Bitcoin Dominance Weakness Fuels Breakout Potential

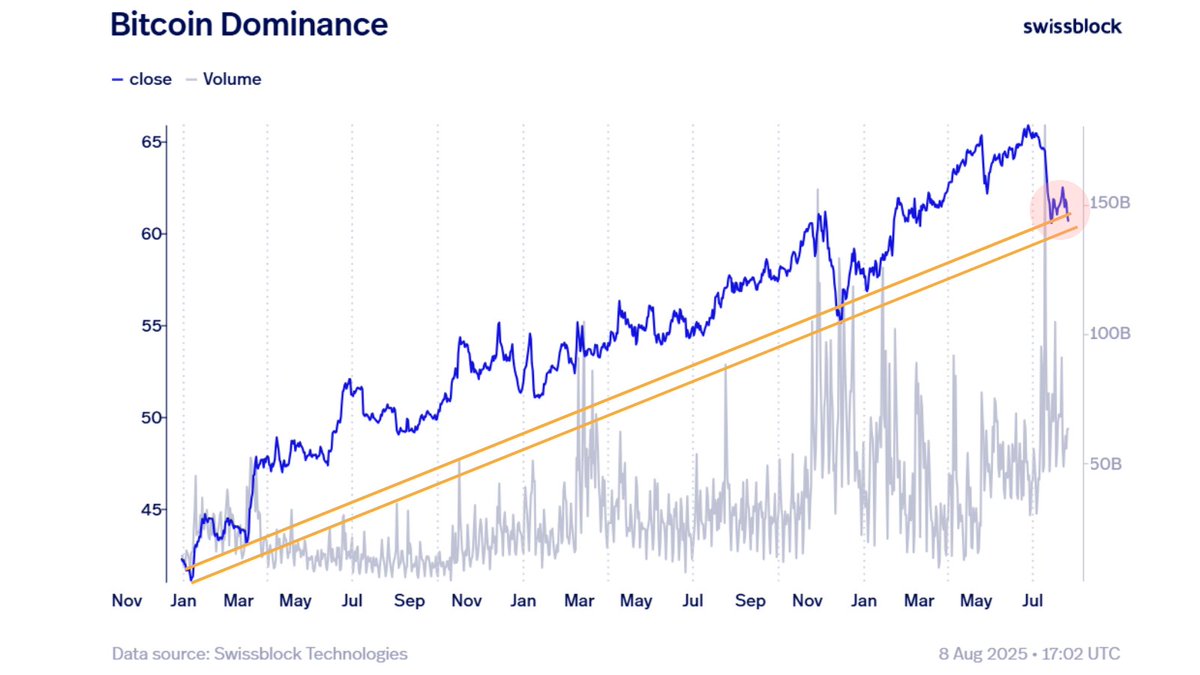

Market analysts are closely watching Bitcoin dominance (BTC.D) as it tests a critical long-term rising channel, a structure that has been in place for over two years.

According to Swissblock, volume is fading and momentum is weakening, setting the stage for a potential breakdown. A decisive break below support – marked in their analysis as the “red circle” – would be the first such event in more than two years, potentially accelerating the start of a full altseason.

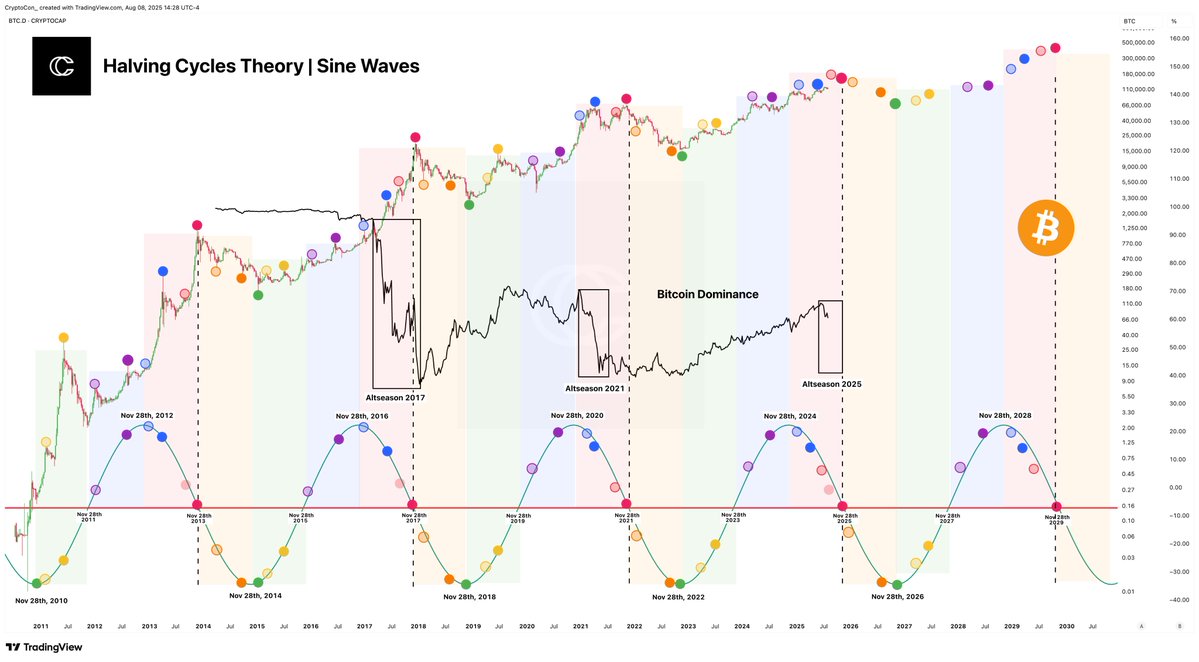

CryptoCon adds that while early signs of altseason are emerging, the phase is far from complete. Historically, altseason has been a crucial part of every major crypto cycle, driving substantial gains in non-Bitcoin assets. The analyst emphasizes that the current market has been heavily Bitcoin-focused, but once altcoins gain traction, they could dominate investor attention.

Looking at past cycles, CryptoCon highlights that altseasons often coincide with specific phases in Bitcoin’s halving cycle and periods of declining BTC dominance. These phases have historically produced explosive rallies across the altcoin market, with many projects delivering outsized returns compared to Bitcoin.

Both analysts agree that the coming weeks will be critical. If BTC.D breaks its long-term support, it could trigger capital rotation from Bitcoin into altcoins, leading to heightened volatility and rapid price appreciation in the broader market. However, without this structural shift, altseason may remain in its early stages, delaying the broader crypto finale.