Will PI’s price decline further after its March surge? Gauging…

- Pi Network’s coin holdings sparked debates about centralization and validator control.

- The short-term price prediction was firmly bearish.

Since the strong rally on the 12th of March that saw the token gain 26.28% in a single day, Pi Network [PI] has been in a severe downtrend.

The 82.8 billion PI coin holdings of the project raised concerns about the network’s centralized nature and its long-term sustainability.

PI has shed 54% since that one-day surge. Technical analysis marked support levels where bulls could force a price bounce. Investors looking to buy can wait for the trend to shift bullishly.

The PI market structure remains bearish across timeframes

The 4-hour chart reflected a firm downtrend. The CMF has been below -0.05 for most of the past week, showing steady capital outflows from the market. This reflected selling pressure.

The 20 and 50-period moving averages also captured the downtrend well.

In recent days, the 20SMA on the 4-hour chart served as a dynamic resistance. Therefore, a retest of the two moving averages could see PI prices rejected in the coming days.

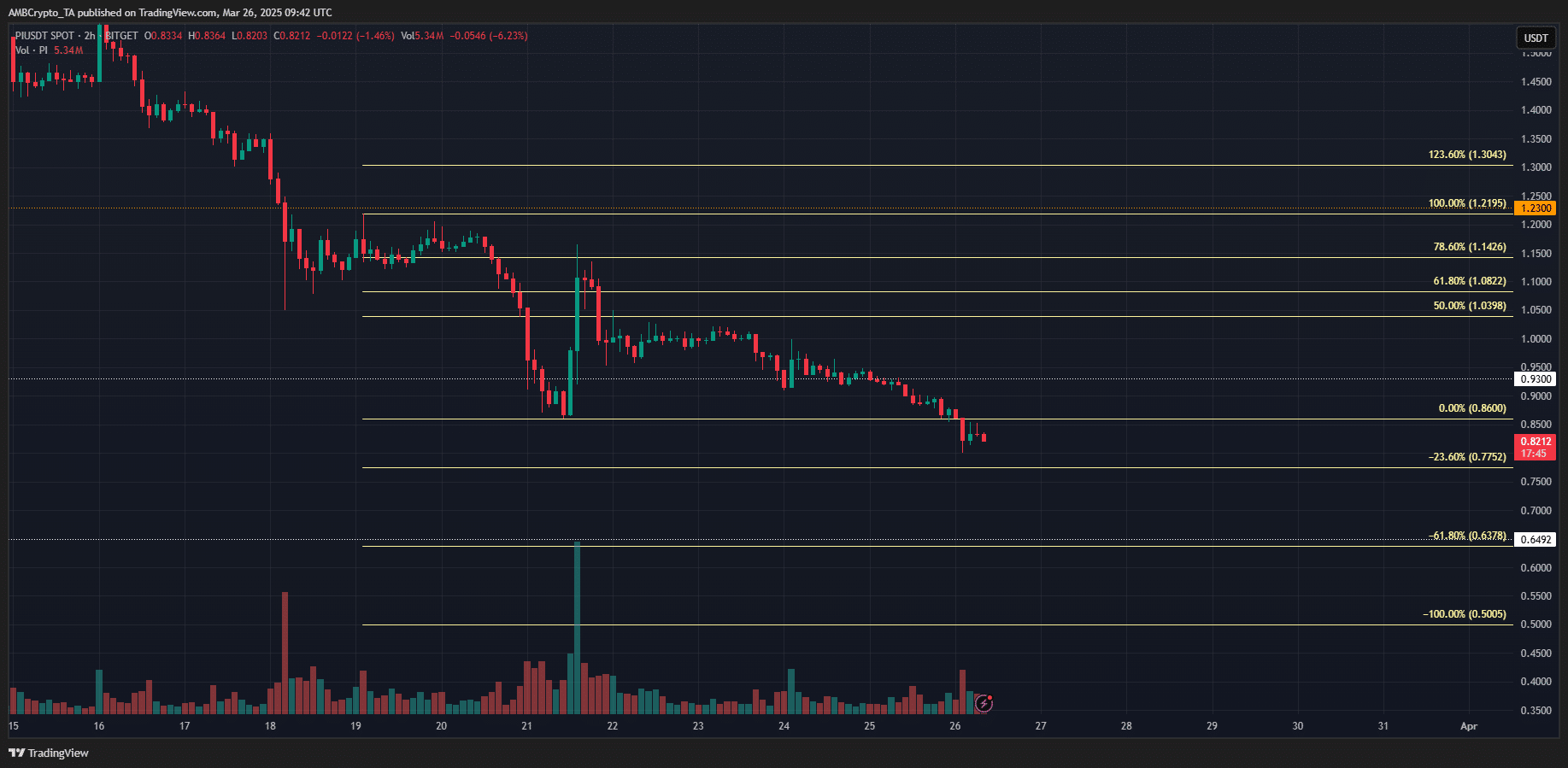

Using the swing move downward from $1.22 to $0.86 a week ago, a set of Fibonacci retracement and extension levels were plotted.

It showed that the Pi Network token was headed for $0.775 and $0.638 in the coming days, marking these as take-profit levels for short sellers.

The price bounce on the 21st of March turned out to be a rejection from the 78.6% retracement level at $1.14. Since then, PI was down by 28.38%, and has slipped below $0.86 as well.

The $0.65 support zone was interesting, since it lined up with the lows from the 21st of February, marking a key support level.

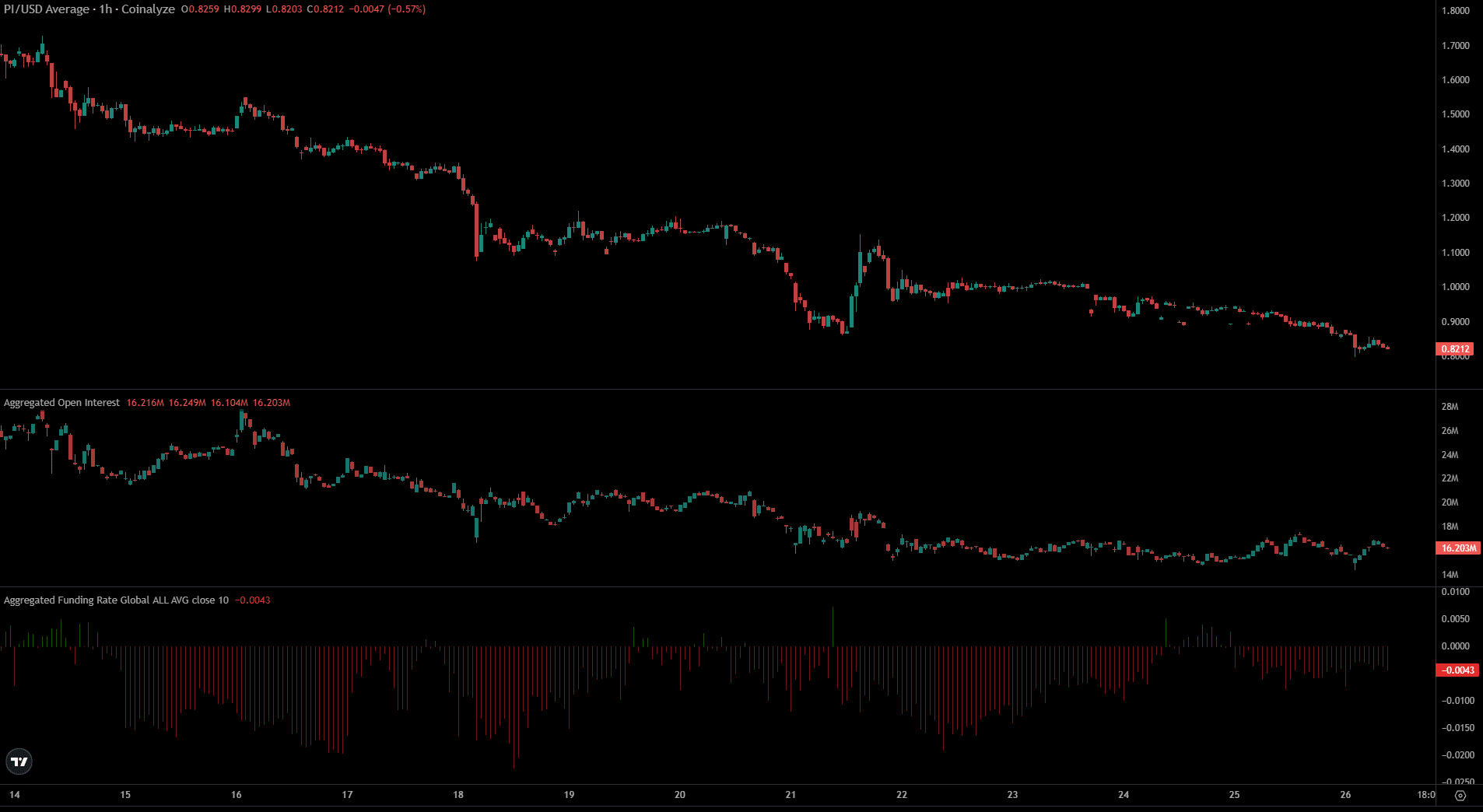

Source: Coinalyze

The Funding Rate was persistently negative over the past week. Short-sellers were paying premium to the long positions, outlining bearish sentiment in the derivatives market.

The Open Interest has been flat over the past four days. Market participants seemed content to stay sidelined as PI continued its steady downtrend.

The findings showed that a move to $0.775 and $0.638 were likely to occur in the coming days.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion