What Labor Day can teach crypto about power

The United States celebrates Labor Day on the first Monday of each September.

Almost everywhere else in the world, Labor Day is celebrated on May 1.

How did this come to be?

During the early Industrial Revolution, US trade unions launched a national strike for the eight-hour work day.

What began as a peaceful rally on May 4, 1886 in Haymarket Square, Chicago, erupted in the deaths of at least thirteen people after a bomb was detonated.

Eight anarchists were convicted. Four were hanged in a trial that went down in the annals of history as something of a mock trial.

The first of May was canonized by the Socialist Second International after the bloody Haymarket affair in 1886. With that, unions embedded May Day in labor calendars across Europe, Latin America, Asia and Africa.

Yet, Washington, rattled by the 1894 Pullman Strike, blessed a calmer existing September parade instead, in part to avoid embracing the revolutionary overtones that May 1 had taken on after Haymarket.

The US’s Labor Day landed in September not because history pointed there, but because of politics — even if May 1 had the stronger moral claim.

The whole tale is politics as usual: power vs. power. Trade unions used force (strikes) to reshape the legal rules of industrial capitalism while state governments used force (law) to assert their own.

That’s because politics is fundamentally a zero-sum game. Extraction is the name of the game. When one wins, the other side has to lose.

The libertarian novelist Ayn Rand put it succinctly:

“All men and all private groups have to fight to the death for the privilege of being regarded as “the public.” The government’s policy has to swing like an erratic pendulum from group to group, hitting some and favoring others, at the whim of any given moment — and so grotesque a profession as lobbying becomes a full-time job.”

Contrast that to the positive-sum nature of markets. Trade takes place only when both parties agree they are better off.

Sure, markets aren’t perfect. Markets have a way of being perverted, they are inefficient, are subject to regulatory capture, or end up in cronyistic relationships that are hard to untangle.

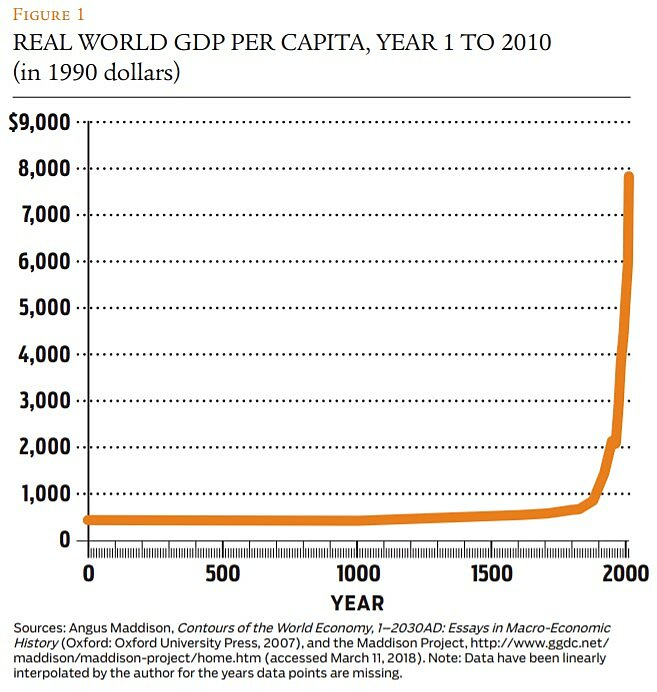

Blockchain technology is the once-in-a-century technological advancement that improves upon the market institutions humankind has enjoyed only over the last 200 years.

Decentralized ledgers mean crypto communities can use exit, rather than force, to settle disagreements and reshape the rules of markets.

When the big blockers didn’t get their way in Bitcoin’s Blocksize Wars, Bitcoin Cash was born.

When the Ethereum community feared Lido’s stake share neared the chain’s liveness threshold of 33% in 2022, ETH stakers opted to stake elsewhere.

When OpenSea tried to enforce mandatory royalty fees, the competing NFT marketplace Blur skirted the ban and offered consumers royalty-free trading because NFTs live on open, composable rails.

And when innovation lags, liquidity migrates — from Compound to Aave, from Balancer to Uniswap.

There are countless more examples, but the lesson is the same: When voice stalls, exit disciplines. Because open source has no moat.

Some fear that as the industry institutionalizes, crypto experiences its own “softening” of values. It’s a rightful concern.

Yet the core fact remains: Exit remains on the table, whether it’s ETF wrappers, digital asset treasuries, custodial UX or centralized blockchains.

That is less true for a Big Tech platform because of lock-ins, and least of all for government laws.

The credible option to exit is what makes crypto a fascinating experiment in and of its own right. Its innovation isn’t consensus by force, but consensus by exit.

That is perhaps what a crypto Labor Day could celebrate. Not a day won by politics, but a day where labor keeps the right to walk.

Get the news in your inbox. Explore Blockworks newsletters: