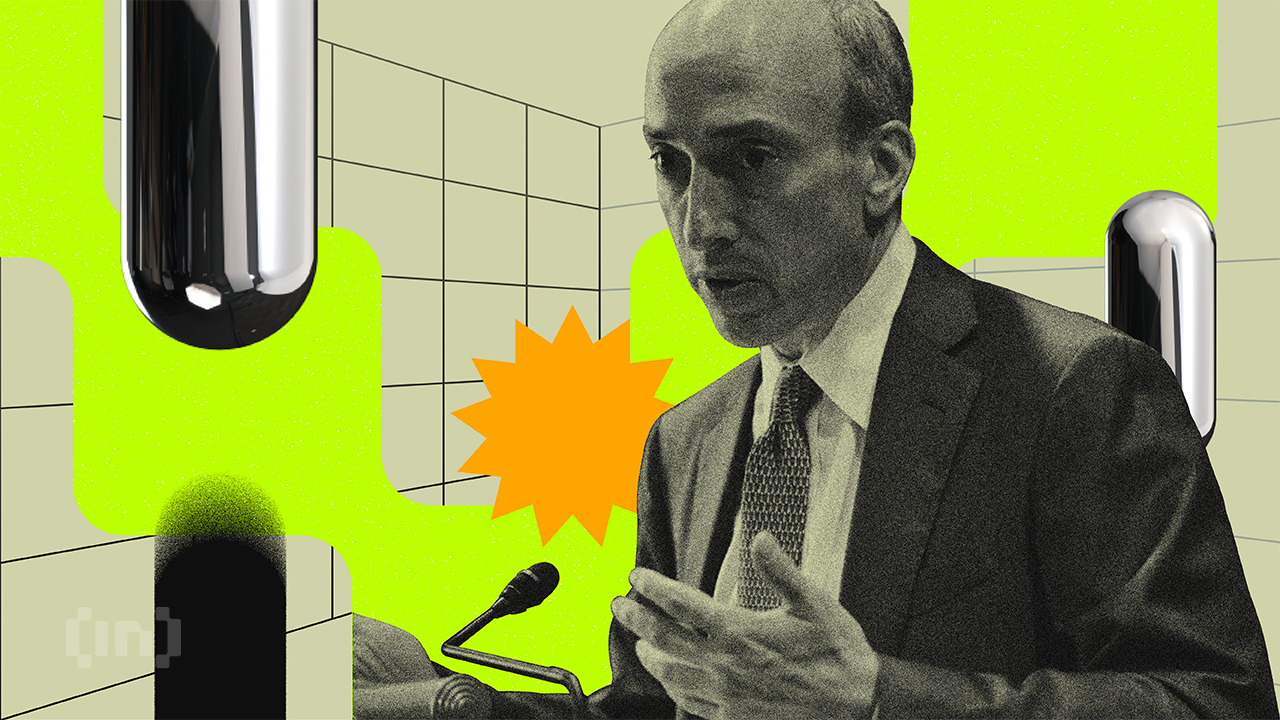

How Can Gary Gensler Still Claim Crypto Regulatory Mandate?

Securities and Exchange Commission (SEC) Chair Gary Gensler testified on Wednesday before the House Financial Services Committee, fiercely upholding his agency’s role as a cop bringing order to the crypto markets.

Gensler spoke at length about the SEC’s role and his understanding of what the securities laws empower it to do. He did not mention significant legal setbacks that might cast doubt on his testimony.

SEC Chair Gensler Argues That Securities Laws Apply to Crypto

In his testimony, Gensler went to some length to argue for what he saw as a clear mandate for SEC oversight of the crypto markets.

His view is plain: if US lawmakers in the past had meant for securities laws to provide a regulatory framework mainly or solely for stocks and bonds, they would have said so. And would have included explicit language to that effect in the Securities Exchange Act of 1934.

“Congress could have said in 1933 or 1934 that that the securities laws applied only to stocks and bonds. Yet Congress included a long list of 30-plus items in the definition of a security, including the term ‘investment contract.’”

Gensler then alluded to earlier statements of his where he argued that the “vast majority” of crypto investment tokens are classifiable as securities. Given the supposed presence of an investment contract.

An argument that a US District Couty judge in July of this year explicitly repudiated in a 34-page ruling.

Learn more about Gary Gensler’s legal war on cryptocurrency and the growing backlash against regulatory overreach.

Gensler Claims Longstanding Legal Precedent

He went on to state that clauses of the Securities Act requiring exchanges, brokers, and dealers to register, or meet requirements for an exemption, “have been on the books for decades.”

In Gensler’s view, the crypto industry’s “wide-ranging noncompliance” with the securities laws accounts for the turmoil that has made headlines in recent months.

A reference to the controversies engulfing failed exchanges such as FTX, Three Arrows Capital, and Celsius. (Only the last of which had its actual headquarters in the United States.) And an attempt to smear the industry as a whole by painting such fiascos as typical. Every crypto exchange in operation today is an embryonic FTX, Gensler all but stated.

“We’ve seen this story before. It’s reminiscent of what we had in the 1920s before the federal securities laws were put in place,” he said.

Gensler then tried to use this vague reasoning to justify the SEC’s recent and ongoing enforcement actions.

No Mention of Ripple Ruling

In view of the fact that a landmark legal ruling, bearing directly on these issues, just came down in July, Gensler’s testimony seems curiously selective.

He said that could not comment “on any active, ongoing litigation.” Perhaps attempting to deflect any objection that Gensler failed to mention Judge Analisa Torres’s July 13 ruling.

The judge sided with Ripple against the SEC. Finding that sales of Ripple’s XRP token via public exchanges do not count as securities, though those aimed at institutional investors do.

XRP soared 105% in the hours after this monumental ruling. The crypto industry celebrated. Many viewed Gensler and SEC as having suffered a historic defeat in their hardline approach to crypto regulation.

Typical were the sentiments of Gemini’s co-founder, Cameron Winklevoss, who hailed the outcome as a “watershed moment.” And not just for Ripple and XRP, but, Winklevoss argued, for all crypto exchanges over which the SEC has claimed oversight.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.