4 Altcoins Called Explosion This Week and Predictions! – TechnoPixel

Bitcoin’s rally improved the sentiment and attracted purchases in several altcoin projects. The strong recovery in Bitcoin surprised several analysts who were skeptical of the rally. While some believe the current rally is a dead cat bounce that will reverse direction sharply, others see similarities between the current rally and the 2018 bear market rebound. On the other hand, according to analyst Rakesh Upadhyay, the continued recovery of Bitcoin may encourage buying in certain altcoins. Here are the altcoin projects that show strength according to the analyst…

At the top of the altcoin list is ApeCoin

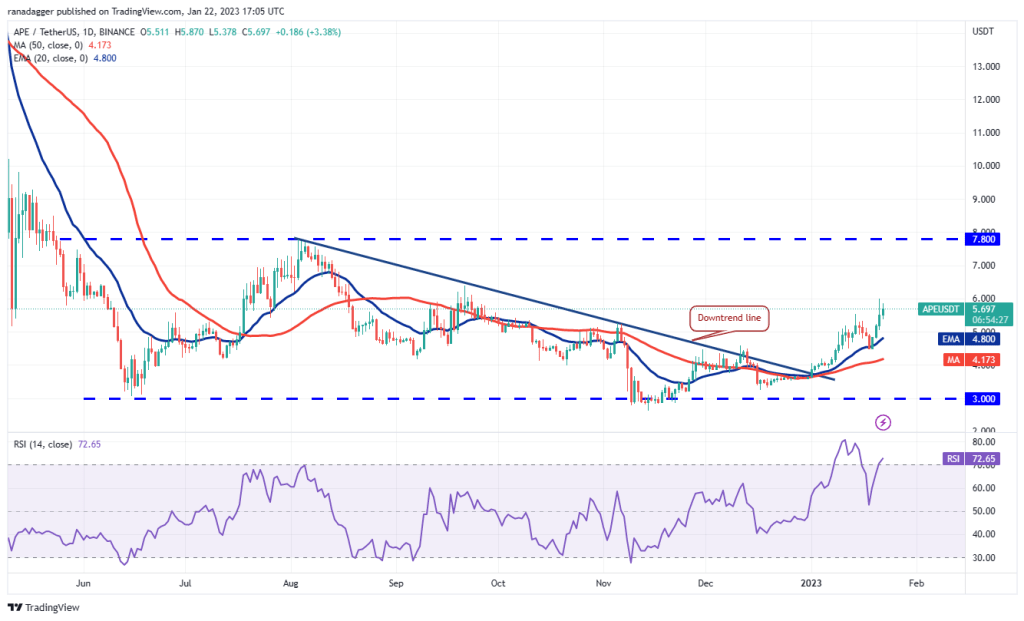

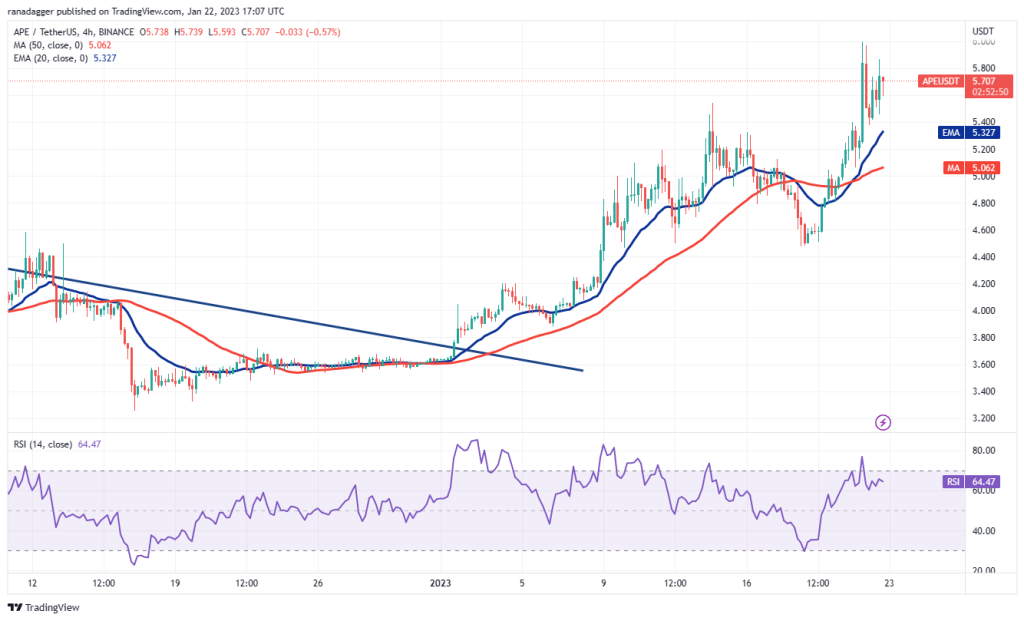

ApeCoin has been fluctuating between $7.80 and $3 for the past few months. As the bears fail to push the price below the range, the bulls are trying to make a comeback. According to the analyst, they will try to push the price to the resistance of the range. The upward sloping moving averages and RSI in the overbought zone suggest that the buyers have the upper hand. There is a minor resistance near $6.40, but if buyers can clear it, the APE/USDT pair could rise to $7.80. This level could be the scene of aggressive selling by the bears. The positive view may be invalidated in the near term if the price declines and breaks below the 20-day EMA ($4.80). This could push the price down to the 50-day simple moving average ($4.17).

The four-hour chart shows that the pair is in a strong uptrend. The bears are trying to stop the upside move at $6, but a positive sign is that the bulls haven’t left much ground. This indicates that every little drop is bought. The bulls will now try to push the price above $6 and continue the uptrend. On the contrary, the bears will try to push the price below the 20-EMA. If they are successful, the pair can profit from short-term bulls. The pair could drop to $5 later.

What are the prospects for Decentraland (MANA)?

