BTCFi Report: Why DeFi on Bitcoin is Inevitable?

This report is written by Tiger Research, analyzing the BTCFi argument and examining why decentralized finance on Bitcoin is becoming an inevitable trend by looking at improvements in capital efficiency, drivers of institutional adoption, and the development of technological infrastructure.

Key Takeaways

-

Bitcoin’s capital base is vast but underutilized; BTCFi will change that: Currently, over 14 million BTC are idle, and Bitcoin lacks the capital efficiency found in the Ethereum DeFi ecosystem. BTCFi unlocks liquidity by converting BTC into yield-bearing assets, making it available for lending, staking, insurance, and other decentralized finance applications built on Bitcoin’s security.

-

Institutional demand for native BTC yield is growing, and the infrastructure is ready: From compliant custody solutions to real-world yield protocols, the BTCFi ecosystem now encompasses ETFs, licensed lending, insurance models, and staking protocols that meet institutional standards.

-

Technological breakthroughs and Layer-2 innovations provide BTCFi with scalability and programmability.

Upgrades like Taproot and emerging Layer-2 platforms now support smart contracts, token issuance, and composable DeFi applications on Bitcoin.

1. Capital Liquidity Bottleneck: The Significance of BTCFi

Data Source: Glassnode

Today, Bitcoin has an asset base of over $1 trillion, but most of these assets are idle. Analysts estimate that 99% of BTC’s market value is “idle,” meaning almost all Bitcoin is stored in wallets or cold storage, generating no on-chain yield. On-chain data confirms this: over 14 million BTC have not been utilized for a long time.

Data Source: DefiLlama

This stands in stark contrast to Ethereum, where a large amount of ETH is actively deployed in DeFi and staking. For example, liquidity staking protocols on Ethereum have locked over 14.37 million ETH (approximately $56 billion), converting ETH into yield-bearing assets and driving a vibrant on-chain economy.

Ethereum’s DeFi “summer” showcased how capital efficiency achieved through staking rewards, lending interest, and liquidity provision can unlock tremendous value for smart contract platforms. In contrast, Bitcoin has not been fully utilized in this regard; its vast liquidity yield is 0%, and it cannot be further combined into financial products at the base layer.

The goal of BTCFi (Bitcoin DeFi) is to unlock this dormant capital. As CoinGecko’s introductory guide states, Bitcoin DeFi “transforms Bitcoin from a passive asset into a productive asset,” allowing holders to earn yield through BTC or use it in DeFi applications.

Essentially, BTCFi aims to bring about the transformation for Bitcoin that DeFi brought to Ethereum: converting static assets into sources of yield and becoming a cornerstone for further innovation.

2. Growing Institutional Demand for Yield

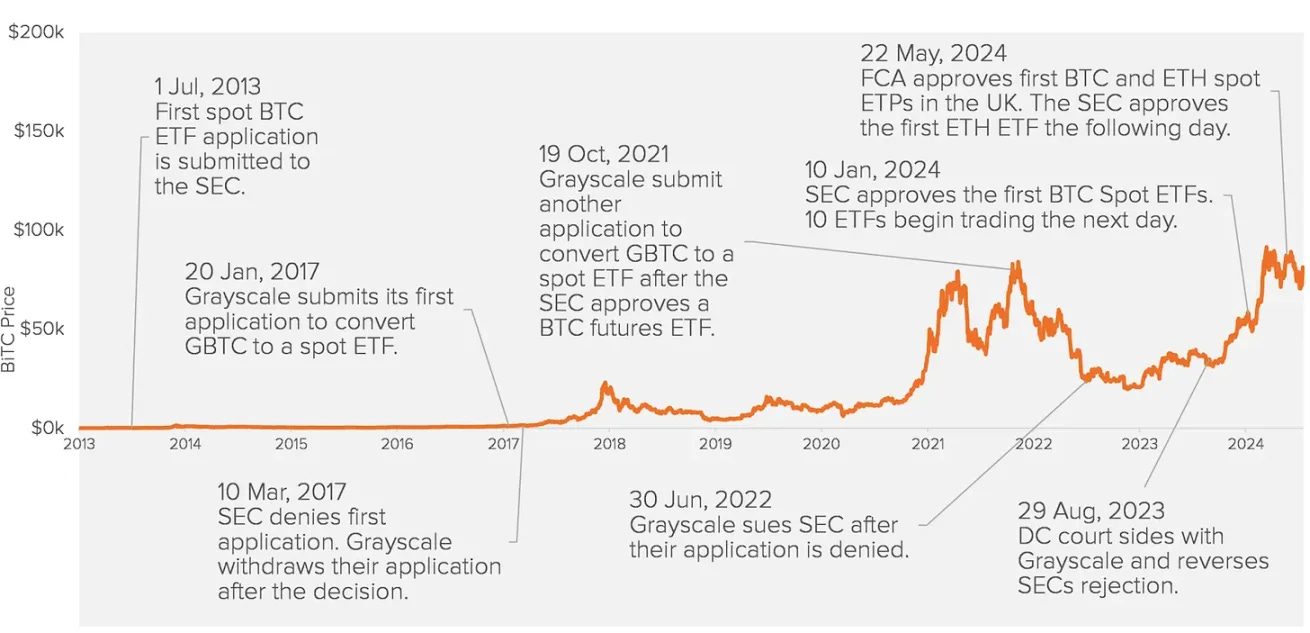

History of Bitcoin ETFs. Data Source: Fioderers

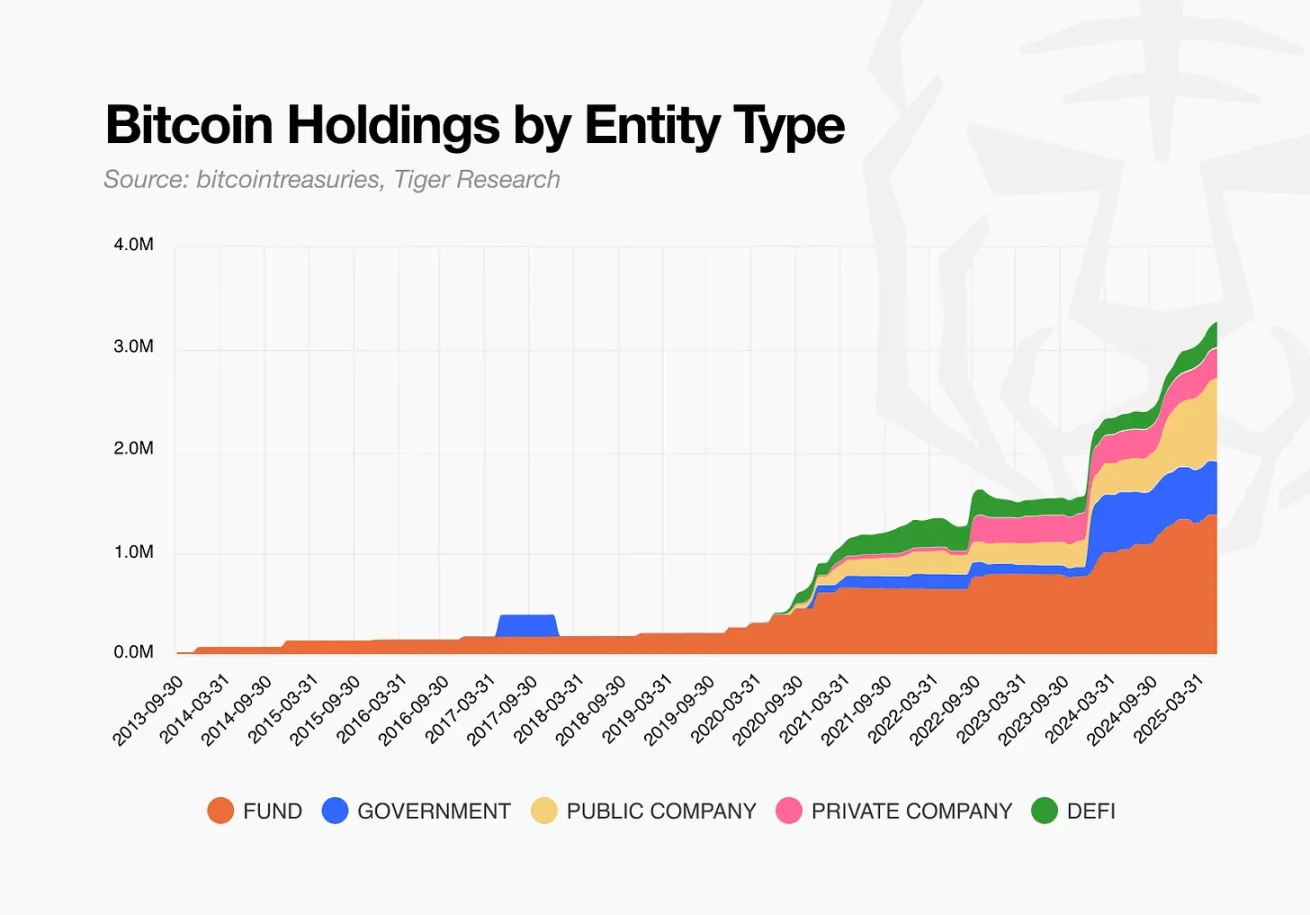

Institutional demand may be the strongest catalyst driving BTCFi growth, and this trend is already evident. By the end of 2023 and into 2024, several large asset management firms have applied for and been approved to launch spot Bitcoin ETFs, ultimately bringing BTC into mainstream portfolios.

Institutions have viewed Bitcoin as a strategic reserve asset, but they are also yield-sensitive. In traditional finance, capital is never idle; bonds pay interest, stocks pay dividends, and even cash is deposited in money market funds. Until recently, Bitcoin generated no yield.

BTCFi is changing that. Institutions are now asking a logical question: What can we do with the BTC we hold? More and more institutions are exploring ways to lend, stake, or use Bitcoin as collateral to unlock yield, similar to traditional financial models.

With these options emerging, institutional interest in BTCFi is surging. An annualized return of 3%-5% on BTC may not seem high, but when managing billions of dollars, this incremental yield is highly valuable.

As BTCFi matures, BTC holders can now earn annualized yields of 10%-20% through decentralized protocols, making this opportunity even more attractive. If BTC can provide stable and low-risk returns while retaining price appreciation potential, it will not only be a reserve asset but also a monetary anchor for DeFi.

As more institutions and individuals adopt BTC as a long-term reserve asset, the demand for earning yield on idle assets becomes increasingly clear. Yield generation is evolving from a niche strategy to a fundamental component of asset management.

