North America Crypto Adoption: Institutions and ETFs

This post is an excerpt from our 2025 Geography of Cryptocurrency Report. Reserve your copy now!

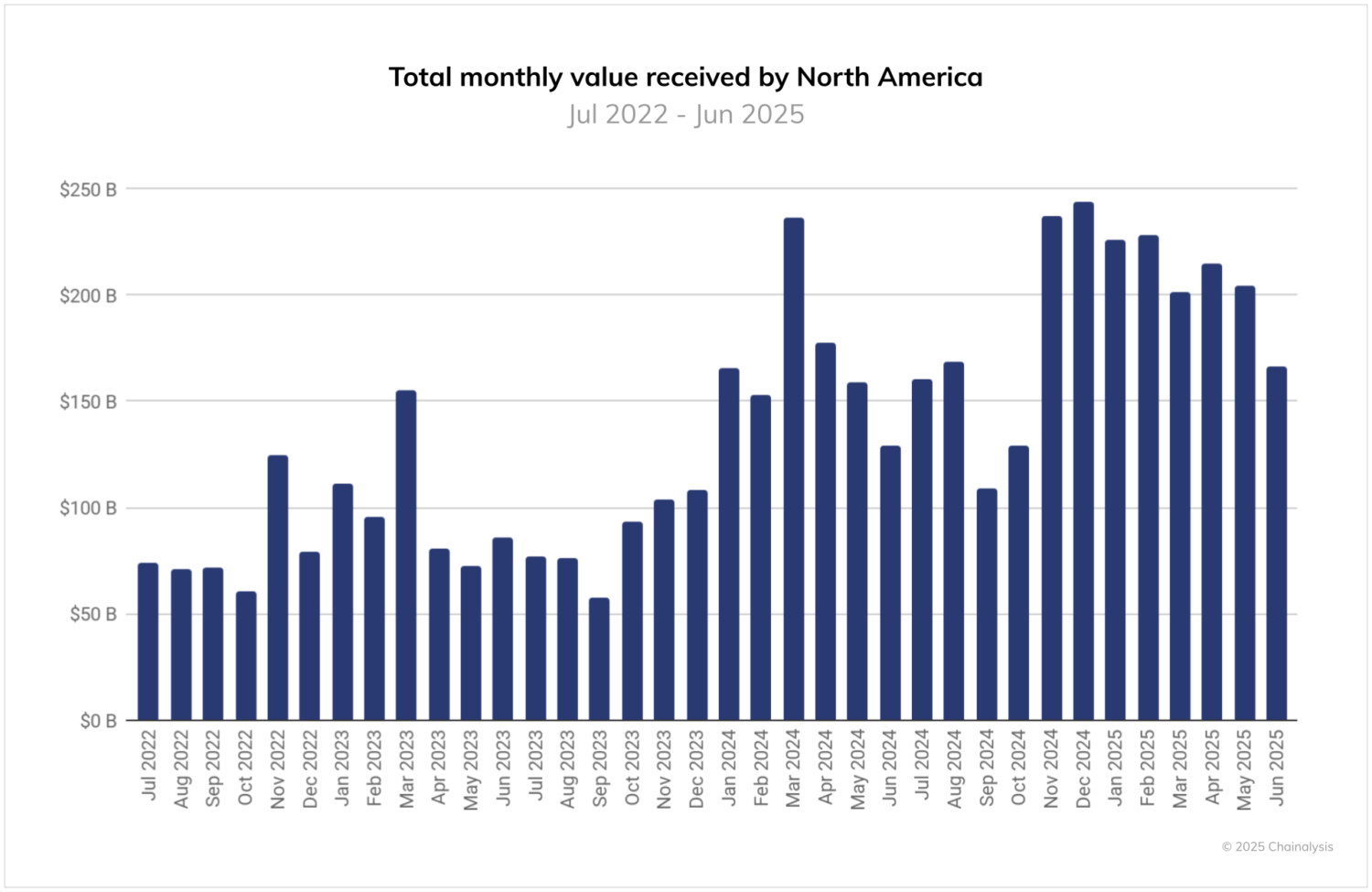

Riding the waves: Why North America swings harder

With the United States coming in at number two in the Chainalysis 2025 Adoption Index, North America is broadly considered to be a major leader for crypto adoption, accounting for 26% of all transaction activity in the period studied. The region received a total of $2.3 trillion in cryptocurrency transaction value between July 2024 and June 2025, reaching a peak in December 2024, when an estimated $244 billion was received in a single month. The spike in North America’s value received at the end of 2024 also featured unprecedented stablecoin activity, with December 2024 seeing the highest recorded number of monthly stablecoin transfers.

A key driver of these flows was likely the election of President Trump in November 2024, which drove bullish market sentiments amid expectations for greater regulatory clarity and a more crypto-friendly policy stance. Monetary easing in Q4 2024 likely also contributed to driving risk appetite, alongside institutional trading activity, including ETF-driven flows and portfolio rebalancing. While flows tapered in 2025, they remained elevated compared to the previous year, indicating sustained interest in digital asset markets.

