Crypto crisis unfolds: 1.8M tokens fail in Q1 2025 – What sparked it?

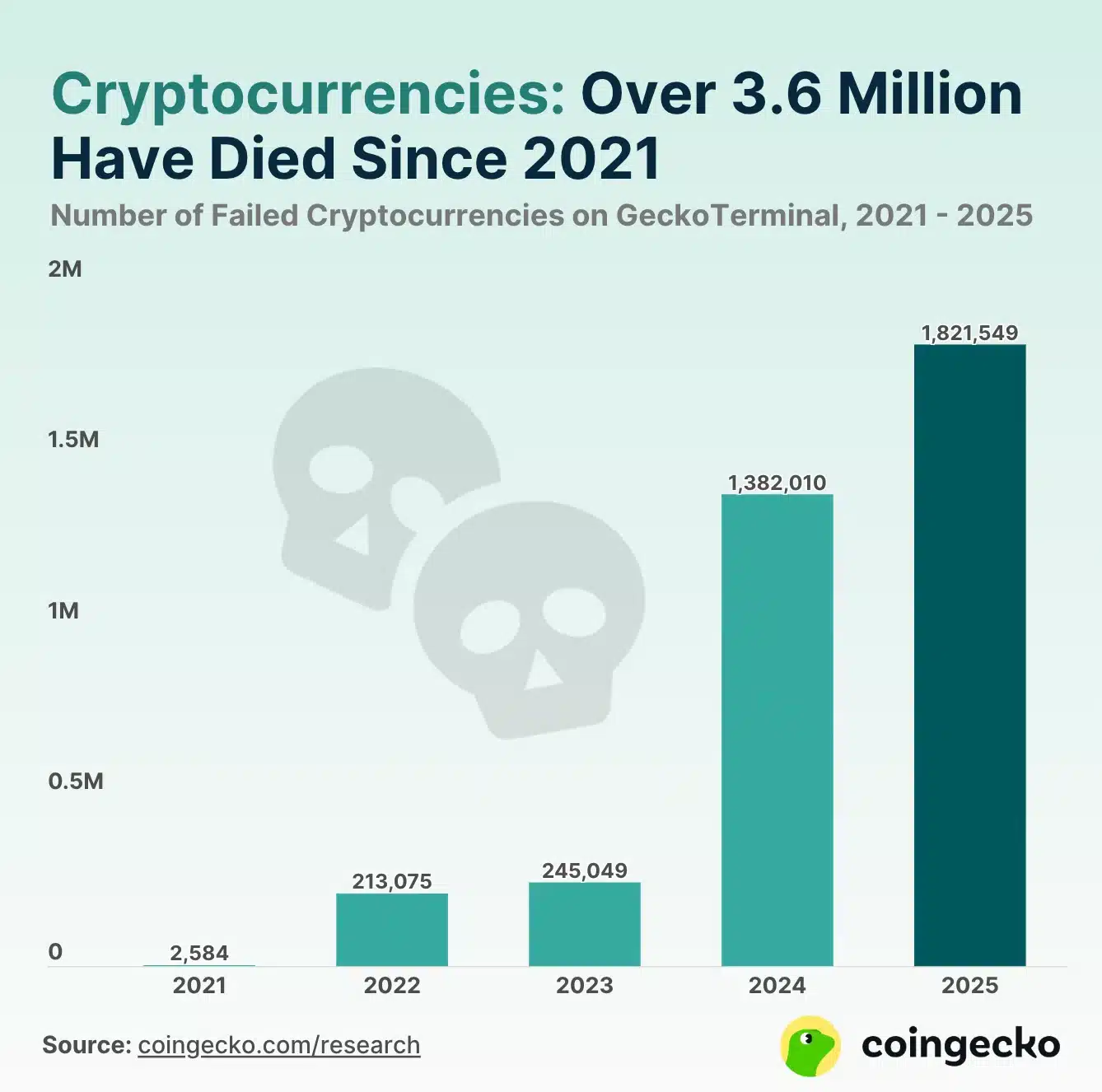

- Over 3.7 million crypto projects have failed since 2021, mostly in 2024–2025.

- Bitcoin’s dominance surged in 2025, shrinking the altcoin market by $300 billion.

The year 2025 has ushered in significant shifts for the crypto ecosystem, marked by both broader acceptance and rising uncertainty.

Despite renewed optimism under President Donald Trump’s administration, recent data from CoinGecko paints a dark picture, wherein over half of all cryptocurrencies listed since 2021 have failed.

Out of nearly seven million tokens tracked by GeckoTerminal, a staggering 3.7 million are no longer active.

The most alarming trend emerged in early 2025, when 1.8 million tokens collapsed in just the first quarter, accounting for nearly half of all project failures.

This wave of token deaths appears closely tied to heightened market instability triggered around the time of Trump’s inauguration, raising questions about the sustainability of the crypto boom amid shifting regulatory and economic conditions.

In 2021, GeckoTerminal tracked just over 428,000 listed projects, but by 2025, that figure had surged to nearly 7 million.

How was pump.fun a catalyst for this crisis?

The dramatic rise in crypto projects can be largely attributed to pump.fun, a platform that simplified token creation. It lowered barriers significantly, leading to a surge in meme coins and hastily developed projects.

However, this growth has come with significant drawbacks. As of the 31st March 2025, 1.8 million crypto projects have failed. This marks the highest annual failure rate ever recorded, accounting for almost half of closures since 2021.

In 2024, a record-breaking 3 million new cryptocurrencies were launched. However, 1.4 million projects failed during the same year. This figure accounts for 37.7% of all closures from the past five years.

The launch of pump.fun played a key role in driving both project creation and collapse. It enabled the mass production of low-effort tokens, amplifying the failure rates. Before its launch, yearly failures rarely exceeded six digits.

Meanwhile, the broader crypto market paints a mixed picture, showing both opportunities and challenges

Overall market performance

The global crypto market cap has reached $3.01 trillion, with Bitcoin [BTC] nearing the $100K milestone. BTC was trading g at $96,311.37, at press time.

Meanwhile, the altcoin segment has experienced significant losses. Bitcoin’s dominance surged by 13% between January and April 2025. This increase reduced the altcoin market’s valuation by nearly $300 billion.

This widening gap between Bitcoin and the rest of the crypto market reflects a maturing industry. The focus appears to be shifting toward quality and resilience, away from speculative projects.

This trend suggests that the era of low-barrier meme token mania may be approaching its conclusion.