Just as U.S. Treasuries underpin traditional capital markets, Bitcoin may become the underlying asset for yield in crypto finance, setting benchmarks across all areas from lending rates to DeFi protocol valuations.

3. Infrastructure is in Place

The BTCFi ecosystem is rapidly moving forward, launching new products and frameworks designed for institutional adoption:

3.1 Compliant Custody and Liquidity Wrapping

Companies like Fidelity Digital Assets, Coinbase Custody, and BitGo now support participation in DeFi under strict custody compliance. Emerging solutions like liquidity custody tokens (LCTs), such as BounceBit’s BBTC, enable institutions to hold BTC under compliant custody while deploying it on-chain to earn yield. Institutions can enjoy the yield potential of DeFi while maintaining regulatory compliance.

3.2 ETFs and Yield Integration Products

The first yield-bearing Bitcoin ETP in Europe. Data Source: CoreDAO

Yield-bearing Bitcoin ETPs have already launched in Europe. Valour’s BTCD ETP stakes BTC in Bitcoin Layer-2, with an estimated annualized yield of around 5.6% by the end of 2024. Meanwhile, institutions are exploring structured notes linked to BTC, dual yield products, and basis trading strategies that combine traditional financial instruments with crypto-native yield engines.

BounceBit aims to allow institutions to earn yield through BTC. Data Source: BounceBit

For example, BounceBit Prime combines tokenized U.S. Treasuries with BTC yield strategies in one product, offering traditional investors (like family offices and hedge funds) familiar dual returns, designed as a Bitcoin yield product for Wall Street.

