Real-World Asset Tokenization Remains a Hot Crypto Narrative

The tokenization of real-world assets (RWA) is still a major growth area despite the deepening crypto bear market. Furthermore, the value of those tokenized assets has reached an all-time high and continues to grow.

On September 13, decentralized finance analyst ‘Viktor DeFi’ predicted that real-world asset tokenization would surpass $10 billion in 2024.

Real-World Assets Narrative

Moreover, RWA tokenization is one of the hottest crypto narratives despite the lengthening crypto winter. Real-world assets are tangible assets that exist in the physical world, which are brought and sold on-chain.

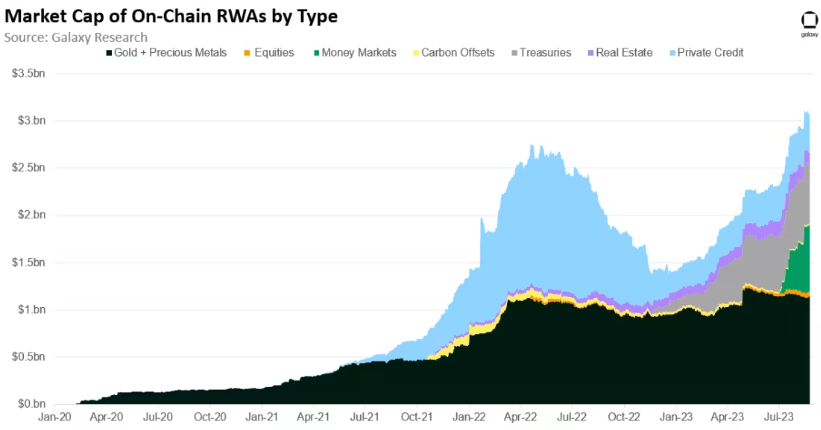

According to Galaxy Research, the total value of all tokenized real-world assets reached a new all-time high of $3.1 billion in August.

The assets include sectors such as gold and precious metals, equities, money markets, carbon offsets, treasuries, real estate, and private credit.

Galaxy Research revealed,

“The recent expansion of RWAs has been fueled by on-chain demand for off-chain sources of yield.”

It added that in the wake of aggressive rate hikes, yield-bearing RWAs have grown by $1.44 billion. Additionally, this accounts for 87% of the $1.66 billion in value added to RWAs this year.

According to the chart, gold and precious metals comprise around 37% of the total. Around 23% is money markets, and 20% is tokenized treasuries.

Read more: Real World Asset (RWA) Backed Tokens Explained

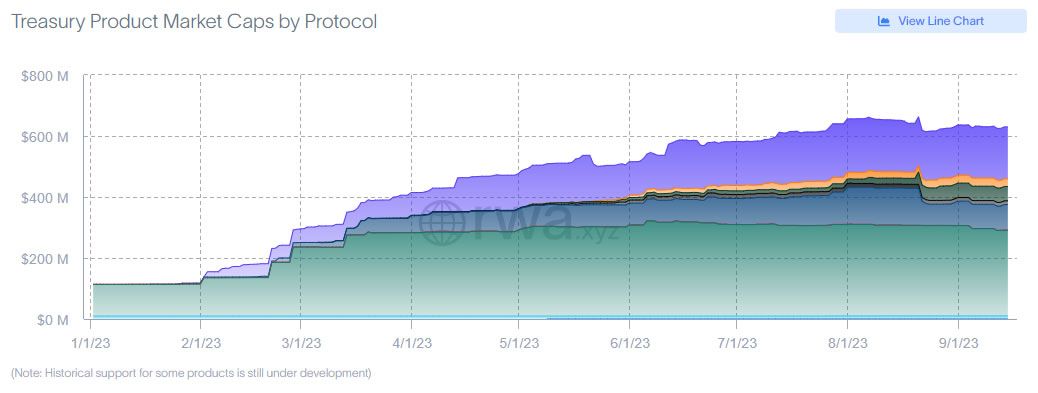

Tokenized treasuries have seen explosive growth this year, increasing by around 450% since the beginning of 2023.

According to rwa.xyz, the total value of tokenized treasuries is $630 million. However, there has been little additional growth since mid-June.

Centrifuge and Goldfinch hit all-time highs in active loan values this week. This followed their alignment with the newly formed Tokenized Asset Coalition (TAC).

Furthermore, the coalition was announced on September 7 with members including Circle, Coinbase, Aave, and Goldfinch.

Moreover, the industry group’s mission is to help educate the industry. It also advocates for standardization and innovative companies and collectively builds the protocols and infrastructure needed for scale adoption.

Chainlink and ANZ Test Tokenized Asset Transfer

In related news, one of Australia’s largest institutional banks, ANZ, has tested a cross-chain transfer of tokenized assets using Chainlink. The bank stated,

“Tokenised assets are already changing the way banking works, and the technology has the potential to do more.”

The bank worked with Chainlink Cross-Chain Interoperability Protocol (CCIP) to simulate the purchase of a tokenized asset, facilitated using a digital Aussie dollar (A$DC) and an ANZ-issued Z-dollar-denominated stablecoin.

Chainlink said that the test,

“Showcases how financial institutions can utilize CCIP to facilitate cross-chain transactions across public and private blockchains.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.