XRP Whales Continue Accumulating as Sentiment Turns Positive

XRP has managed to outperform every cryptocurrency in the top 100 coins by market cap gaining over 67% in the last week alone, but what’s behind these bullish waves?

After a long-drawn consolidation, Ripple (XRP) appears to be finally gaining momentum recovering from the months of battered price action. One reason behind this sudden price pump was the possibility of a final verdict and closure of the SEC v Ripple case in the upcoming days.

Settlement rumors aiding bullishness

Amid rumors of a Ripple and SEC settlement, a motion was granted to give deadlines to motions to seal requests that prevent evidence. The final deadline for any motion to seal by by third-parties is Dec. 9 and the final date to oppose any motion is Dec. 22.

In a recent interview, Ripple CEO Brad Garlinghouse stated that the Securities and Exchange Commission (SEC) had “lost its way” and was a “cuckoo for cocoa puffs.” Garlinghouse’s statements have further paved the way for the market’s raised expectations.

Apart from external news that heavily affects investor sentiment, certain technicals and on-chain indicators also painted a pleasant picture for XRP.

XRP whales back in action

The XRP price oscillated at the $0.536 mark at press time charting 27.27% gains on the 24-hours chart and almost 67% gains on the weekly price chart.

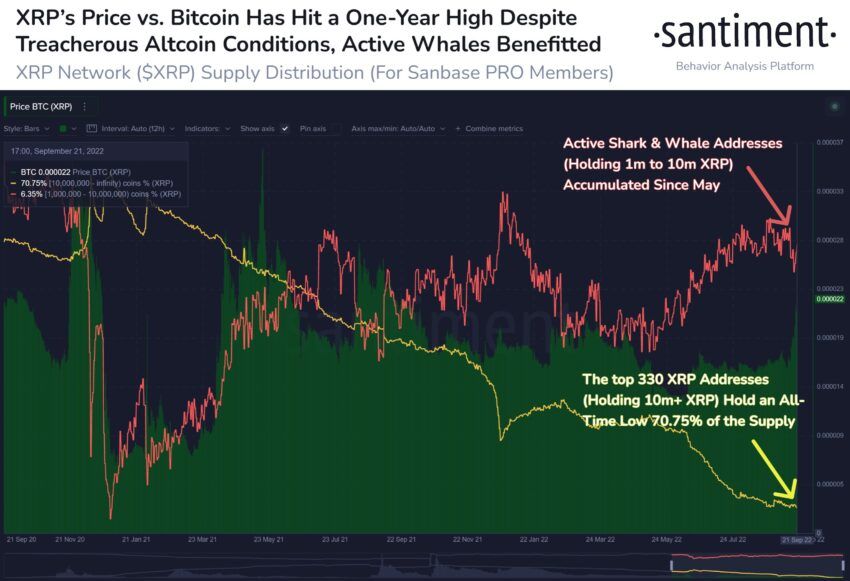

On-chain data from Santiment presented that active shark and whale addresses holding 1 million to 10 million XRP have been in an accumulation pattern since late 2020.

With active whales and sharks adding to their balances the same portrays a healthy long-term trend for XRP, which could give the price an added boost.

That said, the price ratio of XRP/BTC has hit a one-year high of ₿0.000025 breaking from the long-term downtrend that the ratio had followed.

Sentiment flipping positive

From a technical perspective, XRP’s price recovered from the long-term descending trendline resistance as trading volumes and open interest on futures contracts saw a major uptick.

Daily RSI noted highly overbought values indicative of a high buying pressure in the market as bulls dominated. Long-term signals also seemed to turn bullish as the weekly RSI broke out from its own descending resistance line.

Open interest in the future and perpetual markets rose by 65.43% in just 24 hours. On the other hand, $14.1 million worth of XRP shorts were liquidated after the bullish price action.

In the near term, looking at the saturated market if a short-term pullback takes place, XRP could revisit the $0.39 support.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.