Solana Price Prediction in April: Short term outlook

After a turbulent quarter in the crypto market, Solana (SOL) is once again in the spotlight as investors increasingly ask: is SOL forming a bottom and preparing for a rebound, or is the downtrend not over yet?

As of today, SOL is trading in the $130–$134 range, significantly below its March peak of $205. However, technical indicators and capital flows are showing some encouraging signals, potentially laying the groundwork for a short-term recovery.

Technical Indicators Suggest a Short-Term Bottom for Solana

The $120 level is currently acting as the most critical technical support for Solana SOL in April. As long as the price holds above this zone, a short-term recovery toward the $144-$145 range in the coming weeks remains a realistic possibility.

On the daily chart, this zone represents the nearest resistance, where previous price rallies have repeatedly faced rejection. Reclaiming this level would serve as a confirmation signal for a clear short-term trend reversal.

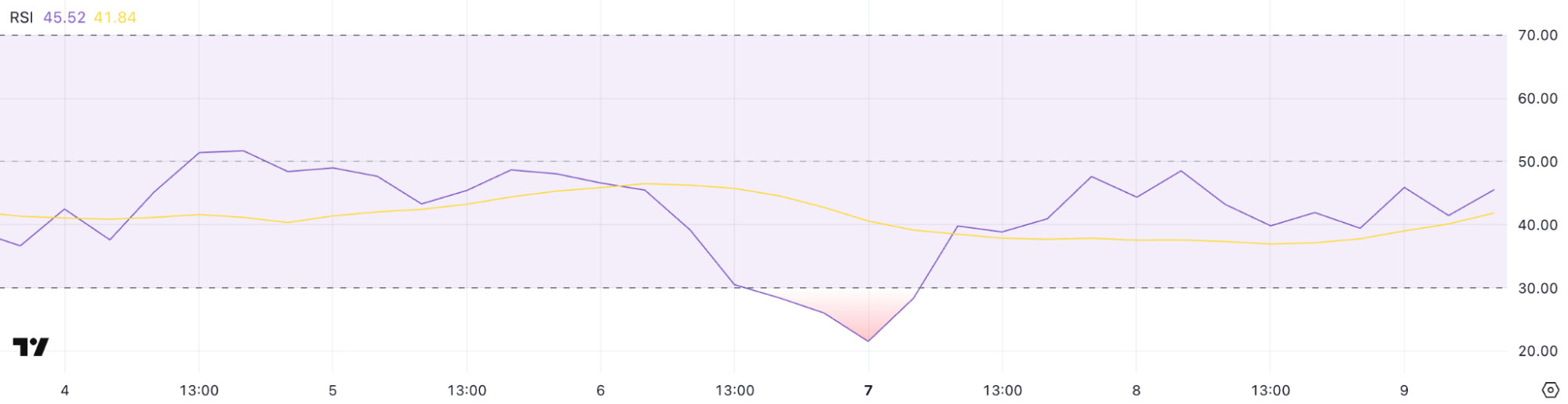

In addition, the Relative Strength Index (RSI)—a momentum indicator used to gauge overbought or oversold condition, fell to around 35 late last week. This level is often interpreted by technical analysts as an indication of an oversold market, suggesting that selling pressure may be exhausted and that a rebound could be imminent.

Several bullish candlestick reversal patterns have also started to appear on the daily chart, further supporting the case for a potential short-term bounce.

Beyond technical indicators, on-chain data from Coingape provides additional insights. During the recent price consolidation between $125 and $130, there was a notable uptick in trading activity from whale addresses (wallets holding more than 100,000 SOL), hinting at accumulation during this range.

The combination of technical analysis and on-chain behavior paints a relatively optimistic short-term outlook for SOL heading into the second half of April, provided that macroeconomic conditions remain stable. That said, a daily close above $145 with strong volume is still required to confirm a sustainable bullish breakout.