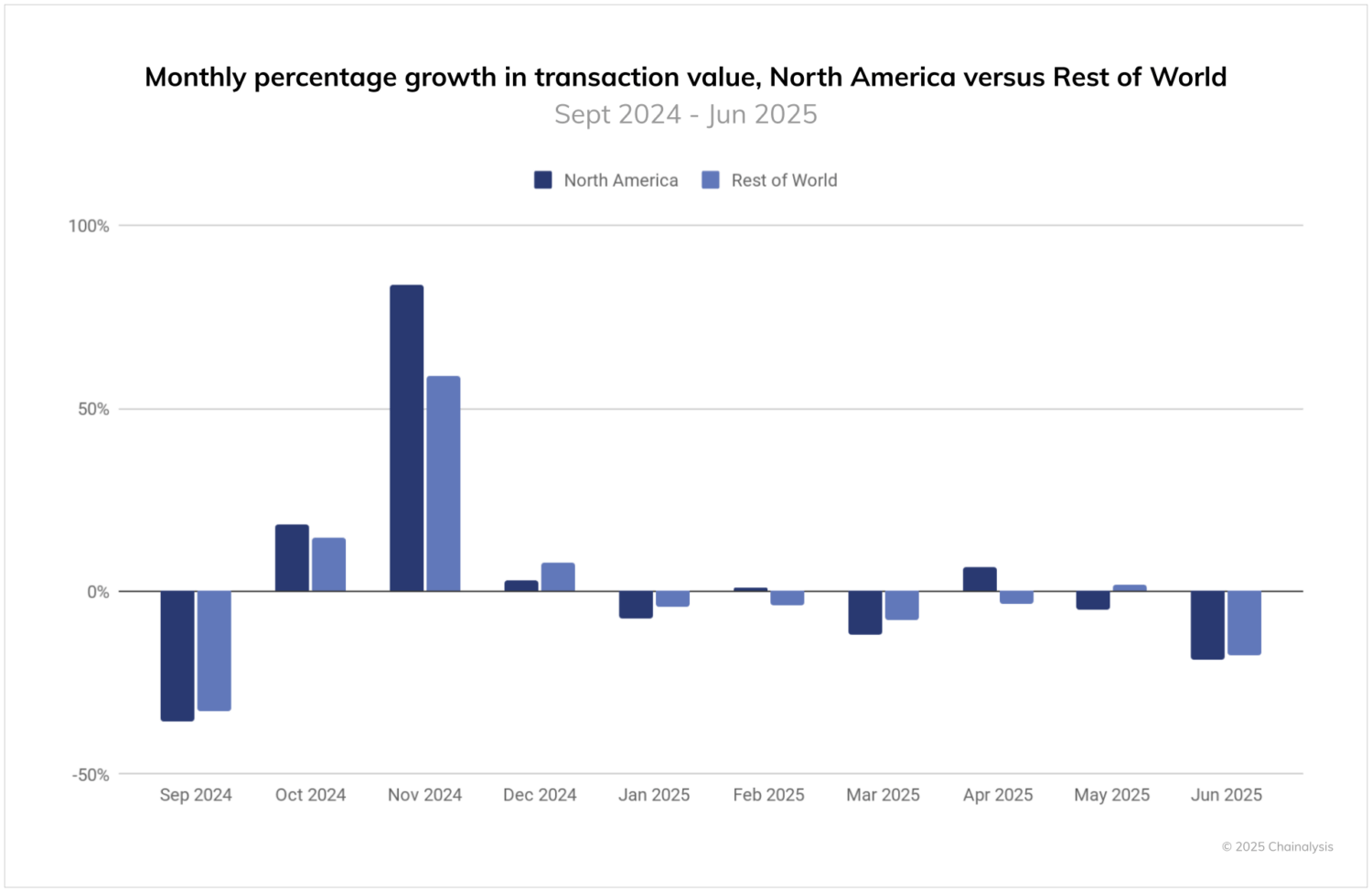

North America shows more volatility in crypto transaction value than the rest of the world, likely due to its heavier concentration of institutional activity and active trading strategies. Between September 2024 and June 2025, North America’s monthly transaction growth rates swung more significantly than those in the rest of the world, from a steep 35% month-on-month decline in September to an 84% spike in November.

These larger swings suggest that North American markets are more sensitive to short-term catalysts, such as shifts in market sentiment or macroeconomic signals. At the same time, the rest of the world exhibits more stable patterns of adoption and use. This divergence suggests differing market structures: institutional and investment-driven in North America, versus potentially more utility- and remittance-driven activity in other regions.

