Bybit to Close NFT Marketplace Amid 95% Collapse in Trading Volume…

Bybit, a cryptocurrency exchange, has announced that it will shut down its NFT marketplace on April 8. This means users will no longer be able to buy, sell, or trade NFTs on the platform after that date.

Apart from NFT, Bybit will also close its Inscription Marketplace and its Initial Decentralized Exchange Offering (IDO) platform on the same day. These platforms allowed users to engage with various blockchain-based assets and fundraising activities.

Bybit explained that this step is part of a broader strategy to “streamline” its offerings, meaning the company is choosing to focus on fewer, but stronger, products.

NFT Market Faces Major Slowdown

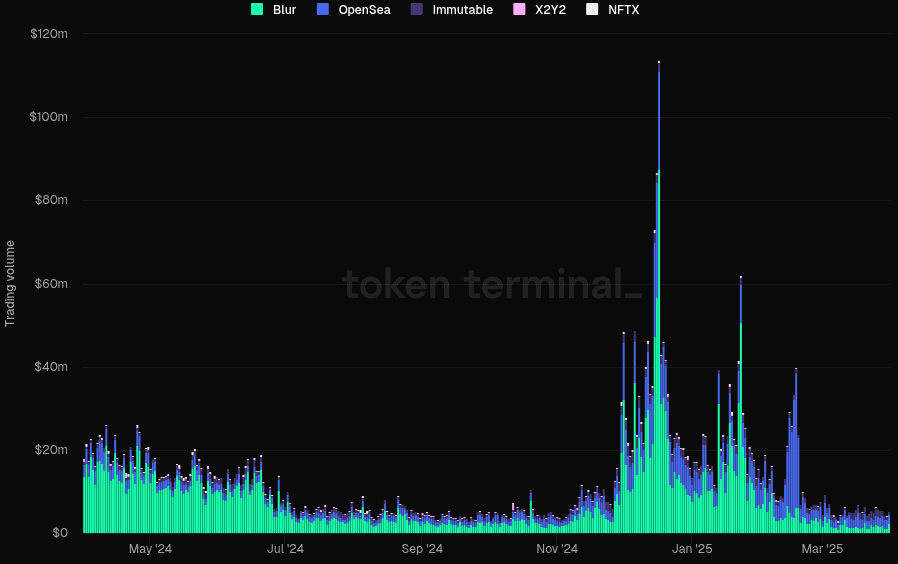

Bybit’s decision comes at a time when the entire NFT market is seeing a sharp decline. NFTs, or non-fungible tokens, are digital assets used to represent ownership of art, collectibles, and other digital content on the blockchain. NFTs gained popularity between 2021 and 2022, but trading activity has fallen steeply since then.

A year ago, the daily trading volume for NFTs was around $18 million. However, by early 2025, this number had dropped to about $5.34 million — a decline of nearly 70%. The fall is even more striking when compared to the peak on December 17, 2024, when NFT trading volume hit $113.6 million. Since that peak, NFT trading has dropped by over 95%.

Some blockchain experts believe this slowdown marks a shift in how NFTs will be used in the future. Expert believe that the “speculative phase” — where people bought NFTs mainly as collectibles to trade for profit — is ending.

Instead, NFTs may now be used more for practical purposes such as gaming, artificial intelligence (AI) integrations, fan engagement, and verifying digital content. This shift means that while speculative trading may decline, NFTs could still play a role in building future blockchain applications.

Q1 2025 Sales Plunge 63% Year-over-year

The weak demand for NFTs has also affected specific projects. For example, the Gutter Cat Gang (GCG), an NFT project, launched its GANG token on March 31 but failed to meet expectations.

The project aimed to raise about $1 million. However, early data showed that it only attracted about 3.66 Ether (worth around $6,800 at the time). The team blamed technical issues for the poor performance. However, many believe the low turnout is the reason behind reduced investor interest in NFTs.

A recent market report revealed that total NFT sales fell by 63% in the first quarter of 2025, compared to the same period in 2024. Despite the general decline, some NFT projects, such as Doodles, Milady Maker, and Pudgy Penguins, managed to outperform market expectations.