Crypto History Signals Altcoin Boom

A bold call from analyst Rekt Fencer has ignited debate across the crypto community: “Buy any altcoin now, sell in October.”

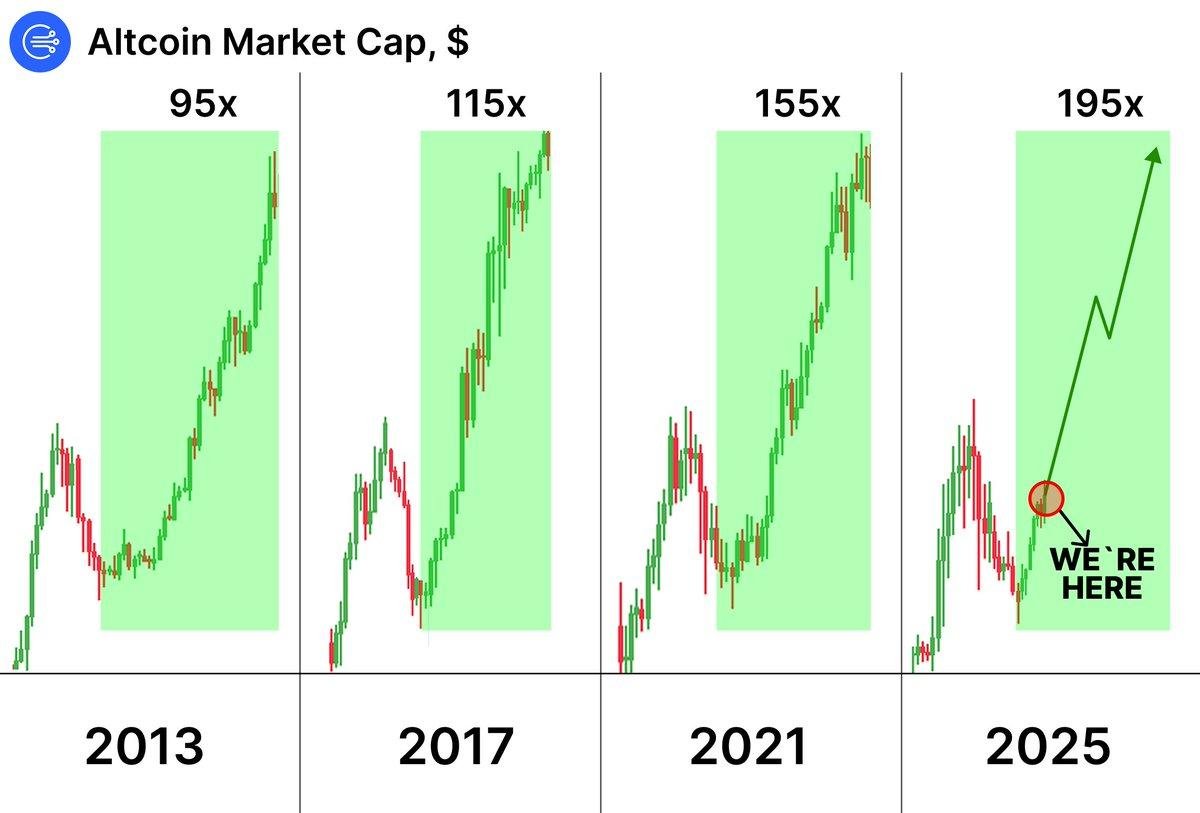

The statement, shared on X with a chart comparing past altcoin market cycles, suggests that 2025 could be setting up for one of the largest altcoin rallies ever recorded.

The chart shows altcoin market capitalization multipliers from previous cycles: 95x in 2013, 115x in 2017, and 155x in 2021. For 2025, the projection climbs even higher – a staggering 195x, with the marker “WE’RE HERE” highlighting that the market may still be in the early stages of acceleration.

Altcoin history shows Q4 is the sweet spot

Historically, the altcoin sector has delivered its strongest returns in the final months of the year, particularly after Bitcoin rallies and consolidates. In 2017, Ethereum, XRP, and smaller-cap coins surged in October through December. The same pattern repeated in 2021, when altcoins vastly outperformed Bitcoin after its initial run-up.

This seasonal rotation often follows a cycle: Bitcoin first absorbs liquidity and sets new highs, then traders shift capital into Ethereum, and eventually, smaller-cap altcoins capture the bulk of speculative flows. Analysts argue that this sequence is already underway in 2025, with Bitcoin’s consolidation near $117,000 setting the stage for capital to rotate into riskier plays.

Social and on-chain metrics confirm early build-up

The surge in altcoin market interest is not only visible in price charts but also in social sentiment and on-chain activity. CoinMarketCap’s trending algorithm shows mid-cap projects like Cartesi, Epic Chain, and Alpine Fan Token gaining momentum, with volume spikes in the thousands of percent. Meanwhile, whale wallet data confirms accumulation across multiple altcoins, echoing conditions seen before previous October rallies.

Liquidity patterns also mirror historic set-ups. Exchange reserves for many altcoins are at multi-year lows, meaning there is less supply available to absorb demand once momentum fully kicks in. This dynamic has often amplified altcoin rallies into parabolic phases in past cycles.

A 195x cycle projection sparks excitement – and caution

If the 195x projection plays out, the altcoin market could dwarf its prior all-time highs. However, such models rely on historical fractals, and while patterns can rhyme, they rarely repeat exactly. Macro factors, ETF flows, and global liquidity conditions in 2025 add variables not present in earlier cycles.

Still, the consistency of altcoin cycle blowoffs every four years cannot be ignored. For traders, the strategy outlined by Rekt Fencer, buying ahead of the October window and scaling out during peak retail excitement has historically been among the most profitable timing plays in crypto.

Conclusion

The message is simple but powerful: history suggests October could once again be the launchpad for altcoins. With Bitcoin consolidating, social sentiment heating up, and whale wallets loading up, the setup strongly resembles past cycle moments when altcoins went on to post triple- and quadruple-digit gains.

If Rekt Fencer’s 195x projection holds any weight, the coming months could mark one of the most aggressive altcoin rotations in crypto history.