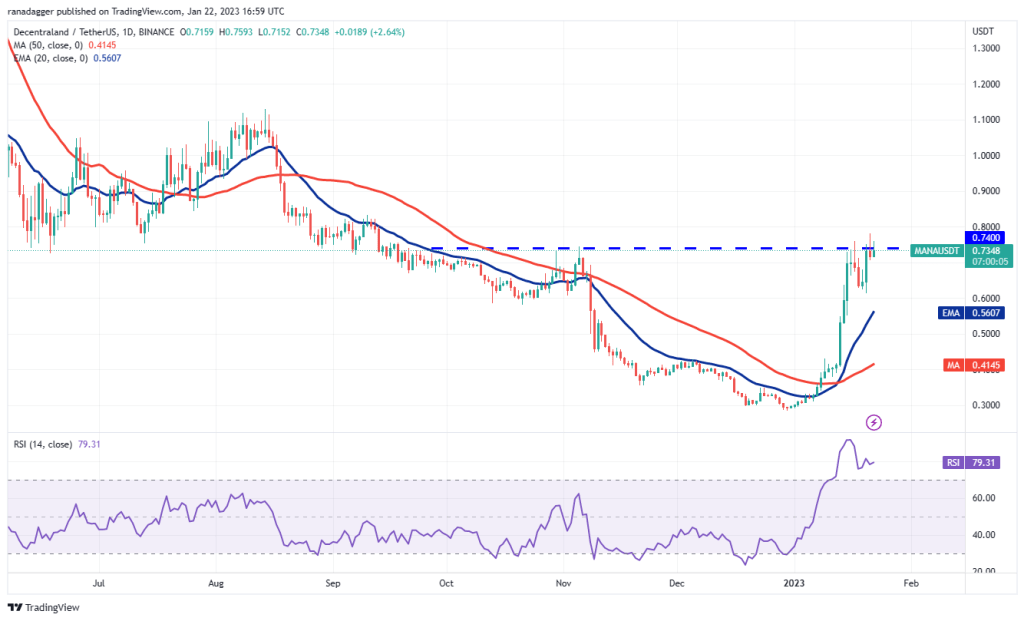

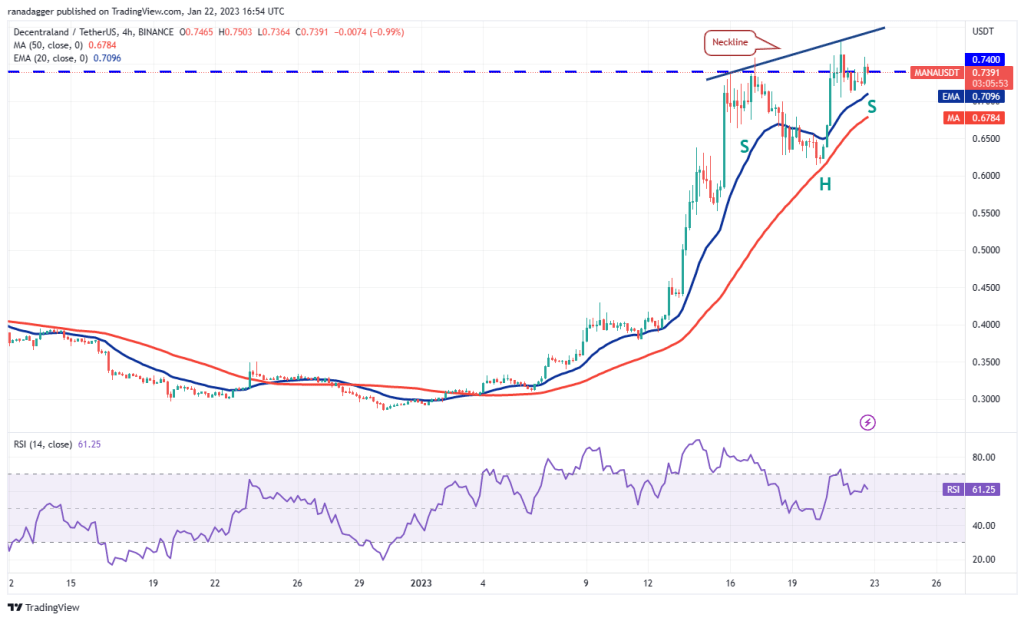

MANA/USDT rose from $0.28 on December 30 to $0.78 on January 21, indicating strong momentum in favor of the bulls. The bears sold above $0.74 after the January 17 breakout, but the bulls stepped in and bought the dip at $0.61. This shows that sentiment remains positive and traders see the dips as a buying opportunity. The bulls will have to hold the price above $0.74 to signal the start of the next leg of the recovery. According to the analyst, the MANA/USDT pair could rise to $0.87 and then to the psychological barrier at $1.

“If the bears want to gain the upper hand, they will have to push the price below $0.61,” Upadhyay said. If they do, the pair could start a deeper correction towards $0.53.” The four-hour chart shows the formation of an inverted head and shoulders pattern. If buyers push the price above the neckline of the pattern, the setup will complete and the pair could skyrocket towards its target target of $0.93. On the contrary, if the price breaks down from the current level and breaks below the moving averages, it will show that the bears are fiercely holding the $0.74 resistance. The pair could later decline to the $0.61 to $0.55 support zone.

