Bitcoin: What this ‘gray-haired’ exchange movement could mean for BTC

- Bitcoin’s exchange inflows CDD value witnessed a surge

- BTC exchange inflow stood lower than BTC’s exchange outflow

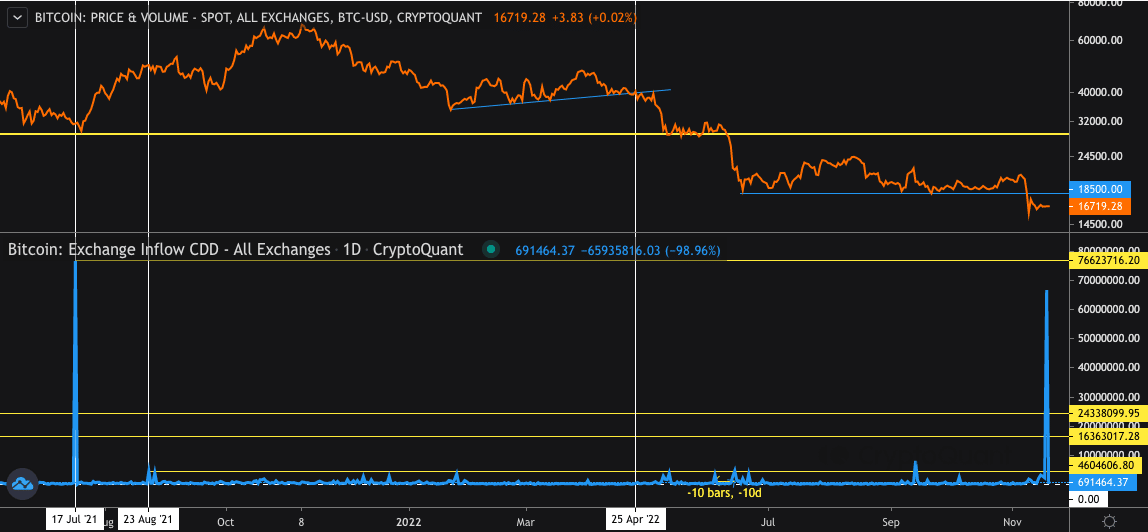

Bitcoin[BTC] exchange inflows Coin Days Destroyed (CDD) increased tremendously as several dormant addresses moved their coins. According to CryptoQuant analyst, Tomáš Hančar, the recent movement signaled the highest since BTC hit its lowest in 2021.

Due to the action, investors might expect that it was an indication of a sell-off. However, the BTC price action didn’t seem to respond as it increased 0.43% in the last 24 hours.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Highs and balances

However, the exchange inflow CDD was not the only metric interested in reaching highs. Hančar, in other parts of his post, mentioned that the Spent Output Value Bands hit its highest since October 2019.

On assessing the data, CryptoQuant showed that the exchange inflow value bands were at a point where coin distribution was extremely high. This point indicated that both retail investors and whales were driving their BTC holdings into exchanges. Thus, the possibility of price reaction due to selling pressure was still imminent.

