Flare Kicks Off FAssets Program to Power BTC, DOGE, XRP DeFi Growth

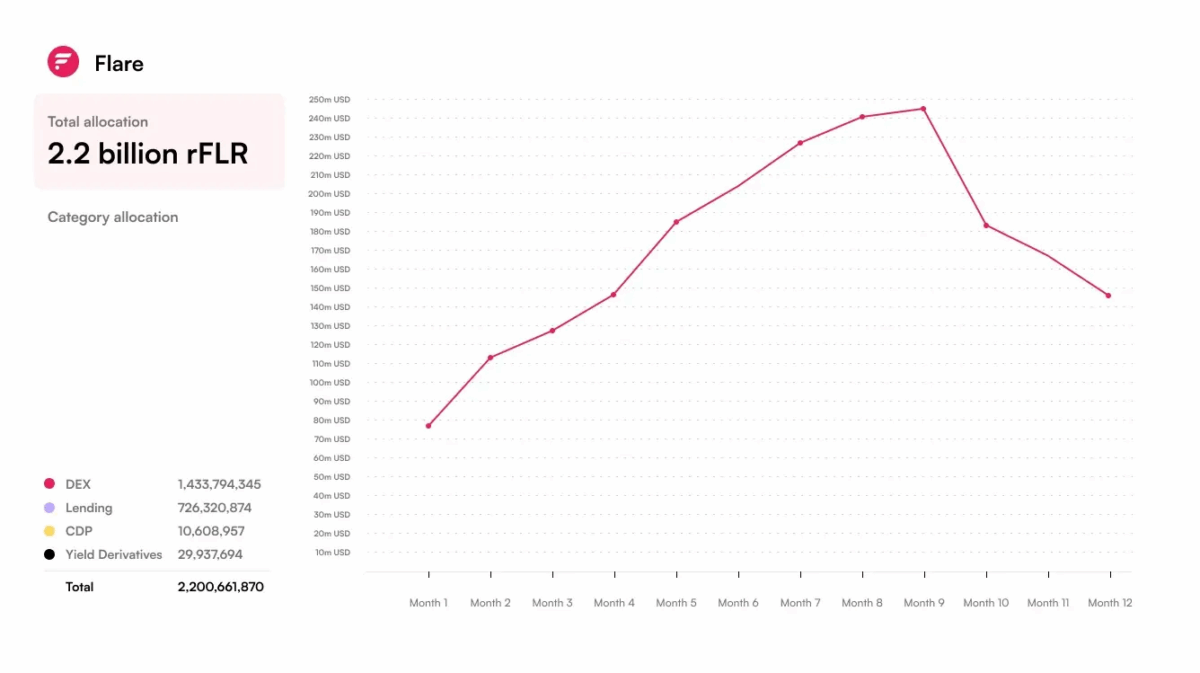

Flare Network has officially launched its FAssets Incentive Program to accelerate institutional-grade decentralized finance (DeFi) activity on XRP. Building on the model of its earlier rFLR incentives, the program aims to reward participation while scaling the broader Flare ecosystem. The program allocates 2,200,661,869 FLR to participants actively contributing to this vision, from July 2025 through July 2026.

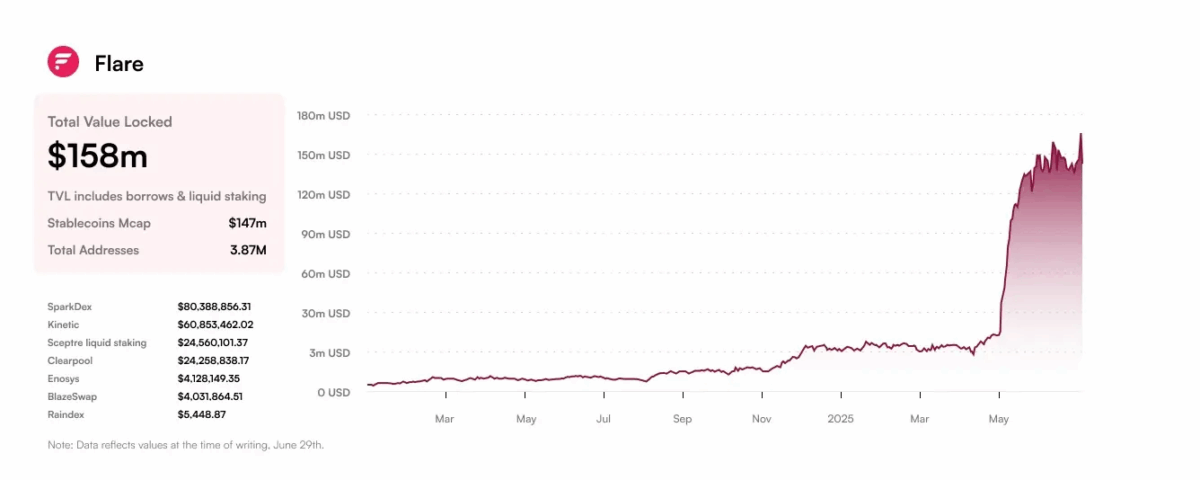

This program builds upon the foundation laid by FIP.09 in 2024, which introduced a 510 million FLR emissions schedule to support essential DeFi infrastructure, including decentralized exchanges (DEXs), stablecoin routes, and lending protocols. The success of these initiatives is evident, with Flare’s Total Value Locked (TVL) surging from $9.95 million to $150 million, reflecting growing demand for yield and composable assets within the ecosystem.

The FAssets Incentive Program Targets Four Core Verticals

- DEXs: Incentivizing liquidity for key token pairs like USDT0, FXRP, and other FAssets.

- Lending: Supporting protocols that enable borrowing and lending of Flare-native and cross-chain assets.

- Collateral Debt Positions (CDPs): Facilitating overcollateralized stablecoin and credit systems leveraging FAssets.

- Yield Derivatives: Encouraging the development of protocols for yield trading, fixed income, and risk management strategies.

- Rewards will be dynamically allocated across these categories to maximize impact on FAsset usage, TVL growth, and liquidity health.

The distribution mechanism employs the rNAT contract, utilizing rFLR tokens to maintain compatibility with existing infrastructure. Incentives will be distributed in 30-day epochs, with a 48-hour window for decentralized applications (dApps) to distribute rewards post-epoch. The program’s oversight remains with the existing committee, ensuring transparent and accountable allocation.

Notably, the 2.2 billion FLR allocation represents the maximum available for the incentive program, with actual distribution contingent on participation levels. Unutilized FLR will be reserved for future community initiatives, allowing for adaptive and responsive ecosystem growth.

This initiative aligns with Flare’s broader strategy to reward active participation across its ecosystem. Following the success of FlareDrops (FIP.01), the network aims to develop simplified and transparent yield mechanisms for FLR holders, particularly those who wrap into wFLR and support network activity. Ensuring wFLR’s proper recognition in on-chain TVL metrics across analytics platforms is a key priority, enhancing visibility of ecosystem participation and supporting deeper insights into Flare’s economic activity.

As Flare transitions from infrastructure-building to ecosystem activation, the launch of the FAssets Incentive Program signifies a major milestone. With liquidity flowing, protocols launching, and new primitives on the horizon, the Flare ecosystem is poised for a new wave of builders, users, and institutions.

Also Read: XRP, SOL, BNB ETF Launch on July 16? SEC Receives Amended Filing