6 Best Altcoins to Watch Today, June 29 – Kusama, Monero, Dash, Filecoin

Join Our Telegram channel to stay up to date on breaking news coverage

Amid a changing cryptocurrency ecosystem, today’s focus shifts to a few altcoins exhibiting new life and practical promise. You’ll discover what distinguishes these 6 best altcoins to watch today, why they might be ready for new growth, and how their special advantages help solve pressing issues in the digital economy.

Meanwhile, the European political scene is rocked by worries: watchdogs have warned that Reform UK’s decision to accept cryptocurrency payments could allow for undetectable foreign meddling in elections. This calls into question the security and transparency of online political funding.

6 Best Altcoins to Watch Today

This article explains why investors and innovators are interested in Filecoin’s drive to decentralize data storage, Dash’s near-instant transaction network, Monero’s steadfast dedication to privacy, and Kusama’s rapid governance testing ground.

1. Kusama (KSM)

In contrast to Polkadot, Kusama provides inexpensive parachain slots that allow for experimentation. And it’s already drawing mission-critical deployments: XCM messages that route cross-chain traffic, asset bridges that connect to Ethereum, and AI parachains like Bittensor that feed real-time data.

The team organized “ZK Day” on X (previously Twitter) to exhibit zero-knowledge experiments from building researchers, emphasizing a fresh focus on layer-2 applications and privacy. Among its ecosystem partners are these parachains, development teams that support Substrate, and validator collectives that oversee Kusama’s future and consensus.

It has fallen almost 25% in the last month, which indicates sound corrective action following a brief rise. It is currently 98% lower than its all-time high of $623. In high-inflation environments, that decline emphasizes supply dynamics and cyclical risk rather than indicating collapse.

Solidity contracts are live now on Paseo testnet.

Deployment to Kusama: optional.

Reading docs: encouraged.

Bragging without testing: don’t. https://t.co/QZjnzJ25DF

— kusama (@kusamanetwork) June 26, 2025

Reddit developers and validators announced an “emergency release” along with runtime v1.5.0 to the community. There is strong resilience and proactive governance at work, as that patch resolves consensus difficulties and permits elastic scalability, opening the door for other parachains.

2. Monero (XMR)

Every Monero swap is almost impossible to track down and completely fungible thanks to ring signatures that shuffle sender identities, stealth addresses that obscure recipients, and confidential transactions that conceal quantities. Most blockchains, whose money has a clear history, stand in stark contrast to this degree of anonymity.

With the debut of GMX’s synthetic perpetual swap markets for XMR on Arbitrum on June 26, Monero joined the expanding DeFi community, and its users gained access to new financial instruments.

Even though XMR is currently almost 40% below its peak of $517 in May 2021, it has produced an outstanding +85% rally so far this year. The recent decline from June’s low of $347 to today’s $318 indicates a traditional pullback in a bullish cycle, which may present a buying opportunity before potential gains.

Make sure to submit your submission for the FCMP++ Optimization Competition before the deadline on Monday! https://t.co/vca2GKXTD7

— Monero (XMR) (@monero) June 27, 2025

By including human-readable.xmr addresses, Unstoppable Domains and Cake Wallet expand Monero’s reach without compromising anonymity. In the meantime, non-custodial swaps provided by Exolix are now a feature of decentralized exchange tools like Monerujo, simplifying trading without ever requiring users to leave their wallets.

3. Dash (DASH)

Dash’s master nodes and governance style make it unique as one of the 6 best altcoins to watch today. Without centralized control, Dash uses genuine financial incentives to support partnerships, authorize development, and keep the network running by allocating 60% of each block reward to these nodes.

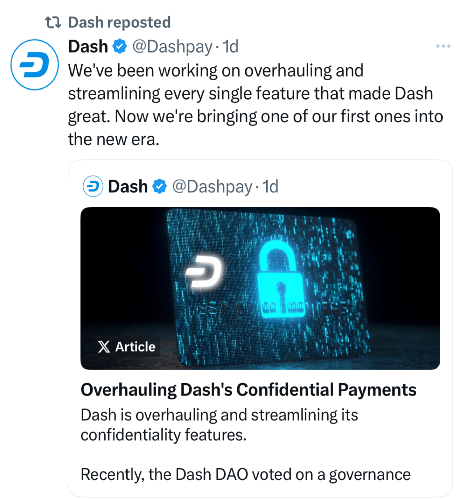

The Dash DAO community has been very active over the last week. In their official X channel, they hinted at an upgrade of PrivateSend and maybe a closer connection with master node analytics, promising an impending overhaul to streamline privacy standards.

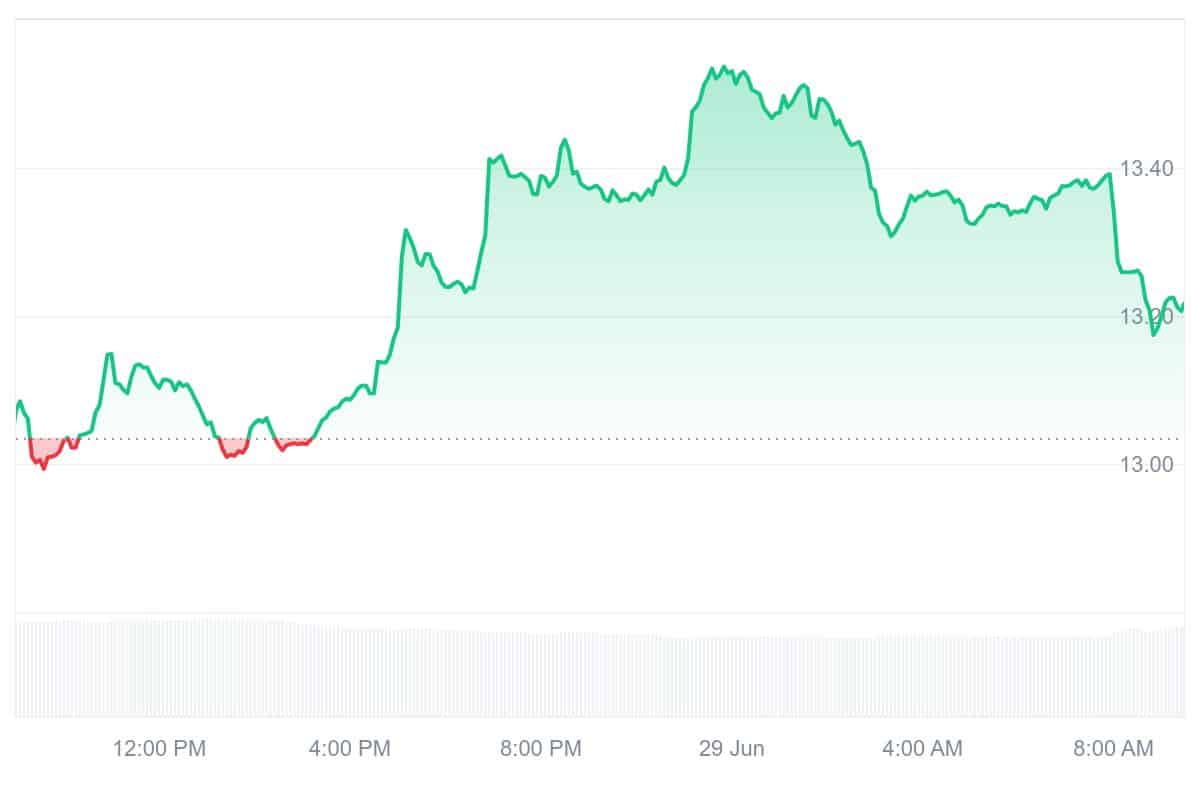

At $19.8, DASH is up roughly 1.8% today and almost 6.6% over the previous week, staying close to its mid-$20s cycle high. With over 12.3 million DASH in circulation and inflation at a moderate 4.3% per year, its market capitalization is approximately $244 million.

The SpendIT SendIT initiative, using Visa Direct and Pathward, demonstrated Dash’s potential for real-time remittances. Moreover, Dash and Web3 wallet provider Vultisig partnered in February to integrate InstantSend swaps into its ecosystem and add threshold-signature protection.

4. Filecoin (FIL)

In a peer-to-peer environment, Filecoin turns empty hard drive space into a decentralized marketplace that rewards storage providers and allows users to rent space. The cost, censorship risk, and data vulnerability issues that have plagued cloud storage for a long time are addressed, and a scalable, censorship-resistant web is produced.

A significant milestone was reached when the protocol launched its first Ecosystem Metrics Roundup on June 26th. This effort makes it obvious how much data is stored daily, how many clients are onboarded, how much FIL is moved in paid deals overall, and the activity related to gas fees.

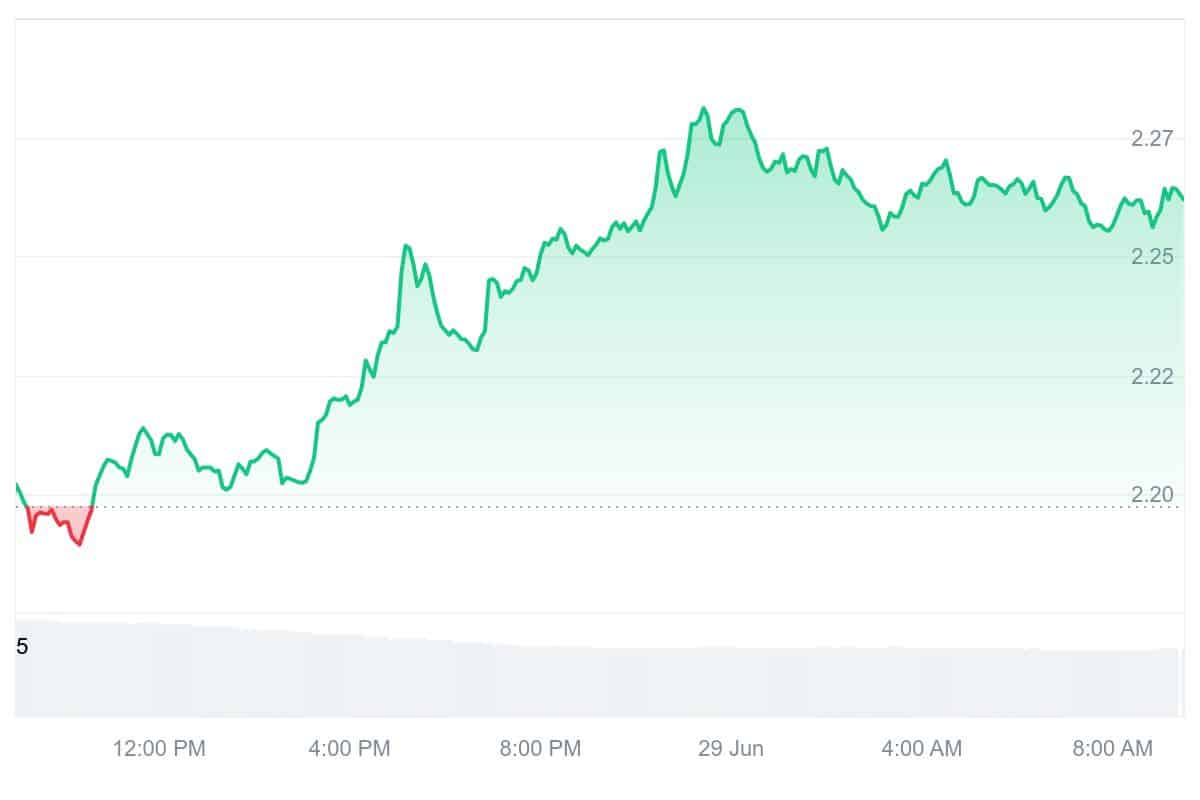

FIL sells at about $2.27, with daily fluctuations ranging from roughly $2.19 to $2.30. With a total market capitalization of around $1.5 billion and a daily trading volume ranging from $230 million to $330 million, Filecoin is a significant participant among decentralized Layer-1 storage currencies.

The number of clients with more than 1 TiB of active data shows true engagement. This metric filters out noise and helps assess real adoption, using Lily BigQuery to identify which clients are sustaining long-term data on the network. pic.twitter.com/a5yxTFE4IJ

— Filecoin (@Filecoin) June 29, 2025

Ecosystem integration and strategic alliances are where its true worth resides. Prominent organizations like the Internet Archive collaborate with Protocol Labs, and community initiatives at summits (such as FDS-6 in Toronto) center on DePIN, AI, and decentralized computing. Protocol infrastructure funding is being redirected internally by the ProPGF committee. It’s not exciting, but it’s a good foundation for FIL’s long-term infrastructure.

5. Snorter Token (SNORT)

Prepare to be amazed by Snorter Token, a bold combination of meme coin mayhem and handy functionality that is upending the presale market. With incredibly cheap fees and significant staking returns, Snorter powers a potent trading bot local to Telegram. It monitors hype tokens, steers clear of scams, and even mimics the moves of prominent traders.

With prices already over $1.2 million and getting close to the next tier, now just under $0.10, SNORT‘s presale is getting much attention. As staking dashboards light up and wallets fill, the community is excited due to that early traction. By locking in rates exceeding 250% APY, investors are igniting their enthusiasm and committing to the long haul.

Why should investors take notice, then? SNORT provides genuine tools, real yield, and real growth potential, all at the ideal moment in a market favorable to bulls. This combination is uncommon: a bot-driven token currently generating significant money, providing a high annual percentage yield, and providing real-world use beyond rhetoric.

6. Ethena (ENA)

Ethena was created to fill a void in DeFi: a stable, cryptocurrency-native dollar independent of US Treasuries and conventional banks. By staking ETH and shorting perpetual futures, the protocol established USDe, an algorithmic synthetic USD supported by a delta-neutral strategy that preserves the peg while generating income.

To illuminate USDe acceptance, the protocol released its first “Ecosystem Metrics Roundup” on X (previously Twitter), which included data on gas consumption, daily active wallets, transaction volumes, and paid deal volumes. This step toward transparency is significant because it demonstrates how events are occurring and helps transform Ethena’s story from theoretical to real-world.

Terminal is building a liquidity hub for sUSDe and institutional assets

Terminal has just launched an early deposit program, accepting USDe, WBTC, & ETH

Alongside early deposits, sENA will begin to accrue Terminal rewards for a potential future airdrop https://t.co/3FK24uWStg pic.twitter.com/1khktdHo1Y

— Ethena Labs (@ethena_labs) June 27, 2025

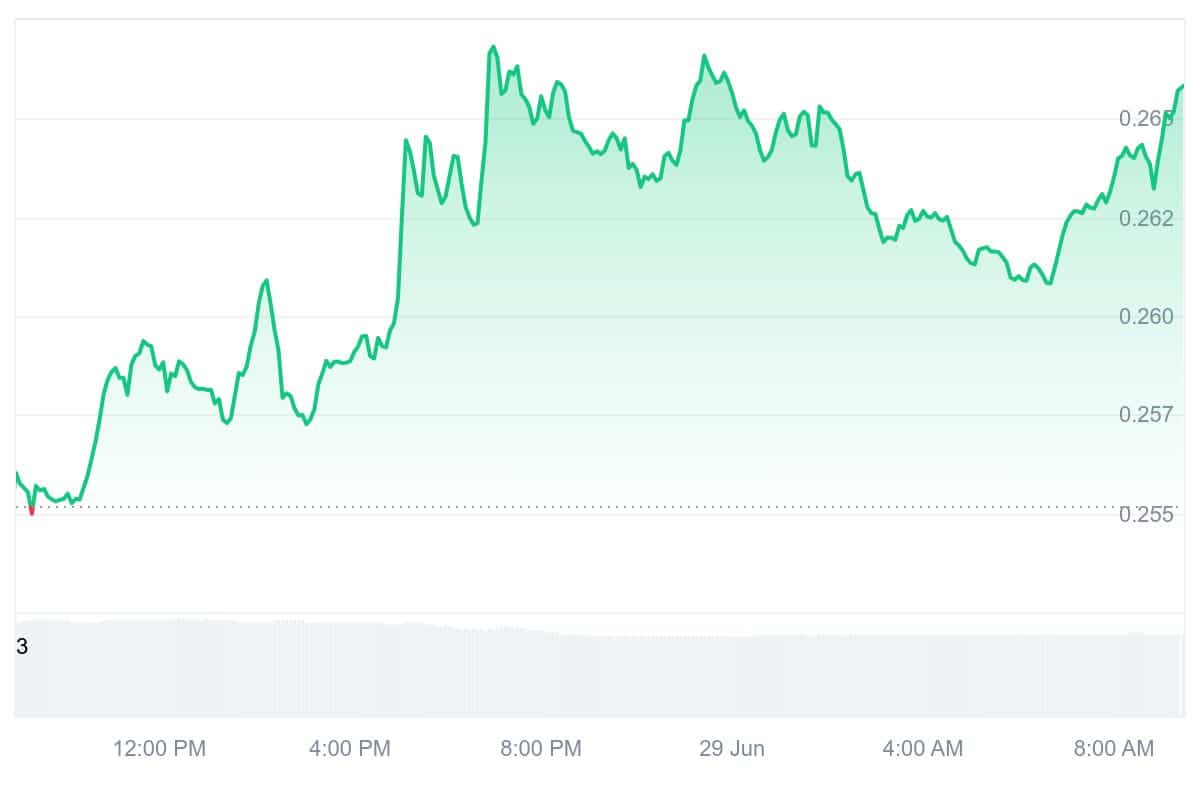

ENA has lost around 28% in the last month and is still roughly 83% behind its all-time high of $1.52 from April 2024, indicating significant volatility and a severe correction. As algorithmic models predict a range of $0.185 to $0.266 through July 2025, the upside potential is limited unless a significant catalyst materializes.

BaFin and Ethena GmbH recently agreed on a redemption plan allowing holders to redeem USDe. Additionally, Ethena partnered with Securitize on Converge, which might help connect DeFi with regulated tokenized assets.

Learn More

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage