From chocolates to shades: Bolivia’s embrace of USDT signals major shift

- Bolivian shops now display prices in USDT, showing growing stablecoin trust.

- Tether maintains dominance with $132.97B weekly volume and 61% market share.

In Bolivia, a subtle yet transformative shift is underway as stablecoins begin redefining how daily transactions take place.

Shops across the country are now displaying product prices in Tether’s USDT, marking a striking shift in consumer behavior.

From sunglasses to chocolates like Milka and Cadbury, everyday items now carry digital price tags.

Tether CEO Paolo Ardoino appreciates USDT’s success

Remarking on the same, Tether CEO Paolo Ardoino took to X (formerly Twitter) and highlighted USDT’s deep integration into everyday financial transactions.

The Central Bank of Bolivia reported that some products are now solely priced in USDT, reflecting increasing public confidence in stablecoins during times of economic instability.

This coincides with the crypto market pushing for a late-week recovery, network adoption continues to climb steadily.

According to recent data from Santiment, Ethereum [ETH] leads with over 148 million holders, followed by Bitcoin [BTC] at 55 million.

Even memecoin Dogecoin [DOGE] boasts nearly 8 million holders, slightly edging out Tether, which stands at 7.79 million.

Jon Ma adds on to the fray

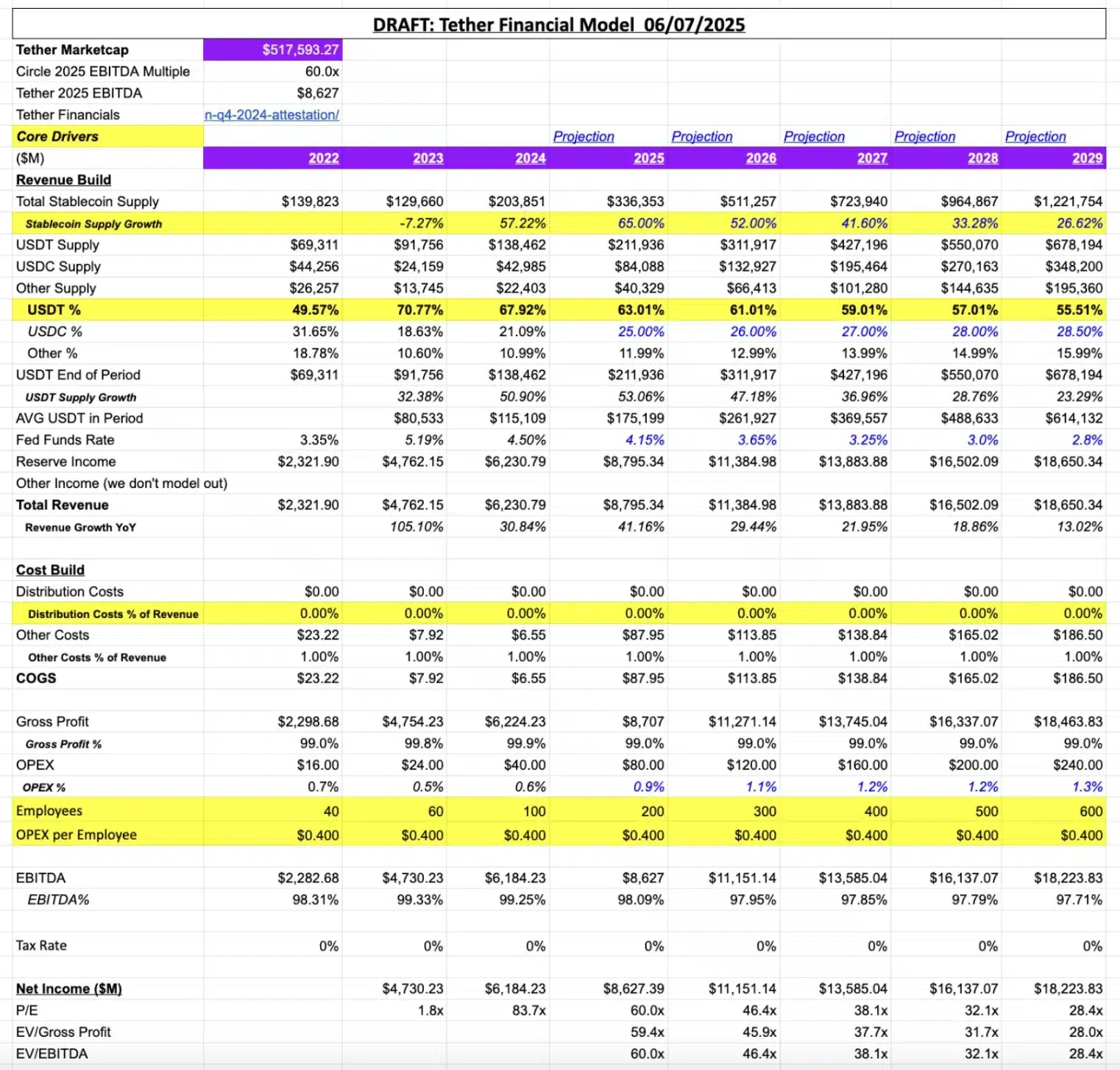

Artemis CEO Jon Ma chimed in, stating that while USDC may grow, Tether’s dominance could hold firm depending on broader market dynamics.

His remarks emphasize the importance of personal due diligence in analyzing stablecoin performance.

He further added,

“Either way, crazy how profitable Tether is.”

Tether’s dominance in the stablecoin sector remains unshaken, supported by both market utility and strong financial metrics.

USDT current dynamics

Meanwhile, in just the first week of June, USDT recorded an impressive $132.97 billion in transaction volume, according to Visa’s on-chain analytics.

Artemis’ Jon Ma noted that while Circle’s 2025 EBITDA multiple might compress over time, Tether’s financial resilience remains clear.

Currently holding over 61% of the stablecoin market share, USDT has entrenched itself as crypto’s go-to hedge, offering liquidity, reliability, and widespread trust when it matters most.