Bitcoin reclaims $107K – What’s next as 3 factors align for BTC

- Miners appear to be preparing for a Bitcoin rally in the coming trading sessions.

- Market behavior from whales and derivatives traders also aligns with the ongoing bullish sentiment.

Bitcoin [BTC] has maintained its upward trajectory, reclaiming the $107,000 region after gaining 1.89%.

This continues its upward momentum from last week, although BTC remains in a broader corrective phase, down 2.45% over the same period.

Miner activity indicates a strong possibility of further upside, supported by liquidity from whales and increased activity in the derivatives market.

Miner activity mirrors historical pattern

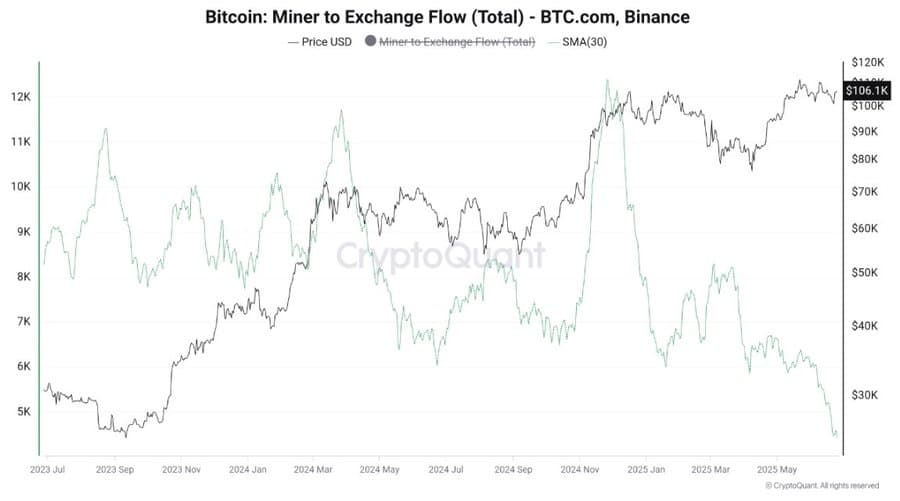

CryptoQuant’s analysis of miner behavior revealed a bullish setup forming, suggesting Bitcoin may be poised for another rally.

According to the data, BTC.com—a mining pool responsible for 98% of miners’ flows into Binance—has gradually reduced its exchange inflows over the past month.

Historically, a decline in these miner inflows to Binance often precedes a Bitcoin rally, and vice versa.

As of this writing, these inflows have decreased, indicating that miners prefer to hold BTC while anticipating a rally, only offloading when they believe the market has peaked.

AMBCrypto also analyzed the overall Bitcoin Miners’ Reserve and found a similar pattern.

The reserve declined from 574,678 BTC to 1.807 million BTC, suggesting that miners across the board are holding with a long-term outlook.

Whales and derivatives traders in support

Whales and derivatives traders appear to support the bullish trend seen in miner activity.

At press time, whale-controlled liquidity on exchanges has increased. The Whale Exchange Ratio surged to 0.59—a relatively high level—suggesting increased whale presence on exchanges.

Although this is not inherently bullish, Bitcoin’s reclaiming of the $107,000 level implies that whales may be buying.

In the derivatives market, Funding Rates have turned positive after two consecutive days of selling, indicating more long contracts are open.

This shift in Funding Rate is significant, confirming more long bets have been made on Bitcoin in the pat 24 hours.

If the trend continues, it could mean derivatives traders will join whales and miners in positioning for a major upward price movement.

On-chain activity confirms growing momentum

Nansen data shows a surge in on-chain activity over the past 24 hours, reinforcing the bullish outlook. Active addresses have risen by 21.3%, reaching 535,900, confirming increased usage of the Bitcoin network.

Transaction-related gas fees also increased, indicating higher utility of Bitcoin protocols.

Sustained high usage of Bitcoin on-chain would further strengthen the asset’s potential to continue its upward market trend.