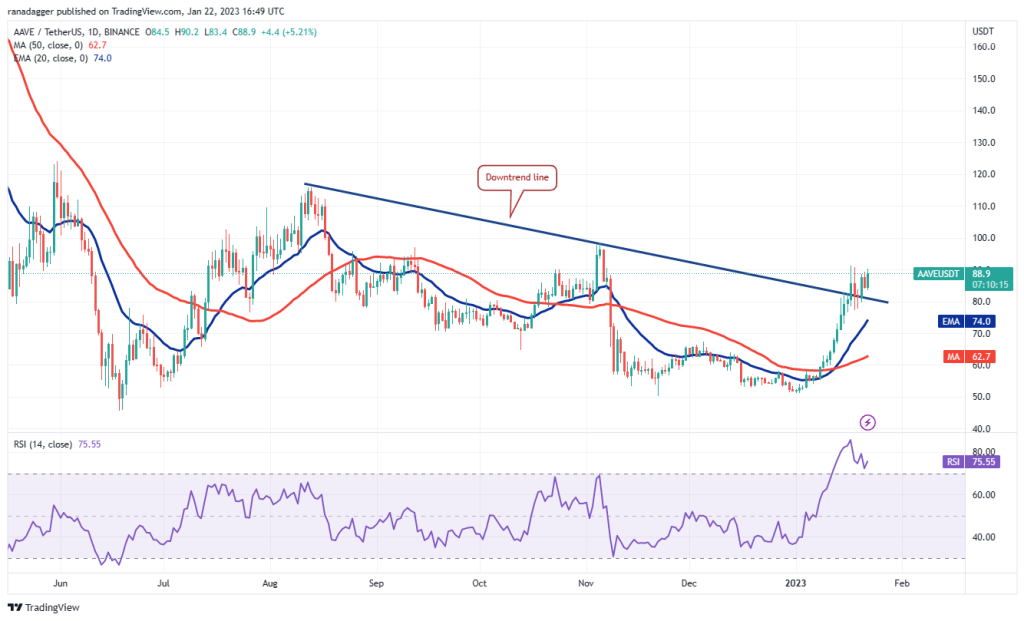

What’s next for AAVE/USDT?

Aave broke above the downtrend line on Jan 17, signaling a potential trend reversal. The bears tried to push the price below the downtrend line on Jan. 18, but the bulls held their ground. The rising 20-day EMA ($74) and the RSI in the overbought zone suggest that the bulls have the advantage. This advantage could be strengthened further with a break above $92. The AAVE/USDT pair could then rise to the psychologically important $100 level.

This level can again pose a strong challenge for buyers, but if they break this hurdle, the pair could skyrocket to $115. Contrary to this assumption, if the price turns down and breaks below the downtrend line, it will signal that the bears are active at higher levels. The advantage could tilt in favor of the bears with a break below the 20-day EMA.

