Why Are Crypto Prices Down Today? Top 3 Altcoins to Buy on the Dip

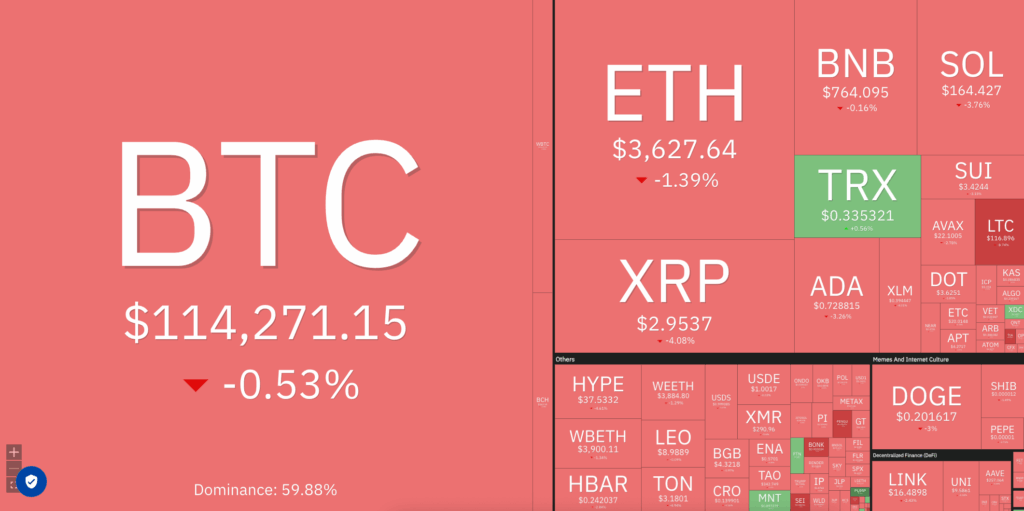

The crypto market is deep in the red today, and it’s got traders wondering if this dip is just temporary noise or something more catastrophic. BTC and ETH are both down around 1%, while 24-hour spot trading volumes have tanked to $139 billion.

Corrections like these can feel unsettling – but they often create the best buying opportunities for those willing to take a risk. Smart investors know that downturns separate the projects with real utility from the ones relying purely on hype.

So, what’s driving today’s sell-off, and which altcoins to buy on the dip might take off once the market recovers? Let’s dive in and find out.

What’s Behind Today’s Market Dip?

The numbers aren’t pretty. Bitcoin and Ethereum are only down slightly today, but major altcoins are bleeding harder. XRP and Solana have dropped over 4%, while Litecoin is down 8%. The total crypto market cap has slipped just over 1%, which doesn’t sound huge until you remember we’re talking billions in lost value.

So, what’s behind the slide? It seems to be a mix of macro headwinds and market mechanics. Trump’s surprise tariff announcement has spooked investors and reignited recession fears. The Fed holding rates steady with no hint of cuts isn’t helping – it props up the dollar and sucks liquidity out of risk assets like crypto.

Institutional flows look grim, too. The spot BTC ETFs saw over $800 million in outflows on Friday – the biggest daily drop since May. On top of that, $172 million in long positions were liquidated after Bitcoin’s price dipped below $114,000, forcing more selling.

Even old Bitcoin whales are moving their coins to exchanges – including one enormous wallet from the Satoshi era that holds 80,000 BTC.

Lastly, August’s seasonality doesn’t help. Bitcoin has a habit of dipping this time of year, and combined with all the factors discussed above, it’s easy to see why investors are choosing to sell their crypto holdings.

Top Altcoins to Buy on the Dip

While the current market conditions might look bad, they’re creating some interesting entry points for quality projects. Here are three altcoins that could reward investors who buy during this dip:

1. Bitcoin Hyper (HYPER)

Bitcoin Hyper (HYPER) is going viral, and the current market dip could be the perfect entry point. The project just crossed $7.3 million in its presale, with over $1 million raised in the past week alone. That’s the kind of momentum you want to see during uncertain times.

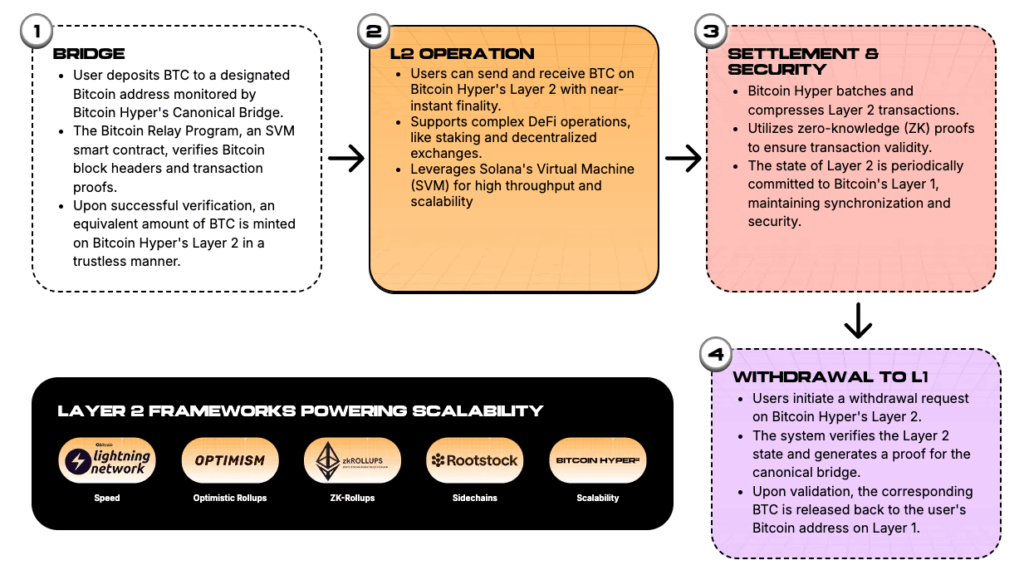

What makes Bitcoin Hyper so exciting is how it’s tackling Bitcoin’s biggest limitation: speed. While Bitcoin’s security is top-notch, its processing speed of just 3-7 transactions per second, combined with unpredictable fees, isn’t exactly ideal for today’s crypto users.

Bitcoin Hyper is building a Layer-2 solution that brings Solana-like performance to Bitcoin’s blockchain, promising near-instant transactions with much lower fees. Users can swap their BTC to wrapped BTC through Bitcoin Hyper’s Canonical Bridge, then enjoy fast transactions in areas like DeFi, NFTs, and meme coins.

With HYPER tokens currently priced at just $0.01255 and a staking APY of 148% on offer during the presale, early investors have an excellent opportunity to gain exposure and generate passive income. This 2-for-1 deal makes Bitcoin Hyper a top altcoin to buy on the dip.

2. Maxi Doge (MAXI)

If you’re looking for something completely different during this market dip, Maxi Doge (MAXI) might be the wildcard play. This meme coin has raised $400,000 in just over a week, and it’s positioning itself as “Dogecoin squared” with a hilarious mascot.

The project draws parallels to the 2021 retail trading revolution, where everyday investors took on Wall Street institutions and won big. Now, MAXI is bringing that same energy to crypto, complete with plans to launch the first 1,000x leveraged trading platform.

Maxi Doge’s tokenomics show the team is serious about growth. A whopping 25% of all funds raised go directly into marketing and exposure, so if the team hits their $30 million target, that’s $7.5 million for raising awareness. And for early investors, there’s the option to stake MAXI during the presale for an APY of 659%.

While many investors are playing it safe this week, Maxi Doge is continuing to gain traction. That’s a good sign – and it suggests that MAXI might be the next big meme coin breakout.

2. Succinct (PROVE)

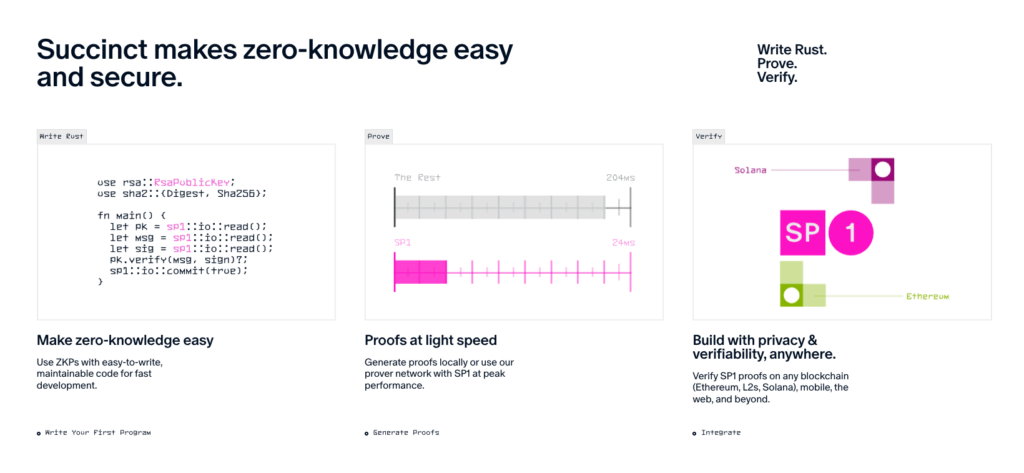

Succinct (PROVE) might not grab headlines like meme coins, but it’s building something the crypto ecosystem desperately needs. This zero-knowledge (ZK) proof infrastructure project is making this technology accessible to developers who don’t have advanced cryptography knowledge.

Think of Succinct as the “bridge” between complex ZK mathematics and practical applications. While projects like Ethereum are relying on ZK rollups for scaling, and privacy coins need ZK proofs to function, most developers struggle to implement these solutions from scratch.

Succinct provides the tools and infrastructure to make ZK integration straightforward, which could position it as an essential platform in today’s market, similar to how Chainlink became the go-to oracle solution.

What makes this dip interesting for PROVE is that it’s still rallying – up 30% in the past day alone. If this is how PROVE performs during turbulent periods, then imagine what could happen when the market recovers.