Fixed Yield Farming in DeFi: An Expert Analysis

Defining Yield in Yield Farming: Fixed vs. Variable

Earning yield in DeFi involves leveraging decentralized protocols to generate returns on cryptocurrency holdings, typically in the form of additional cryptocurrency. This practice is broadly categorized under terms like yield farming or liquidity mining, where participants lend or stake their digital assets within DeFi protocols to earn interest, tokens, or other incentives.

For more: A Comprehensive Analysis of Yield and Payment Stablecoins

Variable Yield in Yield Farming

Variable yield is characterized by its fluctuating nature. Returns are dynamic, changing based on prevailing market conditions, the supply and demand for liquidity within a protocol, and its utilization rates.

Common strategies for earning variable yield include staking assets in a proof-of-stake (PoS) consensus mechanism, utilizing liquid staking tokens (such as Lido’s wstETH or Rocket Pool’s rETH, often accessed via products like Index Coop’s dsETH), participating in lending protocols, or providing liquidity to Automated Market Makers (AMMs) like Uniswap or Curve.

While variable yield often presents the potential for higher returns, it necessitates continuous monitoring of rates and active adjustment of strategies to capitalize on shifting opportunities.

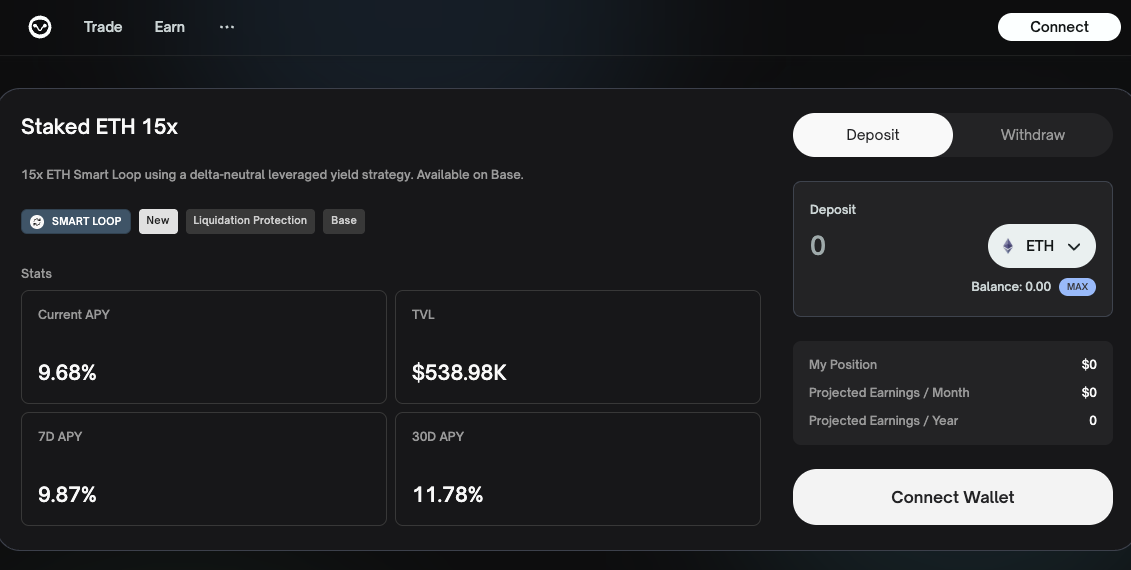

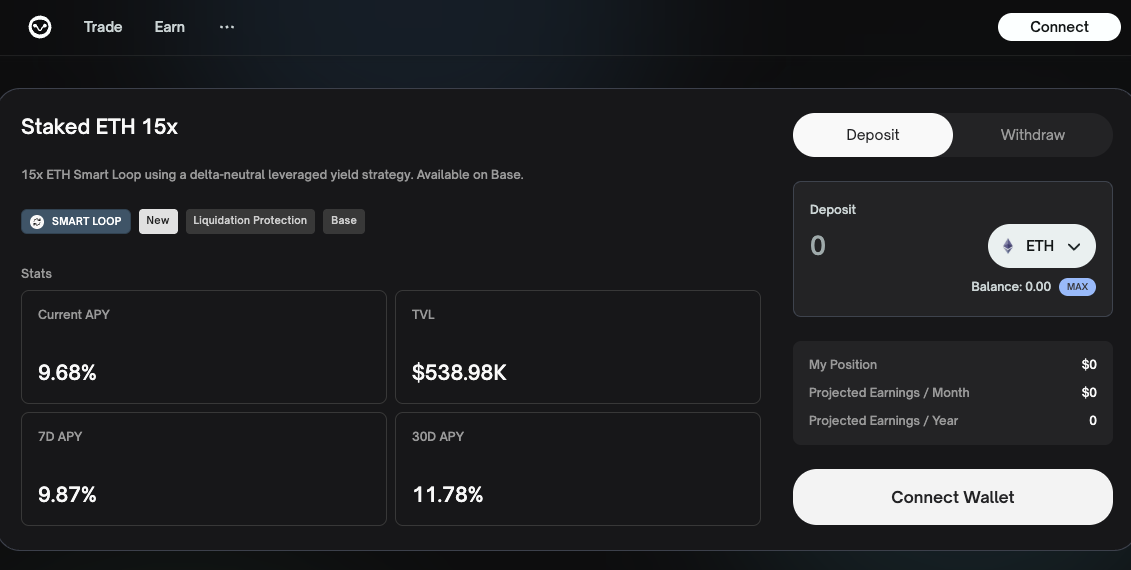

Source: Index Coop ETH

Fixed Yield in Yield Farming

Fixed yield strategies in DeFi offer predictable returns, maintaining a constant interest rate throughout a specified period. This predictability significantly benefits financial planning, accounting, and tax purposes, allowing precise profit assessments. These products often provide “true passive income,” requiring no active management once allocated.

A crucial distinction exists between Annual Percentage Rate (APR) and Annual Percentage Yield (APY). APR calculates interest solely on the principal, while APY accounts for compounding interest, generally making it higher. Understanding this difference is vital for accurate return evaluation.

Fixed yield’s predictability and passive nature represent a strategic DeFi development. It attracts a broader spectrum of investors, particularly risk-averse individuals and institutions, by reducing cognitive burden and direct market risk exposure. This boosts Total Value Locked (TVL) and enhances DeFi’s legitimacy.

