DeFi Value Plunges 27% in Q1 2025 Amid Trump Tariffs and Economic …

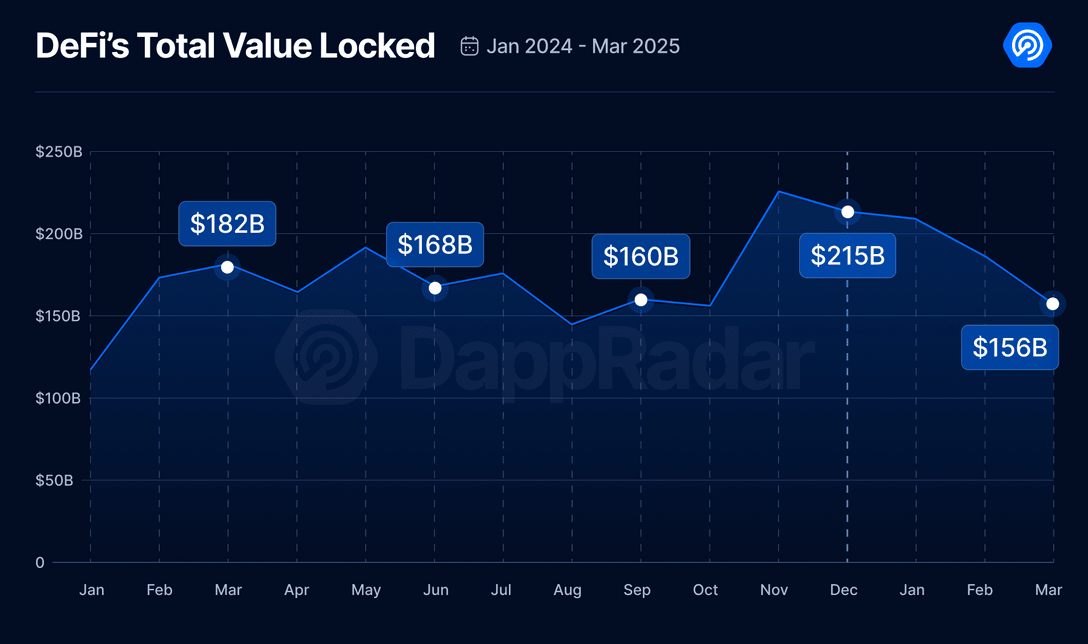

The decentralized finance (DeFi) sector faced a sharp decline in the first quarter of 2025. According to a report by crypto analytics firm DappRadar, the total value locked (TVL) in DeFi protocols fell by 27% compared to the previous quarter. This drop brought DeFi’s TVL down to $156 billion by the end of March.

DappRadar cited global economic uncertainty especially due to Trump Tariffs and the aftermath of a Bybit hack as the key reasons behind the fall. These factors triggered market volatility and led investors to withdraw funds from DeFi platforms.

Ethereum and Other Major Chains Suffer Major Losses

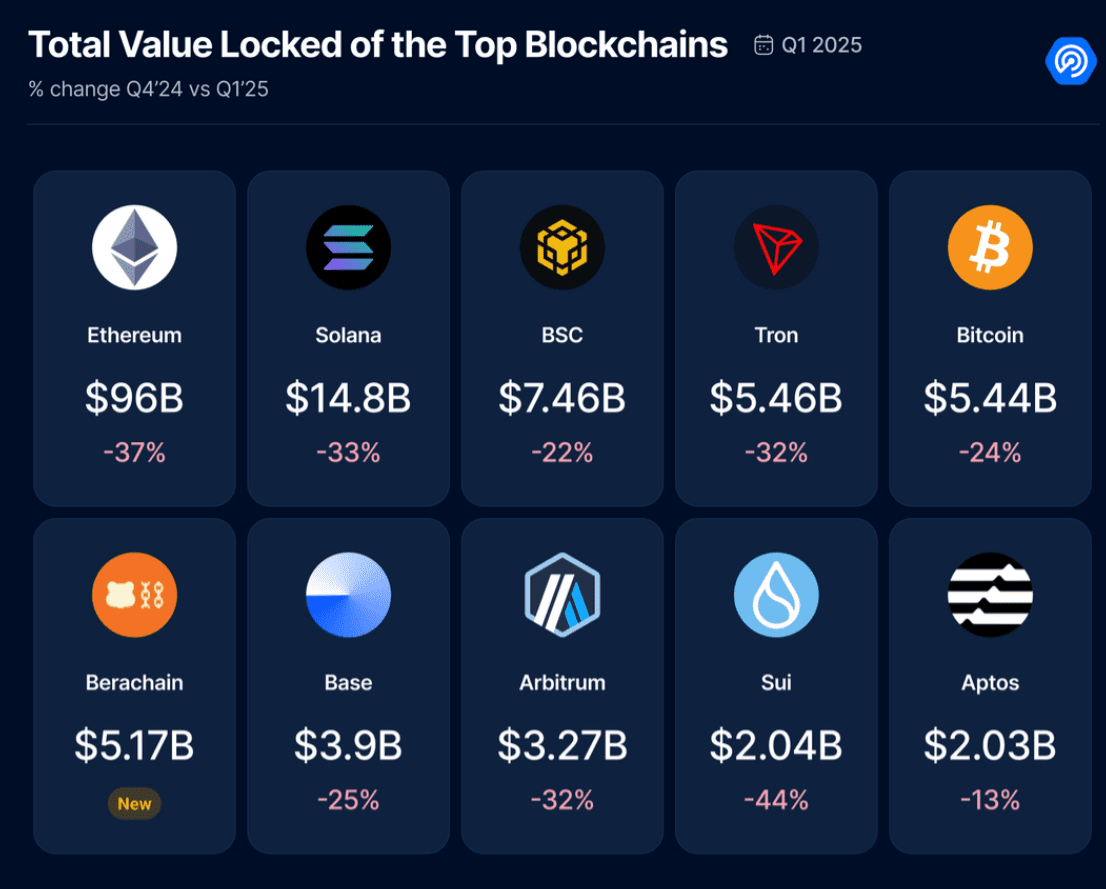

Ethereum, the largest blockchain in terms of DeFi TVL, was not spared. The Ethereum network saw a 37% drop in its TVL, falling from $152 billion to $96 billion during the first quarter. This happened as the price of Ether (ETH) fell 45% to $1,820. This price decline contributed to the decrease in the value of assets held within DeFi protocols.

