Dogecoin price prediction: Can DOGE rally to $0.22 and beyond?

- DOGE has hit a key support level on the weekly chart, hinting that a major move is near.

- The coin’s volume, OI-Weighted sentiment, and multiple millions worth of DOGE purchased place it on the bullish end.

Dogecoin’s [DOGE]fall in the past 24 hours could be beneficial for the asset, allowing it to see a continued move to the upside similar to its past week’s trend where the asset gained 18%.

This rally would require a collective effort of the spot and derivative market traders to push the asset to the upside. Here’s how it could play out:

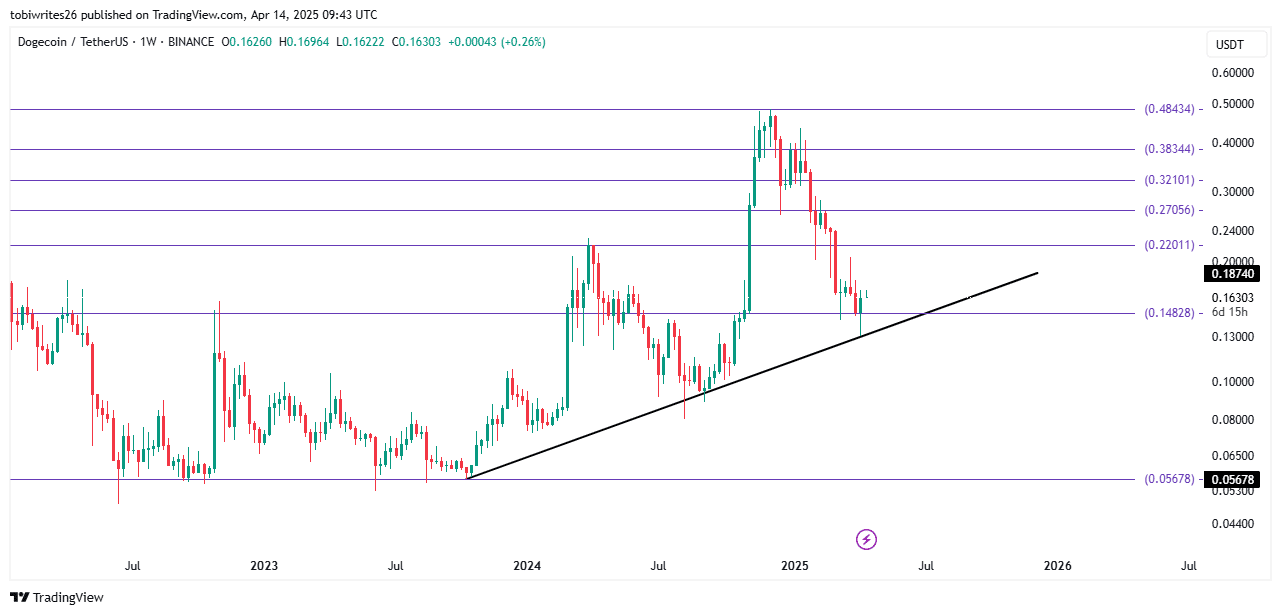

Key support level could shoot DOGE higher

Dogecoin has just traded into a key level on the chart, known as the ascending support line, which could be a major catalyst for a price rally.

This level has been a major price catalyst in the past, which prompted the recent market high of $0.48. This time around, the rally would be within the range of $0.22 to $0.48 depending on market movements.

It’s essential to highlight that if Dogecoin surpasses the $0.22 level, it could advance further. Notably, the $0.38 level represents a significant target, as it houses a major batch of liquidity clusters in the market.

This potential progression underscores the importance of DOGE maintaining upward momentum to achieve this key milestone.

