Visa, Mastercard race to capture a US$253b crypto threat

That stablecoins are part of the financial-disruption story marks a rare break from the crypto industry’s reputation for speculation and gambling.

(July 1): A turf war is breaking out in the vast world of digital payments — and the incumbents are suddenly on defence.

Tech firms and crypto start-ups are moving in on territory long dominated by Visa Inc and Mastercard Inc, powered by a new type of currency — the stablecoin — and a pitch merchants can’t ignore: lower fees, faster settlement and a way to bypass the big two altogether.

It’s a tech threat and a financial threat. Digital tokens, which are typically pegged to the dollar, allow consumers to pay merchants directly from their crypto wallets — without routing payments through a bank or card network. Last year alone, US businesses paid an estimated US$187 billion (RM787.83 billion) in swipe fees, most of it via Visa and Mastercard’s systems. Stablecoins promise to make that toll much lower, or even obsolete.

“It’s clear that eventually this entire space could be a threat to TradFi providers,” said Christian Catalini, founder of MIT Cryptoeconomics Lab. “But credit card networks aren’t sitting on the sidelines. The card networks will push to work with many stablecoins, so they retain their central role.”

That pressure is prompting Visa and Mastercard to brand themselves — not as old-school toll collectors — but as the backbone for all kinds of digital transactions, including those originally designed to bypass them. With President Donald Trump poised to sign the legislation that creates formal federal oversight of stablecoin issuers, they’re offering crypto-linked cards and building services for banks experimenting with digital dollars.

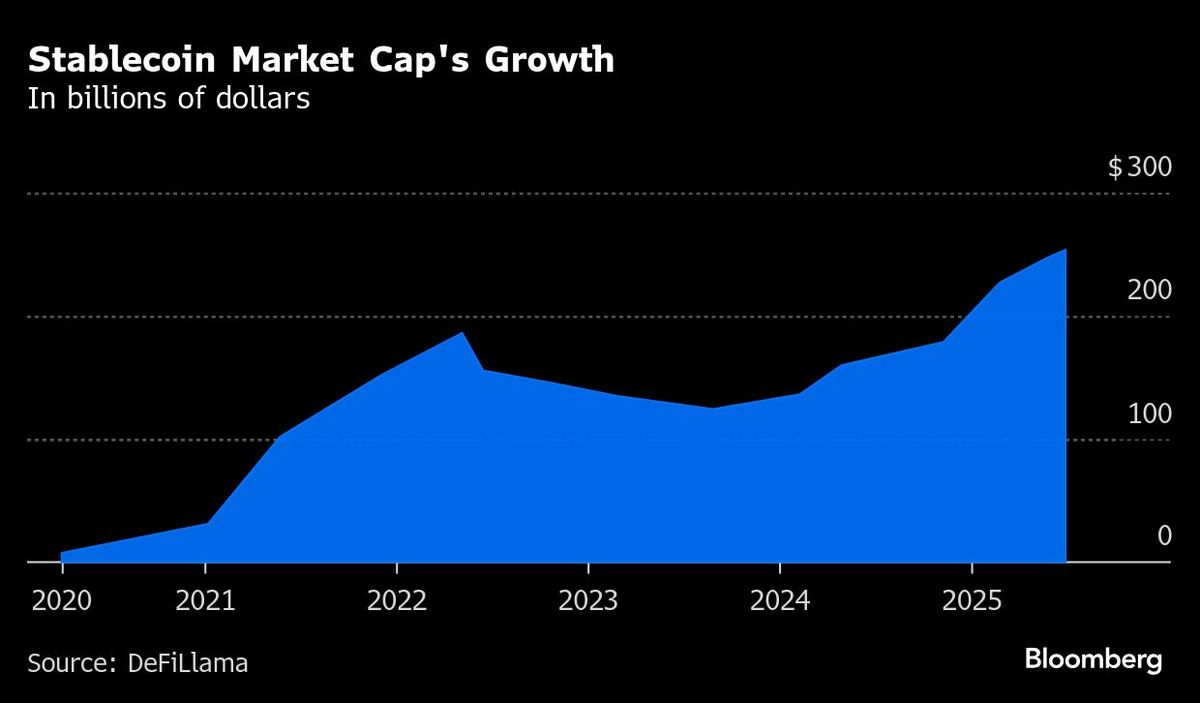

Their influence cuts both ways. Visa and Mastercard have a long history of neutralising competitive threats by absorbing them into their own networks, often in ways designed to preserve their pricing power. In pulling stablecoins closer, it may prove just the latest feat of co-option by the big guns, with the stablecoin market now worth US$253 billion — and on course to reach US$2 trillion in the next few years, according to Treasury Secretary Scott Bessent.

That stablecoins are part of the financial-disruption story marks a rare break from the crypto industry’s reputation for speculation and gambling. In that sense, stablecoins offer something radical: a tool that might actually make financial systems work better, giving the crypto community a socially useful function at long last.

That momentum is beginning to reshape corporate behaviour. Mega retailers like Walmart Inc are reportedly considering stablecoin pilots and earlier this month, bank technology provider Fiserv Inc introduced its own fiat-backed token to help smaller financial institutions keep pace with payment innovation.

Still, displacing card networks won’t be easy, especially in the US, where consumers are used to rewards, fraud protection and credit access — perks not easily replaced. Stablecoins offer limited advantages at the checkout and, for many, crypto remains unfamiliar or suspect. Stablecoin balances aren’t expected to carry FDIC insurance, and consumer protections may differ sharply from regular cards. For merchants, new technology may bring compliance, tax and operational risks.

Digital proponents are pressing ahead, regardless. Shopify Inc recently partnered with Stripe Inc and Coinbase Global Inc to let merchants accept USDC, a dollar-backed stablecoin from Circle. Behind the scenes, the payment can take place without ever touching a card network. Instead, it’s processed entirely on a blockchain protocol, which allows merchants to accept USDC directly into their own crypto wallets or instantly convert it into local currency paid out to their bank account.

Shopify will be offering 1% cashback to customers who pay with USDC. The rewards will also be paid in USDC. Coinbase has launched its own payments platform to enable stablecoin acceptance across more e-commerce providers.

“It’s hard to change consumer payment preferences but, unlike in the past, the wheels are in motion for a dramatic shift in consumer payment preferences,” said Richard Crone, chief executive officer of payments consulting firm, Crone Consulting.

That pressure is forcing Visa and Mastercard, which combined hold more than 85% of total US card spending, to go on the offence. Both are promoting their global merchant reach, fraud protection, consumer privacy and brand trust. The networks’ tokenisation technology, for example, obscures sensitive account information to protect consumers when they buy online.

“We’ve been tokenising access to value for a very long time now,” said Jack Forestell, chief product and strategy officer at Visa. “Now the value that underlies that token, by and large, is either bank accounts or credit lines, debit and credit cards, but there’s absolutely no reason that can’t be a stablecoin or another cryptocurrency.”

Digital future

Visa now lets financial institutions issue fiat-backed digital tokens and is piloting the ability for clients to settle on their network using stablecoin. Mastercard recently announced it’s joining the Paxos’s Global Dollar Network, allowing Paxos to help institutions on its network mint and redeem a stablecoin known as USDG. The network also gives users detailed control over how payments are routed. A transaction under US$100 might draw from a checking account, larger ones from credit lines, and certain merchants from a crypto wallet — all tied to a single payment identity.

“We shouldn’t assume that overnight, stablecoins will replace existing card payments or fiat,” said Jorn Lambert, chief product officer at Mastercard. “We think this is much more about new use cases and new opportunities than about replacing the existing system, especially in remittances, disbursements and business-to-business payments.”

Visa’s Forestell notes that every prior disruption — from mobile wallets to buy-now-pay-later — triggered similar warnings. In the end, corporate adaptation won out.

“When you’re crypto natives, you can send money back and forth, but if you want to use that in a broad scale manner for your everyday purposes, you need that hyperscale connectivity, and we provide the best onramp to that,” Forestell said.

Uploaded by Chng Shear Lane