Bitcoin weighed down by debt ceiling uncertainty

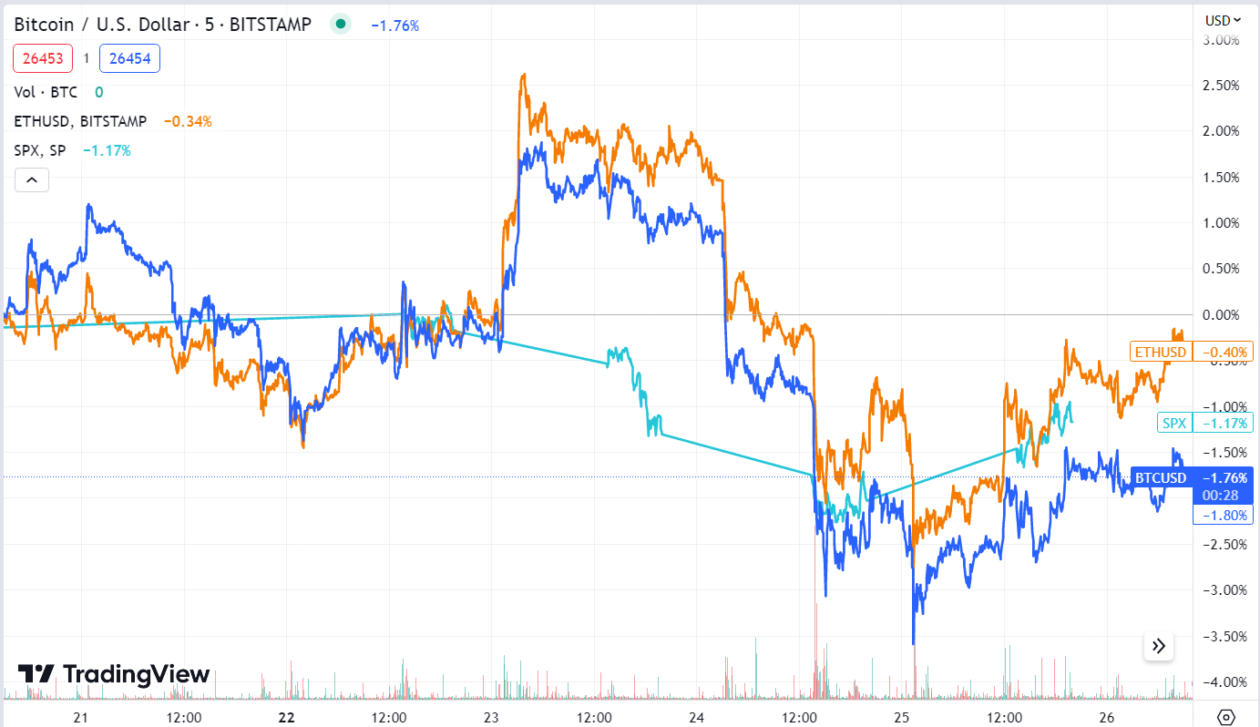

Bitcoin fell 1.40% from May 19 to May 26 to trade at US$26,451 at 7:00 p.m. Friday in Hong Kong. The world’s largest cryptocurrency by market capitalization has been trading under US$30,000 since April 19. Ether rose 0.34% over the week to US$1,813 recapturing US$1,800 on Thursday.

The lack of progress in U.S. debt ceiling negotiations continued to erode risk appetite as the June 1 deadline neared. On Wednesday, Fitch Ratings placed the U.S.’ AAA rating on a negative rating watch, saying that debt ceiling negotiations raised the risks of the government missing payments on some of its obligations.

“Bitcoin and Ether have shrugged off the U.S. debt ceiling negotiations and the potential ripple effects for crypto. President Biden has already declared the country will not default on its debt,” Lucas Kiely, the chief investment officer of digital asset platform Yield App, said. “With liquidity tight, the crypto market doesn’t seem to be too concerned over these macro events. It will take something much more substantial to move these markets.”

Johnny Louey, a crypto research analyst at trading platform LiquidityTech Protocol, disagreed, saying that the debt ceiling negotiations are the main factors weighing down Bitcoin price.

