Will Powell Speech Break the Stalemate?

Bitcoin Hesitates Below $106K as Traders Brace for Powell’s Words

Bitcoin is drifting lower this morning, trading near $105,200 after briefly poking above $106,800 in the early hours. It’s not a big selloff; it’s more like a cautious exhale after a sharp run earlier this week. The spotlight is now on Jerome Powell, who’s set to speak later today. Traders aren’t expecting fireworks, but any hint about rate cuts (or delays) could shift sentiment fast.

The market’s also reacting to renewed Middle East tension, with Trump issuing a fresh Tehran evacuation warning. That’s added a layer of geopolitical stress just as crypto was starting to look confident again above $ 107 K. For now, Bitcoin’s holding firm, but the next move depends on what Powell says and how risk assets respond.

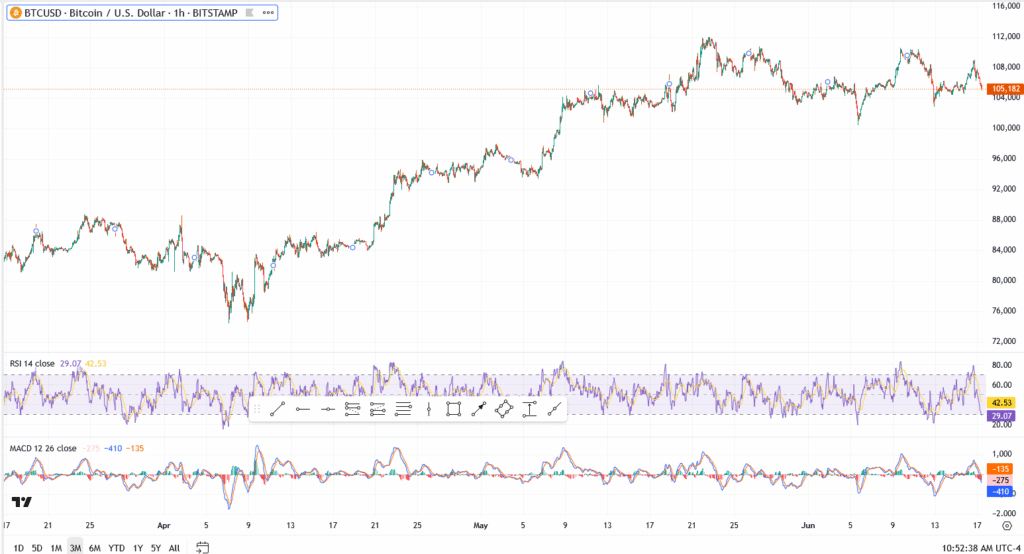

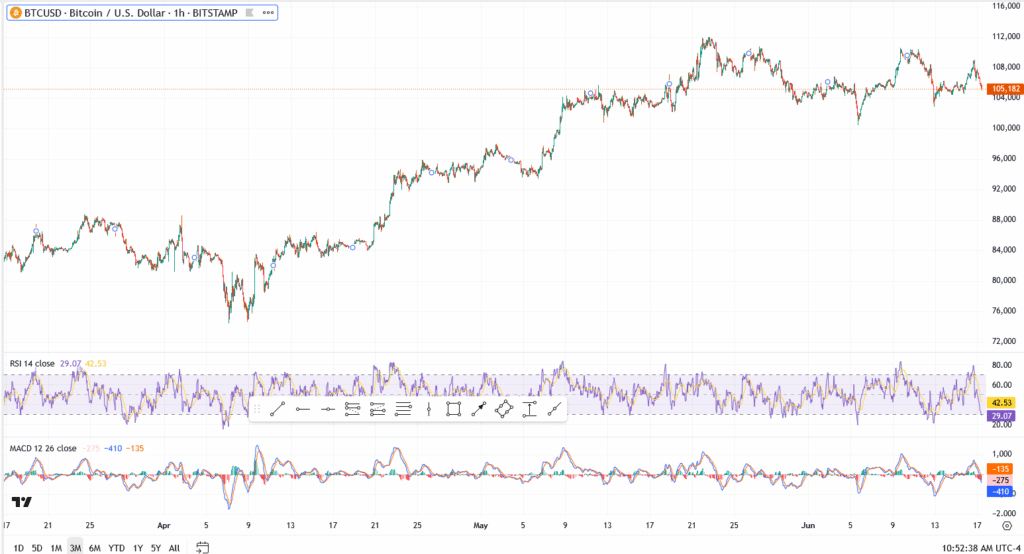

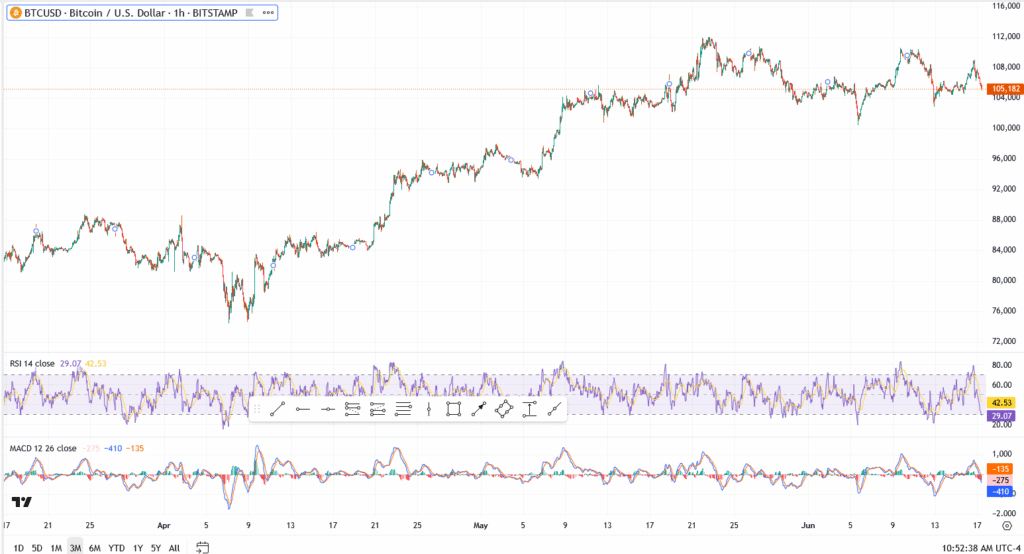

Bitcoin Chart Analysis Today

- Current price: $105,200

- Resistance: $107,000 (psychological barrier), $110,000 (recent rejection zone)

- Support: $103,500 (recent bounce area), $100,000 (key psychological level)

- RSI: 42.5 – shows mild bearish momentum

- MACD: Turning flat, signalling possible consolidation

Bitcoin remains inside a tight range, and until Powell’s comments hit the wire, traders should expect indecision. A break below $103K could trigger short-term selling, while a dovish Fed tone could quickly send BTC back toward $107K–$ 110K.

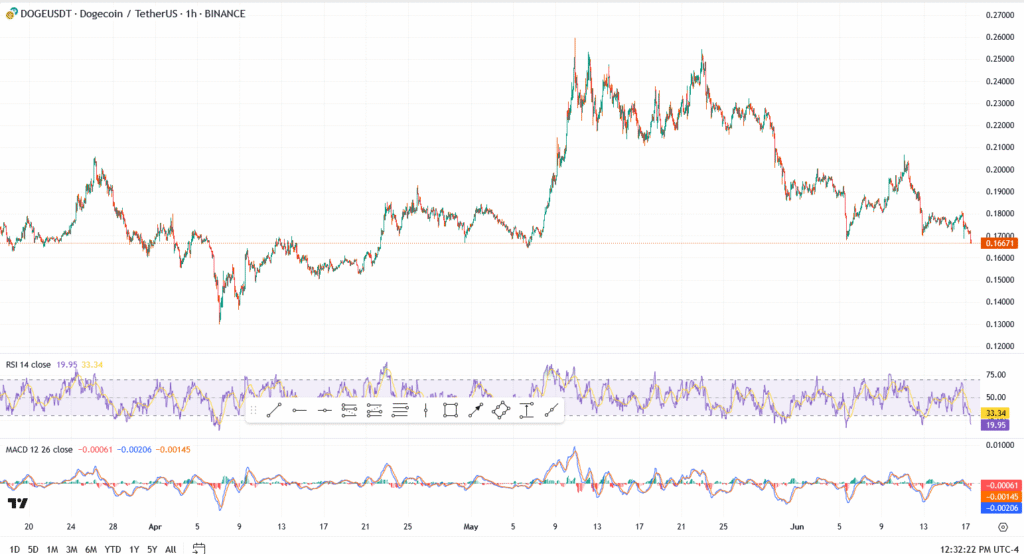

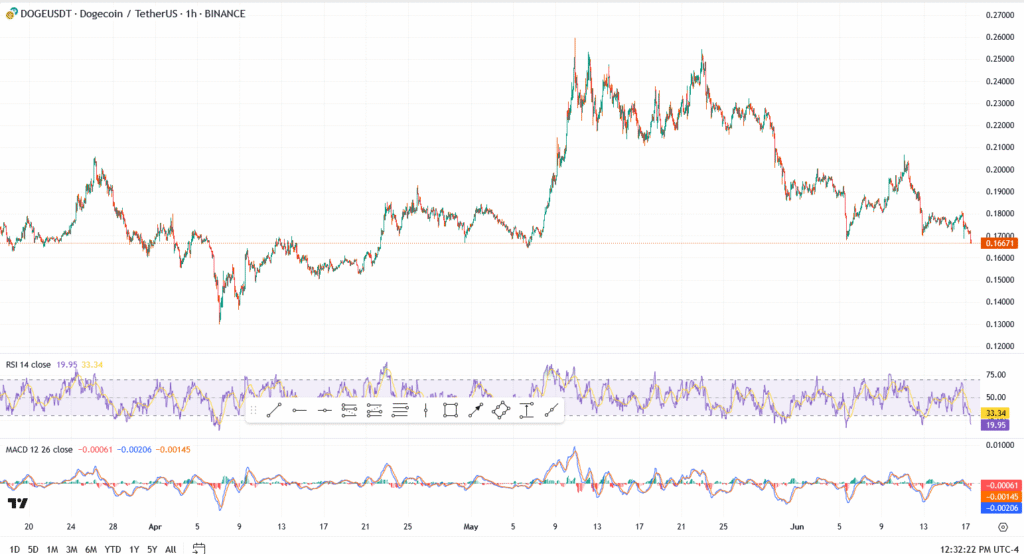

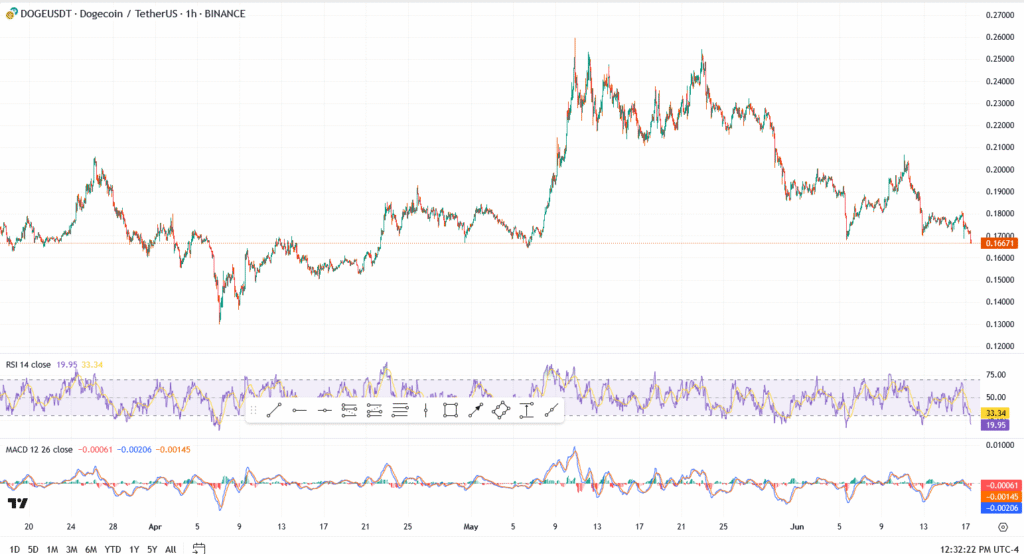

Dogecoin Price Drops Below $0.17 as Momentum Fades, Will $0.16 Hold the Line?

As of Tuesday midday, Dogecoin (BINANCE: DOGEUSDT) was trading around $0.166, having shed nearly 9% from last week’s high near $0.182. The drop extends a multi-day slide that’s seen bulls retreat as broader crypto sentiment weakens. With no major catalysts and risk appetite fading, DOGE appears to be drifting lower under its own weight.

DOGECOIN Chart Anaysis Today

- Current price: $0.1667

- Resistance: $0.1750 and $0.1900

- Support zones: $0.1620, then $0.1520

- RSI: 19.95 (deeply oversold)

- MACD: Bearish momentum intact

Dogecoin’s structure has unravelled since peaking above $0.25 in early May. Sellers have gradually regained control, and price action has now compressed into a tight descending channel. Unless DOGE clears $0.175 with volume, bulls may remain on the sidelines.

Conclusion

There’s little hype right now. Dogecoin is lacking fresh catalysts, and Elon Musk’s X ecosystem remains quiet on the crypto front. With broader markets watching Powell’s comments and oil jitters reemerging, speculative appetite for memecoins is fading.

DOGE isn’t dead, but it’s dozing. With RSI this low, a short-term bounce is possible, but real momentum won’t return unless bulls reclaim control above $0.18. Until then, Dogecoin remains a shadow of its former self: reactive, not leading.

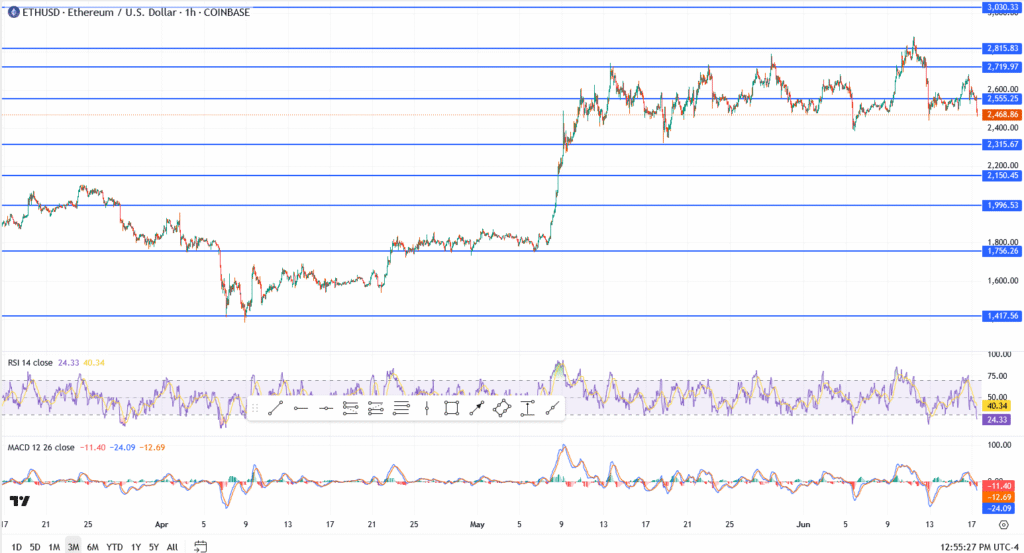

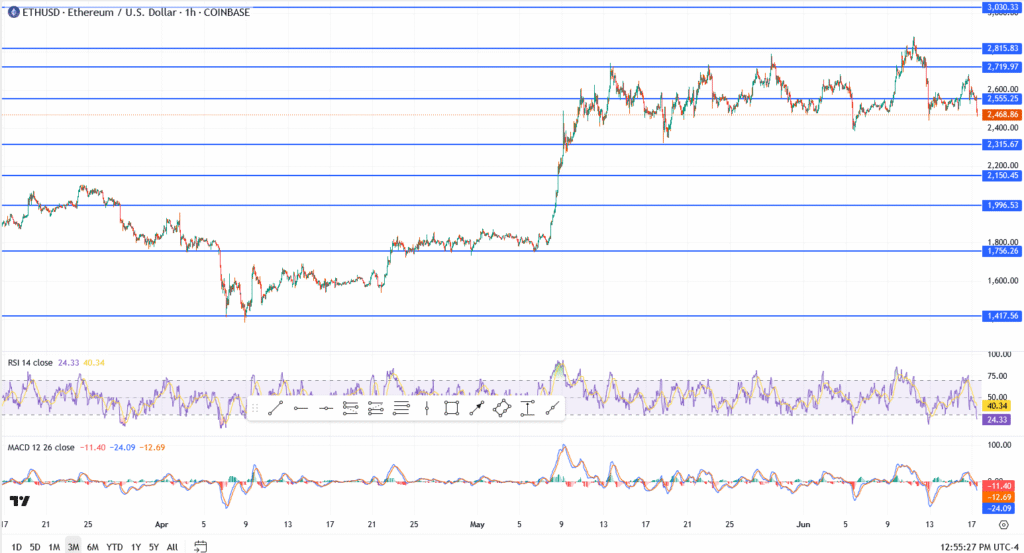

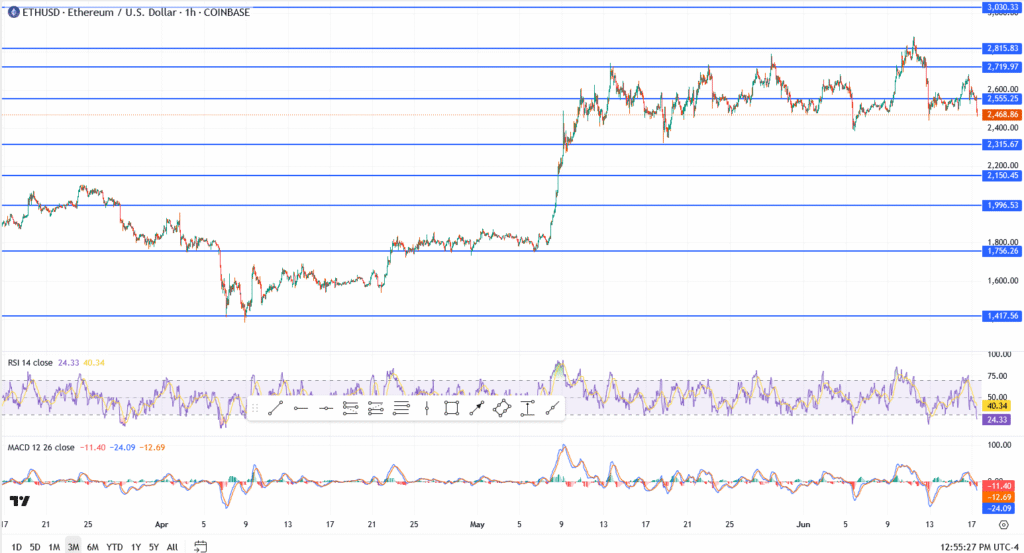

Ethereum Price Dips to $2,468 as Whale Momentum Slows: Can Bulls Reclaim $2,555?

Ethereum (ETH/USD) isn’t holding up as well this Tuesday. The coin has slipped to around $2,468, giving up ground after bulls failed to defend the $2,555 pivot, a level that’s quietly become ETH’s center of gravity for the past two weeks.

As of midday U.S. trading, the tone is clearly defensive. The price has softened alongside weaker Bitcoin action and rising caution ahead of Jerome Powell’s speech later in the day. Momentum indicators show fatigue, with RSI sliding toward oversold and MACD leaning bearish.

Ethereum Share Price Analysis Today

- Current price: $2,468

- Resistance: $2,555, then $2,719

- Support zones: $2,315, then $2,150

Unless ETH bounces back above $2,555 soon, the next leg could test $2,315. That zone has held firm in past pullbacks and could attract short-term buyers, but only if sentiment stabilises.

Right now, the market feels like it’s waiting for a signal. And until Ethereum reclaims lost ground, bulls are unlikely to rush back in.