Another example is SatLayer, which has launched a decentralized insurance tool backed by yield-bearing BTC. SatLayer is often referred to as the “Berkshire Hathaway of Bitcoin,” allowing any BTC holder to re-stake their assets into an on-chain insurance pool and earn a portion of the premium income. SatLayer is collaborating with both crypto-native and traditional underwriting institutions (like Nexus Mutual and Relm) to build a new class of decentralized BTC insurance products.

3.3 Protocol Maturity and Institutional Trust

BTCFi protocols like Babylon and Lombard have surpassed billions in total locked value (TVL), passed security audits, and are advancing SOC2 compliance. Many protocols have also hired seasoned Wall Street professionals as advisors and prioritized risk management in their design. These initiatives build credibility for large global capital allocators.

All of this points to a future where BTC yield will become a cornerstone of institutional portfolios, just like U.S. Treasuries in traditional markets. This shift will also create a ripple effect: institutional capital flowing into BTCFi will not only benefit Bitcoin holders but also enhance cross-chain liquidity, promote more DeFi standards, and provide a reliable, productive capital base layer for the entire crypto economy.

In short, BTCFi offers institutions a win-win choice: the reliability of Bitcoin as a quality asset and the opportunity to earn yield.

4. Why Now? The Technological Stack Driving BTCFi’s Explosion

BTCFi is no longer just a theoretical concept—it is becoming a reality, thanks to breakthroughs in three areas: technological upgrades in the Bitcoin ecosystem, increased market demand from improved infrastructure, and institutional interest driven by regulatory clarity.

