6 Best Altcoins to Watch Today, June 21 – Frax, Ultima, Aptos, Kava

Join Our Telegram channel to stay up to date on breaking news coverage

Staying ahead of the curve in the ever-changing cryptocurrency industry requires monitoring the proper altcoins before they become well-known. As June 21 approaches, astute investors are taking notice of the 6 best altcoins to watch today that aren’t merely surviving the market commotion but are gaining momentum covertly through innovation, calculated movements, and practical applications. Beyond price movement, this assortment of altcoins offers high-value tokens pushing cross-chain boundaries and stablecoin innovations.

The stablecoin law is quietly making its way through the US Congress and is bringing forth some surprising developments. The GENIUS Act, which mandates that stablecoin issuers provide monthly audit reports and fully back tokens with liquid reserves, was just approved by the Senate.

6 Best Altcoins to Watch Today

Why should we examine Frax, Ultima, Aptos, and Kava more closely today? In an ocean of hundreds of tokens, what separates them? Each of these initiatives, whether they are addressing critical infrastructural issues, entering new markets, or establishing strong alliances, has something special to offer that might influence the next wave of cryptocurrency growth.

1. Frax (FRAX)

So, what distinguishes Frax? This dynamic ecosystem is supported by open governance and high activity and includes a tight peg, strategic institutional credibility, aggressive chain extension, AI integration, and next-generation tooling.

With the support of BlackRock’s Institutional Digital Liquidity Fund through Securitize, Frax introduced its new stablecoin, frxUSD, at the beginning of 2025. This raises the threshold for openness and establishes Frax as a link between traditional finance and DeFi by providing the USD with direct fiat redeemability, complete transparency, U.S. compliance, and support from cash, treasuries, and repos.

