Is Donald Trump’s Re-Election Good for Bitcoin?

As the November presidential election approaches in the United States, speculation mounts about the potential repercussions of Donald Trump’s re-election, particularly concerning Bitcoin’s future.

With an astute blend of financial analysis and political insight, what could be the nuanced interplay between a Trump victory and the cryptocurrency market?

Donald Trump’s Potential Presidency Impact on Bitcoin

DWS Group, with its formidable $924.5 billion in assets under management, expressed apprehensions regarding Donald Trump’s potential re-election. Especially, regarding its impact on US Treasury bonds.

The firm recalled the 2016 aftermath when Trump’s win led to a sharp increase in 10-year government bond yields. It hinted at inflationary pressures that could re-emerge with Trump at the helm.

“[Donald Trump] has said he will raise the tariff on all imports to 10%, which is likely to be inflationary, and announced that he will retain the 2017 tax cuts, which are also fueling growth and prices. This, together with the experiences from Trump’s first term in office, in our opinion provide sufficient arguments for higher yields in the event of his election,” analysts at DWS Group wrote.

Moreover, Rick Santelli, an On-Air Editor at CNBC Business News, cautioned about the high yield close for 30-year bonds in 2024, standing at 4.41%. He highlighted that reaching this yield level again could trigger a wave of selling, even after positive auction outcomes.

“We talk about tailing. Tailing’s bad. This was on the screws, which is exactly the opposite. It stopped through by two basis points. I can’t tell you how aggressive that is. So 4.38 is the one issue market. This came in at 4.36. Lower yield, higher price, the government selling. Higher prices are good when you’re a seller. Now, two basis points is very large historically,” Santelli said.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Trump’s economic strategies have historically triggered fluctuations in the market. His pointed criticism of the Federal Reserve’s approach, coupled with his promise to replace Jerome Powell as Chair, hints at significant changes in US monetary policy.

This is a pivotal consideration for investors, given its potential to profoundly impact currency values and, consequently, Bitcoin’s attractiveness as an investment option. Furthermore, policies leading to inflation and increased bond yields might enhance Bitcoin’s allure as a protective measure against inflationary pressures.

It is worth noting that Trump’s critical stance on Central Bank Digital Currencies (CBDCs) and artificial intelligence further improves the scenario. Trump opposes CBDCs, citing threats to personal financial autonomy and increased government surveillance. This could inadvertently bolster the case for decentralized cryptocurrencies like Bitcoin.

Read more: Bitcoin Price Prediction 2024/2025/2030

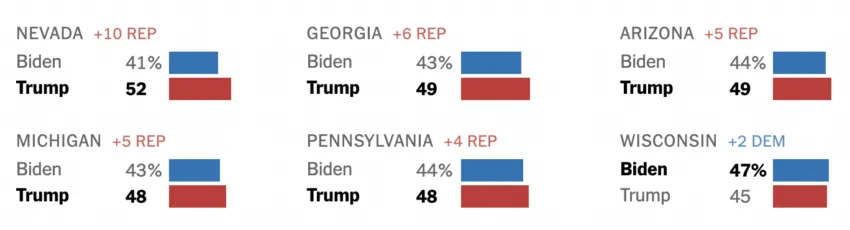

With Trump ahead in five of six swing states, the interconnection between his economic and political strategies and Bitcoin’s market position is intricate. Trump’s policies might induce short-term market jitters, leading to increased interest in Bitcoin as a safe haven. Still, the long-term impact is contingent upon broader economic outcomes, including inflation rates and the dollar’s strength.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.