Can Bitcoin Cash Whales Push the Price Rally Toward $300?

After defending the $180 support last week, Bitcoin Cash (BCH) reclaimed $220 on Monday to emerge as the top gainer among the 20 largest crypto projects by market capitalization. On-chain data analysis examines some of the vital indicators that could push BCH’s price toward the $300 mark during the next bull rally.

Bitcoin Cash (BCH) price sent holders into a panic mode last week, coming close to losing the critical $180 support level. However, bullish whales braved the bearish headwinds, triggering a price recovery. On-chain data analysis examines how high the BCH price rally could go if the upcoming Fed rate announcement on September 20 bodes well for risk-on assets.

Despite Bearish Headwinds, BCH Whales Stepped Up the Buying Pressure

Bitcoin Cash (BCH) price decreased in the first ten days of September, dropping 19% from $226 to $184. But despite the intense bearish headwinds, the bullish crypto whales maintained a bullish stance.

On-chain data shows how the whales holding 1,000 to 100,000 BCH coins have played a pivotal role in pushing Bitcoin Cash to up the top gainers’ chart this week. Between August 31 and September 18, they bought the dip to the tune of 70,000 BCH coins, increasing their balances from 7.85 million BCH to 7.92 BCH.

Whale investors are high-net-worth investors or corporate entities holding a significant amount of cryptocurrency, ideally $100,000 or more. Due to their financial muscle, their trading activity often moves the markets significantly.

At current prices of $222, the 70,000 BCH the whales have accumulated this month is worth approximately $15.5 million. The chart above illustrates that despite the price uptrend, they are not showing signs of slowing down yet.

Notably, corporate entities are known to be sensitive to changes in interest rates set by central banks like the Federal Reserve, as it impacts yield obtained on other investment alternatives.

Considering that Reuters economists anticipate a rate freeze, the BCH whales will likely step up the buying trend after the Sept 20 Fed Meeting.

Retail Investors are Yet to Get In on the Act

Despite the recent double-digit price gains, Bitcoin Cash is still flying under the radar of many retail market participants. As depicted below, while Bitcoin Cash has been on a tear since September 11, Social Dominance has trended downward from 0.87% on September 12 to 0.55% on September 18.

Social Dominance measures the percentage of social media traffic a cryptocurrency network attracts in direct comparison to the top 50 most talked about projects. During a price rally, a downtrend in Social Dominance means the project is not yet attracting extreme media hype and retail market attention.

This could mean the Bitcoin Cash price is yet to hit a local top and has room to score more gains before the market euphoria sets.

In conclusion, if the Fed holds rates unchanged as predicted, Bitcoin Cash whales could intensify the buying pressure even further. And if the retail investors also ape in on the rally, both blocs of investors could push the BCH price rally to $300.

BCH Price Prediction: The Bullish Whales Could Target $300

From an on-chain perspective, the whales could trigger another BCH price rally toward $300 territory, especially if the upcoming Fed rate announcement triggers a favorable response across the crypto market.

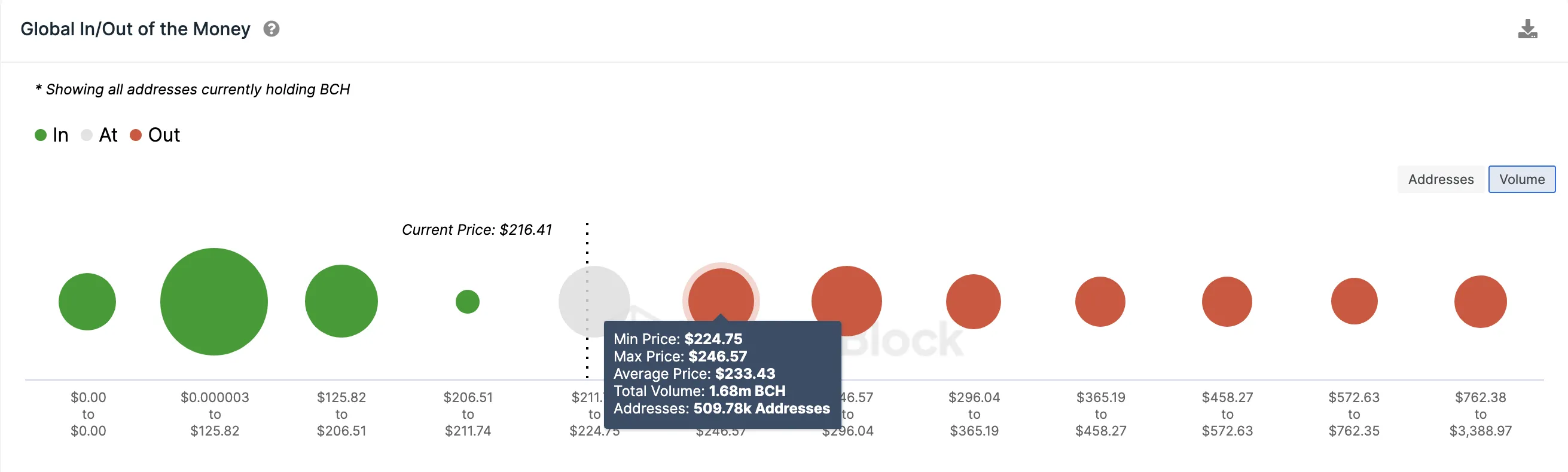

The In/Out of Money Around Price data, which depicts the purchase price distribution of current Bitcoin Cash holders, also validates this bullish thesis.

It shows that if the BCH price scales the initial resistance around $245, the bulls could gain momentum to push for $300. As shown below, the 509,780 addresses bought 1.68 million BCH at the maximum price of $246, the largest resistance cluster on the road at $300.

But if the Fed meeting outcome buoys the whales’ optimism, the BCH price rally could scale that obstacle and reclaim the $300 level for the first time since July 2023.

Conversely, the bears could seize control if the Bitcoin Cash price drops below the $180 level. However, as shown below, 162,580 addresses had bought 2.08 million BCH at the minimum price of $211.

They could offer considerable support, especially if the retail investors also buy in on the price rally.

Although unlikely, if that $211 support level caves in, the BCH price could eventually drop to $180.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.