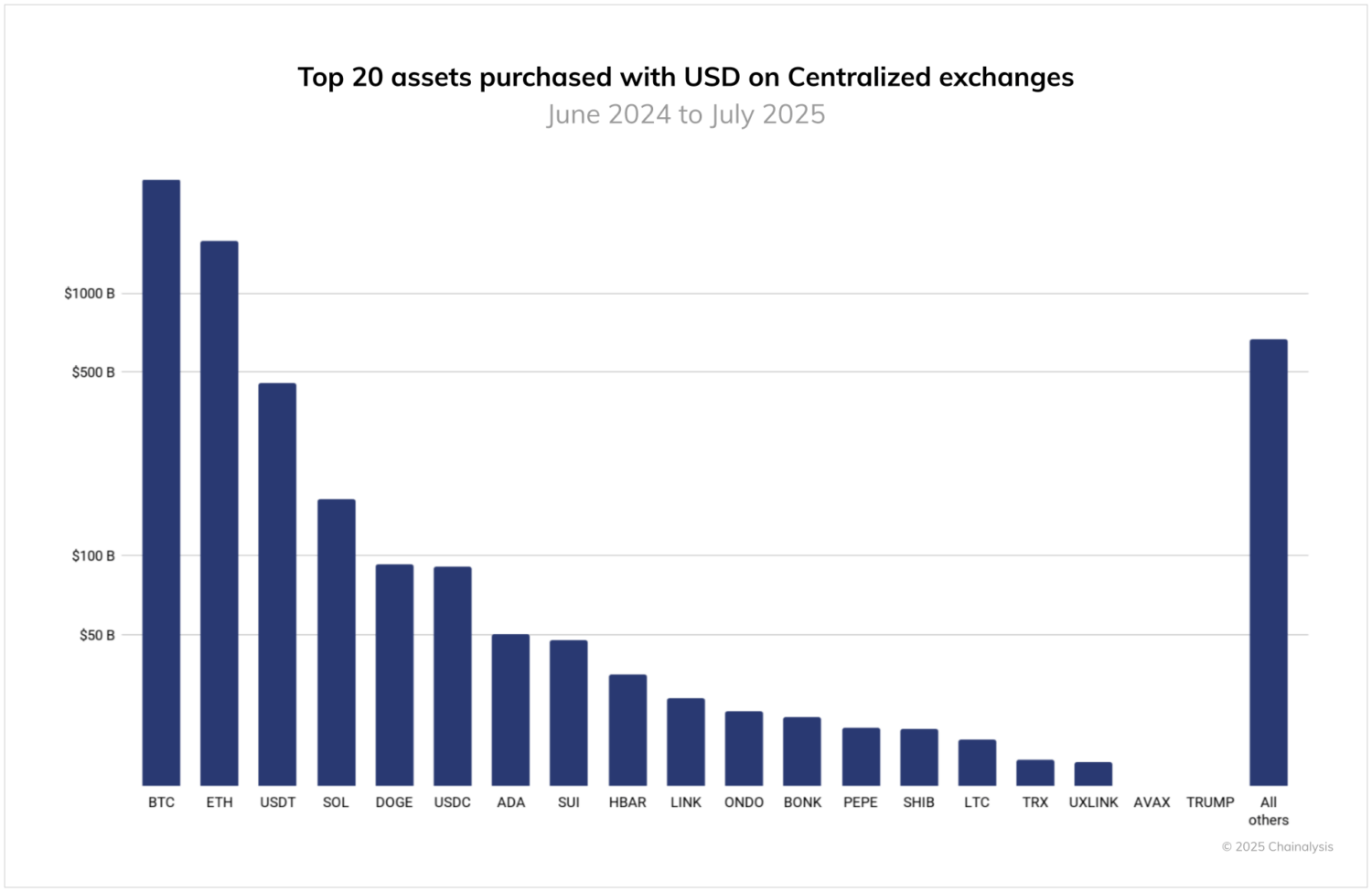

While institutional participation in North America has evolved significantly over the last year, and bitcoin ETFs are gaining momentum, as we analyze in the following section, retail activity on centralized exchanges remains strong. When we focus on centralized exchange activity, the data reveal that between June 2024 and July 2025, everyday users purchased $2.7 trillion worth of bitcoin using USD, followed by $1.5 trillion in ETH and $454 billion in USDT. The share of bitcoin in all fiat trading has remained incredibly stable over the past four years, capturing around 42% of all fiat trading in December 2022 and 42% of all fiat trading again in June 2025.

North America: The institutional powerhouse of crypto

The year 2025 has ushered in a more favorable U.S. regulatory environment for institutions seeking exposure to cryptoassets. Regulators such as the Securities and Exchange Commission (SEC), Office of the Comptroller of the Currency (OCC), and Commodity Futures Trading Commission (CFTC) have withdrawn past guidance that created operational barriers for financial institutions to undertake crypto-related activities, replacing restrictions with clearer frameworks that enable broader institutional engagement with digital assets. More recently, the President’s Working Group on Digital Asset Markets issued a set of recommendations aimed at making the U.S. the “crypto capital of the world,” further strengthening policy momentum on this front.

The U.S. SEC has dropped a number of investigations and enforcement actions in a shift away from what was widely perceived as a “regulation by enforcement” strategy. Meanwhile, other regulators in the U.S. have revoked hawkish guidance and opened the door to greater participation by traditional financial institutions in crypto markets.

