Is Worldcoin’s [WLD] 30% rally a prelude to ‘FOMO-driven’ growth to $1?

- WLD continues to ride the AI momentum with a $200M market cap surge, fueled by macro and micro drivers.

- The altcoin faces a key test at the $1 threshold, where breaching this level could trigger widespread FOMO.

The AI sector is seeing a strong bid following recent tariff exemptions on semiconductors and key tech imports from China.

Artificial Superintelligence Alliance [FET] is not the only one benefiting – Worldcoin [WLD] is capitalizing on the momentum, registering a solid 30% gain for the week.

However, much like Trump’s erratic trade policies, is WLD’s rally just another liquidity sweep targeting weak hands, or does it have the structural strength to hold its ground against looming resistance? AMBCrypto investigated.

Macro and micro drivers fueling the WLD boom

Worldcoin, launched by the AI visionaries behind ChatGPT, continues to capitalize on the sector-wide AI narrative. Over the past week, WLD’s market cap has expanded by nearly $200 million, currently hovering near $945 million. Hence, a clear sign of accelerating capital inflow.

In fact, with a circulating supply of 1.25 billion, a reclaim of the $0.80 level would vault WLD into mid-cap territory.

Momentum indicators reinforce bullish continuation. At press time, RSI remained in neutral territory but pointed north, while MACD was close to flipping bullish.

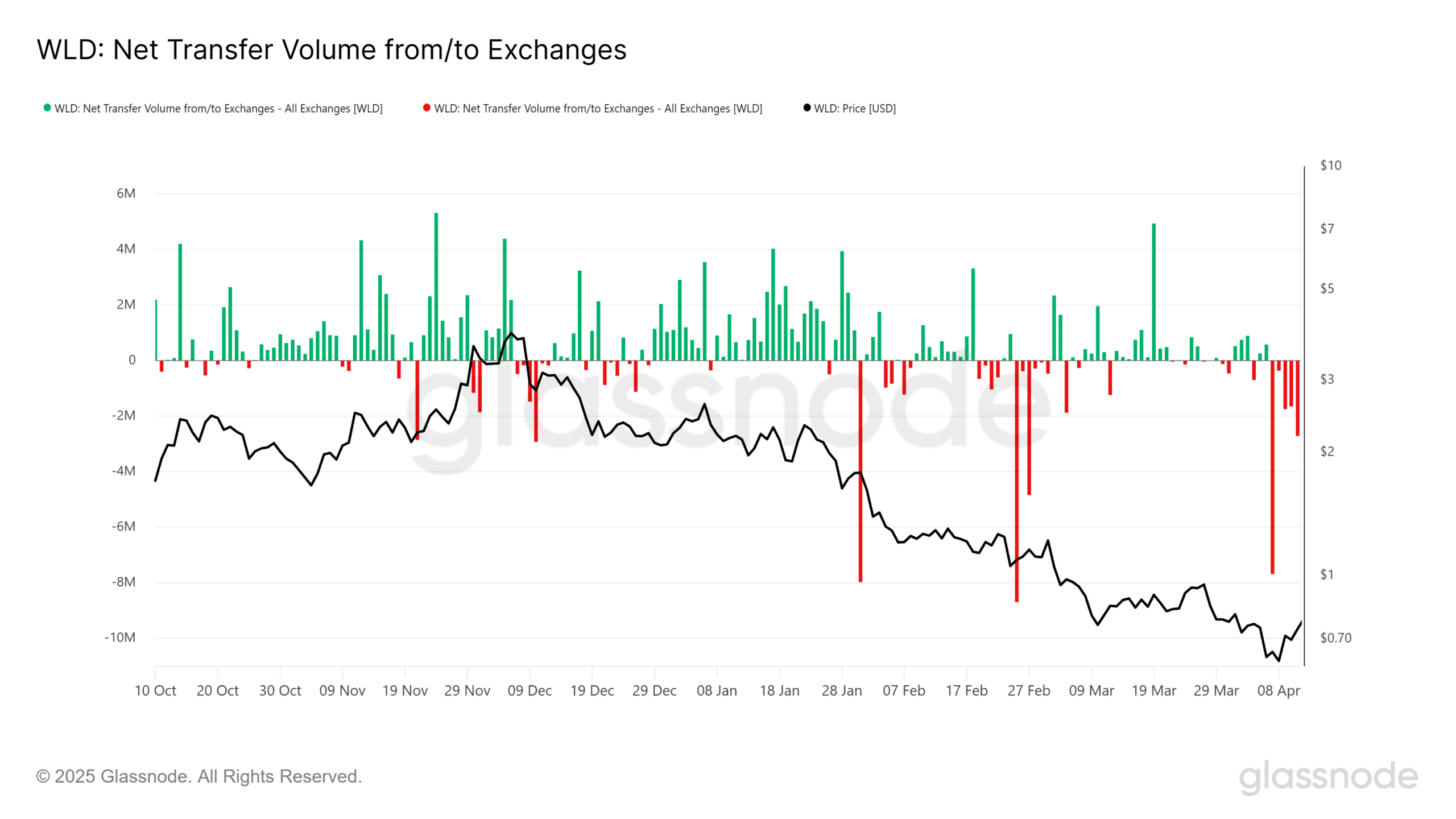

Notably, exchange outflows hit a four-day peak on the 11th of April, with 2.78 million WLD tokens absorbed. This aligned with macro developments, as Trump halted tariffs on China-based electronics.

Short liquidation data further reinforced the trend: On the 12th of April, approximately 206k short positions were wiped out, suggesting bears were caught offside as bulls defended key levels.

Moreover, the recent wick to $0.64 during the market-wide flush triggered a sharp rebound in Net Unrealized Profit/Loss (NUPL).

Although still in the red (capitulation zone), the move suggests an early-stage shift toward the optimism quadrant. Traditionally, it is a potential precursor to FOMO-driven upside.

From a structural perspective, WLD is exhibiting both technical and behavioral conviction. Furthermore, macro catalysts, smart money rotation, and rising momentum collectively signal that this may be more than just a reflexive bounce.

Key level to watch for FOMO

Typically, a rebound in NUPL often marks the onset of sell-side exhaustion — a phase where weak hands are flushed, paving the way for early accumulation.

Current on-chain trends, especially smart money absorption, suggest this foundational stage could be underway.

However, for true FOMO to ignite, which means pulling in both sidelined capital and prompting long-term holders to delay profit realization, WLD needs to reclaim the psychological $1 level.

According to AMBCrypto’s analysis of the chart below, previous entries into the FOMO/Hope zone on the NUPL metric have consistently aligned with price action breaching the $1 threshold.

Until WLD clears the $1 barrier, the likelihood of liquidations — both weak and strong hands — remains elevated, making the current dip a higher-risk zone for new entries.

Thus, NUPL becomes a pivotal indicator for monitoring potential bullish continuation. Watch for a decisive shift.