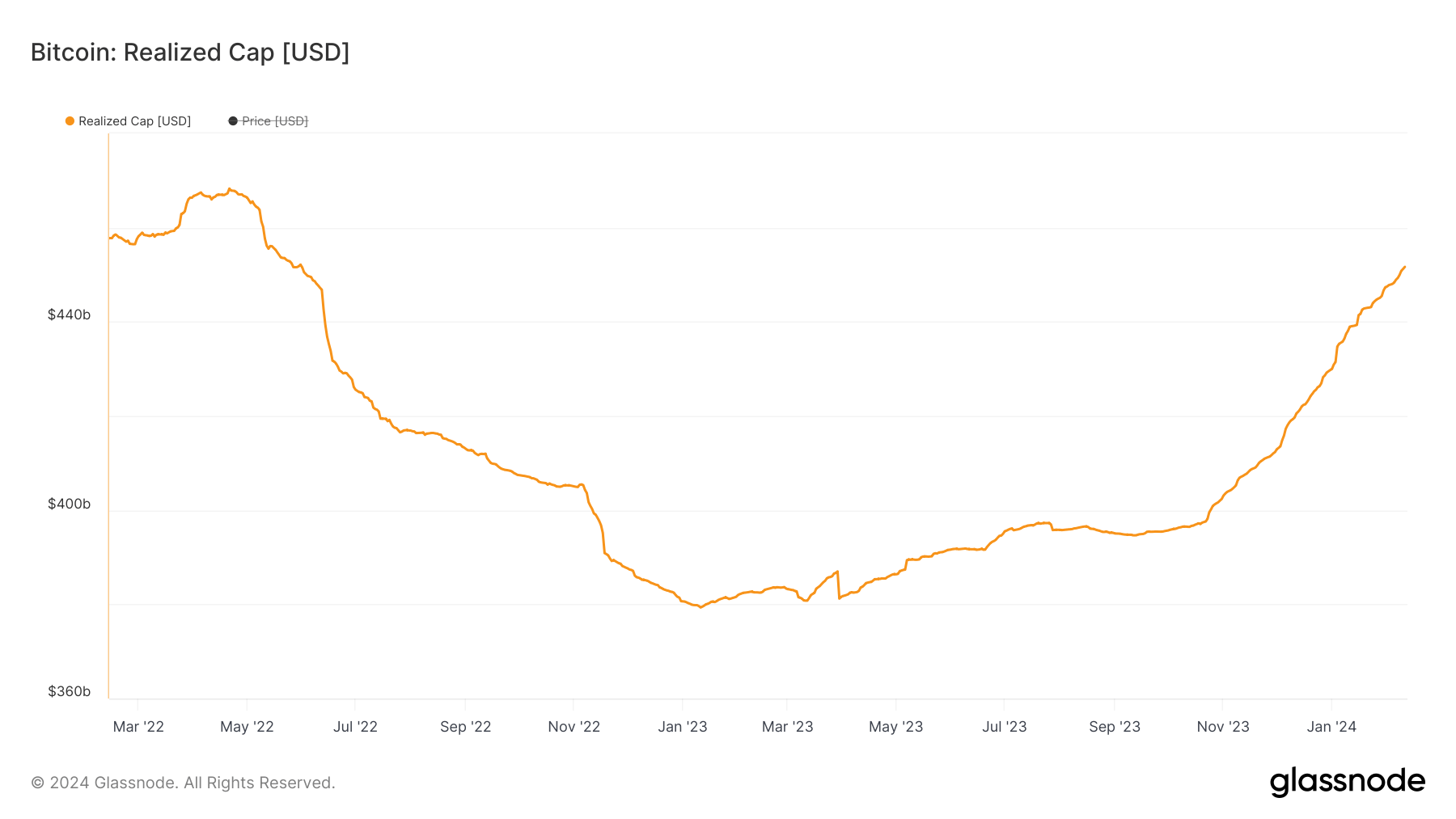

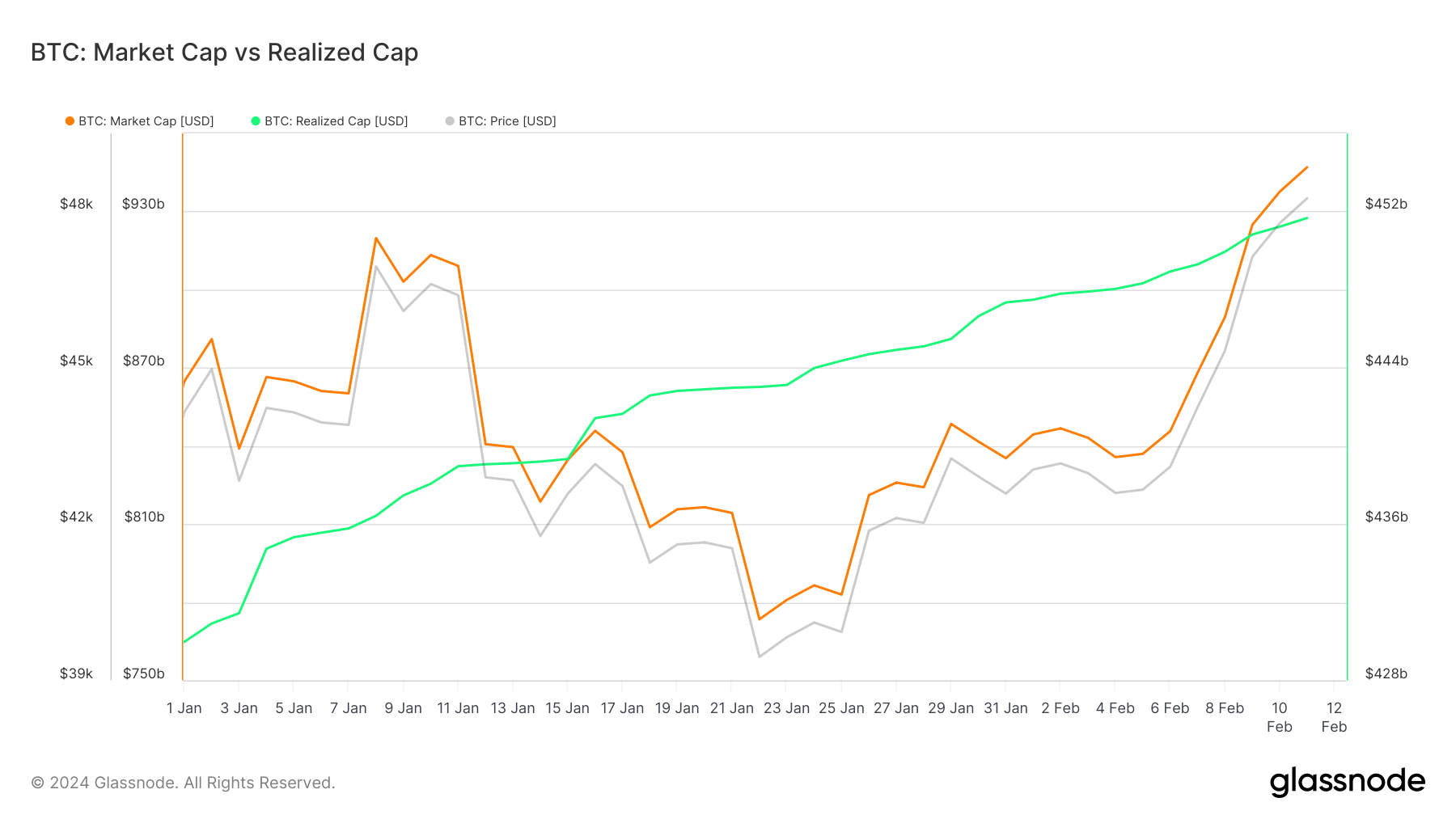

Bitcoin’s price saw a significant increase in February, jumping from $43,049 at the beginning of the month to $49,900 on Feb. 12, as of press time. Crossing $49,000 marks a significant milestone for BTC, as it indicates the potential to breach the $50,000 resistance and move closer to its all-time high. Alongside its price surge, Bitcoin’s market capitalization increased dramatically by over $102.5 billion in February. During the same timeframe, Bitcoin’s realized cap saw a more modest increase, rising just over $4 billion, from $447.48 billion to $451.66 billion.

Understanding the differences and increases in these two metrics is crucial for market analysis. While both might seem too broad to offer insight into subtle market movements, their difference, and long-term trends are often among the best market health indicators. This is especially true for realized cap, an often overlooked metric that provides valuable information about the aggregate cost basis for the entire market.

Market capitalization is calculated by multiplying Bitcoin’s current market price by the total number of coins in circulation. It’s a very crude metric but a widely used one, as it’s the best way to present the size of a particular asset or market. Market cap is highly responsive to price fluctuations and often experiences significant shifts within short periods, mirroring the immediate market sentiment and speculative activities. An uptick in Bitcoin’s market price can quickly and aggressively expand the market cap, showing the current valuation of all Bitcoins at BTC’s latest market price.

Realized cap, on the other hand, provides a more nuanced perspective of Bitcoin’s value. Unlike market cap, which only considers Bitcoin’s latest market price, realized cap considers the history of each coin to understand its contribution to the total value of the Bitcoin network. This method looks at the price at which each Bitcoin was actually moved. By focusing on these transaction prices, realized cap offers a snapshot of the market that considers the actual prices people paid for their BTC rather than the current market price, which can be influenced by short-term trading.

