The Three Cryptos Set to Soar on a White House Push

A new crypto surge is brewing – and this time, it’s not about hype. It’s about hard money, blockchain rails, and a $3.4 billion institutional rotation into Bitcoin ETFs.

Meme coins are riding high, yes. But beneath the noise, something serious is unfolding.

Altcoins are breaking out.

Most investors are still anchored to the Bitcoin narrative. But that’s a mistake…

Because while Bitcoin (BTC/USD) may have touched $120,000, the real action is elsewhere.

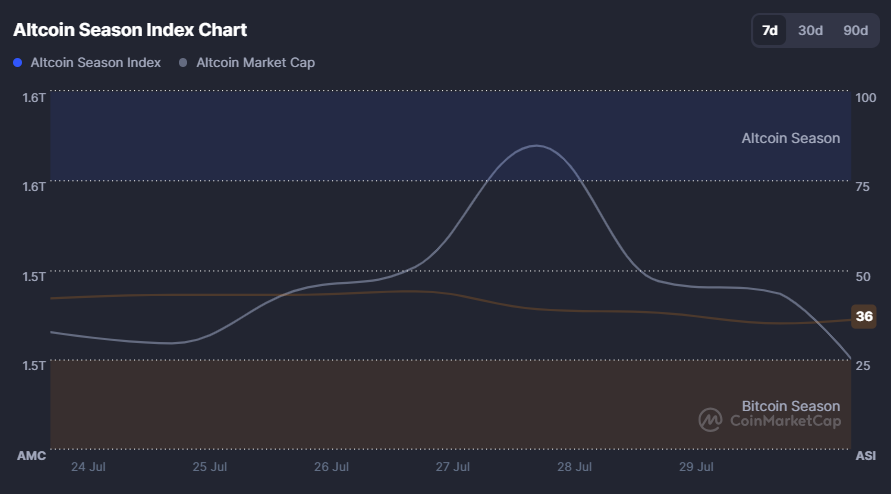

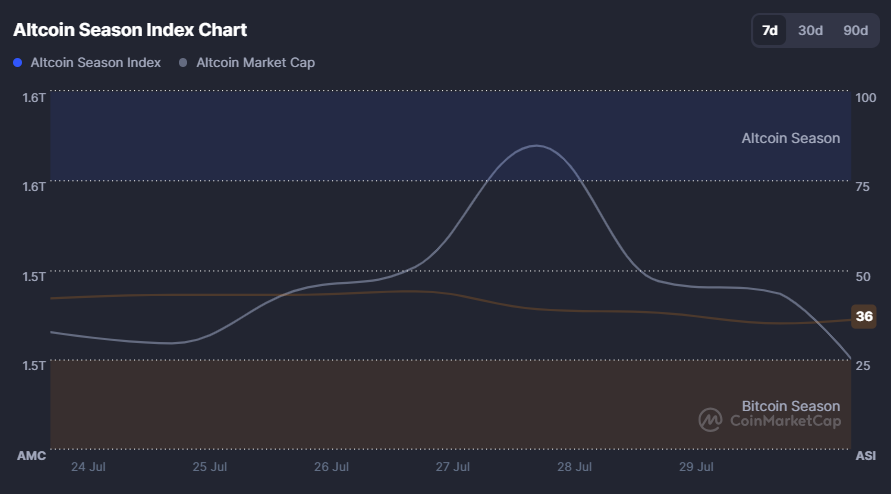

CoinMarketCap’s Altcoin Season Index just hit 89/100, signaling a decisive shift away from Bitcoin and into high-beta altcoins.

If you’re not paying attention, you could miss the biggest moves of the entire cycle.

Luckily, we’re still early. In fact, our research has revealed three altcoins poised to 10x – right as tokenization and stablecoin infrastructure go mainstream.

What’s driving this?

To get to the core of the story, I sat down with InvestorPlace’s chief content officer, Luis Hernandez, to discuss the recent surge in altcoins.

Click the image below to watch the interview now:

From Bitcoin Halving to Altcoin Season: Why the Crypto Market Is Ripping Higher

Part of the reason why altcoins are flying stems from Bitcoin’s programmed scarcity…

Bitcoin’s April 2024 halving slashed the mining reward from 6.25 to 3.125 BTC. Historically, such events trigger multiyear bull markets.

After the 2024 halving, Bitcoin rose 12%, Ether climbed, and Solana surged more than 20% within days.

We noted the strength – but stopped short of calling it late-cycle.

This cycle, however, has a distinctly institutional tone.

There have been massive flows into Bitcoin ETFs and corporate treasuries…

U.S. spot Bitcoin ETFs saw $3.4 billion in early July inflows – and $2.2 billion of that came in just two days.

Indeed, institutions tend to buy with longer horizons, which could strengthen long-term support.

The Big-Picture Trends Driving Altcoin Growth

But this isn’t just about capital flows. It’s about coordination.

Institutions and policymakers alike are now laying the groundwork for the next phase of blockchain adoption. And two major structural trends are emerging from that foundation, giving altcoins a powerful new tailwind.

- Tokenization: Turning real-world assets – stocks, bonds, deposits – into blockchain-based tokens. BlackRock (BLK) and Coinbase (COIN) are already deep in the space. Progress has lagged early predictions, but legislative clarity could accelerate growth. The GENIUS Act, among others, sets a regulatory path for stablecoins and tokenized assets.

- Stablecoins: Dollar-pegged tokens used to move capital quickly across networks. The GENIUS Act, signed July 18, forces issuers to hold liquid reserves and bans interest payments on regulated stablecoins. Deutsche Bank (DB) analysts say this spurred a rotation into ETH to seek DeFi yield. But the law doesn’t open the gates to all. Only licensed banks or approved issuers may mint payment stablecoins – and public companies need unanimous regulatory board approval.

While much of this activity still sits at the institutional level, it’s already beginning to trickle down.

Soon, even everyday investors may get access to private-market exposure.

Indeed, SoFi (SOFI) now offers funds with stakes in OpenAI and SpaceX. And Robinhood (HOOD) floated similar plans in Europe – though OpenAI made clear that tokenized shares are not real equity.

Volatility Meets Opportunity: Altcoins and Meme Coins in the Next Crypto Wave

Right now, altcoins and meme coins are ripping higher. But these moves are still sentiment-driven and tightly linked to regulation.

Tokenization and stablecoin infrastructure could eventually reshape finance…

But altcoins are just getting started.

In fact, we believe they’re going to go vertical over the next six to 12 months.

Though, for now, investors are riding early waves in a volatile, policy-sensitive market.

We’re confident this is the beginning of a cycle – possibly one that lasts into 2026.

Of course, that being said, investors shouldn’t confuse the spark for the bonfire here. Instead, look for altcoins with a lot of liquidity trading on central exchanges. For example, if you’re willing to stomach a bit of risk, even meme coins like BONK are seeing massive surges, riding the wave of retail excitement.

The Final Surge? Why Three Altcoins Could 10X in the Crypto Supercycle

But if you’re hoping for something a bit less uncertain…

A massive push from the White House for mainstream crypto adoption is opening a new window of opportunity. It may be short – but the upside could be life-changing.

We’ve just revealed our top three altcoin picks in a brand-new special report: “Altcoin Awakening: The Next 3 Cryptos Set to 10X.”

These are the coins we believe are best positioned to soar in this final – and most explosive – phase of the crypto boom.

And right now, you can gain instant access to this exclusive report when you join Ultimate Crypto – our elite research service – for just $1,799 (a massive 64% discount off the regular $5,000 price).

Rest assured; there’s no guesswork here. Our last halving-cycle portfolio produced altcoin gains as high as 3,209% – enough to turn $10,000 into $330,900 at peak.

Of course, no gain is guaranteed. But with crypto entering what could be a $100 trillion tech revolution, this could be your second chance to target 1,000%, 5,000%, even 7,000%-plus returns in the next 12 months or less.

Click here to join Ultimate Crypto now and unlock that report.

The next wave is already building. Don’t miss your shot to ride it.