However, some consider this an “illusion of fixed” within DeFi’s volatile ecosystem. While the interest rate itself is fixed, the underlying environment remains susceptible to significant risks, including smart contract vulnerabilities, impermanent loss, and broader market volatility.

The “fixed” yield is contingent on the stability of smart contracts, pool liquidity, and general market conditions, all dynamic. Thus, the fixed rate applies to interest calculation but doesn’t guarantee the principal’s fiat value or immunity from protocol-specific operational risks. This highlights the critical need for robust risk disclosure and comprehensive user education for fixed yield products.

For more: The Rise of Stablecoins: 2025 Market Update and Key Statistics

| Characteristic | Fixed Yield | Variable Yield |

| Predictability | High (rate remains constant) | Low (rate fluctuates based on market) |

| Active Management | Low (true passive income) | High (requires constant monitoring and adjustment) |

| Risk Profile | Lower (but still subject to DeFi inherent risks) | Higher (due to market dynamics and active strategies) |

| Typical Return Range | Moderate | Potentially High |

| Primary Use Case | Long-term growth, predictable income | Maximizing short-term returns, opportunistic |

| Examples of Strategies/Protocols | Fixed-rate lending, Bond-like instruments (e.g., Notional Finance, Yield Protocol) | Staking, Liquid Staking, Lending Pools, Liquidity Providing (e.g., Aave, Compound, Uniswap) |

Table 1: Fixed Yield vs. Variable Yield in DeFi

The Value Proposition of Fixed Yield in a Volatile Market

Fixed yield in DeFi offers crucial predictability and certainty in a volatile market. It provides stable interest rates over defined periods, enabling clear financial planning, especially for accounting and tax purposes, by ensuring minimum profit margins.

Furthermore, fixed yield strategies generate “true passive income.” Once invested, they require no ongoing management, unlike variable yields demanding continuous adjustments. This hands-off approach highly appeals to investors seeking consistent returns without intensive time commitments.

Given their stable nature, fixed yield strategies are conducive to long-term growth within DeFi. They foster compounding returns, promoting a more sustainable investment approach over speculative ventures.