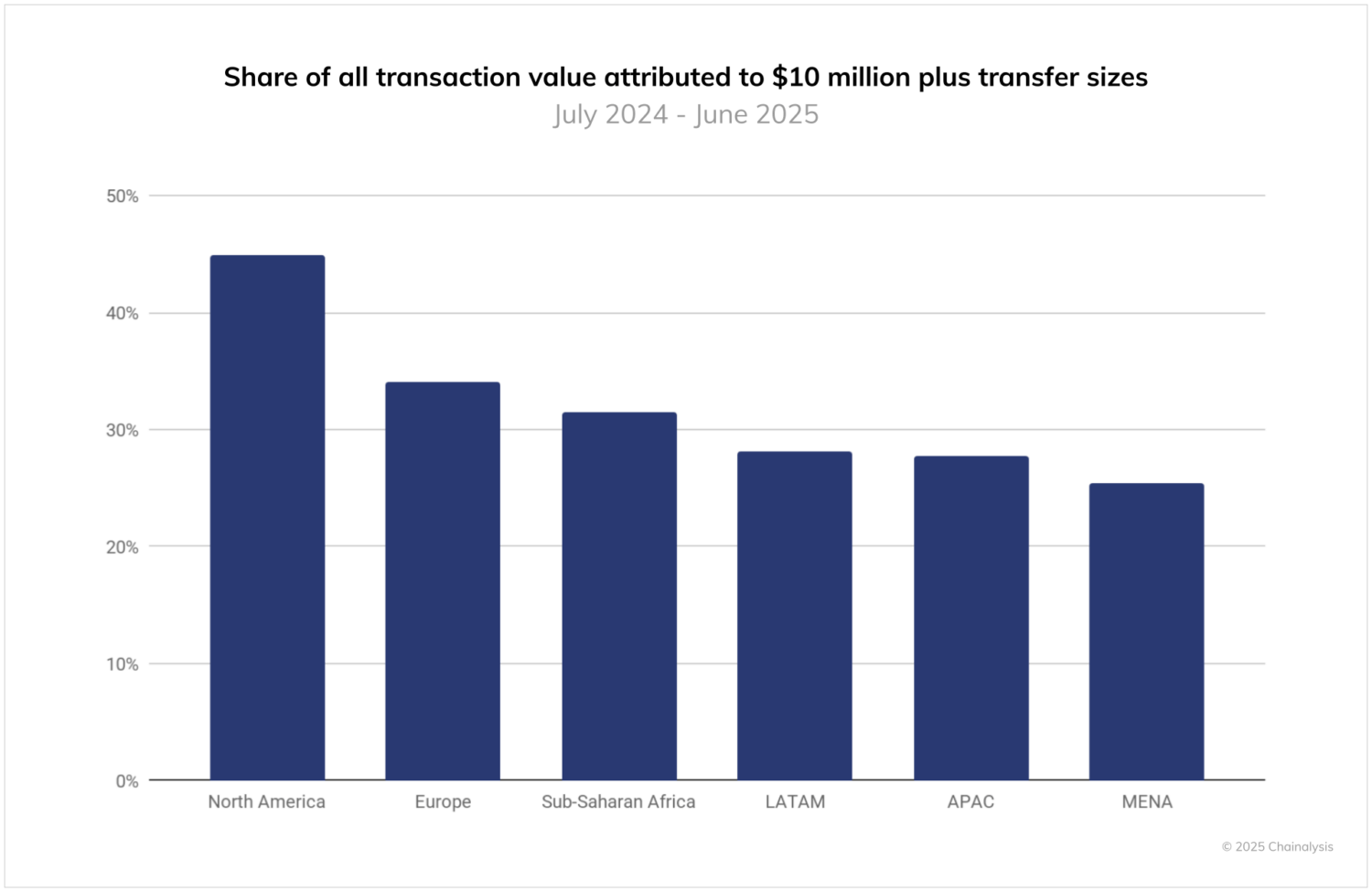

While the full effect of these regulatory shifts will only become apparent on-chain over time, North America already leads the world in high-value crypto activity, with 45% of all transaction value occurring in transfers over $10 million. Europe follows at a distant second, with 34% of value transfer taking place through these large-scale transfers, underscoring North America’s outsized role in institutional crypto adoption.