4.1 From Taproot to BitVM

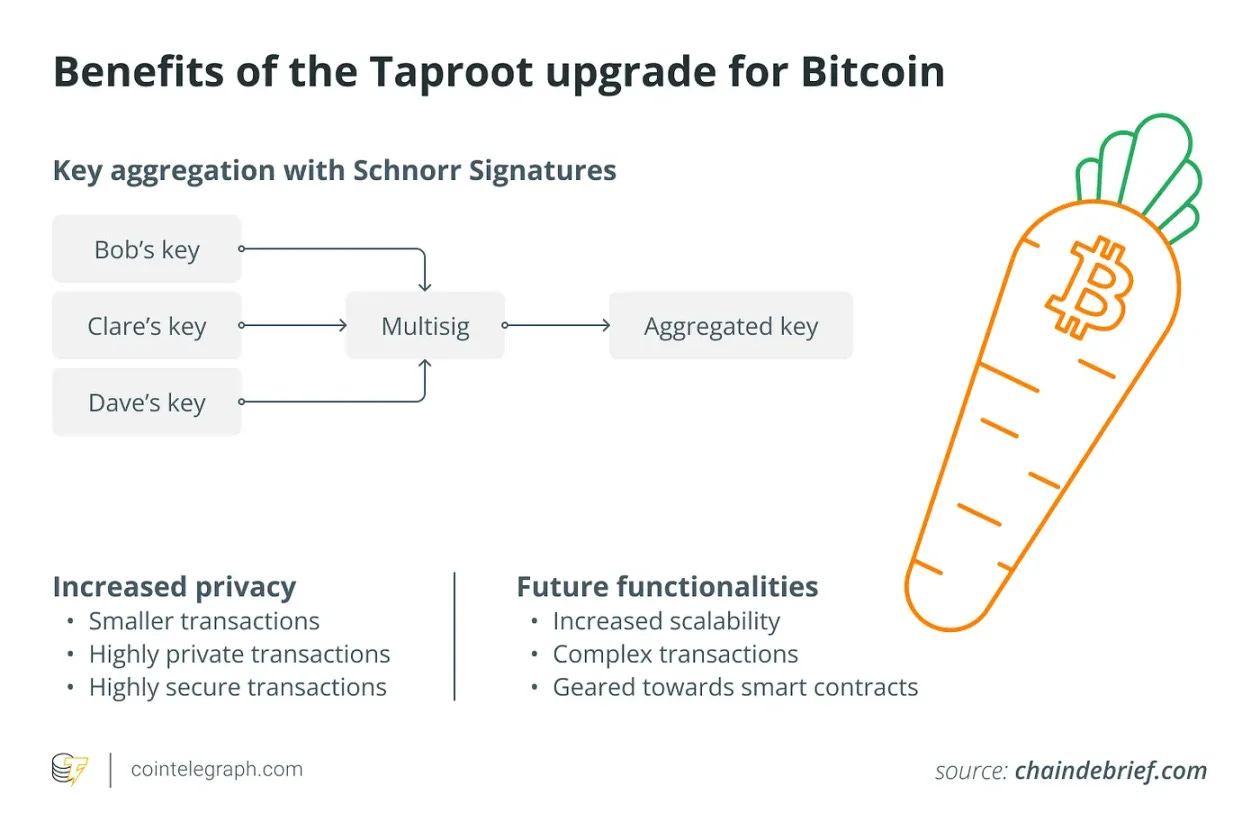

The Taproot upgrade enhances Bitcoin’s privacy and efficiency. Data Source: chaindebrief

Recent upgrades to the Bitcoin protocol and ecosystem lay the groundwork for more complex financial applications. For example, the 2021 Taproot upgrade improved Bitcoin’s privacy, scalability, and programmability, even “encouraging the use of smart contracts on Bitcoin” by enhancing efficiency. Taproot also supports new protocols like Taro (now Taproot Assets) for issuing tokens and stablecoins on the Bitcoin ledger.

BitVM. Data Source: Bitcoin Illustrated

Similarly, concepts like BitVM (a proposed Bitcoin “virtual machine”) are expected to enable Ethereum-like smart contracts on Bitcoin, with a testnet planned for release in 2025. Equally important, a number of Bitcoin-native Layer-2 networks and sidechains have emerged.

Platforms like Stacks, Rootstock (RSK), Merlin Chain, and the new BOB Rollup are introducing smart contracts to the Bitcoin ecosystem.

Stacks supports smart contracts through Bitcoin’s computational power, enabling cross-chain tokenization via sBTC and achieving native BTC yield through proof of transfer (PoX) staking, making Bitcoin more programmable and productive for developers and institutions.

BOB (Build on Bitcoin) is an EVM-compatible Layer-2 that uses Bitcoin as its finality anchor. It even plans to leverage BitVM to implement Turing-complete contracts based on Bitcoin’s security.

Merlin’s TVL currently exceeds many ETH Layer-2s, such as ZkSync, Linea, and Scroll. Data Source: Merlin

Meanwhile, the Babylon protocol has introduced Bitcoin staking to secure other chains and has attracted tens of thousands of BTC. As of the end of 2024, Babylon has staked over 57,000 BTC (approximately $6 billion), making it one of the top DeFi protocols by TVL. Merlin, once the highest TVL platform in Bitcoin Layer-2, reached about $3.9 billion in TVL within 50 days of launch, greatly expanding the landscape of BTCFi.

These upgrades and new layers together address many early barriers, allowing Bitcoin to support tokens, smart contracts, and cross-chain interactions in a modular way.

4.2 From Ordinals to BRC-20

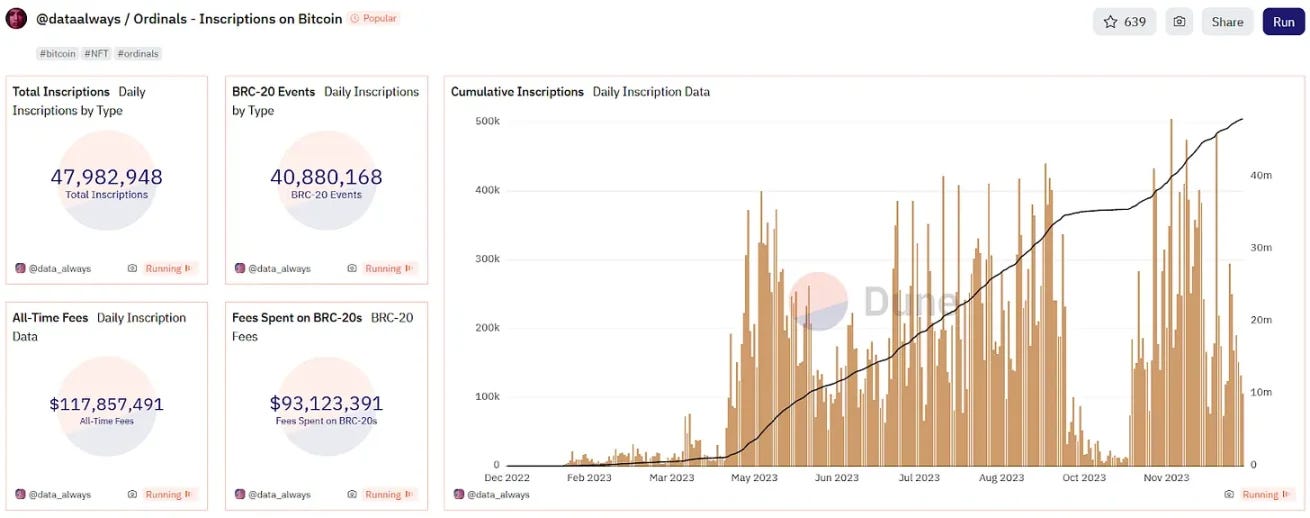

2023 is the year of the explosion of Ordinals and BRC-20 tokens. Data Source: Dune @dataalways

In the past two years, there has been a clear increase in market demand for more expressive uses of Bitcoin. A typical example is the explosion of Ordinals and BRC-20 tokens in 2023. Users began inscribing assets and NFTs on satoshis (sats), driving a surge in on-chain activity.

By the end of 2023, over 52.8 million Ordinals inscriptions had been created, growing to about 69.7 million by the end of 2024. Meanwhile, miners collected hundreds of millions in fees, with fees exceeding 6,900 BTC (approximately $405 million) by the third quarter of 2024.

This craze proves that users are willing to utilize Bitcoin’s block space for more than just simple holding or payments; the demand for Bitcoin NFTs, tokens, and DeFi applications has already emerged.

The emergence of the Ordinals protocol fundamentally enables Bitcoin to carry these new types of assets, while the BRC-20 standard provides a framework for tokenization. Although technically different from Ethereum’s ERC-20, its role in expanding Bitcoin’s use cases is similar.

All these advancements constitute a technological stack that did not exist a few years ago. The Bitcoin ecosystem is now ready to build a complete DeFi infrastructure around its core asset.

In summary, these catalysts are working together to mature BTCFi, and this trend may accelerate in the coming years.

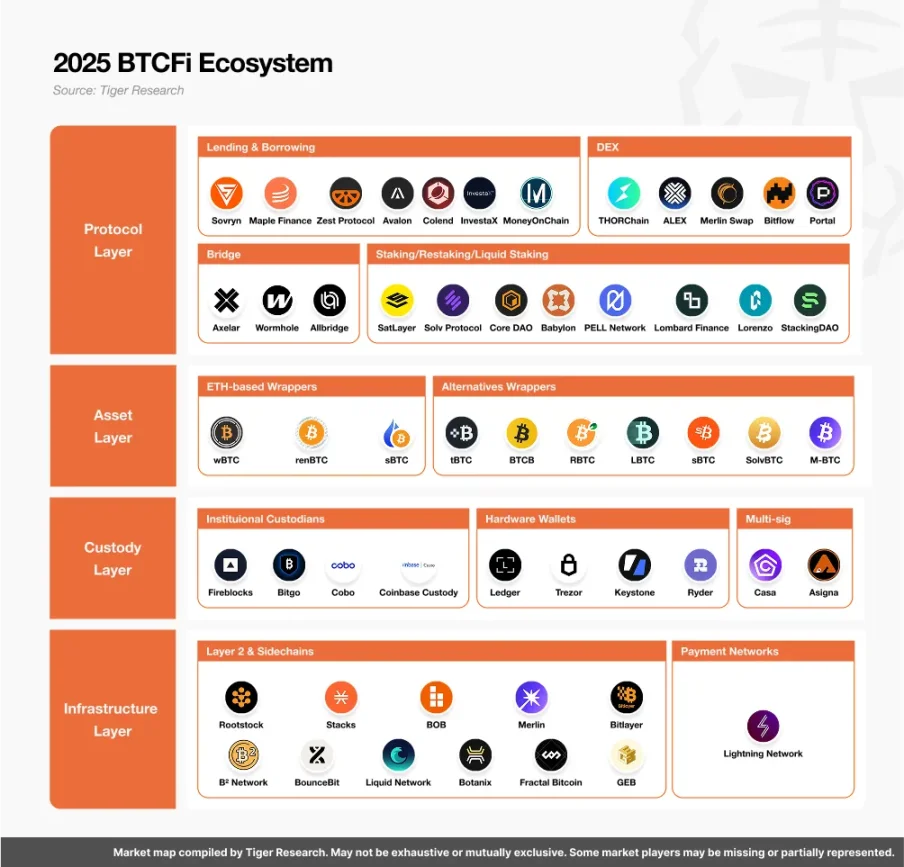

5. BTCFi Ecosystem Scenarios

BTCFi aims to transform Bitcoin from a passive store of value into an actively deployed financial asset in decentralized finance.

5.1 Bringing Bitcoin into DeFi

The lifecycle of BTCFi typically begins with BTC holders transferring their assets to a bridge or custodian. The original BTC is locked, and a 1:1 tokenized version is issued. This wrapped BTC enters the asset layer of the ecosystem, allowing it to integrate with smart contracts and DeFi protocols.

5.2 Exploring the BTCFi Technological Stack

Once tokenized, BTC flows through a structured hierarchy within the BTCFi technological stack. At the asset level, Solv Protocol enables BTC to serve as cross-chain yield-bearing collateral through SolvBTC and a staking abstraction layer (SAL), supporting structured products and capital-efficient use cases.

Institutional adoption is supported by products like lstBTC. lstBTC is launched in collaboration between Maple Finance and CoreDAO, utilizing Core’s dual staking mechanism. BitLayer provides a trust-minimized Bitcoin-native Layer-2 environment, where Peg-BTC can support smart contract activities.

In terms of compliance, IXS offers real-world yield based on BTC through compliant financial structures. Meanwhile, infrastructure projects like Botanix expand Bitcoin’s programmability by introducing EVM compatibility, allowing BTC to serve as Gas for smart contracts.

5.3 Using BTC as Collateral and Staking Assets

With the improvement of infrastructure, BTC can be used as collateral. For example, on bitSmiley, BTC can be used to mint stablecoins, enabling yield generation or stablecoin strategies. Emerging staking models are also expanding BTC’s use: protocols like Babylon allow native BTC to participate in securing proof-of-stake (PoS) networks and earn rewards for doing so.

5.4 Risk Management and Exit Positions

Throughout the process, BTC holders retain economic exposure to Bitcoin price movements while earning yields from DeFi protocols. These positions are reversible: users can exit at any time by closing positions, redeeming wrapped BTC, and retrieving the original Bitcoin (minus fees or yields).

5.5 Protocol Incentives and Revenue Models

Supporting this liquidity are diverse revenue models. Lending platforms earn income by initiating and utilizing fees, capturing the spread between borrowers and lenders. DEXs charge liquidity fees on each trade, typically sharing them with liquidity providers and the protocol treasury. Staking and bridging services take a commission from earned rewards, incentivizing them to maintain uptime and network security.

Some protocols use native tokens to subsidize usage, guide activity, or manage treasuries. Custody products often adopt traditional asset management models, charging annual fees (e.g., 0.4%-0.5%) on the assets under custody or management.

Additionally, spread capture provides a less obvious but important revenue source: protocols can profit from interest rate differentials and basis trading through cross-chain arbitrage or structured yield strategies.

These models collectively demonstrate how BTCFi protocols can activate idle Bitcoin while establishing a sustainable revenue base. As more BTC enters this layered system, it not only circulates but also compounds, generating yield and supporting a Bitcoin-centered parallel economy.

ChainCatcher reminds readers to view blockchain rationally, enhance risk awareness, and be cautious of various virtual token issuances and speculations. All content on this site is solely market information or related party opinions, and does not constitute any form of investment advice. If you find sensitive information in the content, please click “Report”, and we will handle it promptly.