When Bitcoins are traded at prices higher than the price at which they were last moved, the realized cap increases. This is because the newer, higher transaction prices are now considered, raising the overall “cost basis” or the aggregate amount spent on acquiring Bitcoins. If, on the other hand, Bitcoin is only being moved at prices lower than their last transaction price, the realized cap decreases.

This “aggregate cost basis” is a crucial concept as it provides insight into the actual investment poured into Bitcoin. It offers a more stable and less volatile metric than the market cap, which can swing wildly with price changes. The realized cap, therefore, can be seen as a more grounded measure of Bitcoin’s economic footprint, reflecting the steadfast commitment of investors to the network over time.

The contrast seen in February — where the market cap saw a substantial rise while the realized cap saw a more modest increase — shows a period of significant price appreciation. This divergence is attributable to the market cap’s direct reflection of current price movements, as opposed to the realized cap.

The surge in market cap indicates the overarching market sentiment and liquidity. A bullish sentiment can catalyze more buying, propelling both the price and market cap upwards. However, the realized cap will not promptly mirror this enthusiasm if this buying activity is concentrated within the young supply rather than involving long-held coins.

The increase in realized cap suggests that a significant volume of Bitcoin has changed hands at prices higher than the historical average at which they were previously acquired. The continuous increase in realized cap since September 2023 shows that the market is steadily absorbing selling pressure, with both new and existing investors showing readiness to buy at or above current prices.

This foundation can serve as a launchpad for future price increases, as it reflects a solid underlying investor confidence and a valuation basis that is less likely to be eroded by short-term market volatility.

The post Why did Bitcoin’s market cap surge by over $102 billion while realized cap only grew by $4 billion? appeared first on CryptoSlate.