NFT Loans to DeFi Integration • CoinLaw

In early 2025, a college senior named Maya walked into a virtual bank branch inside a metaverse city built on Ethereum. She wasn’t alone. Millions are doing the same, from securing loans in virtual reality to trading digital land and earning yield from tokenized NFTs. What felt like science fiction a few years ago is now an everyday experience for both consumers and institutions. As we step deeper into this digital frontier, understanding the pulse of metaverse finance, its size, trends, and players, is critical.

This report will guide you through the current state of metaverse finance, spotlighting the numbers that matter most in 2025.

Key Takeaways

- 1$552 billion: the global metaverse market value in 2025.

- 2$76 billion: financial services sector contribution to the metaverse, driven by DeFi, digital payments, and virtual asset platforms.

- 3$312 billion: tokenized asset market cap within metaverse-linked ecosystems, primarily NFTs and stablecoins.

- 470 million users: estimated active users engaging in financial transactions across leading metaverse platforms in Q1 2025.

- 5$1.2 trillion: projected metaverse economy value by 2030, with finance projected to make up nearly 15%.

Target Audience of Metaverse Investment

- Men are the leading investors in the metaverse, contributing 11.3% of total investment.

- Big brands follow closely, accounting for 10.7%, signaling strong institutional interest.

- Gen Z (ages 10–25) represents 9.9%, highlighting early adoption by younger generations.

- Millennials invest 9.3%, showing steady engagement from digitally native adults.

- Women contribute 8.6%, nearly matching male participation, reflecting balanced gender interest.

- High-income households invest 8.4%, while average-income households contribute 7.3%, indicating broad socioeconomic participation.

- Generation Alpha (born after 2012) already shows 7.2% interest, suggesting future growth potential.

- Singles allocate 5.6%, slightly more than married couples and families, both at 5.1%.

- Boomers (ages 42–76) show lower interest at 4.2%, reflecting a generational gap.

- Low-income households make up the smallest share at 4.0%, likely due to affordability barriers.

Growth Rate of Metaverse Financial Services

- The 28.3% CAGR growth in metaverse financial services is expected to hold steady through 2027.

- DeFi protocols within the metaverse recorded a 42% year-over-year increase in active wallets.

- Peer-to-peer lending platforms in virtual worlds saw $3.4 billion in total loan volume in Q1 2025.

- The insurance sector in the metaverse is projected to grow by 31.5% YoY, with micro-insurance leading.

- Crypto-based payroll systems now support over 19 million virtual economy workers.

- 72% of metaverse-native banks now support stablecoin settlements.

- The average digital loan disbursement time has decreased by 58%.

- More than 30% of Gen Z users report monthly interactions with a metaverse finance product.

- AI-driven credit scoring in virtual environments has seen adoption in over 40% of platforms.

- Virtual hedge funds now manage an estimated $11.2 billion in metaverse-only assets.

Market Capitalization of the Metaverse

- The total metaverse market cap stands at $552 billion as of Q2 2025.

- Financial services represent 13.8%, or approximately $76 billion, of that valuation.

- The tokenized real estate sector now exceeds $112 billion in valuation.

- Top metaverse banking tokens (e.g., METAUSD, BANKVR) collectively hold a market cap of $19.6 billion.

- NFT-backed lending platforms are contributing approximately $6.5 billion to the total cap.

- The largest single metaverse financial institution, MetaBank DAO, has a token cap of $3.1 billion.

- Stablecoins used within the metaverse contribute $88 billion to the broader digital currency valuation.

- The U.S. leads in metaverse financial service capitalization, followed by South Korea and Singapore.

- Publicly listed companies with metaverse finance divisions have seen an average 22% YoY stock growth in 2025.

- Regulatory-approved digital banks in metaverse platforms have seen a 14.6% increase in monthly active users.

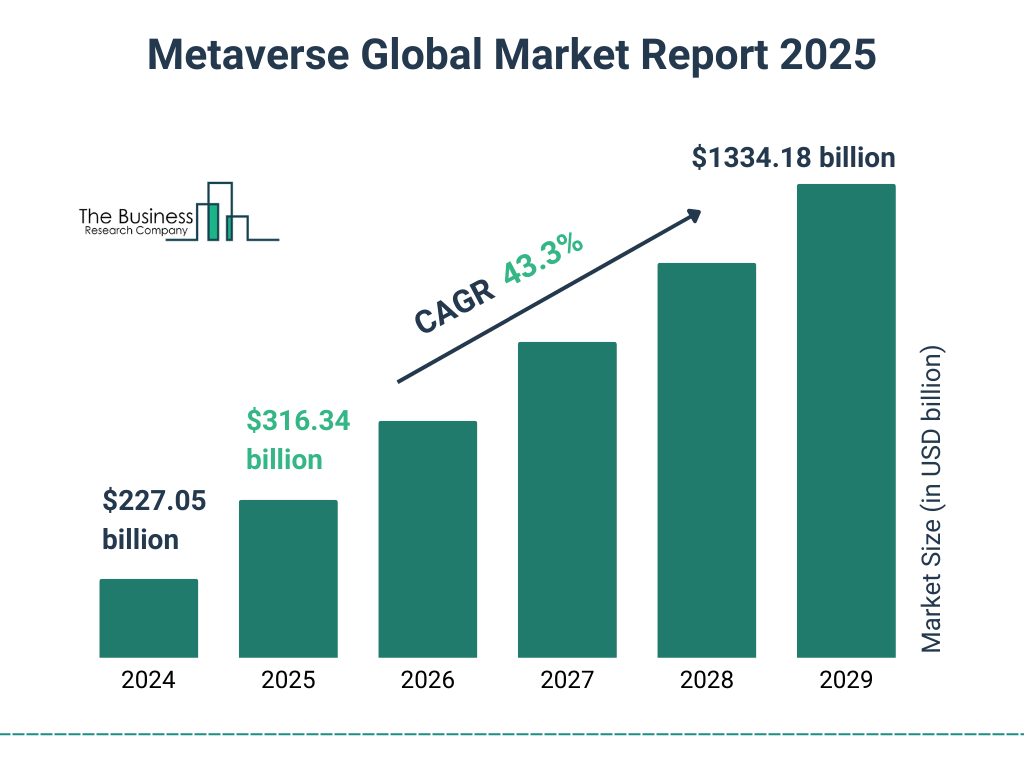

Metaverse Global Market Growth Forecast

- The metaverse market is projected to grow from $227.05 billion in 2024 to $1334.18 billion by 2029.

- By 2025, the market is expected to reach $316.34 billion.

- The sector will grow at a CAGR of 43.3%, showcasing rapid expansion.

- This exponential rise highlights the increasing global investment and adoption of metaverse technologies across industries.

The market is poised to nearly sextuple in just 5 years, signaling a major digital transformation trend.

User Adoption of Metaverse Banking and Payments

- 70 million users are engaging in metaverse financial services monthly as of Q2 2025.

- 1 in 3 Gen Z consumers in the U.S. uses a metaverse-linked digital wallet regularly.

- 58% of metaverse banking users report using services like savings accounts or crypto yield vaults.

- Over 9.5 million virtual cards have been issued across the top five metaverse financial platforms.

- $2.2 billion in daily transaction volume flows through metaverse-linked payment systems.

- Virtual salary disbursements are now used by over 13 million freelancers globally.

- 72% of U.S.-based users say financial inclusivity is the top reason for using metaverse banks.

- Remittances through metaverse platforms are up 44% YoY, especially in Southeast Asia and Latin America.

- Over 320 banks and fintech firms have launched services in at least one virtual world.

- In-world mobile banking interfaces are now accessible via AR and VR devices by default.

Tokenized Assets and Virtual Currency Usage

- The total volume of virtual currencies used in metaverse finance exceeded $212 billion in 2025.

- Stablecoins account for 65% of transactional value in metaverse commerce.

- Over 45% of NFT holders have used their tokens as collateral in financial transactions.

- The top three metaverse tokens, MANA, SAND, and AXS, hold a combined cap of $31.4 billion.

- Smart contracts for asset rentals in virtual real estate increased 93% YoY.

- Gaming tokens now contribute 22% to all value flows within metaverse ecosystems.

- More than 1.3 million fractionalized NFTs have been created for asset pooling and resale.

- CBDCs have been integrated into at least nine metaverse payment platforms in pilot phases.

- Tokenized treasury bonds in sandboxed environments reached $730 million in issuance.

- A growing segment of users, over 11%, report using metaverse assets as retirement investments.

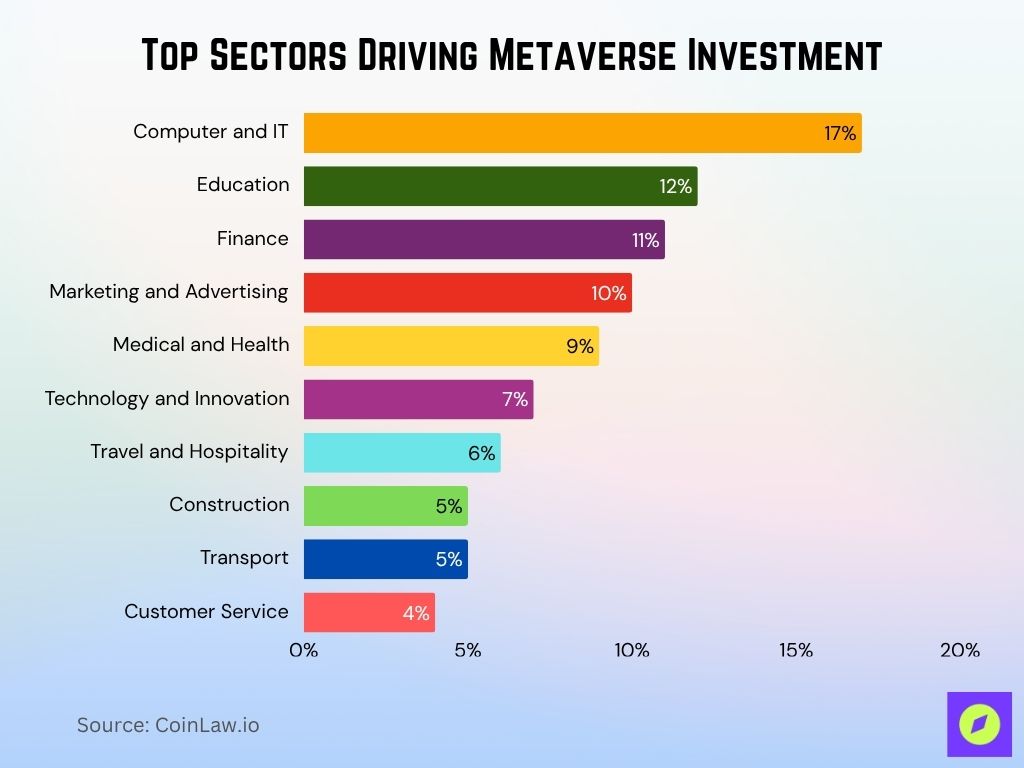

Top Sectors Driving Metaverse Investment

- Computer and IT lead all sectors with 17% of total metaverse investments, showcasing tech’s dominant role in virtual world development.

- Education follows with 12%, indicating rising adoption of immersive learning technologies.

- The finance sector contributes 11%, highlighting growing interest in virtual banking, crypto services, and blockchain integration.

- Marketing and advertising account for 10%, reflecting the shift toward branded virtual experiences and digital product placements.

- The medical and health industries make up 9%, driven by innovations in telehealth, virtual therapy, and simulation training.

- Technology and innovation secure 7%, backing experimental platforms and next-gen solutions.

- Travel and hospitality invests 6%, tapping into virtual tourism and digital experiences.

- Construction and transport each represent 5%, leveraging the metaverse for 3D modeling and logistics simulations.

- Customer service ranks last with 4%, yet it is still showing signs of metaverse-driven support tools and AI agents.

Leading Platforms in Metaverse Finance

- Decentraland, The Sandbox, and Somnium Space remain the top three in transaction volume and user activity.

- Decentraland leads with over $9.1 billion in annual metaverse finance transactions.

- Somnium Space now supports regulated financial instruments in partnership with EU firms.

- Binance’s MiniVerse supports over 600,000 daily active wallets engaged in DeFi.

- Meta’s Horizon World launched its finance layer with embedded token support and now has 38% adoption in North America.

- NetVRk Finance offers proprietary lending protocols used by 2.1 million users monthly.

- Axie Infinity’s Ronin Network processes over $1.3 billion monthly in metaverse gaming-linked DeFi.

- Apple’s Vision Pro headset has enabled financial dApps integration across four leading virtual environments.

- In 2025, over 160 new metaverse finance platforms launched globally.

- Layer 2 protocols dominate, with over 71% of all financial dApps hosted on rollups like Arbitrum and Optimism.

Regulatory Landscape Affecting Metaverse Financial Ecosystems

- The U.S. SEC issued its first stablecoin governance framework tailored for metaverse platforms in March 2025.

- 12 countries, including Canada, Singapore, and the UK, now require AML compliance for virtual asset transactions.

- FINRA and CFPB jointly released best practices for consumer protection in virtual financial interactions.

- The EU’s MiCAR framework has extended to include tokenized metaverse securities.

- Japan launched a regulatory sandbox exclusively for metaverse financial products.

- Over 400 metaverse apps have applied for licenses under new fintech laws worldwide.

- DAO governance protocols must now publish quarterly transparency reports in select jurisdictions.

- KYC integration is mandatory in 70% of regulated metaverse finance platforms.

- Interchain audits are being standardized to support cross-chain compliance efforts.

- The IMF and World Bank released a joint advisory for developing economies on integrating metaverse finance securely.

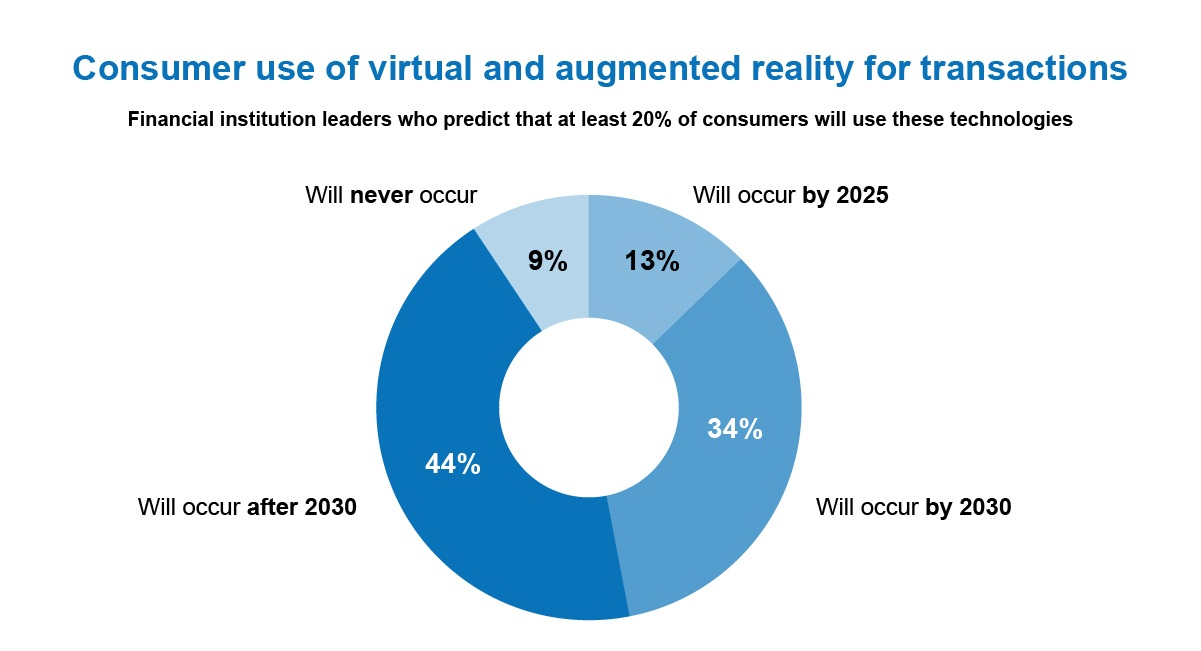

Consumer Use of Virtual and Augmented Reality for Transactions

- 44% of financial institution leaders believe VR/AR use for transactions will occur after 2030.

- 34% predict it will happen by 2030, showing growing long-term confidence.

- 13% expect adoption to occur by 2025, indicating early movers in the space.

- Only 9% believe it will never occur, suggesting strong overall optimism about future adoption.

- The data reveals that 87% of leaders foresee at least 20% of consumers using VR/AR for transactions within the next few decades.

NFT-Backed Financial Products and Services

- NFT-collateralized loans reached $5.3 billion in outstanding volume by mid-2025.

- 1.8 million NFTs were used in active lending or yield farming contracts across DeFi protocols.

- Interest rates for NFT loans now average 9.4% APR, due to risk pooling.

- The launch of NFT-indexed ETFs attracted $740 million in new institutional capital.

- Fractional NFT vaults have grown by 73%, with a total value locked (TVL) of $2.6 billion.

- The insurance sector issued $460 million worth of policies to cover high-value NFT assets.

- Platforms like Arcade and JPEG’d each processed over $400 million in NFT-backed financial products.

- NFT staking programs now offer average yields of 6.2%, drawing long-term digital asset holders.

- Over 160 financial dApps support NFTs as native components for borrowing, collateral, or premium rewards.

- Art-backed NFTs constitute 18% of the NFT-based financial services market as of 2025.

DeFi Integration Within the Metaverse

- DeFi transactions within metaverse ecosystems totaled $96 billion in H1 2025 alone.

- Over 57% of virtual real estate trades use DeFi escrows or smart contract settlements.

- Top metaverse DeFi platforms report 18.7 million active users monthly.

- Yield farming in virtual environments now accounts for 22% of DeFi user activity globally.

- $3.8 billion in liquidity is locked across metaverse-specific DeFi platforms.

- Governance tokens tied to metaverse DAOs saw an average price increase of 28% in Q2 2025.

- New user onboarding for DeFi through metaverse apps grew 52% year-over-year.

- Layer 2 integration slashed gas fees for metaverse finance users by up to 87%.

- Popular protocols like Aave, Curve, and Uniswap launched metaverse-optimized frontends.

- Cross-platform liquidity pools now account for 39% of trading volume on multi-world DEXs.

Public Opinions and Feelings Toward the Metaverse

- 33% of respondents feel curious about the metaverse, making it the most common sentiment.

- 27% are uninterested, showing that over a quarter of people currently lack engagement.

- 23% express suspicion, highlighting trust concerns among a significant portion of the public.

- Both concerned and indifferent groups account for 19% each, indicating mixed emotional responses.

- 18% feel excited, while 16% are optimistic, pointing to moderate levels of enthusiasm.

- 12% report feeling confused, suggesting the need for more public education and clarity.

- Only 7% selected “none of these”, showing most people have some defined opinion on the metaverse.

Risks and Security Challenges in Metaverse Finance

- Smart contract exploits caused $1.17 billion in losses within metaverse DeFi systems in the past 12 months.

- Phishing scams targeting metaverse wallet users surged by 41% from 2024 to 2025.

- Only 32% of platforms meet cybersecurity standards aligned with ISO/IEC 27001.

- Deepfake-enabled financial impersonation cases doubled, hitting 9,000+ incidents in 2025.

- Audited protocols had 93% fewer losses, but only 45% of metaverse finance projects undergo full audits.

- Rug pulls and exit scams in virtual land projects led to $624 million in total damage.

- Credential stuffing attacks on metaverse banking apps increased 36% year-over-year.

- Regulatory gaps are cited as the leading reason for slow institutional adoption, per 2025 reports.

- Bug bounties paid out for security flaws totaled $72 million across 50+ metaverse projects.

- Blockchain forensics tools now cover 70%+ of major metaverse-based transaction activity for fraud monitoring.

Geographic Distribution of Metaverse Finance Adoption

- The U.S. leads in adoption, with 21.4 million active metaverse finance users.

- Asia-Pacific has 19.6 million users, with significant traction in Japan, South Korea, and India.

- Europe accounts for 15.2 million users, largely driven by regulatory clarity in the EU zone.

- Latin America shows the fastest growth rate, with user numbers up 48% YoY.

- Nigeria and Kenya are emerging leaders in mobile metaverse banking in Africa.

- The UAE and Saudi Arabia are driving Middle East adoption with state-backed metaverse finance pilots.

- Over 60% of metaverse-based remittances originate from developing nations.

- Germany, Switzerland, and Estonia are top European hubs for virtual asset regulation.

- Singapore and Hong Kong host over 20% of all registered metaverse finance startups in Asia.

- Brazil is leading South America’s metaverse finance usage with 5.3 million users in 2025.

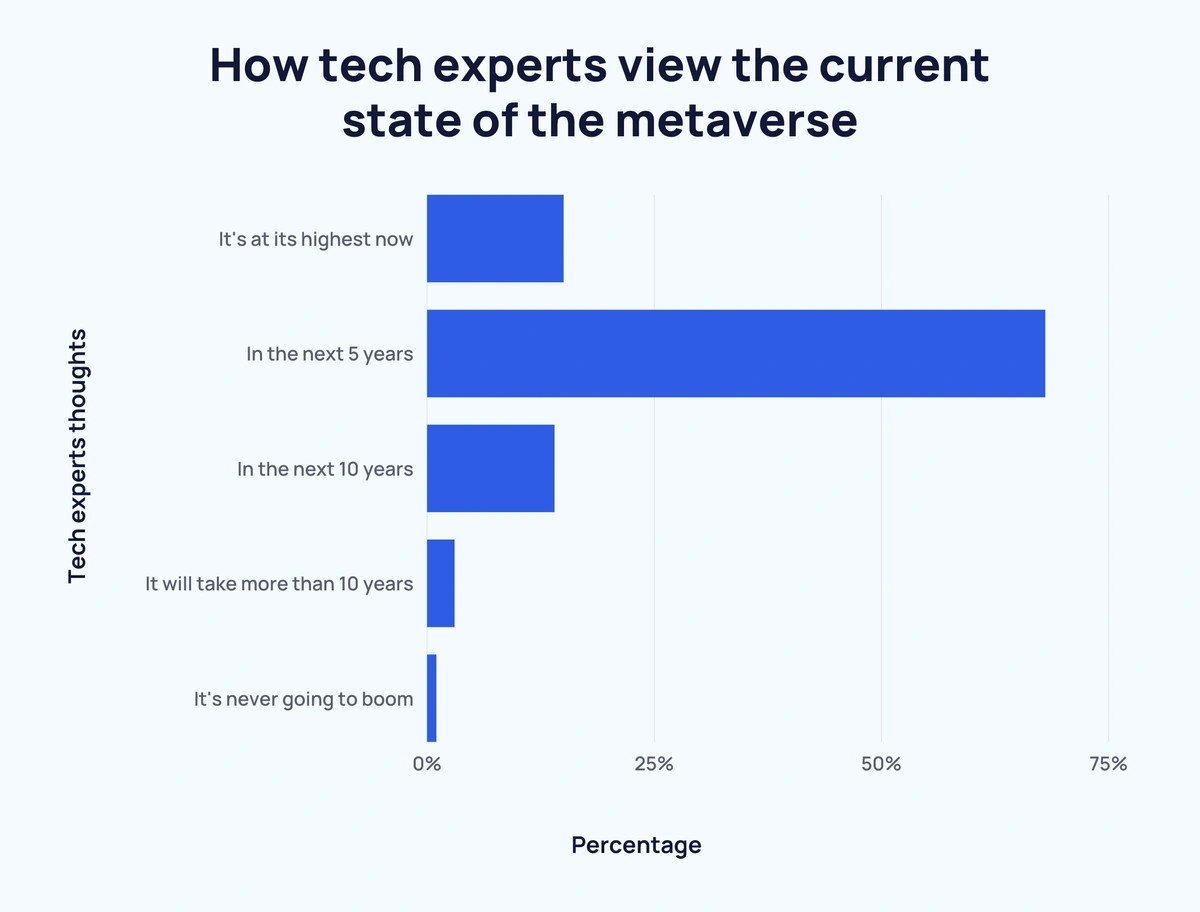

Tech Experts’ Views on the Future of the Metaverse

- 68% of tech experts believe the metaverse will reach its peak in the next 5 years, reflecting strong near-term optimism.

- 15% say it’s already at its highest point, indicating belief in a current plateau.

- 14% expect it to boom in the next 10 years, showing confidence in gradual development.

- Only 3% think it will take more than 10 years for the metaverse to gain traction.

- A mere 1% believe it’s never going to boom, underscoring minimal long-term skepticism.

Recent Developments in Metaverse Finance

- Apple’s Vision Pro integration with metaverse banking apps was finalized in March 2025.

- Visa and Mastercard now support stablecoin payments inside virtual platforms.

- Meta launched an in-world KYC onboarding hub for verified financial interactions.

- Solana Pay expanded to cover five top virtual worlds with sub-second settlement times.

- Chainlink’s new Cross-Chain Interoperability Protocol (CCIP) is now a core feature in metaverse finance applications.

- Stripe rolled out developer APIs specifically for metaverse dApp creators.

- Goldman Sachs created its own virtual trading desk, now in beta with enterprise clients.

- Over 300 new DAOs were formed in Q1 2025 to manage decentralized metaverse economies.

- Epic Games launched Unreal MetaPay SDK to embed finance directly into 3D assets.

- GitHub repositories tagged with “metaverse finance” increased 132% YoY, showing active developer interest.

Conclusion

Metaverse finance is no longer a niche experiment; it’s a fast-expanding arena that merges digital innovation with real-world economic utility. From fractionalized NFTs to decentralized insurance in VR, this sector is attracting billions in investment, regulation, and users. As we move into the second half of the decade, the fusion of Web3, DeFi, and immersive virtual experiences will redefine how people bank, invest, and build wealth. Whether you’re a fintech startup or a global institution, understanding the momentum of metaverse finance is essential for staying relevant in a virtual-first future.