Macroeconomic Factors Remain a Key Influence

Despite encouraging technical signals, SOL’s outlook remains heavily shaped by the broader global market environment. A new U.S. tariff policy targeting imported electronics from Asia – including mining equipment and blockchain-related hardware, has raised concerns among investors. This is a key reason why the Fear & Greed Index remains at 31, firmly in “fear” territory.

In addition, persistently high interest rates in the United States have contributed to capital outflows from risk assets like crypto, along with a weak recovery in the stock market. Every price rally has sparked strong profit-taking, creating invisible pressure.

However, there are signs that the U.S. Federal Reserve (Fed) may consider cutting interest rates if economic conditions deteriorate, particularly if the new tariffs trigger a recession. Fed may introduce stimulus measures if needed to support economic growth.

What’s Keeping SOL Resilient?

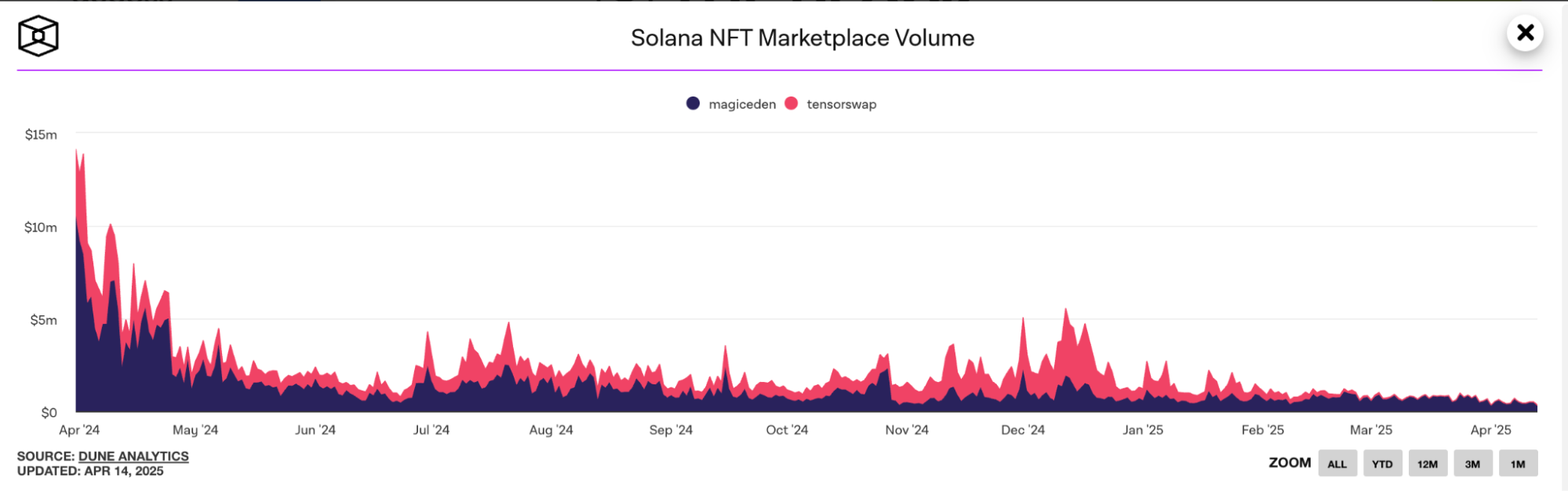

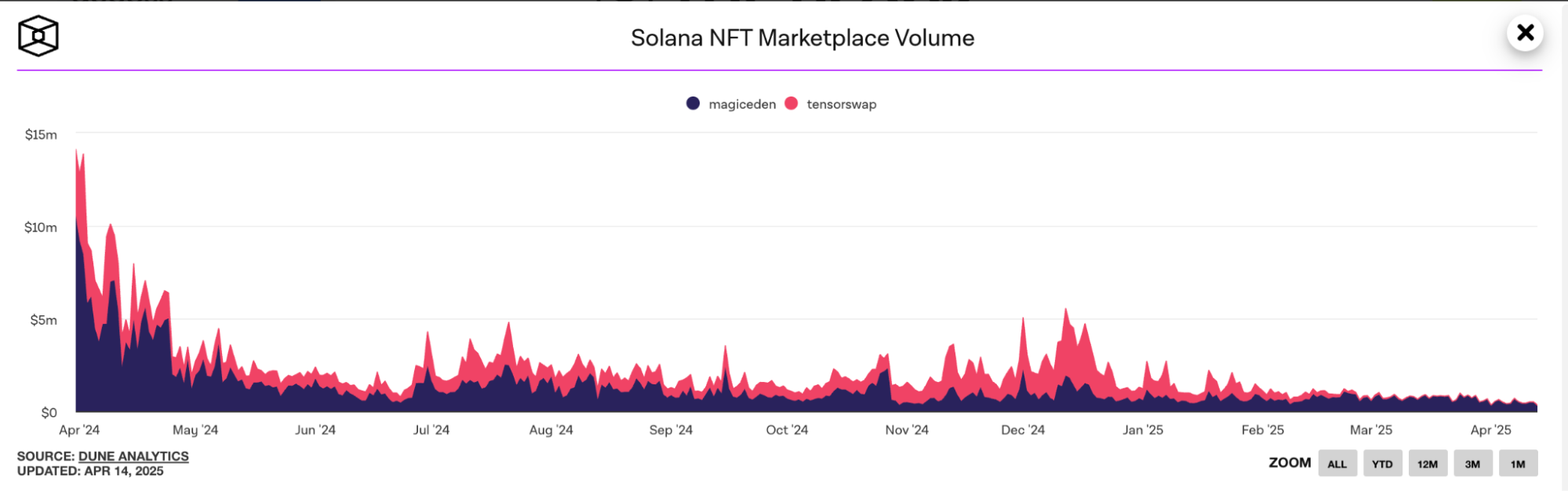

Amid ongoing volatility in the broader crypto market, the Solana ecosystem continues to show strong momentum—particularly in the NFT and memecoin sectors. Platforms like Magic Eden and Tensor, and the growing popularity of memecoins, are playing a crucial role in sustaining activity across the Solana network.

The vibrant NFT landscape has contributed significantly to network usage, providing a fundamental support layer for SOL’s value.

Magic Eden remains the leading NFT marketplace on Solana, currently accounting for approximately 95% of all NFT trading volume on the network.

Solana NFT volume – Source: The Block

Meanwhile, memecoins are seeing explosive activity. For example, POPCAT has surged over 105% in the past four days, reaching a price of $0.25. Whale accumulation exceeding $80 million, along with rumors of listings on Binance and Robinhood, has fueled this growth.