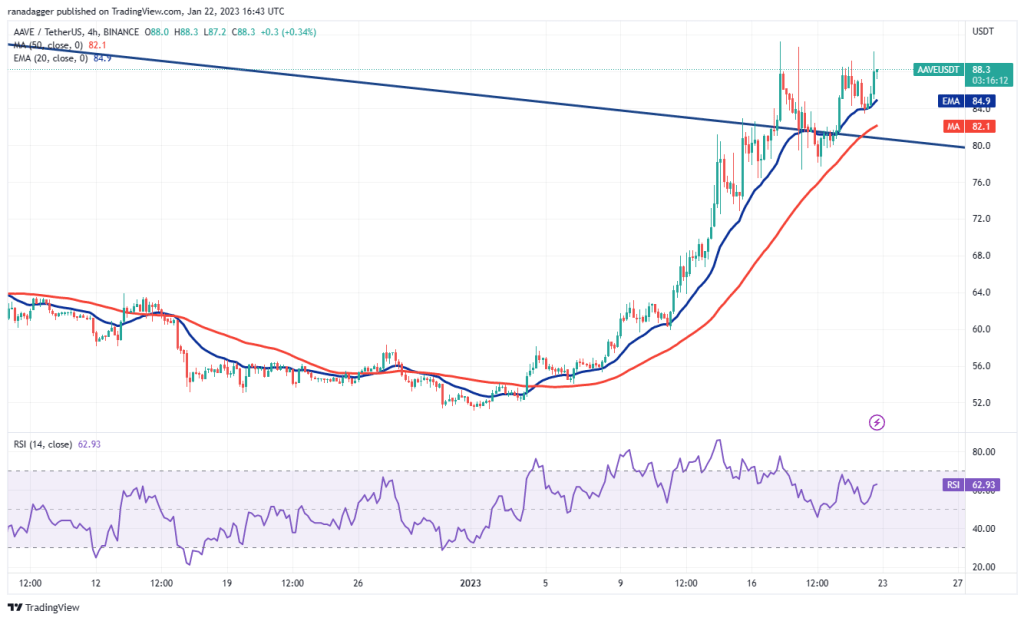

The four-hour chart shows that the bears are defending the zone between $88 and $91, but have not been able to push the price below the moving averages. This signals a bullish sentiment where traders are buying the lows. The bulls will make one more attempt to clear the upper zone. If they can achieve this, the pair could resume its uptrend. Instead, if the bulls fail to push the price above $91, the bears will attempt to push the pair below the moving averages. The pair could decline further to $78 and then to $73.

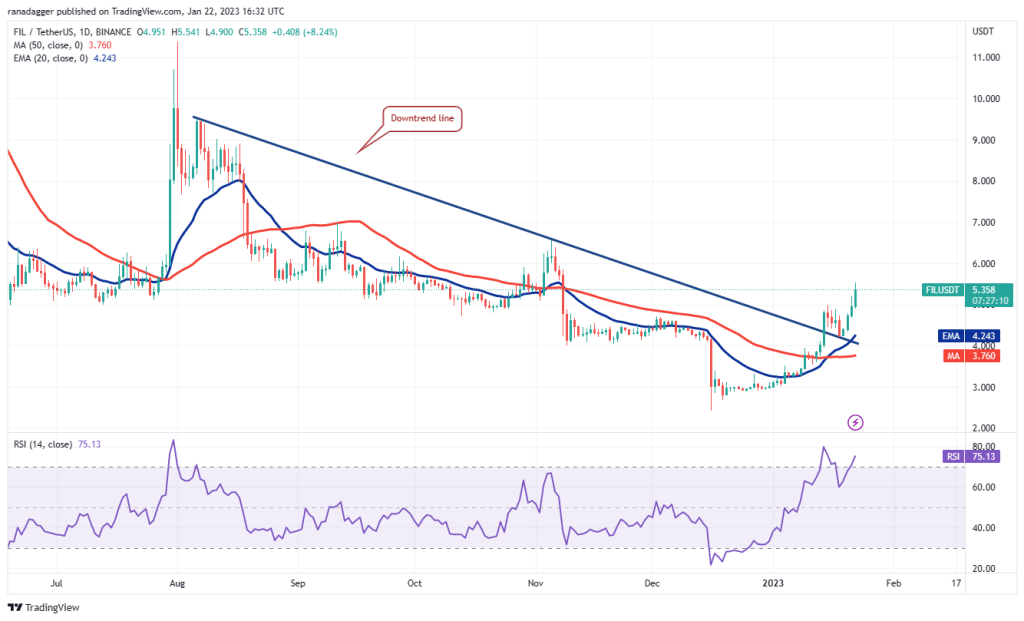

Last altcoin on the list: Filecoin

Filecoin, which is the storage altcoin project, as we reported as Kriptokoin.com, broke above the downtrend line on January 14 and retested the breakout level on January 18. This indicates that the bulls have turned the downtrend line to support. The moving averages have completed a bullish crossover and the RSI is in the overbought area, indicating that the bulls are in control. The FIL/USDT pair could rally to $6.50 where the bears can put up a strong defense again. If the bulls push the price above this level, the upside could reach $9 with a short pause around $7.

The 20-day EMA ($4.24) is important support to watch out for on the downside as a drop below it could turn the advantage in favor of the bears. The bears tried to stop the relief rally at $5 but the bulls overcame this resistance and started the next leg of the recovery. The upward sloping moving averages and the RSI in the overbought zone suggest that the bulls are definitely in the driver’s seat. Buyers will try to push the pair towards $6.50 and then towards $7.

But if we look at the negative factors, the 20-EMA is the critical support to watch out for. If the price bounces back from this level, it will indicate that the uptrend remains intact. On the other hand, if the bears pull the price below the moving averages, the pair could drop to $4.20.