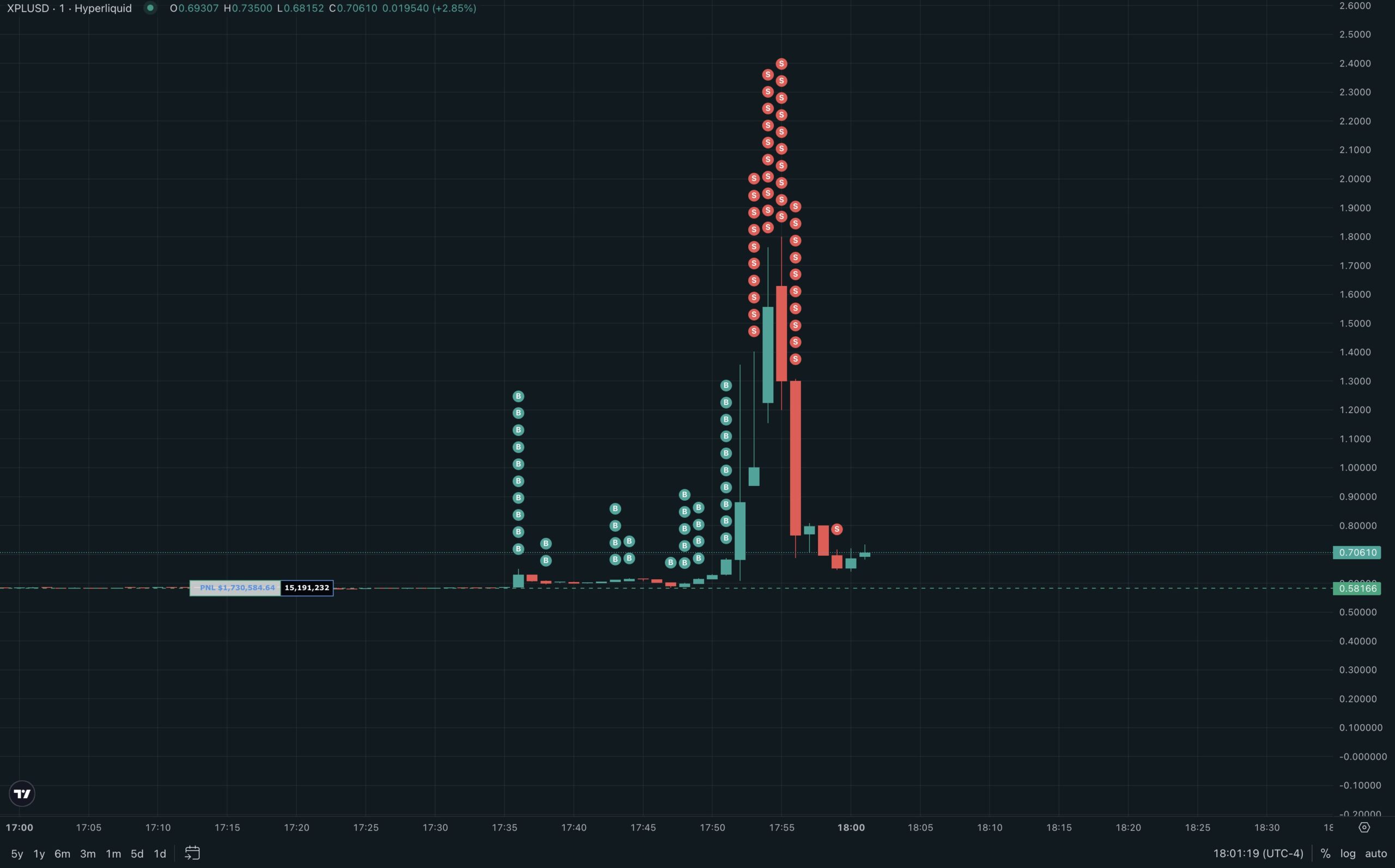

Was It Justin? XPL Soars 200% on Hyperliquid as Whale Wipes Out Order Book

A large wallet rocked the Hyperliquid market when it deposited 16 million USDC and opened millions of XPL long positions in just a few minutes.

This move instantly “swept clean” the order book, liquidating all short positions and driving XPL’s price to soar over 200% from the $0.58 range to a peak of $1.80.

Liquidity Shock

According to data from Lookonchain, this wallet partially closed its position within less than a minute and secured a $16 million profit. Some traders speculate that this wallet belongs to Justin Sun, the mastermind behind the Tron (TRX) network.

“Justin Sun just locked in $16M profit in under 60 seconds. He longed millions of $XPL, nuking the entire order book and wiping traders instantly. Sent $XPL soaring to $1.80 (+200% in 2 minutes). And he’s STILL holding 15.2M $XPL ($10.2M) long. Easily one of the craziest liquidation cascades ever seen on Hyperliquid,” an X user commented.

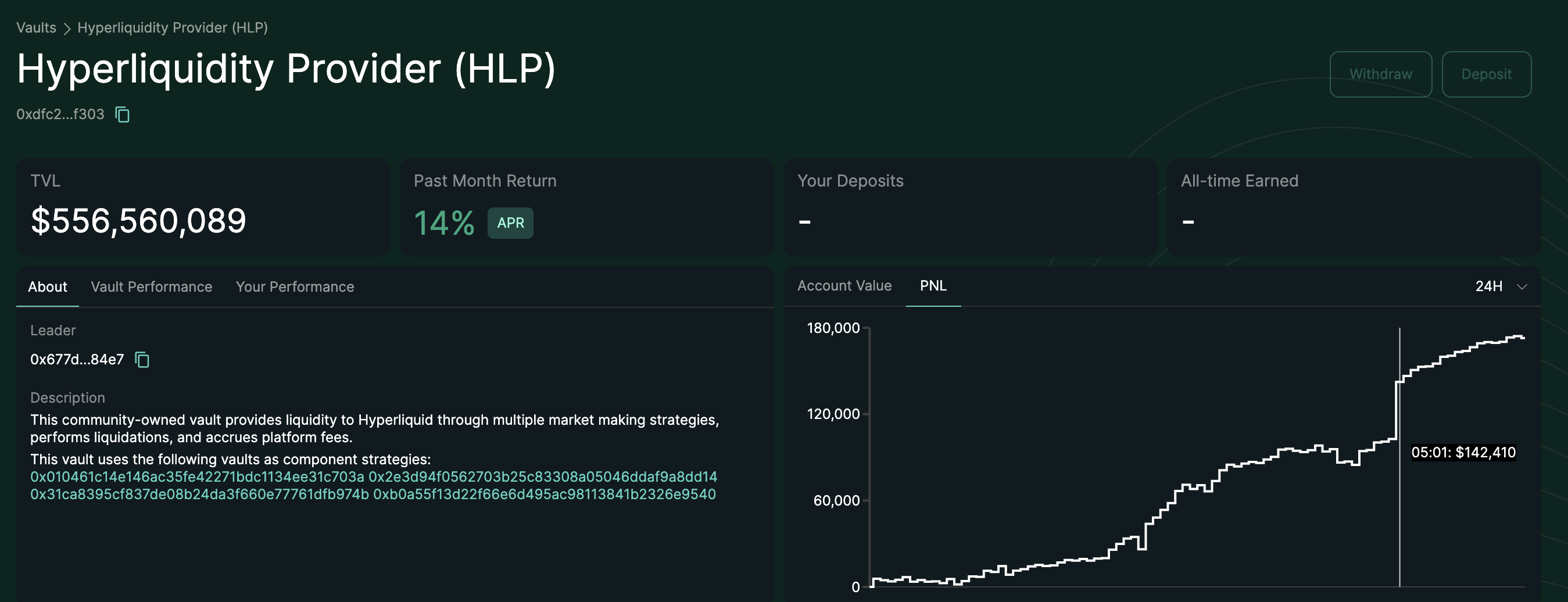

Not only did whales benefit, but Hyperliquid’s HLP vault also earned approximately $47,000 from this volatility. Despite this, the vault suffered a nearly $12 million loss in a similar event. This reflects the dual-risk nature of liquidity providers: they can earn fees while facing significant losses when volatility strikes.

Before XPL, Hyperliquid witnessed a similar event with the JELLY token. At that time, unusual price swings caused the HLP vault to incur a nearly $12 million loss. This loss occurred because the vault was caught up in liquidity provision amid an order book “wipeout.”

HyperLiquid responded to the JELLY squeeze by refunding affected traders and implementing stricter security measures to prevent future incidents. The commonality lies in both cases originating from a mighty whale move in a thinly liquidated market, triggering widespread short squeezes.

Risks for Retail Traders

The XPL price explosion is evidence of the “order book sweep” mechanism on decentralized derivatives exchanges. When liquidity is moderately thin, a sufficiently large order can pierce through multiple price levels, triggering a chain of liquidations. This action causes extreme volatility in an instant. In this case, Hyperliquid’s order book was almost entirely “devoured,” leaving retail traders unable to react and facing mass liquidations.

This pattern reveals the risks of trading in markets with limited liquidity. Whales can manipulate short-term trends, turning profits into massive losses for most other investors.

For individual investors, the XPL event on Hyperliquid highlights three key takeaways. First, investors should avoid high leverage when market liquidity is limited, as a “squeeze” can wipe out accounts in seconds.

Second, monitoring order book depth and on-chain cash flows is essential before entering a position to avoid zones exploited by whales.

Finally, for those participating in liquidity vaults like HLP, it’s crucial to recognize that short-term profits may come with significant loss risks during unexpected volatility.

The post Was It Justin? XPL Soars 200% on Hyperliquid as Whale Wipes Out Order Book appeared first on BeInCrypto.