Bitcoin Whales Return as BTC Price Struggles

Bitcoin (BTC) is down 6% over the past eight days after reaching new all-time highs, and recent technical signals suggest growing uncertainty in the market. Whale activity, which briefly declined, has started to recover, hinting that some large holders may be returning to accumulation.

However, bearish indicators are mounting, with the Ichimoku Cloud showing weakness and BTC trading below key support levels. As price hovers just above $104,584, the threat of another death cross and deeper downside remains unless bulls can reclaim momentum above resistance.

Bitcoin Whale Count Rebounds After Strong Decline

The number of Bitcoin whales—addresses holding between 1,000 and 10,000 BTC—has rebounded slightly to 2,006 after falling to 2,002 earlier this week.

This brief dip followed a sharper decline from 2,021 on May 25, marking a notable short-term reduction in large holders. However, the recovery suggests that some whales may be returning to accumulation.

While the fluctuation was small, such changes are closely monitored, as they often precede shifts in market sentiment or price action.

Monitoring whale behavior is essential due to their outsized influence on Bitcoin’s liquidity and volatility. A decline in whale count can indicate profit-taking or distribution, often signaling caution or a potential market cooldown.

Conversely, a stabilization or rise—like the one observed now—can ease investor concerns and support price resilience at elevated levels.

The number of large holders recovering after a sharp drop may signal renewed confidence among key players, reducing the immediate risk of heavy selling pressure and helping Bitcoin maintain its current range.

Technical Indicators Turn Bearish as BTC Struggles Below Key Levels

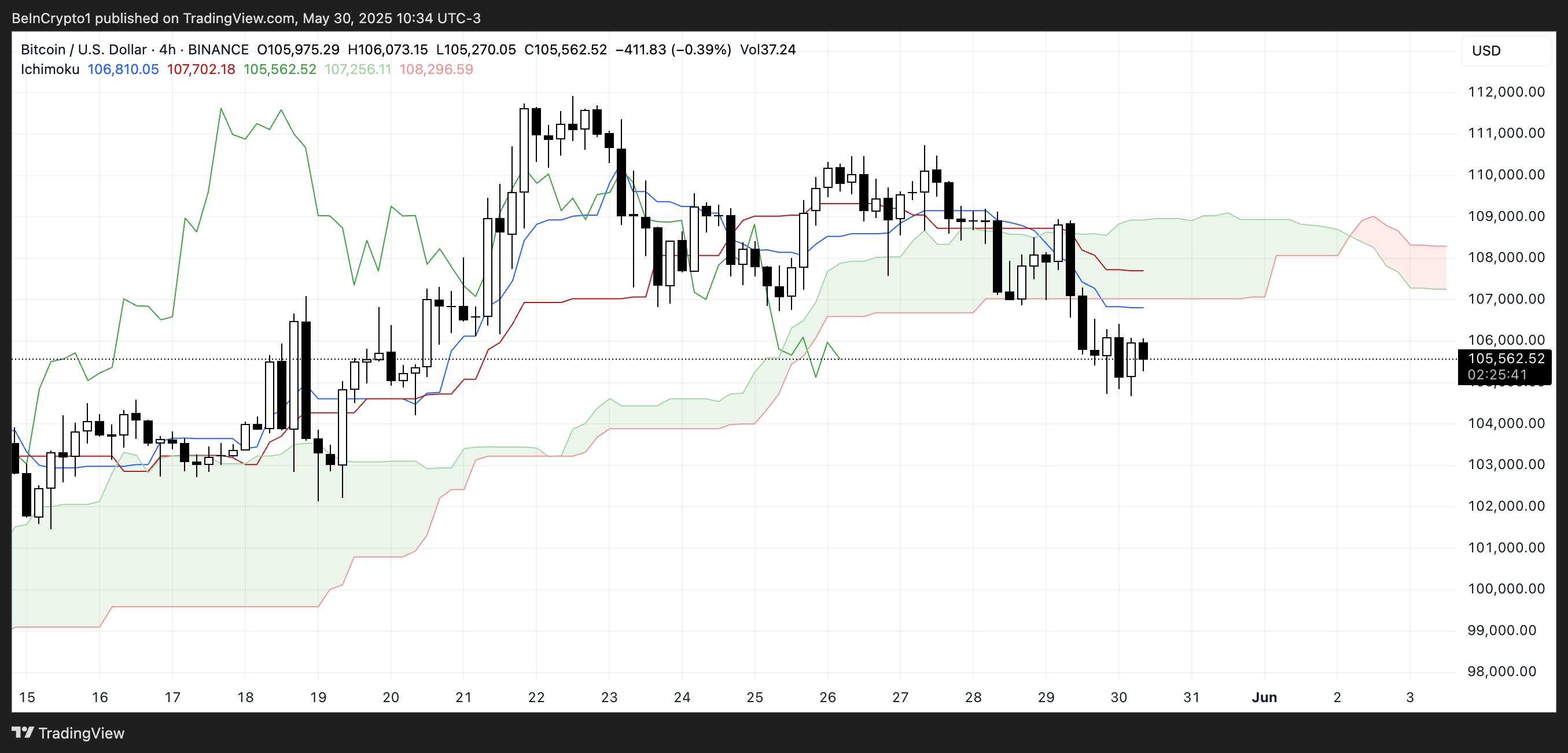

The Ichimoku Cloud chart for Bitcoin shows a short-term bearish structure.