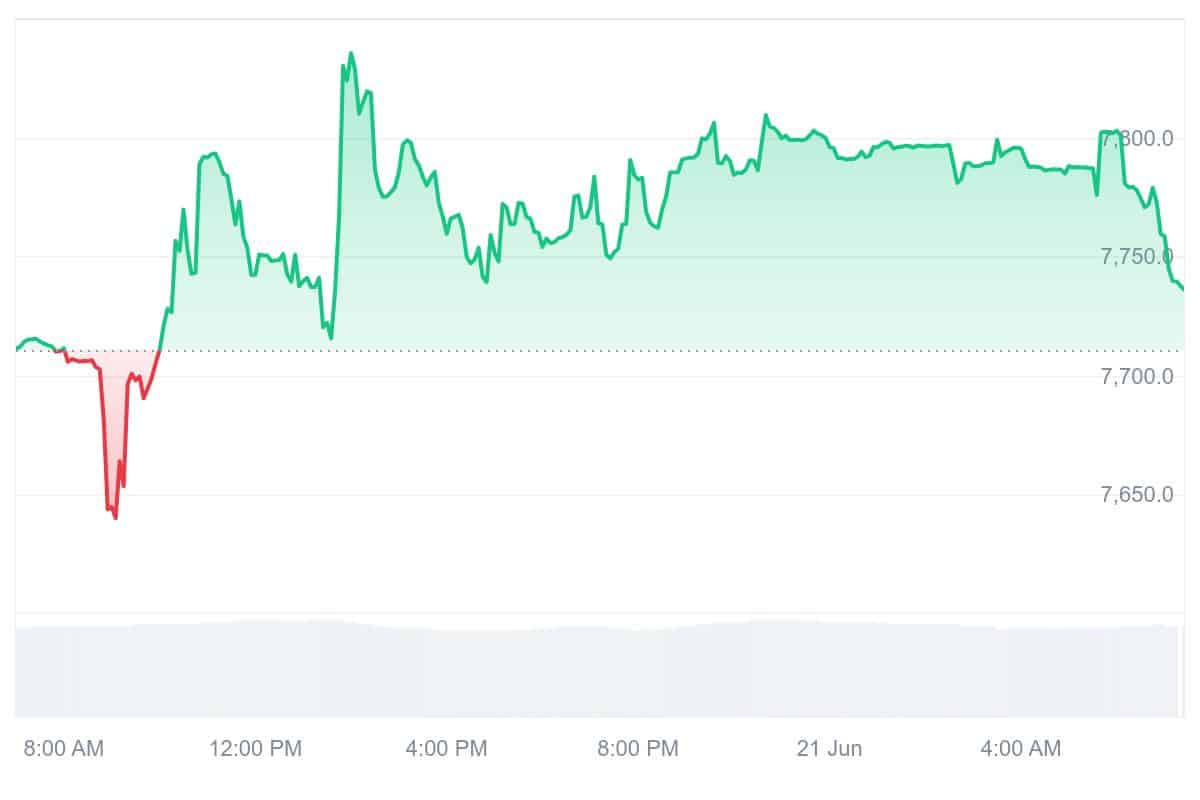

With a minimal daily volatility and a hovering value of just under $1, FRAX is showing exceptional peg performance. Sterling stability is demonstrated by the intraday price movement, which remains within a narrow band of about $0.9982 and $0.9998.

Proposals to implement Frax protocol AI agents, incorporate locked assets into node configurations, extend on Arbitrum via dTRINITY, and move frxUSD onto Cardano were presented at the Frax governance forum in mid-June. These actions are indications of rapid ecosystem expansion beyond Ethereum. A former Mastercard and startup CEO joined the team to strengthen institutional strategy, adding to the traction and indicating significant aspirations for wider market penetration.

2. Ultima (ULTIMA)

Ultima markets itself as a state-of-the-art blockchain infrastructure token designed to address decentralized networks’ scalability and usefulness problems. It serves as the foundation for a platform designed to provide increased throughput, quicker transactions, and acceptance of real-world use cases.

Using Ultima’s UG-100 sequencing technology, sibling company Ultima Genomics has signed agreements with Arc Institute and 10x Genomics to grow its Virtual Cell Atlas. This foray into biotechnology highlights the company’s larger goals to provide large-scale research initiatives with inexpensive, high-throughput sequencing.

We were excited to present the official Ultima Genomics Certified Service Provider plaque to @BroadGenomics . Thank you Niall Lennon and the wonderful onsite lab personnel. The Broad team is ready to take your samples for #sequencing on the #UG100! pic.twitter.com/0jMZ6nS6OB

— Ultima Genomics (@UltimaGenomics) June 12, 2025

It has a market capitalization of about $291 million and a remarkably high 24-hour trading volume of almost $15.6 million. In other words, Ultima trades nearly 5.4% of its total market capitalization daily, suggesting high liquidity and active investor financing.

Ultima Genomics has expanded through service provider alliances like the University of Minnesota Genomics Center, Macrogen, and Inocras. In the meantime, Labcorp is still working with Ultima to expand whole-genome sequencing through its platform. For ULTIMA token holders, these biotech partnerships indicate crossover potential. While they are not yet fully integrated, this demonstrates the ecosystem’s ability to penetrate practical industries like healthcare, research, and diagnostics.

3. Aptos (APT)

Since its introduction, Aptos has aimed to become the next-generation Layer 1 that addresses the three main blockchain issues: usability, safety, and scalability. Aptos offers sub-second finality, low latency, and high throughput because of its parallel execution architecture and Move programming language. As a result, it attracts developers’ interest and is well-represented at ETHCC 2025 in Cannes later this week, underscoring a drive to work with Web3 makers.

By June 30, the network plans to switch APT and all on-chain tokens to a new Fungible Asset (FA) standard. This structural underpinning enables improved token composability, gas optimizations, and more seamless connection with DeFi and payments. It goes beyond a simple technical adjustment.

The Wyoming Stable Token Commission has placed Aptos as the highest-scoring blockchain candidate for WYST—the first fiat-backed stablecoin issued by a U.S State—tying for 1st place with Solana.

WYST will be deployed using @LayerZero_Core. pic.twitter.com/CMUyRbs4Gq

— Aptos (@Aptos) June 20, 2025

With a daily turnover of over $300 million and a market valuation of roughly $2.9 billion, Aptos has fluctuated between $4.21 and $4.60 during the last day. However, the token is now well below its peak of $19.86 in January 2023, dropping about 16% in the past month and over 35% year over year.

A cooperation with Flipster was announced on June 20th to promote stablecoin adoption through multichain pathways. This suggests that Aptos is establishing itself in the DeFi and payment infrastructure markets.

4. Kava (KAVA)

Kava addresses a fundamental issue in decentralized finance as one of the 6 best altcoins to watch today: providing DeFi and safe, fast, cross-chain loan services without compromising decentralization. Built on top of the Cosmos SDK and utilizing the Inter-Blockchain Communication (IBC) protocol, Kava combines the freedom of Ethereum smart contracts with interoperability at the Cosmos level.

As an example of the team’s commitment to remaining innovative and community-led, the latest AMA on X (previously Twitter) on June 13 explored how artificial intelligence can improve decentralized governance in Kava’s ecosystem.

Projects like Wormhole and LayerZero are already integrating AI:

–@wormhole: Anomaly detection + audit automation

–@LayerZero_Core: Real-time route optimizationLearn how we’re entering an era of intelligent interoperability: https://t.co/luiuFFqBEU pic.twitter.com/cflA8FFC4G

— Kava (@KAVA_CHAIN) June 20, 2025

Approximately 120 million KAVA are currently staked across about 100 validators, and there are more than $625 million worth of assets locked on-chain, showcasing that users have faith in the network’s usefulness and security.

Even though no new DeFi protocol launches were revealed this month, Kava Lend (HARD) is helping the network continue to develop. According to industry projections, HARD will remain constant until the middle of 2025, supporting the network’s steady but cautious growth. Meanwhile, as DeFi activity increases across Cosmos chains, Kava’s central IBC-driven bridge is receiving more attention.

5. Bitcoin Hyper (HYPER)

Welcome to the world of Bitcoin Hyper, the presale attracting attention and causing FOMO in the cryptocurrency world. Imagine delivering Bitcoin in seconds for pennies. This isn’t just another token sale; by adding DeFi capabilities and Solana-speed execution to the original Bitcoin, it’s a step toward reimagining its usefulness.

Early investors can stake their HYPER to receive incredible revenue; sources indicate APYs ranging from 528% to over 1000%, depending on the stage. That is a yield magnet for yield-hungry investors who desire both upside and active participation.

A mature approach to security and decentralization is beginning to emerge, as evidenced by the team surrendering ownership and the code being cleared by audits from Coinsult and SpyWolf. Astute capital is placing bets on this Layer-2 vision since whales that have spotted a stealth play have already taken stakes totaling more than $50,000 in a single move.

6. Tezos (XTZ)

Tezos primarily addresses two interconnected issues: smart contract security and blockchain upgrade stagnation. Network stakeholders decide to implement protocol improvements through its formal on-chain governance to prevent disruptive hard forks and facilitate internal evolution.

In anticipation of the July 3 TezDev 2025 Catalyst in Cannes, which will feature a hackathon and unite builders, Tezos is actively seeking submissions in gaming, art, DeFi, and more.

Although the token is still far below its peak of $9.08 (October 2021), it has managed to hold above its cycle low of $0.49, and within the past 30 days, roughly half of the days have ended in profit.

At the Basel Digital Art Mile (June 16–22), the Tezos Foundation and the Musée d’Orsay collaborated to mint digital collectibles of Van Gogh, fusing blockchain technology with art. In addition to galleries, Tezos is promoting tokenization in the financial sector. Uranium.io debuted with tokenized uranium backed by Tezos, and lending platforms are being introduced by DeFi protocols like Yupana, all of which reference Tezos’s smart contract security and upgrade flexibility.

Learn More

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage