Crypto kicks, NFT marketplace workers booted

After the unrelenting horror show that was 2022 (and 2021…), this year is – touch wood – off to a good start for the top end of the market makers.

But the news hasn’t been as good for employees of one NFT marketplace.

A relatively industrious weekend in crypto has continued a really positive start to the year for most of the majors.

Read Next

Just over a week in, January has been kind. (As I write this, I have all of my fingers and all of my toes crossed that by being positive about how it’s all going, I’m not about to send it all crashing it down … I promise.)

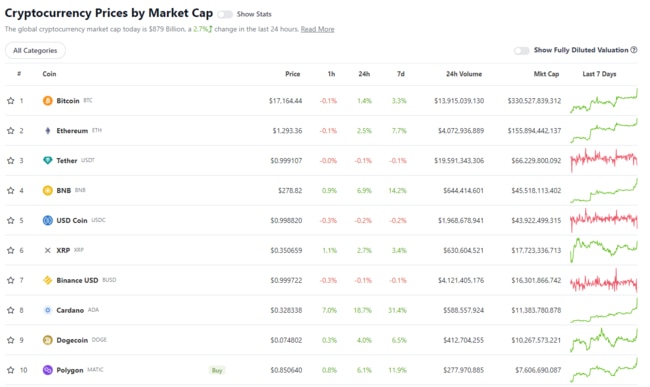

At 1pm (AEST), Bitcoin was up 1.4 per cent on the past 24 hours, with Ethereum up 2.5 per cent. The entire market was up 2.7 per cent in the same time frame.

Looking at the 7-day figures, there have been some impressive movements – BTC has gained 3.3 per cent, ETH’s piled on 7.7 per cent and even beleaguered XRP has added 3.4 per cent.

The clear winner, however, has been Solana … after taking what was looking perilously like a one-way trip to Toilet Town, this past week has seen an enormous recovery.

It’s currently up a neck-snapping 54.8 per cent for the week, and 17.5 per cent in 24 hours.

It’s pretty safe to say that Solana can thank BONK for that – the Solana-based Doge defier has breathed new life into its blockchain token, and itself gone soaring some 43 per cent since it was airdropped to creators, developers, and NFT holders.

There are a couple of very healthy 24-hour gainers – check below to find out what’s gone screaming overnight.

In the meantime, here’s a quick look at the headlines …

I had a beautiful dream …

I had a dream the other day that the FTX thing would stop being in the news.

As with all fabulous dreams, I was shattered when I woke up to find out that my subconscious mind had been doing some serious wishful thinking … because I know I’m not alone in wishing that this entire FTX debacle would stop dominating the news cycle.

Yet, here we are, uttering the same horrid acronym that is no doubt still bringing shudders of despair and probably rage to a large number of people who took a bath when the whole thing went bang.

However, since posting 67-page manifestos on forums and message boards about how badly you got stung is highly likely to get you onto the kind of list that you really, really don’t want to be on – and reading those manifestos is the stuff of nightmares – there’s a new avenue for you to keep abreast of what’s happening in terms of FTX and the US courts.

And it’s thanks to US authorities! That’s right … the US Feds have built a website (address below) for the approximately 100,000 creditors that are owed money by FTX to stay in the loop.

The number of people who are actually impacted is still up for debate – and that 100,000 creditors figure doesn’t include users of its crypto exchanges, FTX and FTX US.

With those people also included, the number swells to an estimate one million-ish – and, according to some very handy research by coingecko.com, Australians make up around 2 per cent of the traffic to the exchange’s website … so we know at least some of you will want to know what’s going on.

As Decrypt reports it, “In criminal cases, prosecutors are required to notify victims ahead of plea or sentencing proceedings and allow them enough time to give testimony if they want to be heard.”

Prosecutors have, quite sensibly, argued that individually informing the 1 million or so people that are into FTX for some sizeable quantities of cash would be a ludicrous undertaking – and the judge overseeing the case, US District Judge Lewis Kaplan, agreed.

So – US authorities now have a website for everyone to visit to read about what’s happening and put their name (we assume) on a list of people who want to have their say about what’s happened.

You can find it here – we’d publish the URL visibly, but for some reason it’s a tediously long and imminently forgettable page on a very official-looking lawyery-justicey boring-boring website.

Another tech company dumps staff

Meanwhile, more folks who were happily employed and doing crypto/NFT related things in order to pay the rent have found themselves on the ever-growing list those who used to have jobs doing crypto / NFT related things.

Coindesk is reporting that NFT marketplace SuperRare has gone on a firing spree, losing 30 per cent of its workforce in a bid to stay afloat in what is turning out to be a very difficult pond to be swimming in.

A memo from SuperRare CEO John Crain did its very, very best to put something of a positive spin on it – including the utterly horrifying attempt to redefine the mass sacking as “rightsizing”, rather than “downsizing” – but the end result is that the start-up began to look like a wind-up after they hired too many people and tried to grow too fast.

You can read Crain’s memo here:

… see? Horrible. Just horrible. At what point did the cool’n’funky start-up scene start sounding like gross’n’grotty corporate America? Did I miss a memo?

Anyway … it is super-unlikely that SuperRare will be the last big name to take an axe to the roster – and it’s joining a rapidly growing list of companies that are hitting the jettison button to get rid of pesky things like “workers” who “cost money” – but anyone who lived through the bursting of the dotcom bubble knows that this is just the way this sector works.

Those of you who weren’t around for the dotcom collapse … let’s just say it was hugely unpleasant and not worth revisiting, and leave it at that.

According to CoinDesk: “Beginning in April, several global crypto exchanges reduced their headcount, with Coinbase laying off 1,1000 employees in June.

Shortly after, top NFT marketplace OpenSea laid off roughly 20 per cent of its staff, followed by cuts from crypto brokerages, trading firms, payment processing companies and Web3 gaming studios.

“In November, Meta Platforms (META) slashed more than 11,000 jobs – an estimated 13 per cent of its workforce – across its apps and Reality Labs segments,” Coindesk continues.

Top 10 overview

With the overall crypto market cap at US$867 billion, up 1.1 per cent since this time yesterday, here’s the 1pm (AEST) state of play among top 10 tokens – according to CoinGecko.

Uppers and downers: 11-100

DAILY PUMPERS

- The Sandbox (SAND), (mc: US$789 million) +33.7 per cent

- Lido DAO (LDO), (mc: US$1.66 billion) +32.5 per cent

- Frax Share (FXS), (mc: US$411 million) +26.1 per cent

- Zilliqa (ZIL), (mc: US$371 million) +25.4 per cent

- The Graph (GRT), (mc: US$524 million) +10.6 per cent

DAILY SLUMPERS

- OKC (OKT), (market cap: US$466 million) -1.9 per cent

- OKB (OKB), (mc: US$6.65 billion) -1.1 per cent

(Stats accurate at time of publishing, based on CoinGecko.com data.)