Buying interest and volume rises

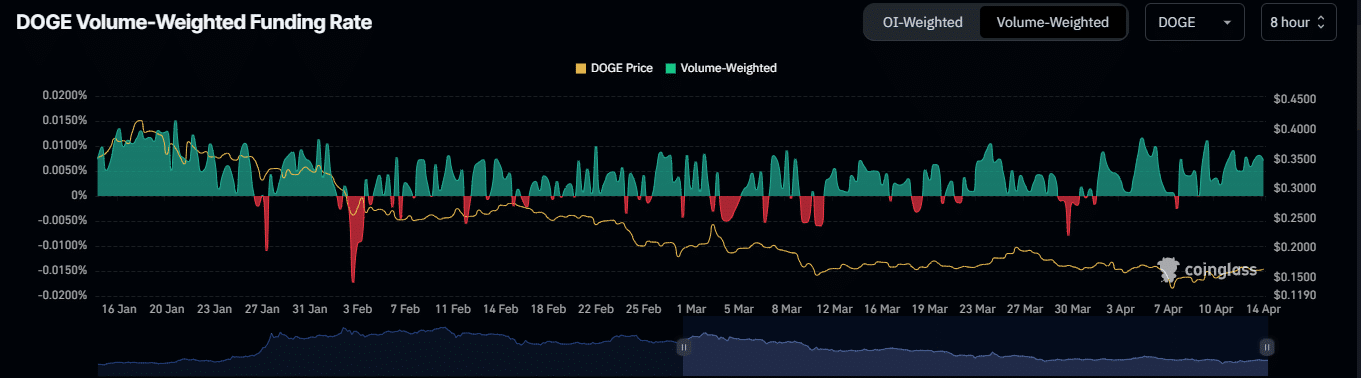

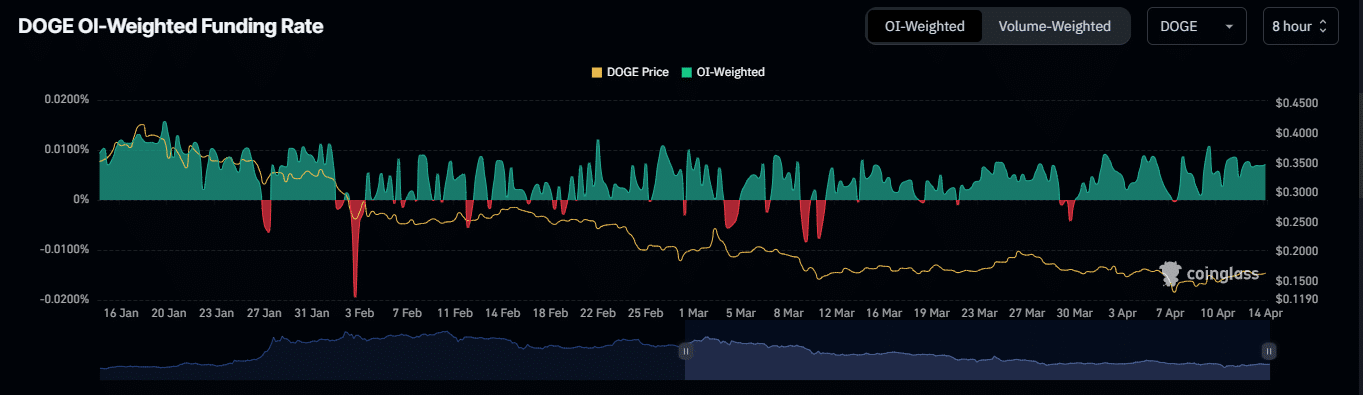

There’s been growing interest in the derivatives market, with the Open Interest (OI)-weighted Funding Rate and the Volume-Weighted Funding Rate seeing a gradual market rise.

At the time of writing, the volume in the general market has surged 16.12%, reaching $2.93 billion, with the option volume climbing an additional 87.59% in the past 24 hours.

The Volume-Weighted Funding Tate combines market volume and Funding Rate to provide a more precise sentiment analysis. Standing at 0.0071% at press time, it suggests the potential for continued market growth in the coming days.

Meanwhile, the Open Interest-Weighted Funding Rate is also positive, showing the same reading of 0.0071%.

This indicates that unsettled contracts in the market are predominantly held by long traders, pointing to a possible upward movement in the market.

With the growing volume and OI rising, it implies that the current long trades in the market are backed by major buying volume. This could have an impact on the asset seeing a price jump.

Spot market momentum adds to the potential jump

The recent rise in trading volume appears to be fueled by spot traders, who have purchased $8.9 million worth of DOGE. This follows several consecutive days of buying activity.

If spot market buying volume continues to increase in the coming days, the DOGE rally could gain significant momentum. Such momentum may accelerate its progress toward the intended price target.

The Long-Short Liquidation Ratio compares buyer and seller losses in the market. It indicates a higher number of sellers.

Currently, sellers have incurred losses totaling $630,000. In contrast, long traders have recorded comparatively lower losses.

This suggests increased buyer activity in the market. Buyers appear willing to pay a premium, potentially driving a price surge.