Chainlink investors looking beyond LINK’s price could find some respite here

- Chainlink clinched an all-time high in the count of its daily social contributors.

- Its price continues to decline, and its outlook in the short term remains bearish

Recent data from cryptocurrency social analytics platform LunarCrush revealed that LINK, Chainlink’s native token, clinched an all-time high of 35,540 in its number of daily social contributors.

Read Chainlink’s [LINK] price prediction 2023-2024

The rally in social activity came after the leading oracle network announced the first 10 participants in the maiden edition of its Chainlink BUILD program.

Give a welcome to the first 10 #Chainlink BUILD projects:@SpaceandTimeDB@truflation@bitsCrunch@KryptonProtocol@InterestDeFi@Galaxisxyz@mycelium_xyz@Dolomite_io@caskprotocol@chainml_

Building the future of Web3? Take your dApp to the next level: https://t.co/uIUNQltMbO pic.twitter.com/29oCUSQFVP

— Chainlink (@chainlink) November 18, 2022

First announced in September, the Chainlink BUILD program formed part of its Chainlink Economics 2.0. Through this program, early-stage and established projects within Chainlink are provided with “enhanced access to Chainlink services and technical support in exchange for commitments of network fees and other incentives to Chainlink service providers, such as stakers.”

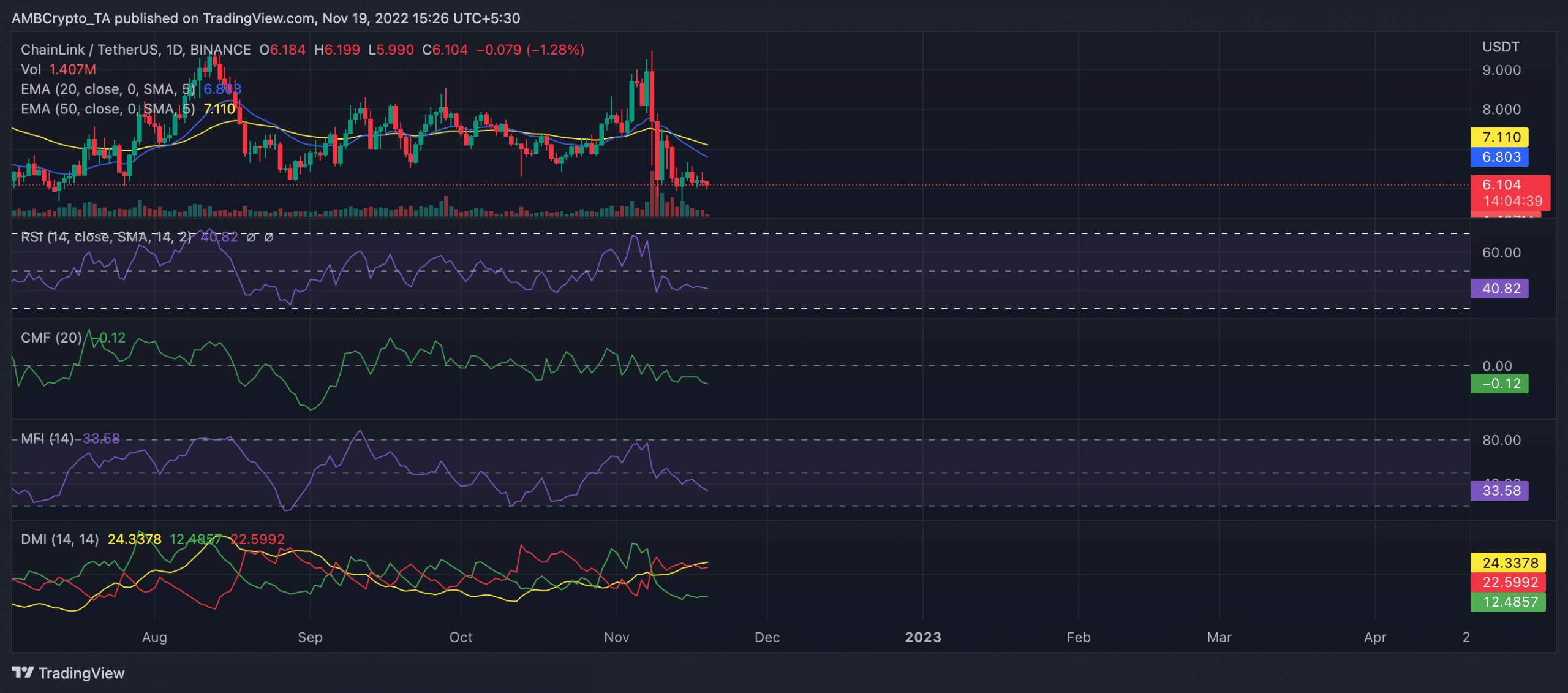

LINK on a daily chart

Ranked as the #21 largest cryptocurrency with a market capitalization of $6.08 billion, LINK exchanged hands at $6.10 as of 19 November. Furthermore, as per data from CoinMarketCap, the asset’s price had declined by 2% between 18 and 19 November. Within the same period, trading volume was also down by 27%. As of 20 November, LINK stood at a price of $6.21 and traded 1.7% higher in the last 24 hours.

