Bitcoin (BTC) Price Prediction: Bitcoin Targets New All-Time Highs After $116K Breakout

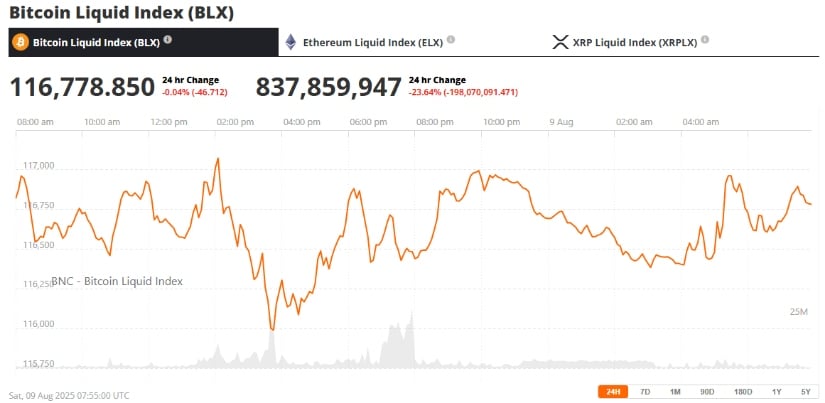

Bitcoin price today has captured market attention by breaking past the significant $116,000 mark, sparking fresh optimism among traders and investors.

With recent catalysts including potential ETF approvals and favorable macroeconomic signals, the stage appears set for Bitcoin to pursue new all-time highs in the near term.

Market Overview: Bitcoin Technical Analysis Signals Strong Bullish Momentum

Bitcoin’s recent price breakout has been underpinned by a textbook bullish flag formation on the daily chart, just below the $117,335 Fibonacci retracement level. This technical setup follows a sharp rally from the $98,000 support zone and is supported by an ascending trendline combined with the 50-day simple moving average (SMA) near $113,157 — a crucial area for Bitcoin technical analysis that has historically triggered rebounds.

BTC is at a key point with a bullish ascending triangle forming; bulls aim to hold above $117,000 while bears target $115,900. Source: Paper_Trader1775 on TradingView

The momentum shift is notable. The relative strength index (RSI) climbed back to 54.77 from oversold conditions, indicating renewed buying interest without entering overbought territory. Meanwhile, the moving average convergence divergence (MACD) indicator is flattening near the zero line, suggesting bearish pressure is waning.

Traders are closely watching key support levels between $113,635 and $113,157, with a vital support floor at $110,685. On the upside, resistance at $117,335 must be overcome decisively for Bitcoin to accelerate toward its next targets at $123,250 and eventually between $126,980 and $131,575. Should this bullish flag resolve as expected, Bitcoin’s price breakout could usher in a new rally phase toward the low $130,000s and beyond.

Trend and News Factor: Bitcoin Halving 2025 and Institutional Catalysts

Several catalysts are backing the positive expectation of Bitcoin price today. The occurrence of the 2025 Bitcoin halving is a top highlight on investors’ calendars. Historically, halving periods have reduced the supply of new Bitcoins, often triggering significant price gains in months and years to come.

President Trump has signed an executive order permitting Americans to include Bitcoin and other cryptocurrencies in their 401(k) retirement accounts. Source: Nick Sortor via X

Second, consider U.S. President Donald Trump’s recent executive order allowing cryptocurrencies, private equity, and real estate to be included in 401(k) retirement plans a milestone in mainstream adoption. This move potentially opens up entry for tens of millions of long-term investors into the world of cryptocurrencies, establishing a robust demand pool.

To further add to positive sentiment, Japanese SBI Holdings has filed for a dual Bitcoin-XRP ETF, a new product that can help catalyze institutional interest by offering exposure to two of the largest crypto assets simultaneously. SEC approval of the ETF would be a major milestone, further accelerating price momentum and boosting Bitcoin ETF news coverage.

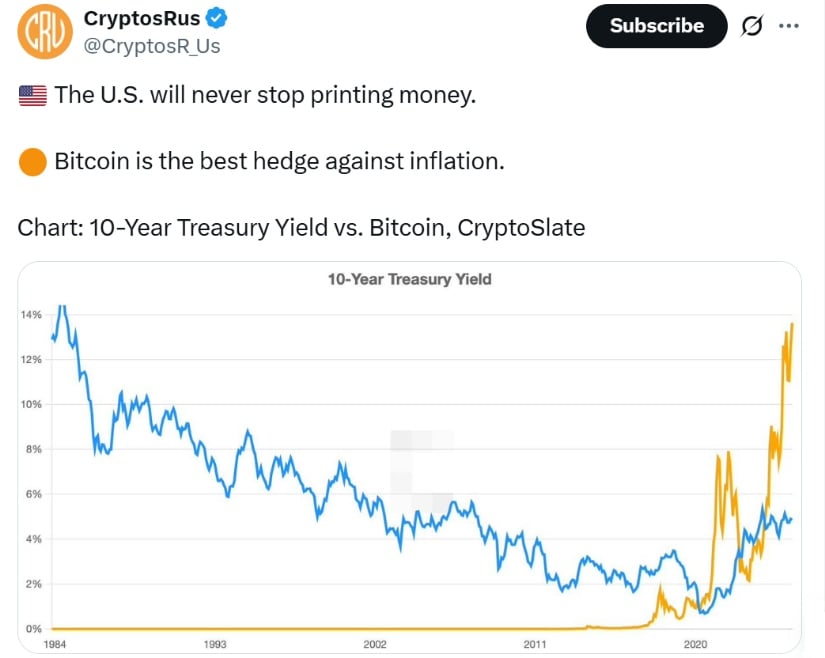

Expert Insights: Bitcoin as an Inflation Hedge and Long-Term Forecasts

Analysts still see Bitcoin as a good inflation hedge during a time of shifting economic policies. With the Fed decreasing interest rates in September 2025, as the CME’s FedWatch Tool indicates a probability of 95%, demand for risk assets like Bitcoin could pick up.

With ongoing U.S. money printing, Bitcoin remains the strongest hedge against inflation, as reflected in the 10-year Treasury yield comparison. Source: @CryptosR_Us via X

Asia’s ongoing pace of adoption of digital assets, spearheaded by China’s stablecoin initiative in Hong Kong to back the Renminbi and break away from dollar reliance, further supports the long-term value proposition for Bitcoin. This action contributes to the global significance of Bitcoin Lightning Network and Taproot upgrades that improve the efficiency and anonymity of transactions on the Bitcoin ledger.

As crypto commentator Francesco explained, “Bitcoin’s price action is like a door ready to be opened. Although it may take a temporary detour to trap liquidity, the path is towards a robust breakout above $116K.”

Looking Ahead: BTC Next Move and Long-Term Outlook

Bitcoin’s technical setup currently, together with the driving factors of fundamentals and macroeconomy, points towards a favorable price breakout situation. Support at pivotal levels around $113,000 is essential to continue the follow-through buying that can take Bitcoin into the $130,000 to $150,000 range over the next couple of months.

Bitcoin (BTC) was trading at around $116,778 at press time. Source: Bitcoin Liquid Index (BLX) via Brave New Coin

For traders and investors, watching for Bitcoin whale alerts and staying up to date with news about SEC approval of Bitcoin ETF will be crucial. The 2025 Bitcoin halving, coupled with positive inflation hedge narratives and continued network upgrades, positions BTC well for new price discovery.

As the market digests these variable changes, the question remains: will Bitcoin maintain its bullish run to reach new all-time highs, or will it give a pause to allow a consolidation? Either way, the long-term future of Bitcoin looks good for those keeping up with Bitcoin news today.