Other major blockchains also experienced substantial declines. Sui, a top-10 blockchain by DeFi TVL, recorded the largest percentage loss, falling 44% to $2 billion. Solana, Tron, and Arbitrum each saw their DeFi holdings shrink by over 30% as users withdrew funds and token prices dropped.

The report explained that blockchains with less exposure to stablecoins—cryptocurrencies tied to traditional currencies—saw even more pressure. With fewer stablecoins locked in, these blockchains were more vulnerable to market declines, leading to a faster and steeper drop in DeFi value.

While most blockchains saw their DeFi numbers fall, newly launched Berachain stood out as an exception. According to DappRadar, Berachain accumulated $5.17 billion in TVL between Feb. 6 and March 31. This growth made it the only top-10 blockchain to see an increase in locked value during the quarter.

Berachain’s rise suggests that new networks can still attract liquidity, especially if they offer fresh incentives.

AI and Social dApps Surge While DeFi and GameFi Activity Shrinks

In contrast to DeFi, blockchain applications focused on artificial intelligence (AI) and social interaction saw strong user growth in Q1. DappRadar reported that daily unique active wallets (DUAWs) interacting with AI protocols increased by 29%, while those using social dApps rose by 10%.

These figures show that even as investors pulled money out of DeFi, users remained active on blockchain networks. AI apps saw an average of 2.6 million active wallets per month, while social platforms had 2.8 million monthly users.

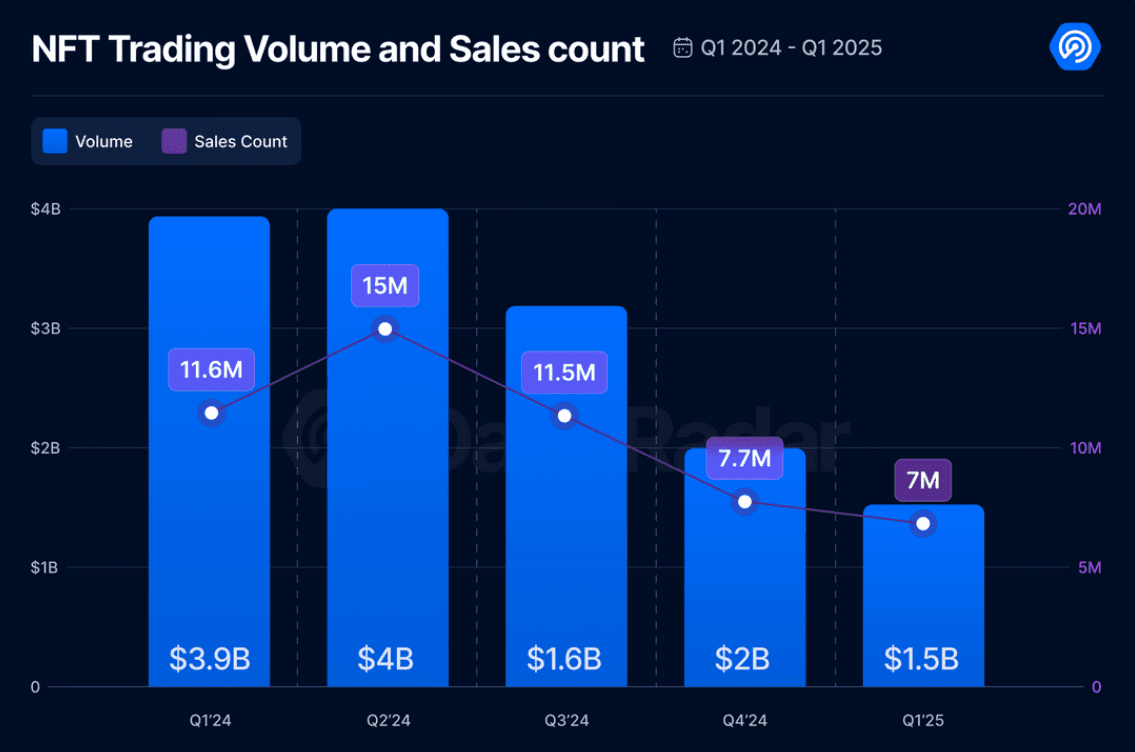

While AI and social apps gained users, other parts of the blockchain space continued to lose ground. Non-fungible tokens (NFTs) and GameFi—blockchain-based gaming platforms—both experienced reduced activity in Q1.

NFT trading volume dropped 25% from the previous quarter, falling to $1.5 billion. Among NFT marketplaces, OKX took the lead with $606 million in trades. OpenSea and Blur followed closely, recording $599 million and $565 million in trading volume, respectively. At the same time, the industry is seeing major platforms pulling back from NFTs altogether. Cryptocurrency exchange Bybit has already announced to shut down its NFT marketplace on April 8.