Chainlink and DeepBook Top DeFi Development Rankings in September

Development activity across the DeFi sector is heating up, with several projects showing strong technical momentum despite muted price action.

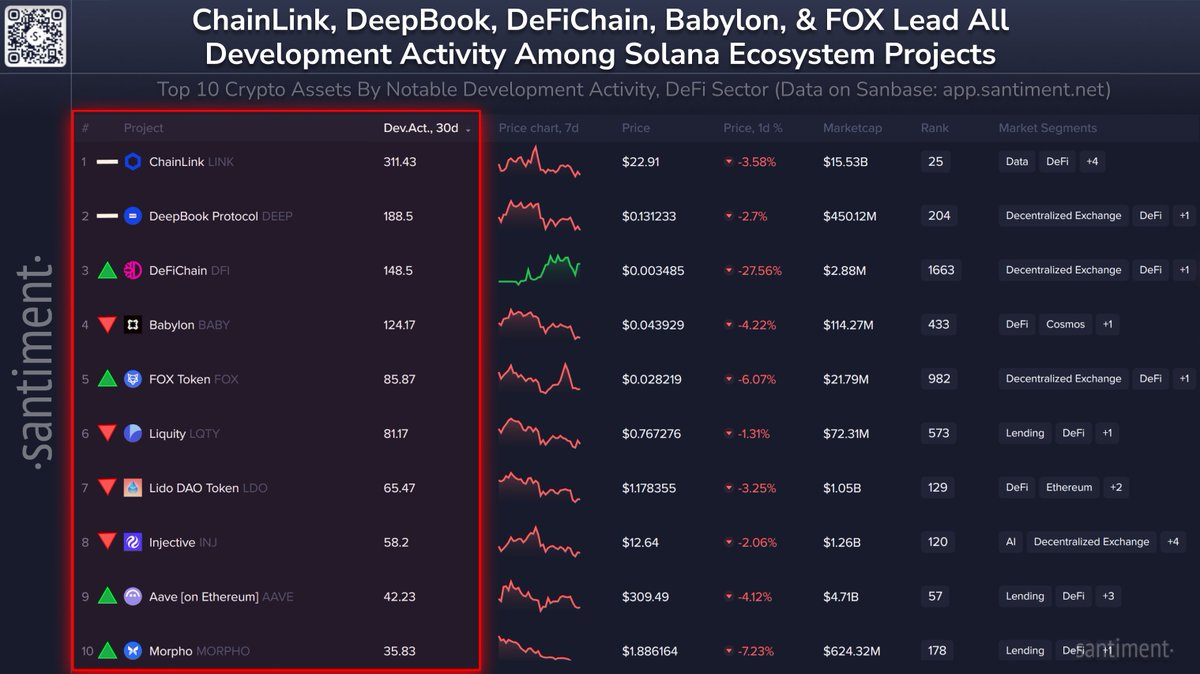

According to new data from Santiment, Chainlink (LINK) leads all decentralized finance platforms by developer commits over the past 30 days, followed closely by DeepBook (DEEP) and DeFiChain (DFI).

Chainlink cements its lead

Santiment’s ranking shows Chainlink with more than 311 tracked development events, far ahead of the pack. The oracle provider continues to expand its Cross-Chain Interoperability Protocol (CCIP), which has become a cornerstone of blockchain connectivity. While LINK’s price has dipped -3.58% over the week, the heavy coding activity signals that fundamentals remain strong.

Rising momentum for emerging projects

In second place, DeepBook logged 188.5 dev events, reinforcing its reputation as one of the most active decentralized exchange projects. Meanwhile, DeFiChain ranked third with 148.5 events, even as its token lost over 27% in the past 30 days. Other names rounding out the top five include Babylon (BABY) and FOX (FOX), both of which saw developer activity outpacing more established players.

Stalwarts remain active

Further down the list, leading DeFi protocols such as Lido (LDO), Injective (INJ), and Aave (AAVE) remain fixtures in the rankings, alongside Liquity (LQTY) and Morpho (MORPHO). Despite market-wide corrections of 3%–7%, these projects continue to attract consistent developer engagement.

Why it matters

Santiment emphasizes that development activity is a strong forward-looking indicator, often preceding price recoveries and long-term adoption. While many DeFi tokens are under pressure, the sustained GitHub commits reflect ongoing confidence in project roadmaps.

As the sector heads into September, this ranking underscores how developer persistence can act as a stabilizing force, even in turbulent markets. For investors, it offers a window into which teams are building through volatility – potentially setting the stage for future growth when market sentiment turns bullish again.