Price action is currently positioned below the Kumo (cloud), which is shaded in green and red—indicating that Bitcoin is trading in a zone of weakness relative to historical and projected momentum.

The cloud ahead is red, suggesting that the trend bias for the near future remains bearish unless a reversal breaks through the upper boundary.

The Tenkan-sen (blue line) is below the Kijun-sen (red line), confirming short-term downward momentum. Both lines are angled downward, another bearish signal.

The Chikou Span (green lagging line) is below both price and the cloud, reinforcing that current momentum lacks bullish confirmation.

The future cloud also narrows, which may hint at a potential equilibrium or a consolidation zone ahead. For now, the Ichimoku components align with a bearish outlook. A bullish shift would require the price to break above the cloud and flip the future Kumo from red to green.

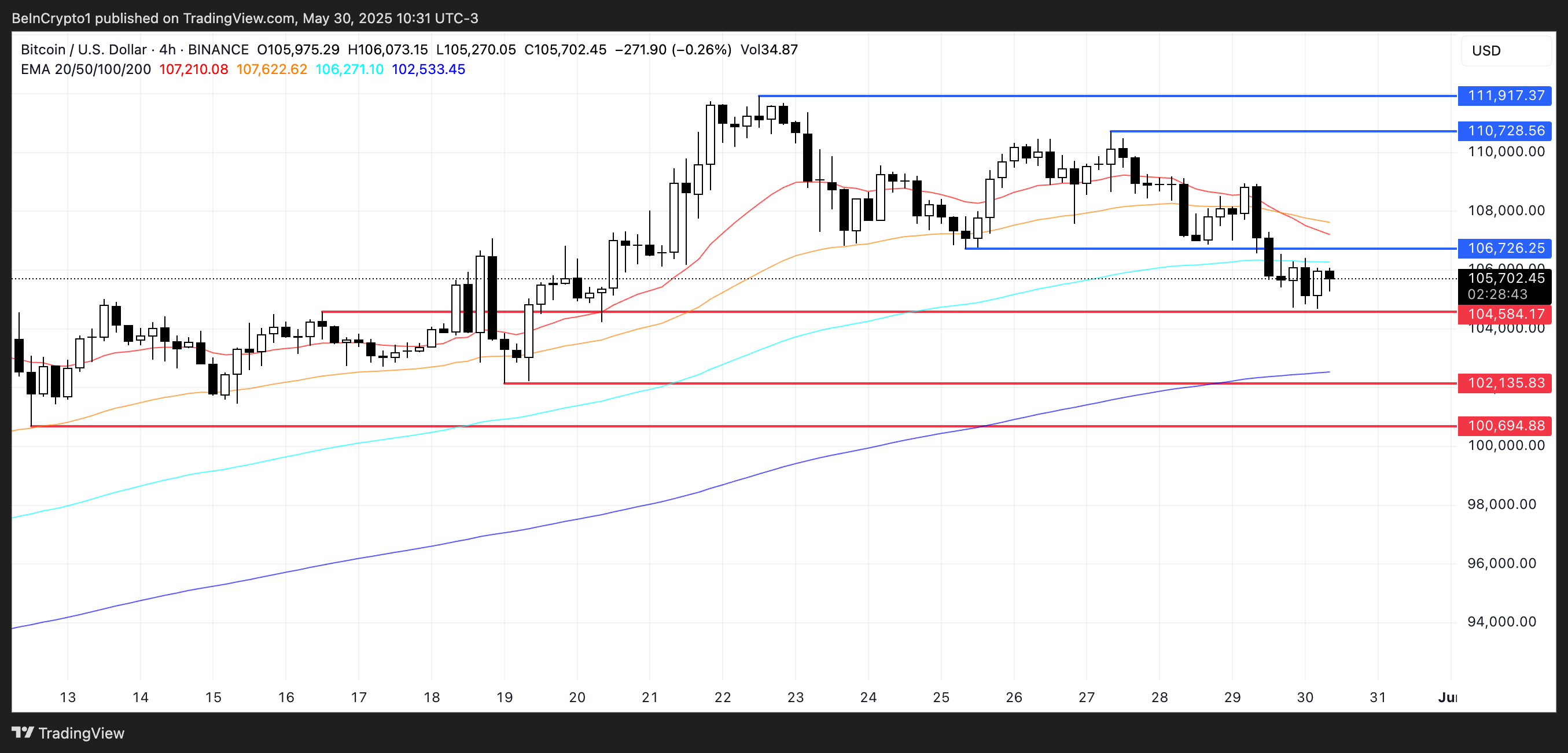

Bitcoin Faces Potential Death Cross

Bitcoin price recently formed a death cross, and technical indicators suggest another one could be on the horizon. Price is currently trading just above critical support at $104,584, which has acted as a short-term floor.

If this support fails, the next downside targets sit at $102,135 and potentially as low as $100,694 if the selling pressure intensifies.

The presence of back-to-back death crosses, combined with weakening price action near these levels, raises the probability of a deeper correction in the short term.

On the bullish side, if Bitcoin can mount a recovery and establish strong momentum, it may retest resistance at $106,726.

A break above this level could trigger a sharper move toward $110,728, with a further upside possibility of reaching $112,000 if the rally accelerates.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.