Explosion of tokenized treasuries and the bitcoin ETF market

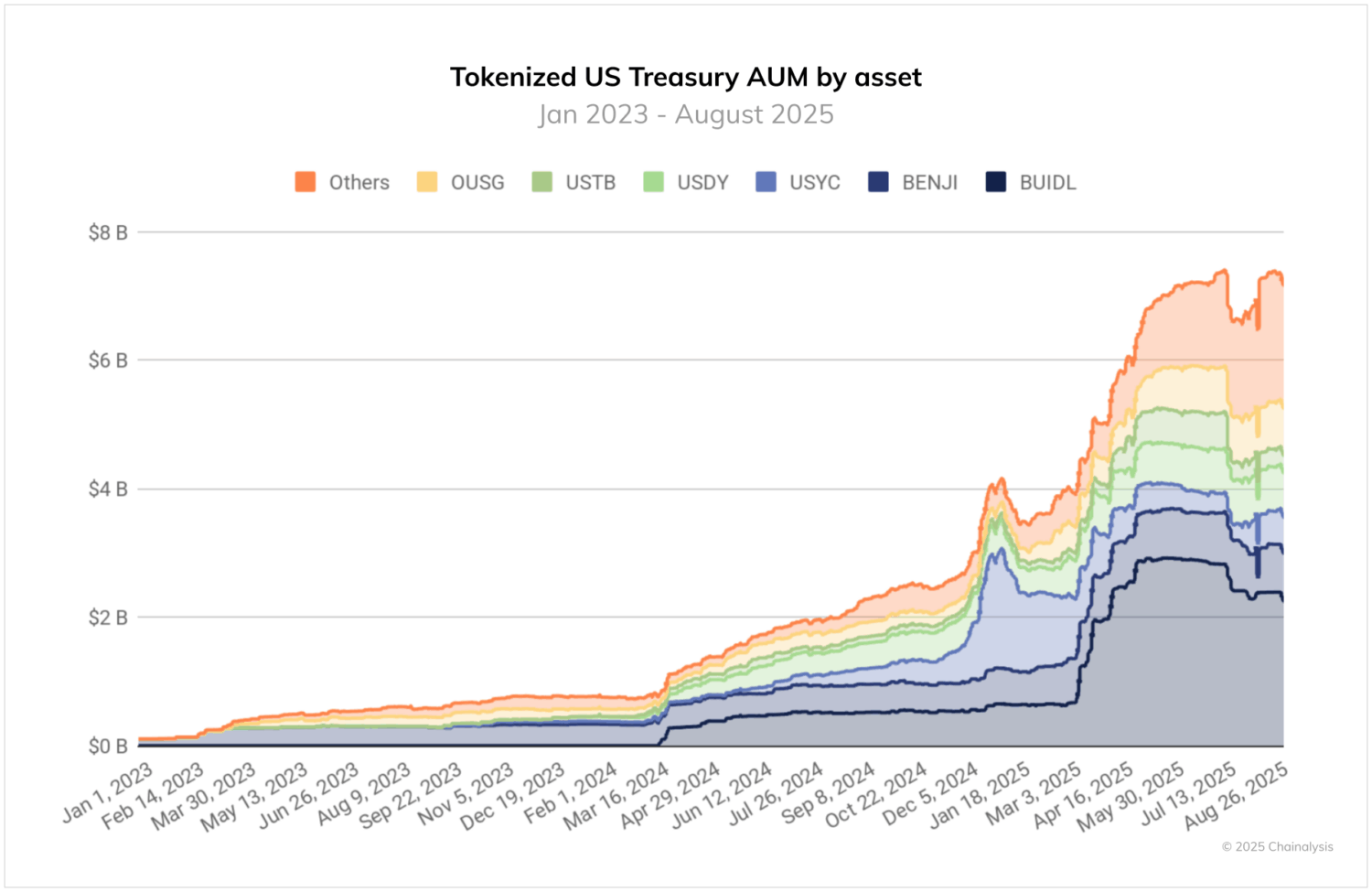

The growing integration of traditional finance and cryptocurrency markets is evident in the United States. Over the past year, two particular segments have shown strong growth: tokenized money market funds, and bitcoin and other spot crypto ETFs.