Similarly, FARTCOIN has gained more than 300% over the past month, now trading at $0.87 with a market cap approaching $1 billion.

A report from Gate.io shows that about 64.9% of all SOL tokens sit in staking contracts, indicating strong long-term confidence in the network despite recent price corrections. Although staking hasn’t surged significantly since then, the current level clearly signals that most SOL holders don’t plan to exit in the short term.

With SOL’s inflation rate set to gradually decline over time and a more optimized staking reward schedule in place, the incentive for long-term token holding continues to strengthen. This phenomenon partly explains why, even though SOL has dropped more than 35% since early March, it continues to hold the $125–$130 support zone.

Solana Price Prediction

Taken together, with technical indicators pointing toward a bottom and whales continuing to accumulate near $130, these factors support the view that SOL could stage a solid recovery if macro conditions stabilize.

In the short term, a breakout above the $145 resistance level would serve as a clear confirmation of a bullish reversal.

Conclusion

Despite facing significant pressure from the macro environment, including high interest rates, U.S. trade policies, and a prevailing “risk-off” sentiment among investors, the underlying fundamentals of the Solana ecosystem continue to serve as a strong foundation supporting SOL’s value.

As long as the support zone around $125 holds and macro conditions do not deteriorate suddenly, SOL has a realistic chance of rebounding toward the $145 level in the short term and potentially regaining sustainable upward momentum in the mid-term.

Read more: ETH Price Prediction in April: Short & Mid Term Analysis