Fixed yield draws direct analogies to traditional fixed-income investments, valued for their regular, non-varying returns. DeFi enhances this by offering accessible lending/borrowing without intermediaries, democratizing yield generation. Benefits for “accounting and tax purposes” and the comparison to “traditional fixed-income investments” strongly position fixed yield for institutional investors and corporate treasuries.

These entities require predictable cash flows and clear financial reporting, which variable crypto yields cannot provide. This makes fixed yield a critical enabler for integrating traditional finance capital into DeFi, moving beyond speculative retail participation towards structured, enterprise-grade financial products. This development signifies a maturing DeFi market, cultivating a new class of investors.

Mechanisms and Protocols Driving Fixed Yield in DeFi

This section explores the specific technical and operational mechanisms that facilitate fixed yield generation within the DeFi landscape, highlighting key protocols and their innovative approaches.

Fixed-Rate Lending Protocols

Fixed-rate lending protocols form the bedrock of predictable yield in DeFi, allowing users to lend crypto at a fixed rate for a set term. Borrowers also benefit from stable costs. These platforms typically use over-collateralization to safeguard lenders, with rates influenced by utilization and liquidity.

Notional Finance is a key example, offering a fixed-rate money market where lender returns come directly from borrower payments. This protocol allows users to lend or borrow at fixed interest rates for specific maturities (e.g., 3 months, 6 months, 1 year).

An investor might lend USDC for 6 months at a fixed 5% Annual Percentage Yield (APY) on Notional. Regardless of market fluctuations, they know exactly how much interest they will earn at maturity.

Notional Finance

Yield Protocol pioneered fixed-term lending/borrowing via fyTokens, acting like zero-coupon bonds. While fyTokens offer fixed returns, Yield Protocol also engages in variable-yield activities (e.g., AMM liquidity pools), meaning impermanent loss can occur. Other protocols like 88mph offer direct fixed-rate lending, and major platforms like Aave and Compound might integrate such features.

The “fixed” yield itself is a structured financial product. It either transfers interest rate risk to borrowers or embeds it in a tradable token. However, a protocol advertising fixed yield might still use underlying variable-yield strategies to sustain its offerings.

This crucial complexity means the fixed rate offered to the user doesn’t insulate the entire protocol from inherent variable yield risks or guarantee the principal’s fiat value. Therefore, investors must look beyond the advertised rate and understand the protocol’s complete operational and risk management model.

| Protocol Name | Primary Fixed Yield Mechanism | Key Features/Notes |

| Notional Finance | Fixed-rate money market (lender-borrower matching) | Lenders lock yield for up to one year; returns from fixed-rate borrowers. |

| Yield Protocol | fyTokens (zero-coupon bond-like) | Pioneered fixed-rate/term; fyTokens bought at discount, redeemed at face value; fungible fyTokens. May have underlying variable pool risks. |

| 88mph | Fixed interest rate lending | Explicitly offers fixed interest rates on crypto assets. |

| DELV | Purchasing assets at discount (e.g., Staked Ethereum) maturing to market rates | Explores tokenized Real-World Assets (RWAs); offers fixed-rate borrowing (DELV Fixed Borrow). |

Table 2: Key Fixed-Rate DeFi Protocols and Their Mechanisms

Structured Products and Tokenized Debt Instruments

Beyond direct fixed-rate lending, DeFi develops complex tokenized debt and structured products. Smart contracts automate debt offerings, ensuring efficient issuance, trading, and management on DEXs, cutting costs and intermediaries.

Protocols like DELV lead this innovation. Its “Hyperdrive One” allows users to buy discounted assets like stETH for a fixed yield, similar to zero-coupon bonds. DELV also offers “Fixed Borrow” to cap variable loan costs. DeFi’s “money legos” design enables seamless integration of these modular products.

Tokenization waves by asset capitalization.

A major trend is RWAs. Protocols are tokenizing tangible assets like treasury bills and real estate. This bridges traditional finance with DeFi, bringing stable, less volatile assets on-chain.

Ondo Finance focuses on bringing Real-World Assets (RWAs) like US Treasury bills onto the blockchain as tokenized fixed-income products. An institutional investor can subscribe to a fund on Ondo that holds short-term US Treasury bills. Their investment is represented by a token that earns a fixed yield (e.g., 4.09% APY) tied to the yield of the underlying Treasury.

