AVAX posts 16% weekly gain: A $30 move possible only IF..

TVL rebounds after three-month decline

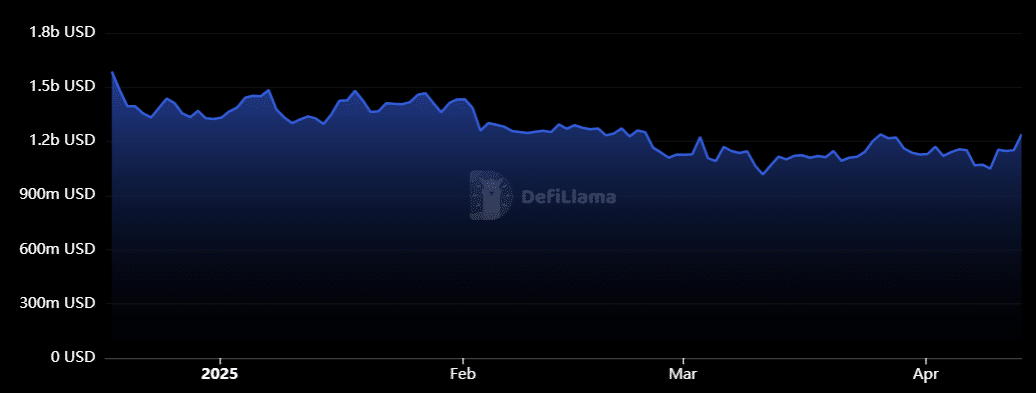

Avalanche’s TVL showed a notable rebound in April, climbing back above $1.2 billion after a persistent downtrend since early January.

The chart reflects a clear dip from over $1.5 billion at the start of 2025 to sub-$1.1 billion by late March, mirroring broader risk-off sentiment in crypto markets.

However, the recent uptick suggests a shift in momentum — likely driven by rising AVAX prices, user incentives, and protocol reactivations.

While still below Q4 2024 levels, this bounce marks the first sign of sustained recovery and could signal a turning point.

AVAX eyes $30, but resistance looms

At press time, AVAX was trading around $20, recovering from March lows near $16.

Technically, the $30 level remains a key psychological and structural resistance – last tested in early February 2025 and again during multiple rejections in mid-2024.

The chart indicates that AVAX is breaking out of its short-term downtrend. However, for a decisive move toward the $30 mark, bulls must clear the resistance zone between $24 and $26.

If momentum holds and AVAX firmly reclaims the $26 level, a push toward $30 becomes achievable. That said, a period of short-term consolidation is likely before any potential breakout occurs.