Ethereum whales scoop up $364 mln – but why ETH isn’t rallying yet

- Three Ethereum whales, including one linked to Consensys, bought over $364 million in ETH over 24 hours.

- ETH lacks full-scale whale backing for now, leaving the altcoin stuck in a range with muted momentum.

Over the past day, Ethereum [ETH] large entities have made a strong comeback, accumulating hundreds of millions in ETH. Thus, multiple transactions involving large entities have been observed by on-chain monitors.

Whales quietly reload ETH

As per Lookonchain, Abraxas Capital withdrew 13,771 ETH worth $36.4 million from Binance. This wasn’t their first accumulation—Abraxas has been active over the past two months.

Next, a newly created wallet withdrew 3056 ETH worth $7.96 million from Binance.

However, the most notable whale activity over the past day involves Consensys.

According to Arkham Intelligence, a whale linked to Consensys acquired $320 million of ETH from Galaxy Digital.

After this acquisition, the whale transferred it to a new address and staked $120 million worth of ETH with the Liquid Collective.

In total, these three whales have acquired a whopping $364.36 million worth of ETH tokens. Such a massive accumulation not only signals bullishness but also conviction in the market.

Naturally, such inflows tend to increase buying pressure and suggest optimism for a near-term rebound.

Large transactions trend downward

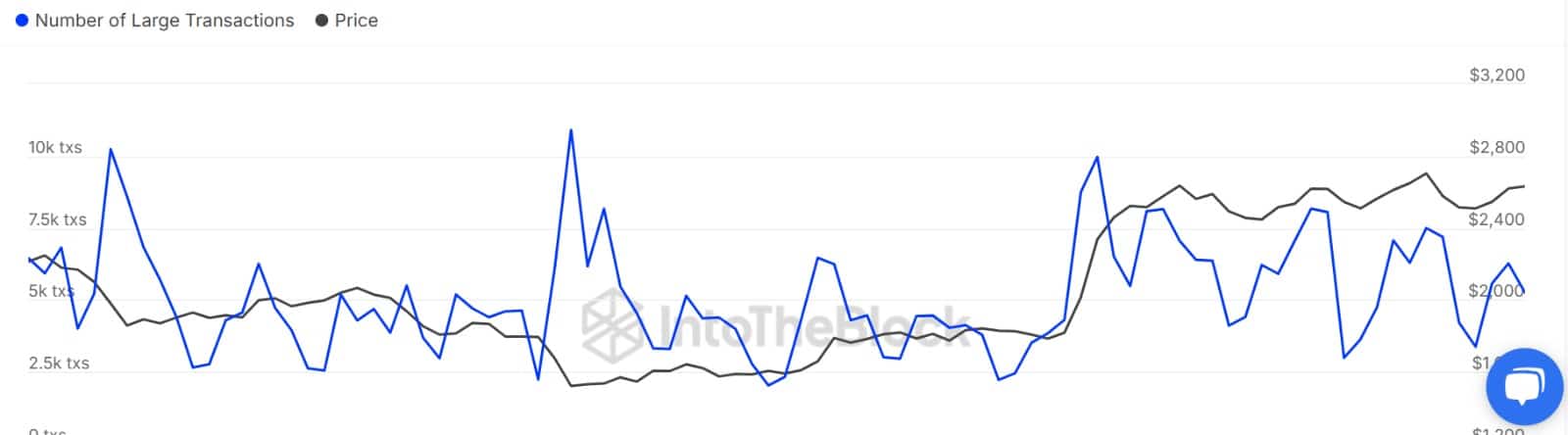

Despite these whale transactions observed over the past day, whale activity has decreased across the board.

Six months ago, when Ethereum was trading at approximately $3,819, there were a total of 65,600 large transactions worth over $100,000.

During this time, transactions between $100,000 and $1 million accounted for 53,800 transactions.

The cohort for transactions between $1 million and $10 million recorded 10,500 transactions, while those exceeding $10 million had 1,300 transactions.

Fast-forward to May 2025—ETH trades at ~$2,590, and the numbers look drastically different.

As such, those worth $100k to $1 million saw 33.9k transactions, while those worth $1 million to $10 million saw $5.8k transactions, with transactions worth over $10 million dipping to 590.

Currently, total Large Transactions have dipped to 5.26k, signaling a massive dip in whale activity.

What’s next for ETH?

So, what does this mean for ETH going forward? On one hand, whale accumulation—like the $364 million bought this week—shows that some large holders still believe in ETH’s upside.

On the other hand, the drop in transaction count indicates many whales are currently inactive.

Of course, ETH doesn’t need all whales to move the needle, but their support is crucial for sparking strong rallies and potential FOMO.

Right now, that support appears fractured.

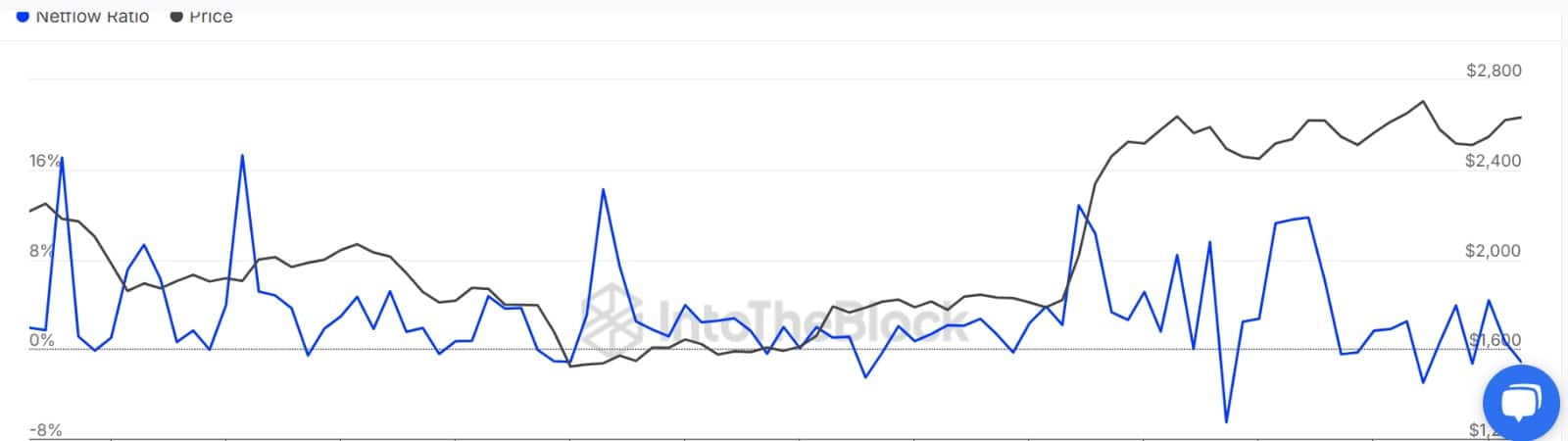

On the positive side, it seems those left in the market are not sellers but buyers, giving some hope to market participants.

The Whale Netflow Ratio dropped to -1.18, meaning more ETH is moving away from exchanges than toward them. In short, whales aren’t selling—they’re holding or buying.

This could be the first signal of a potential return of interest. However, a strong trend reversal is not yet in sight.

At prevailing market conditions, Ethereum lacks strong support from large whales, thus we will see the altcoin continue to trade sideways.