Is It The Right Time to Buy Altcoins Like Ethereum? History Says Y…

YEREVAN (CoinChapter.com) — Buy altcoins when the US President is wrecking the global economy? Let’s examine.

Golden Crossover Signals ‘Altcoin Buy’ Euphoria Ahead

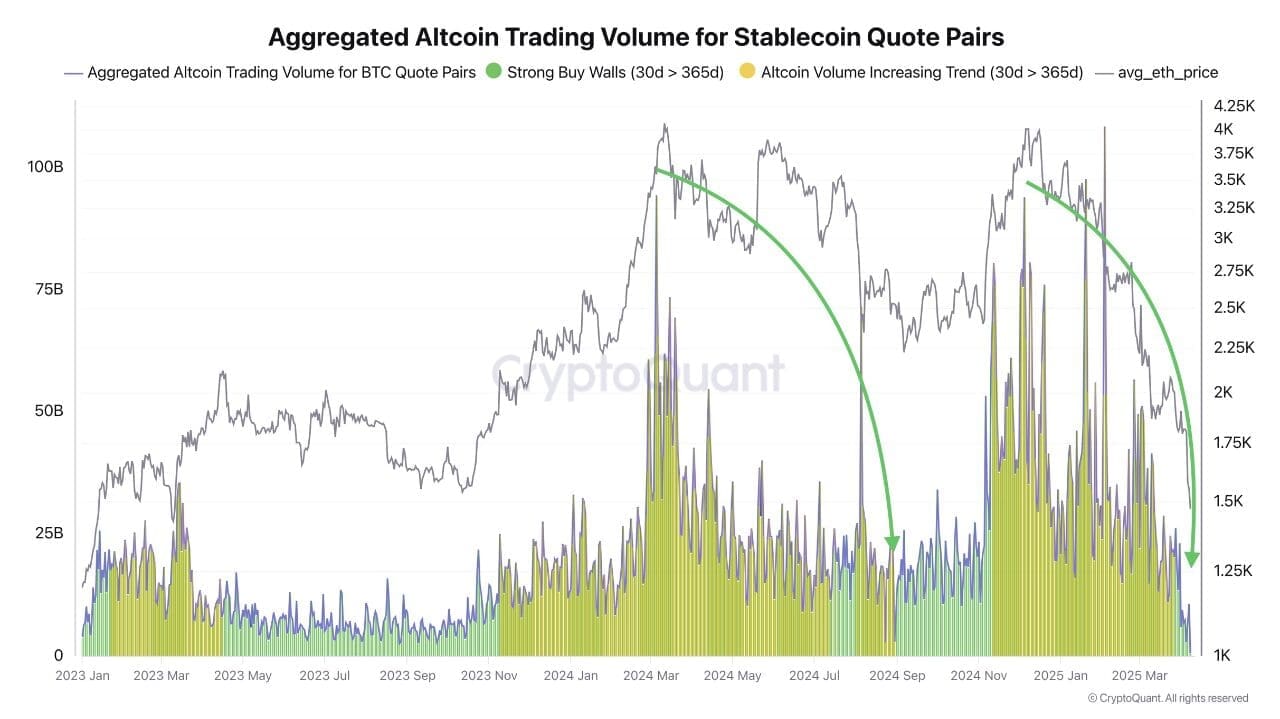

As of April 2025, the 30-day average trading volume of altcoins (quoted in stablecoins) had dipped below their yearly average (calculated on a 365-day timeframe), entering what has historically been a profitable accumulation zone, according to data resource CryptoQuant.

Historically, such crossovers have marked favorable entry points for mid-term altcoin season investors, as they tend to appear near market bottoms or consolidation periods.

The current dip mirrors the setup seen in September 2023, shortly after the bear market ended, suggesting a potentially opportune time to implement a dollar-cost averaging (DCA) strategy before trading activity and altcoin season picks up again, according to CryptoQuant analyst DarkFrost.

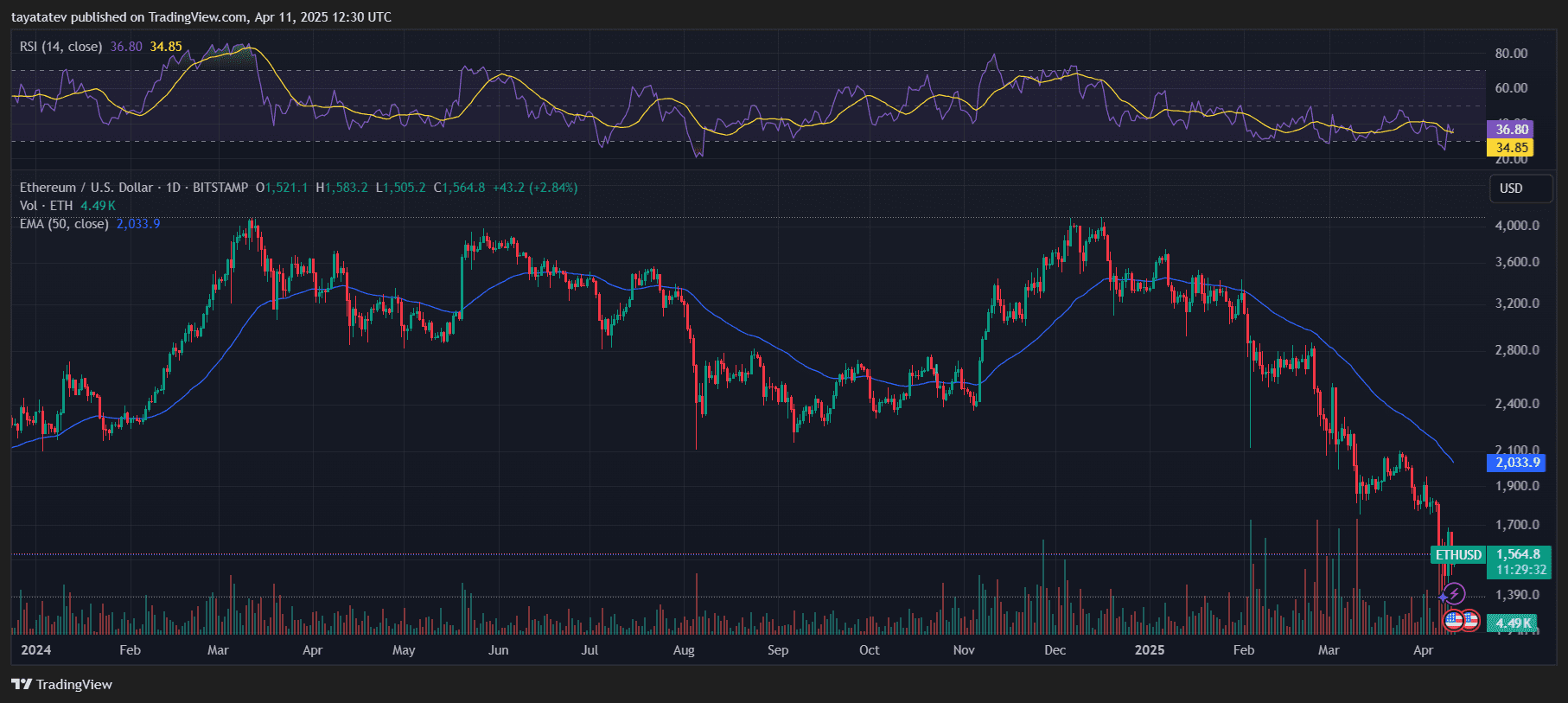

Ethereum’s price action supports the trend seen in altcoin volume data. ETH peaked above $4,000 in early 2024 but has steadily declined, now trading around $1,560. The downtrend aligns with a broader decrease in trading activity, as shown by the recent drop in altcoin volume averages.

Historical volume patterns show that these phases can last weeks or months but often precede sharp recoveries, leading to altcoin seasons. Current metrics reflect those earlier cycles. Traders watching for accumulation signals now have one.

Oversold Market Indicates Another Altcoin Season

The latest RSI-based chart analysis shows altcoins entering a historically consistent reversal zone.

The chart below tracks the total altcoin market cap alongside the Stochastic RSI. Each green circle marks an oversold RSI level, and each orange circle above corresponds to a local market bottom. Every time this combination has appeared since 2019, altcoins have followed with a notable upward move.

The current setup mirrors previous pre-rally conditions. As of April 2025, the RSI has again dropped into the oversold zone, while the market cap holds near $1.35 trillion. Past signals at similar levels led to significant market expansions, often marking the start of altcoin seasons.

Notably, the chart includes a green box projecting a potential upside zone, suggesting that a move toward or beyond $3 trillion in market cap could follow, in line with past market behavior. The consistency of these patterns strengthens the case for an upcoming altcoin rally.

The setup shows nine successful signals over the past five years, with no failed reversals at oversold RSI levels. If this trend continues, altcoins could be approaching another breakout phase.