“Although the debt ceiling has been raised and revised 78 times since 1960, investors are aware of the default risk if negotiations fail. This is the first time Bitcoin encountered such an economic incident and it’s reasonable to assume a risk-off approach would be appropriate,” said Louey.

The global crypto market capitalization stood at US$1.11 trillion on Friday at 7:00 p.m. in Hong Kong, down 0.89% from US$1.12 trillion a week ago, according to CoinMarketCap data. With a market cap of US$512 billion, Bitcoin represented 46.1% of the market, while Ether, valued at US$218 billion, accounted for 19.6%.

“The entire market capitalization of cryptocurrencies has essentially remained unchanged for a year,” said Kiely. “Tether’s plan to expand its Bitcoin holdings may temporarily boost prices but is overall not likely to have a large impact. Bitcoin’s 2024 halving could lead to a price boost, however, we’ve yet to start seeing the effects thereof.”

On May 17, Tether, the company behind the world’s largest stablecoin USDT, revealed its plans to “regularly allocate” as much as 15% of its net operational profits to buy Bitcoin, aiming to boost its reserves portfolio. Tether held approximately US$1.5 billion in Bitcoin reserves, at the time of the announcement.

Dormant Bitcoin hits all-time high

The amount of Bitcoin that has been inactive for at least a year rose to an all-time high of 68.46% on Wednesday, according to data aggregator MacroMicro.

“It could mean short-term selling pressure decreases if the Bitcoin holdings in short-term holdings shift to longer-term holders. However, we will not be able to tell whether the addresses belong to institutional investors or not,” Tom Wan, a research analyst at 21.co, the parent company of 21Shares, an issuer of crypto exchange-traded products, said.

According to Yield App’s Kiely, this suggests that increasingly more investors worldwide intend to hold their Bitcoin for the long term.

“This trend is likely to continue and even quicken — even potentially to the point of hyperbitcoinization — given the uncertainty related to an evolving regulatory landscape and growing recognition of Bitcoin as a store of value,” said Kiely.

“Hyperbitcoinization” is a concept speculating on Bitcoin’s eventual rise to become the world’s ubiquitous form of money.

Notable movers: RNDR & KAVA

The Render Network’s native cryptocurrency was this week’s biggest gainer among the top 100 coins by market capitalization listed on CoinMarketCap, rallying 16.55% to US$2.83. The token started picking up momentum last Saturday, after the announcement of the new Render Foundation website. This is Render’s second consecutive week as the biggest gainer in the top 100 cryptos.

The Render Network leverages idle graphics processing units for digital rendering purposes, catering to areas such as 3D modeling, gaming imagery, and virtual reality.

Kava, the governance token of a layer-1 blockchain of the same name, was this week’s second-biggest gainer, rising 10.70% to US$1.09. The coin started picking up momentum on Monday, following the launch of the Kava mainnet last week.

Next Week: Could a debt ceiling deal break Bitcoin’s crab walk?

U.S. President Joe Biden and House Speaker Kevin McCarthy are reportedly closing in on a deal that would raise the government’s debt ceiling for two years while capping spending on most items. Yet, the June 1 deadline is fast approaching, causing investor concerns about a potential default.

According to WuuTrade’s Kenjaev, the uncertainty around the debt ceiling negotiations will keep weighing down the crypto market until a deal is reached.

“The sideways [movement] of Bitcoin is very much related to the current market risks and the fear. Investors’ activity during any economic risk talks is rather cautious. Hence the sideways in US$26,000 – US$30,000,” wrote Kenjaev, adding that positive news surrounding the U.S. economy will break the crab walk.

Investors are awaiting next week’s release of the U.S. jobs report for May, which includes the crucial nonfarm payrolls data. This information often serves as a barometer for predicting the Federal Reserve’s next steps regarding interest rate adjustments. ING Economics has projected an increase of 195,000 in nonfarm payrolls for May. Additionally, they anticipate a slight uptick in the unemployment rate to 3.5% for May, compared to 3.4% in the preceding month.

In the crypto space, Optimism, an Ethereum layer-2 network, is planning to increase the circulating supply of its governance token (OP) next Wednesday, a year into the coin’s launch. The expansion is part of Optimism’s strategy to augment the pool of votable tokens within the Token House, its group of OP holders responsible for proposing and voting on governance issues.

See related article: Big buys fail to lift NFT markets as regulatory uncertainty weighs heavy on crypto