BitGo CEO slams Galaxy Digital post $200 mln fiasco: ‘Not ethical’

- Galaxy Digital settles with NYAG for $200 million over Terra LUNA mishandling.

- BitGo CEO urges ethical crypto practices and supports principles-based regulation.

Galaxy Digital has reached a $200 million settlement with the New York Attorney General (NYAG) over its alleged mishandling of the collapsed Terra LUNA cryptocurrency.

Mike Belshe takes a jab at Galaxy Digital

However, the settlement has sparked industry-wide discussions, with BitGo CEO Mike Belshe weighing in on the matter.

Despite his advocacy for deregulation, Belshe acknowledged the strength of NYAG’s case against Galaxy Digital, signaling a shift in stance toward regulatory oversight.

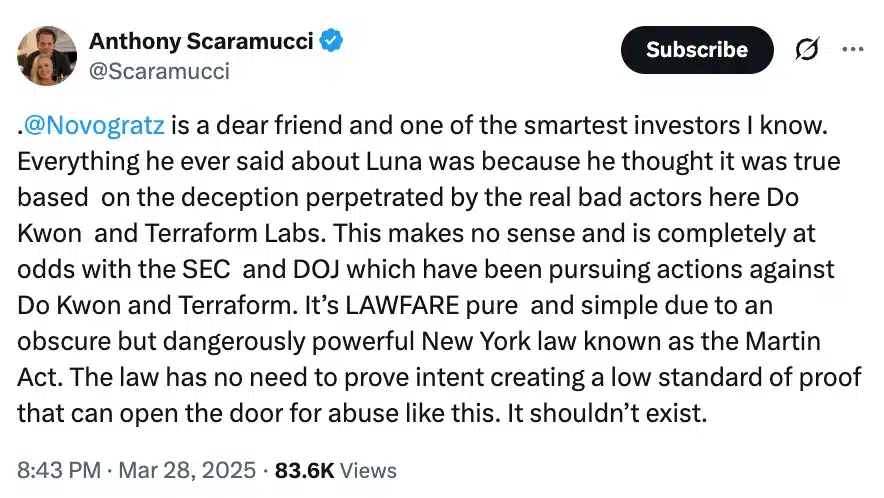

His remarks, made in response to a post by Anthony Scaramucci on X, highlight growing concerns about fraudulent practices in the crypto space.

Belshe criticized Galaxy Digital’s pump-and-dump tactics, pointing out the firm’s practice of offloading tokens upon vesting while simultaneously promoting HODLing.

He emphasized the ethical concerns surrounding such actions but also acknowledged his respect for Novogratz and his contributions to the crypto industry.

Belshe said,

“I’ve always thought Mike brought good maturity to crypto and respected him for it, but I was shocked to read the facts outlined by NYAG. So, legal overreach or not, it’s not ethical, and this type of behavior makes our entire industry look bad. Unchecked, this is what leads to “over regulation”.”

Suggesting a way out, he added,

“’Principles based regulation’ could fit well here: don’t lie to promote assets you hold; don’t tell others to buy while hiding the fact that you’re selling.”

Crypto regulation in the Trump vs. Biden administration

As expected, Belshe’s emphasis on crypto regulation subtly reflects the stark contrast between the Biden and Trump administrations’ approaches to the industry.

Under Biden, major crypto firms like Consensys, Ripple [XRP], Robinhood, MetaMask, Coinbase, and Kraken faced relentless legal battles with the SEC.

However, with Trump’s return, many of these disputes have finally been resolved, signaling a shift in regulatory stance.

This change is further reinforced by Paul Atkins, Trump’s SEC chair nominee, who has recently pledged to establish a more “rational” and “coherent” regulatory framework for crypto, potentially ushering in a new era of industry-friendly policies.

In his statement during the U.S. Senate Banking Committee hearing, he put it best when he said,

“A top priority of my chairmanship will be to work with my fellow Commissioners and Congress to provide a firm regulatory foundation for digital assets through a rational, coherent, and principled approach.”