Within the market for tokenized real-world assets, U.S. treasuries have been a bright spot. Tokenized shares of money market funds that hold U.S. treasuries have grown rapidly. Assets under management (AUM) of these tokenized funds nearly quadrupled over 12 months, from approximately $2 billion in August 2024 to more than $7 billion in August 2025. While still small relative to the overall U.S. government debt market, the strong growth in this sector reflects investor demand for regulated, on-chain, liquid, yet yield-bearing assets. In a high-interest-rate environment, they’ve become especially attractive to crypto-native investors and institutions seeking stable returns on-chain, and they are increasingly used as collateral in DeFi protocols or by fintechs offering yield-bearing products.

The bitcoin ETF market continues to attract noteworthy institutional activity. As of mid-July 2025, the global AUM for bitcoin ETFs has surged to approximately $179.5 billion, with U.S.-listed bitcoin ETFs leading the way and driving the majority of this growth. Some earlier reports cited $120 billion in U.S. bitcoin ETF AUM, highlighting their rapid expansion since approval in early 2024.

The growth of bitcoin ETF AUM has important implications for U.S. markets. With more than $120 billion of the roughly $180 billion in global AUM tied to U.S.-listed products, American investors can get price exposure to Bitcoin without needing a crypto wallet or directly holding the underlying asset. And while the ethereum ETF market has yet to take off in the same manner, it has also attracted significant and growing investment since the first funds were launched, with AUM sitting at $24 billion.

The growing investment in these vehicles and potential approval for Solana ETFs in the US suggest not only is there an appetite, but perhaps more fundamentally, that cryptoassets are increasingly emerging as investible asset classes. At the same time, this expansion strengthens the U.S.’s role in global digital asset investments. ETF-driven flows link bitcoin demand more closely to U.S. monetary policy and market cycles, reinforcing correlations with other risk assets. While this may amplify volatility, it ensures that the U.S. remains the key hub for institutional bitcoin exposure, embedding crypto more deeply into its financial system and extending U.S. influence over global adoption.

