PEPE drops 20%, yet whales just bought 531B tokens – Here’s why

- A new whale purchased 531.63 billion PEPE worth $5.5 million despite overall whale activity falling sharply.

- PEPE must reclaim $0.0000107 to reverse the trend; failure may send it down to $0.00000855.

Over the past day, Pepe [PEPE] dropped below $0.00001 for the first time in over a month, hitting a low of $0.00000963.

Naturally, the dip lured in opportunistic buyers—especially whales—who seem to be scooping the memecoin at markdowns.

$5.5M worth of conviction?

According to Onchain Lens, a new whale has entered the market following the recent market slump and acquired 531.63 billion PEPE, worth $5.55 million.

The entire transaction flowed through Binance, marking a rare moment of confidence despite fading momentum.

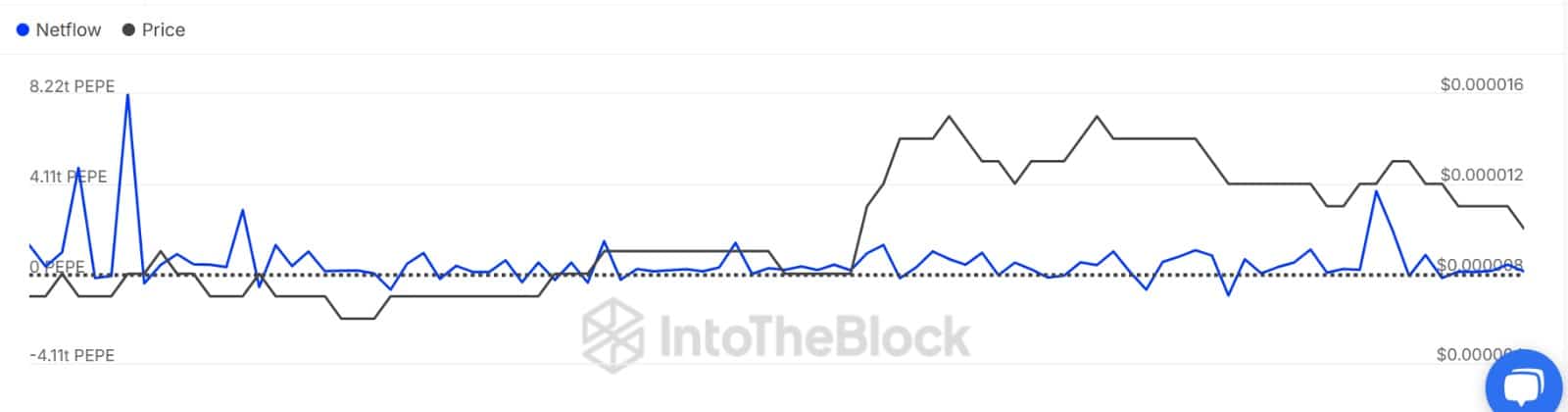

This whale acquisition arises amid reduced whale buying activity. Whale accumulation declined from 28 trillion to 4 trillion between the 16th of June and the 18th of June.

Even as large-scale whale inflows dried up, Netflow remained positive, with a net gain of 106 billion PEPE.

This signaled that buy pressure—though milder—is still alive across the top holder cohort.

Retail joins the party!

In the spot arena, the shift has been even clearer.

On the last trading day, buyers snapped up 1.2 trillion PEPE, a stark reversal from the previous day’s 16.2 trillion dump by sellers.

Moreover, the past three weeks have seen consistent buyer dominance across spot volume.

This aligns with the Spot Taker CVD, which shows sustained Taker Buy Dominance, highlighting demand despite declining price action.

Therefore, both whales and retailers seem to be making a return in the market, as the memecoin increasingly becomes cheaper.

Current market behavior suggests optimism with prospects, thus they continue to buy in a downtrend.

But wait—price is still stuck in a downtrend

According to AMBCrypto’s analysis, PEPE experienced strong downward pressure, dropping from $0.0000135 to $0.0000096 in the past week.

Thus, despite this whale buying, it’s yet to change the path.

PEPE has lost 20.83% over the past seven days, falling from $0.0000135 to $0.0000096. At press time, the memecoin traded at $0.00001023—still below the crucial psychological support.

When we look at momentum indicators, both DMI and Stoch are sitting in the bearish zone and continue to decline. As such, the positive index has dropped to 19, and it’s almost crossing the negative index to the downside.

Another drop below here and a breach of 17 will signal a strong continuation of the downtrend.

This possibility is further supported by declining Stoch RSI that has dropped to oversold territory since making a bearish move three days ago.

The bottom line? Whales are buying, and retail is following—but momentum hasn’t flipped. If the bulls can reclaim and defend $0.0000107, a short-term recovery may unfold.

However, failure to hold current levels could send PEPE tumbling toward $0.00000855.

For now, the memecoin walks a tightrope, flanked by conviction buys and a very real downtrend.