Hong Kong’s LEAP Framework and Guotai Junan’s Crypto Plans

Chinese state-backed brokerage Guotai Junan International has secured regulatory approval to offer cryptocurrency trading services in Hong Kong.

The news arrives just as the Hong Kong government unveiled its comprehensive LEAP framework. The new blueprint advances stablecoin licensing, real-world asset tokenization, and digital asset market infrastructure.

Guotai Junan’s Crypto License Marks Major Win for Hong Kong’s Digital Asset Strategy

On Wednesday, Guotai Junan announced that the Hong Kong Securities and Futures Commission (SFC) has upgraded its Type 1 license. It was previously restricted to traditional securities dealing, with the upgrade permitting cryptocurrency trading.

The brokerage said it will operate through an SFC-licensed crypto platform, allowing clients to trade digital assets compliantly.

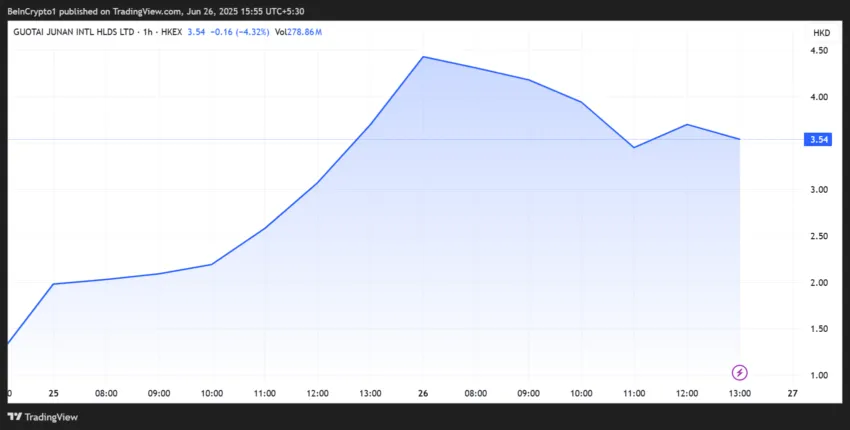

The market responded with enthusiasm. Guotai Junan’s shares surged nearly 470%. It rose from HK$1.24 ($0.16) to HK$7.02 ($0.91) intraday on Wednesday. The stock is traded at HK$3.54 ($0.46) as of this writing.

Despite the slight pullback, the stock remains above its pre-approval highs. This reflects investor optimism over the firm’s foray into digital assets.

Guotai Junan becomes one of the first traditional Chinese brokerages to receive regulatory approval for crypto trading in Hong Kong, amid growing interest from other mainland institutions.

Guotai Junan’s regulatory approval is a strategic win for Hong Kong. It reinforces its ambition to become a global digital finance hub. The brokerage, controlled by a Shanghai state-owned enterprise, went public in Hong Kong in 2010.

Therefore, the approval lends mainstream credibility to the city’s crypto push. According to the state-owned Securities Times, China Merchants Securities and Huatai International are also pursuing license upgrades to enter the crypto space.

Hong Kong Rolls Out LEAP Framework: Everything You Need to Know

The announcement coincides with Hong Kong’s release of its updated digital asset policy framework, known as LEAP (Legal clarity, Ecosystem expansion, Application focus, and People development).

The policy, unveiled Thursday by the Financial Services and the Treasury Bureau (FSTB) and other key regulators, builds on the city’s 2022 digital asset roadmap and outlines specific initiatives to further integrate crypto into mainstream finance.

Under the LEAP framework:

- A new licensing regime for stablecoin issuers will launch on August 1, enabling regulated issuing and circulating fiat-backed stablecoins.

- The government will regularly issue tokenized government bonds and promote tokenized ETFs, clarifying stamp duty treatment to support secondary market trading.

- Broader tokenization efforts are planned across sectors, including precious metals and renewable energy assets like solar panels.

- Hong Kong’s financial authorities also revealed plans to enable crypto derivatives trading for professional investors, building on recent approvals for spot crypto ETFs, futures products, and staking services.

Financial Secretary Paul Chan said the new framework aims to demonstrate the practical use of tokenization and build a flourishing digital assets ecosystem that will integrate the real economy with social life.

While mainland China maintains a strict ban on crypto trading, Hong Kong operates under a distinct legal and regulatory regime. It offers a regulatory sandbox for experimentation and institutional adoption.

As more Chinese brokerages seek to enter the space, with LEAP laying the groundwork for tokenized assets and stablecoin circulation, Hong Kong is quickly shaping up to be Asia’s most dynamic crypto and Web3 launchpad.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.