This provides a transparent, blockchain-based access to a traditionally stable asset class, offering the predictability and risk profile that corporate treasuries and large financial institutions demand for structured, enterprise-grade financial products within the DeFi ecosystem.

Yield from Ondo Finance

This strategic shift leverages blockchain’s efficiency for off-chain assets. It significantly increases DeFi’s TVL by attracting institutional capital, especially those mandated to hold traditional fixed-income. This convergence blurs TradFi and DeFi lines, suggesting blockchain will underpin a broader financial product spectrum, driving DeFi’s mainstream adoption and regulatory acceptance.

Core Mechanisms of Fixed Yield in DeFi

Smart contracts form the bedrock of all fixed yield mechanisms in DeFi. These self-executing agreements automate every aspect of yield farming, lending, and debt issuance. They precisely define reward distribution, establish liquidity pool policies, and ensure transaction transparency and accuracy without human intervention.

AMMs like Uniswap and Curve, are crucial DeFi infrastructure components. They facilitate decentralized trading and liquidity provision, letting users swap tokens by interacting directly with liquidity pools. Liquidity Providers (LPs) deposit token pairs into these pools, earning a share of trading fees.

Upon providing liquidity, LPs receive LP tokens, representing their proportional share of the pool. These critical tokens can be staked in other protocols for additional rewards, forming the basis of many complex yield farming strategies.

The rising complexity of DeFi strategies has led to yield aggregators and vaults. Protocols such as Yearn Finance optimize yields across various DeFi protocols. These platforms automate investment strategies, often including auto-compounding, to maximize user returns with minimal manual effort. They serve as an easy entry point for DeFi, letting users invest without needing to understand every portfolio component.

Advantages and Disadvantages of Fixed Yield in DeFi

Fixed yield offerings in DeFi present a compelling proposition for investors, yet they are accompanied by a distinct set of risks and challenges that necessitate careful consideration.

Benefits for Investors

Fixed yield appeals to investors due to enhanced predictability and passive income. A stable interest rate throughout the investment’s term is invaluable for financial planning, budgeting, and tax considerations, offering clear expected returns despite market volatility.

Fixed yield products typically demand minimal active management. This “set-it-and-forget-it” feature makes them a genuine source of passive income, freeing investors from the constant monitoring needed for variable yield strategies.

Compared to traditional finance, DeFi fixed yield can offer significantly higher returns. These opportunities also allow investors to diversify portfolios across various protocols and cryptocurrencies, helping mitigate risk.

Leveraging blockchain and smart contracts, DeFi fixed yield platforms offer unparalleled transparency. All transactions are publicly recorded, enabling independent verification and auditing. Smart contract automation reduces human error and fraud. Furthermore, DeFi platforms are open and permissionless, fostering greater financial inclusion by providing access to anyone with an internet connection and a digital wallet, regardless of credit history or location.

Inherent Risks and Challenges

Despite the benefits, fixed yield in DeFi presents substantial risks investors must understand.

Smart contract vulnerabilities are a primary concern; bugs or exploits can lead to significant financial losses. While the yield rate is fixed, many protocols rely on underlying liquidity pools susceptible to impermanent loss, where asset price changes can reduce the dollar value of deposited funds. Liquidity risk means investors might struggle to exit positions in less liquid protocols or during market stress.

Oracle risk arises if manipulated or incorrect data feeds trigger faulty contract execution, leading to losses. Governance risk exists in some protocols where concentrated power among large token holders can lead to detrimental decisions.

Even with a fixed interest rate, market volatility of the underlying crypto assets can cause an overall loss in fiat terms. Gas fees, especially on busy networks, can be substantial, impacting profits. Rug pulls and scams remain a threat in the nascent DeFi space, where developers can withdraw all invested capital, leaving investors with worthless tokens.

Finally, regulatory uncertainty varies across jurisdictions, posing challenges for DeFi projects and creating unpredictable legal frameworks for investors. DeFi also lacks standardized benchmarks and robust hedging instruments common in traditional finance, making interest rate risk management difficult in a predominantly floating-rate environment.