On the daily chart of 19 November, LINK sellers overpowered the buyers in the market. At the time of writing, the 20 Exponential Moving Average (EMA) was positioned below the 50 EMA (yellow) line.

Furthermore, lending credence to this position was LINK’s Directional Movement Index (DMI). As of this writing, LINK’s sellers’ strength (red) at 22.59 rested above the buyers’ (green) at 12.48.

The Average Directional Index (ADX) showed that buyers might find it difficult to revoke the sellers’ strength in the short term.

Further, key indicators such as the Relative Strength Index (RSI) and Money Flow Index (MFI) were positioned in downtrends. Headed towards the oversold position at press time, LINK had seen significant distribution in the last week. At press time, the RSI was 40.82, while the MFI was 33.58.

Also signifying the decline in LINK buying momentum was its Chaikin Money Flow (CMF). At the time of writing, the dynamic line (green) of the CMF was positioned below the center line in a downtrend at -0.12.

Here comes the respite

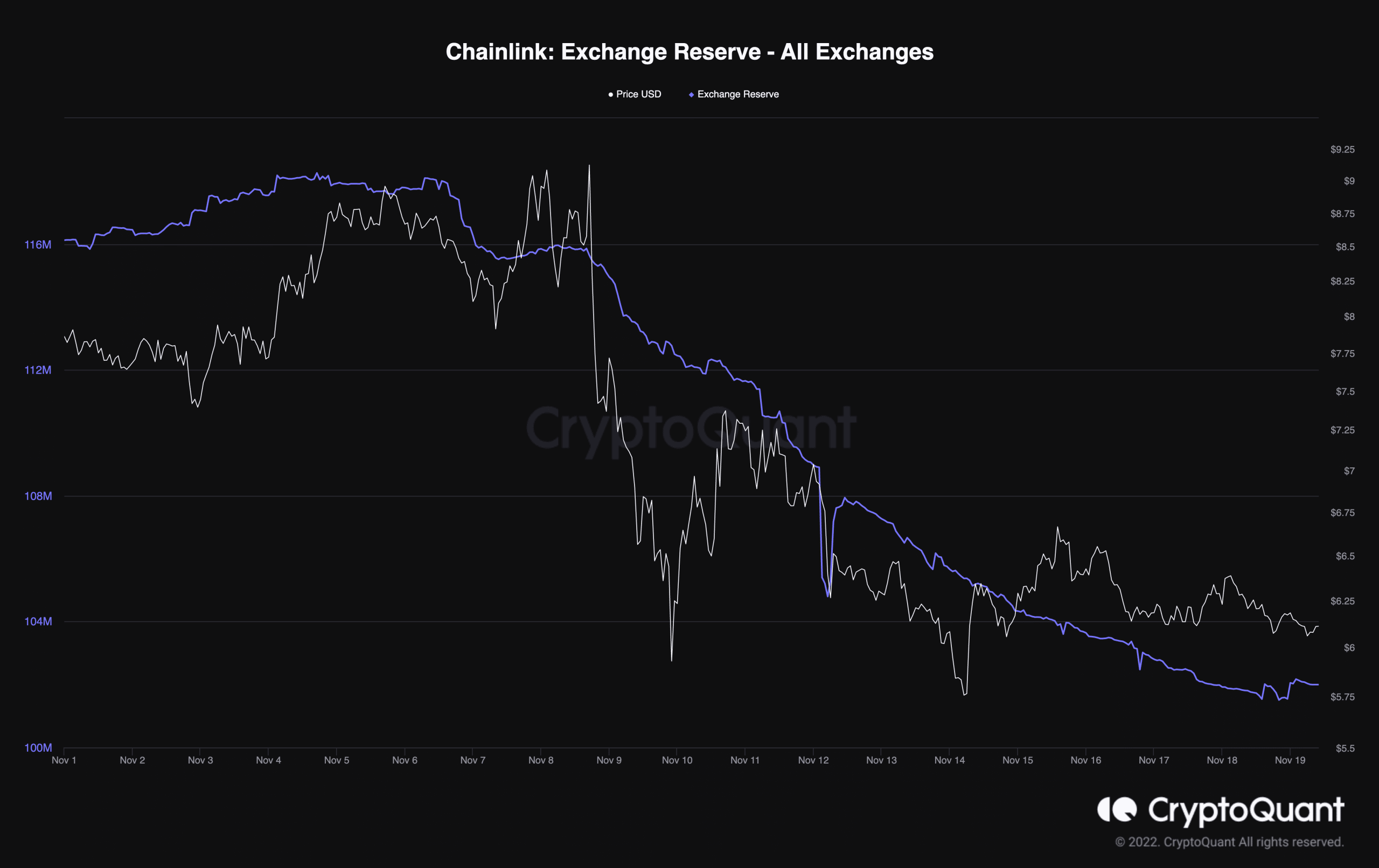

Interestingly, as the alt’s price fell, on-chain data revealed that its exchange reserve had declined since the beginning of the month. With 101.99 million LINK tokens present on exchanges as of 19 November, data from CryptoQuant showed that its exchange reserve dropped by 13% in the last 19 days.

Further, at the same time, its supply outside of exchanges rose by 1.2%, data from Santiment showed.

This indicated that while LINK’s price might be down, there were fewer sellers than buyers in the market.