The U.S. dollar goes borderless

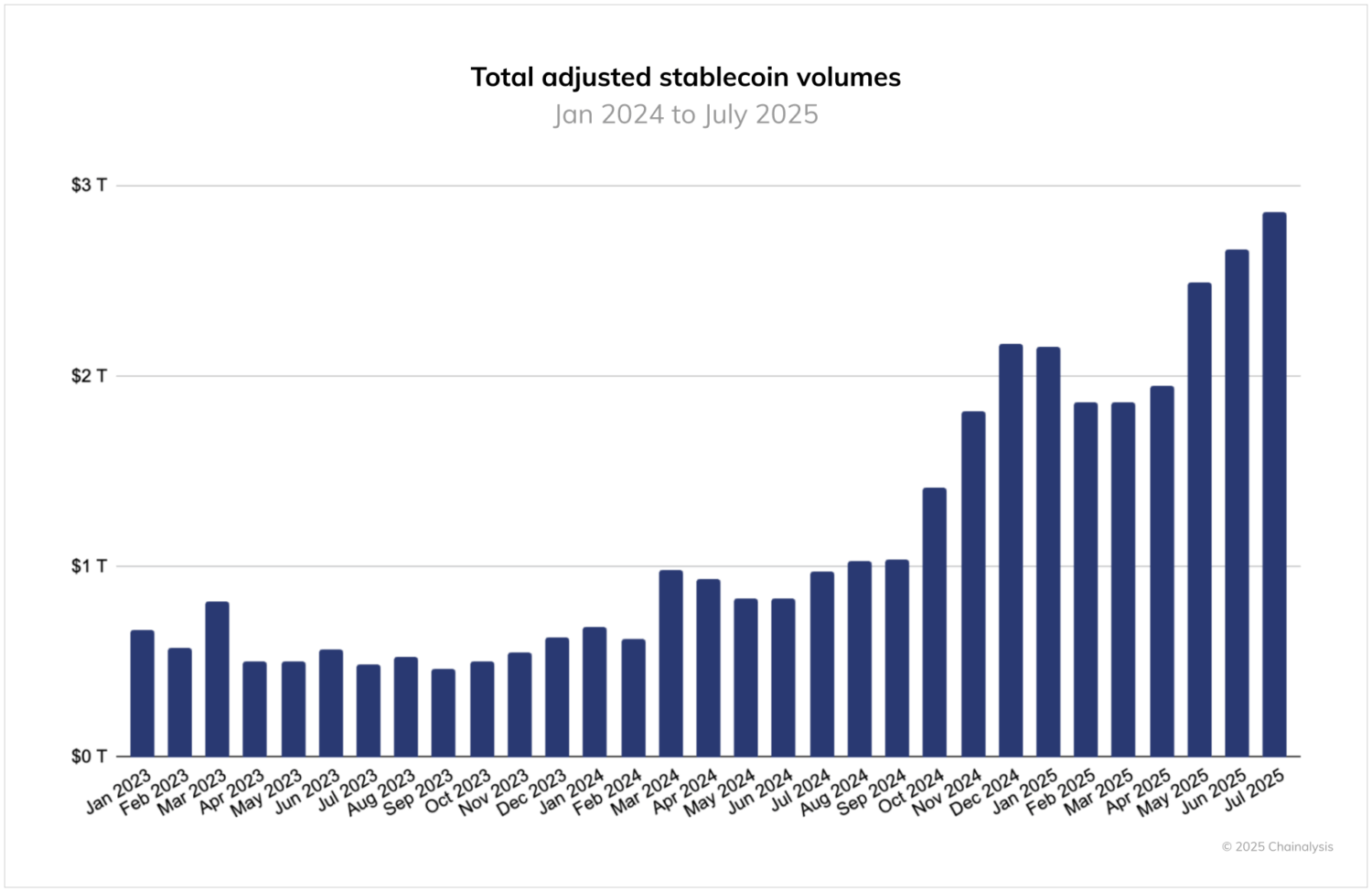

The outsized role of the U.S. dollar in global trade and finance is reflected in the market composition of stablecoins, which now facilitate the movement of trillions of dollars worldwide each month. In 2025, transfer volumes frequently exceeded $2 trillion per month, with peaks approaching $3 trillion. Today, with a total adjusted transaction value of nearly $16 trillion between January and July 2025, volumes have nearly tripled from the same period last year.

These volumes underscore how dollar-referenced digital assets have become integrated into global finance. Within cryptoasset trading markets, stablecoins provide a vital settlement asset. Outside of crypto trading markets, stablecoins provide an alternative set of rails for populations often underserved by traditional banking, offering access to efficient transfers and stable savings in a way that reinforces U.S. monetary influence well beyond domestic borders.

Under the new administration, policy momentum on stablecoins has been swift. In July 2025, President Trump signed into law the GENIUS Act, which establishes a two-tier regulatory approach to stablecoins. Stablecoins with a market capitalization of over $10 billion fall under federal-level oversight, while those with less than $10 billion have the option to opt for state-level oversight. Besides protecting consumers through strict rules on reserve backing, disclosures, and marketing, the GENIUS Act is explicitly geared toward maintaining the U.S. dollar’s dominance as a global reserve currency. The rationale seems sound; the sustained scale of stablecoin flows demonstrates their importance in shaping the financial markets of the future.

So, what does this mean for U.S. crypto adoption?

Recent regulatory changes have opened the door, enabling both financial institutions and retail investors to participate more actively in crypto markets. Such strong demand from both Wall Street and Main Street is helping ensure the United States cements its position as a global hub for cryptocurrency investment and innovation. Meanwhile, the global adoption of dollar-backed stablecoins is extending American monetary influence beyond traditional borders, reflecting and entrenching the outsized role of the U.S. dollar in global markets.

With no signs that regulatory momentum will slow any time soon and institutional demand continuing to rise, the U.S. appears well-positioned to remain near the top of the charts and potentially claim the top spot in global crypto adoption as we look to next year.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.