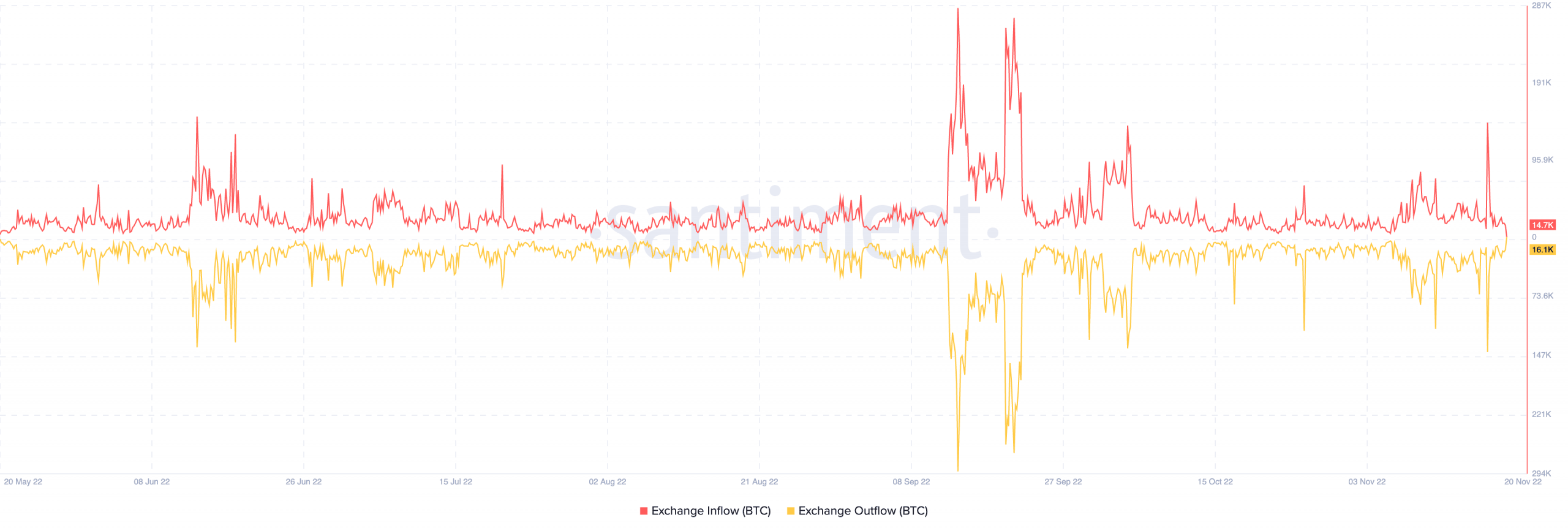

Moreover, recent actions had shown that investors might no longer be at ease with the BTC price performance. This was evident per the recent steps geared towards the volume and SOPR. Furthermore, Santiment showed that the exchange flow was close to balanced.

According to data from the platform mentioned above, the BTC exchange inflow at press time was 14,700. On the other hand, the exchange outflow value was 16,100. With a difference of less than 2,000, the status indicated that the number of investors willing to sell were less than those accumulating.

Hence, there was hope that BTC might not fall further per its price. Nevertheless, the status also signified that the talks about the king coin already hitting the bottom could be valid.

In other ends…

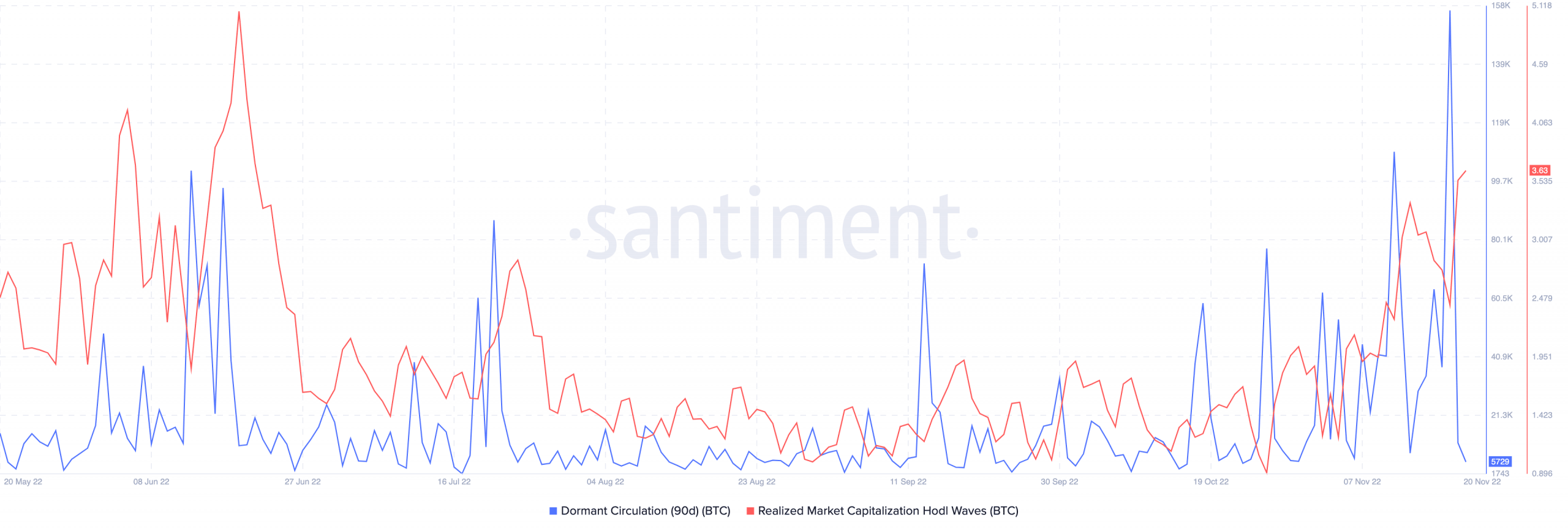

Despite the exchange inflow from the dormant addresses, the ninety-day dormant circulation was still at a low point. At press time, Santiment showed that the value stood at 5,729. However, it was noteworthy to mention that the circulation spiked to 155,000 on 18 November.

Now that witnessed a decrease, it meant that the number of long-term BTC holdings held during the period had remained in non-transactional mode. Hence, the decline in volume could continue unless retail investors increase the rate of transacting the king coin.

Furthermore, the Realized Market Cap Hold Waves increased to 3.63 as of this writing. This indicated that the realized value of BTC transacted in the last seven days was worth a better price than the previous one. So, if increased further, more BTC could be in circulation. Therefore, it could also lay an impact on the price action towards an upward movement.