Quant Explains How Bitcoin NUPL Cycles Are Getting Less Volatile With Time

Bitcoin NUPL data suggests that the crypto’s cycles are getting less sharper with time as profit tops and loss bottoms aren’t following a horizontal line.

Bitcoin NUPL Didn’t Exceed The 0.75 “Greed” Mark During This Cycle

As explained by an analyst in a CryptoQuant post, the BTC profit and loss cycles shouldn’t be treated with horizontal lines.

The “Net Unrealized Profit and Loss” (or the NUPL in brief) is an indicator that tells us whether the market as a whole is holding a net profit or a net loss right now.

The metric’s value is calculated by taking the difference between the market cap and the realized cap, and dividing it by the market cap.

NUPL = (Market Cap – Realized Cap) ÷ Market Cap

When the value of this indicator is greater than zero, it means the average investor is currently holding some profits.

On the other hand, negative NUPL values imply the overall market is holding a net amount of unrealized loss at the moment.

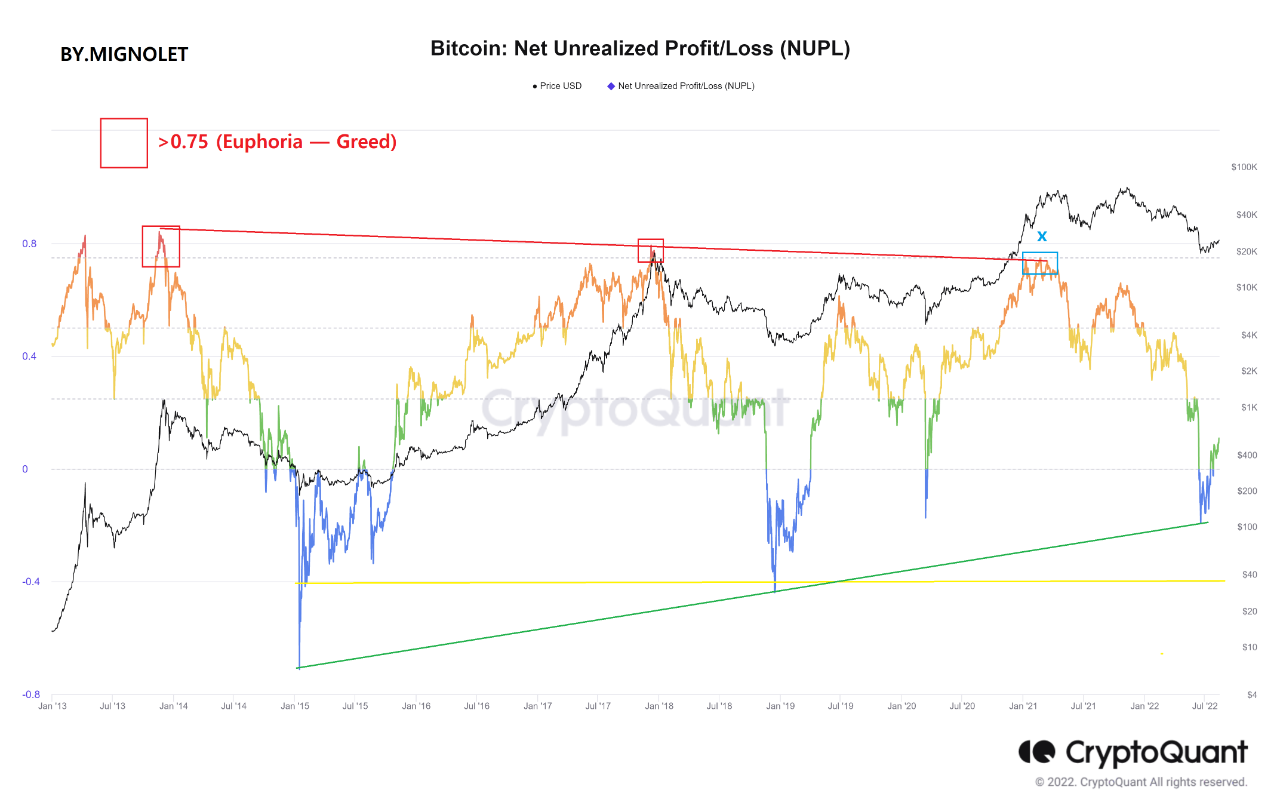

Now, here is a chart that shows the trend in the Bitcoin NUPL over the course of the history of the crypto:

Looks like the value of the metric has surged up and turned positive again recently | Source: CryptoQuant

As you can see in the above graph, the quant has marked the relevant zones of trend for the Bitcoin NUPL indicator.

In the past, many traders used to believe that cycle tops form whenever the metric’s value surges above 0.75, entering into the “greed” zone.

Similarly, bottoms were thought to take place when the indicator went below the -0.4 mark, reaching into the “fear” region.

However, the analyst from the post argues that horizontal lines like these shouldn’t be used to mark these cycle tops and bottoms.

During the previous two cycles, the top that came after was lower than the one before. In the current cycle, the metric never crossed into the greed zone and topped out just around the 0.75 level. This could mean that tops are getting lower and lower with each cycle.

Similarly, the last two bottoms also had descending loss amounts. Just a while ago, the NUPL’s value sharply dropped off into negative and subsequently rebounded back up into positive values after forming a potential bottom. However, this low was far from the conventional 0.4 mark.

If this low was truly the bottom for this cycle, then it would add further credence to the idea that profit and loss fluctuations in the market are getting less drastic with time.

BTC Price

At the time of writing, Bitcoin’s price floats around $24.4k, up 5% in the past week.

The value of the crypto seems to have been moving sideways recently | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com